This is the accessible version of the Annual assessment of National Highways from April 2021 to March 2022.

Executive summary

Introduction

- National Highways was set up as a government-owned company in 2015, tasked with managing the strategic road network (SRN) – the motorways and major A-roads in England. In its second road investment strategy (RIS2) the government specified a set of outcomes and investments that it requires National Highways to deliver over the second road period (RP2), from April 2020 to March 2025.

- The Office of Rail and Road (ORR) holds National Highways to account for the delivery of the requirements set out in RIS2, its broader licence commitments and how it achieves its efficiency targets. This report sets out our assessment of National Highways’ performance in 2021-22.

- In 2021-22, travel restrictions put in place for the coronavirus (COVID-19) pandemic eased. Traffic levels across the SRN returned to close to normal levels. While rail services continued to be impacted, National Highways was able to work through the pandemic and return to business-as-usual. However, it faced its own challenges from a series of protests that disrupted the network (for example by Insulate Britain, on the M25). It faced separate (unrelated) issues around the Port of Dover.

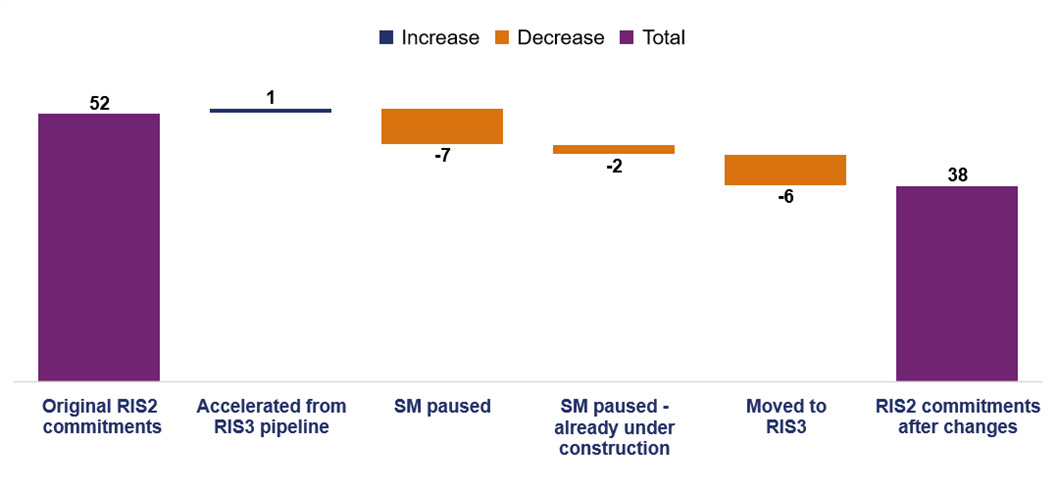

- Overall, in 2021-22 National Highways’ primary focus was on the safety of the SRN and the delivery of the government’s smart motorway action plan. In January 2022, following the Transport Select Committee’s (TSC’s) report on the roll-out and safety of smart motorways, the government announced a pause to the construction of all new smart motorways until five years’ worth of safety data for existing smart motorways is available.

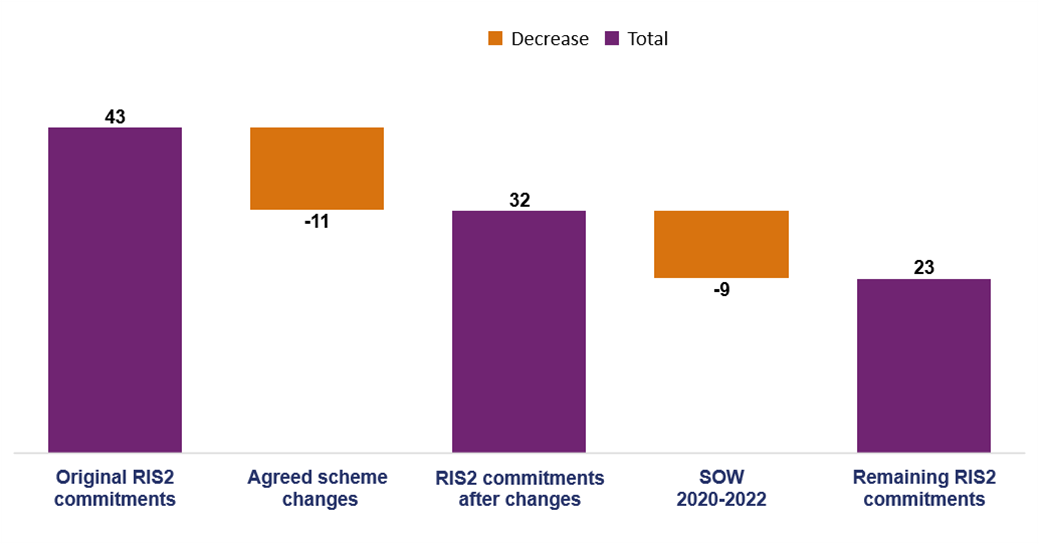

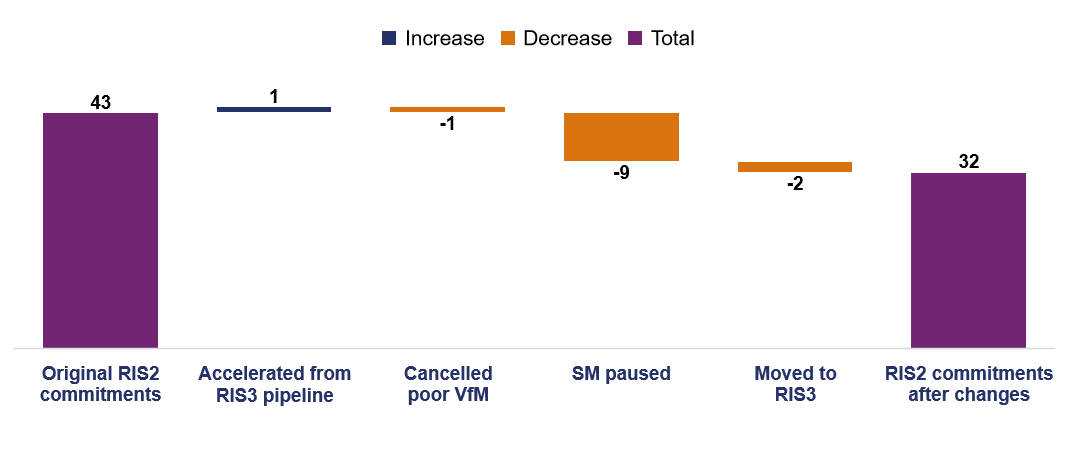

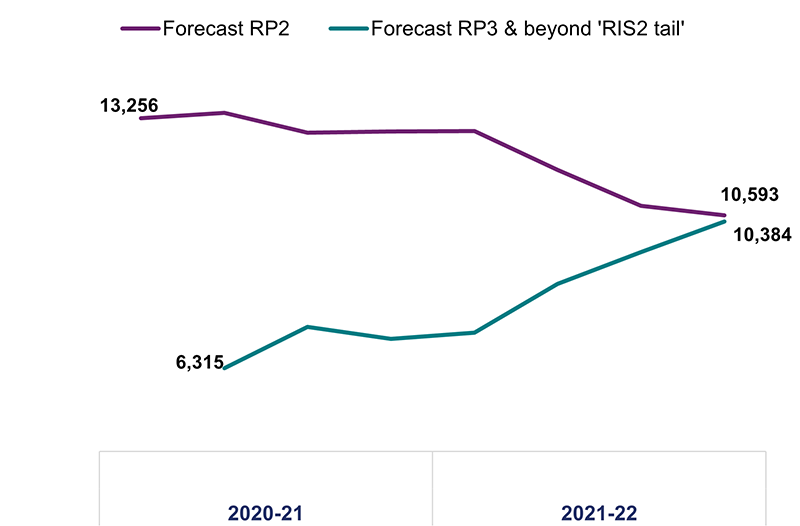

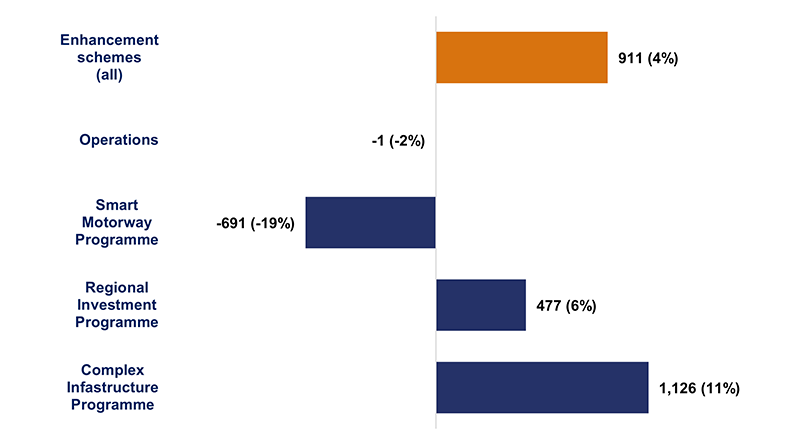

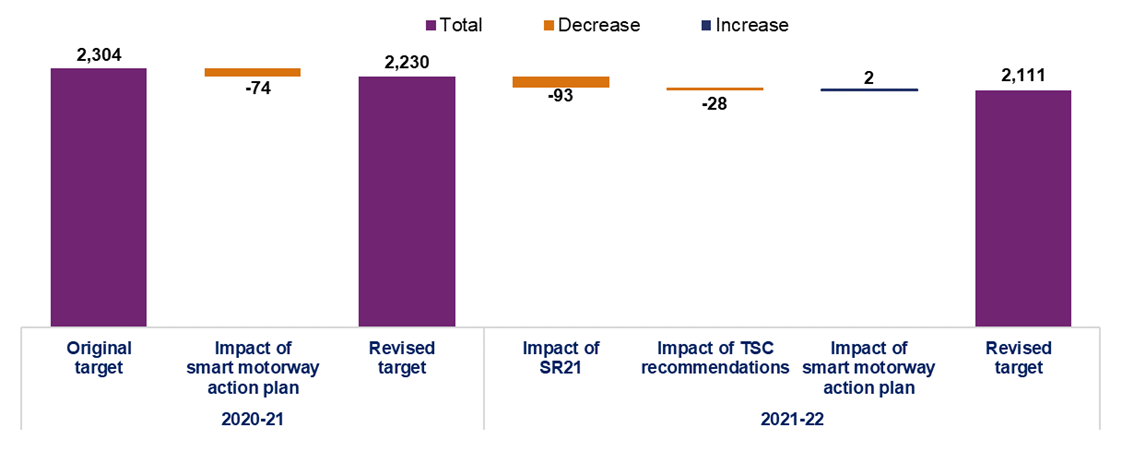

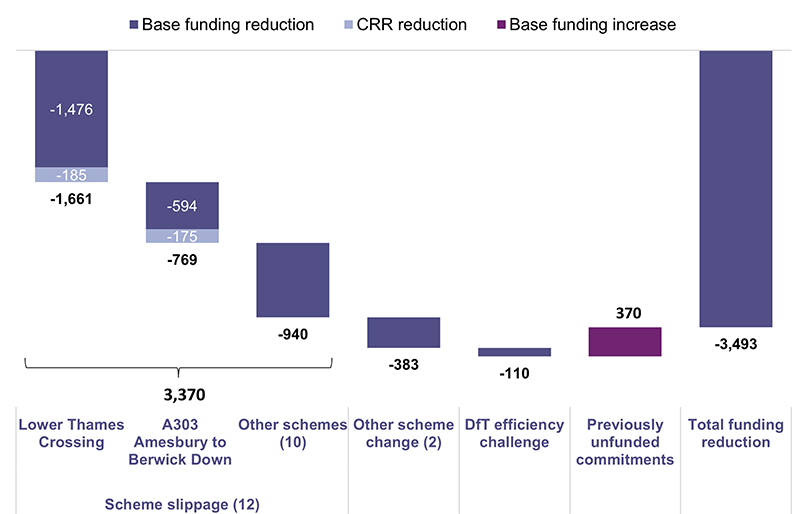

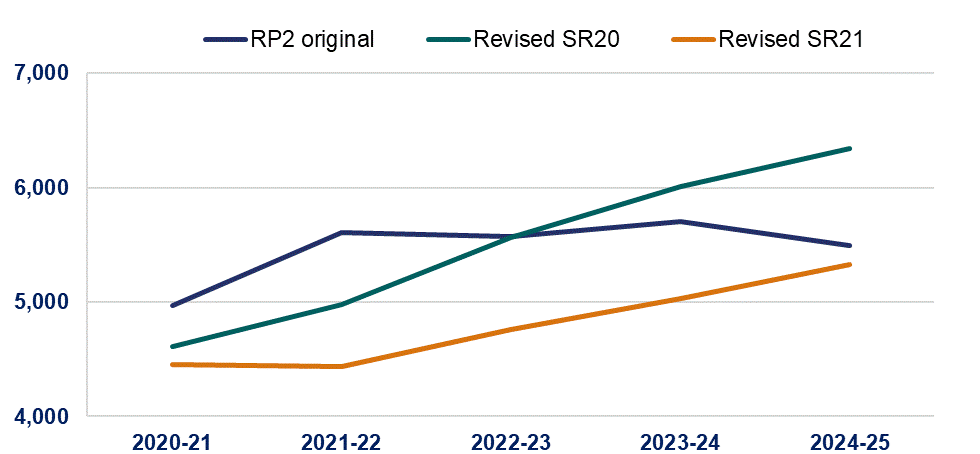

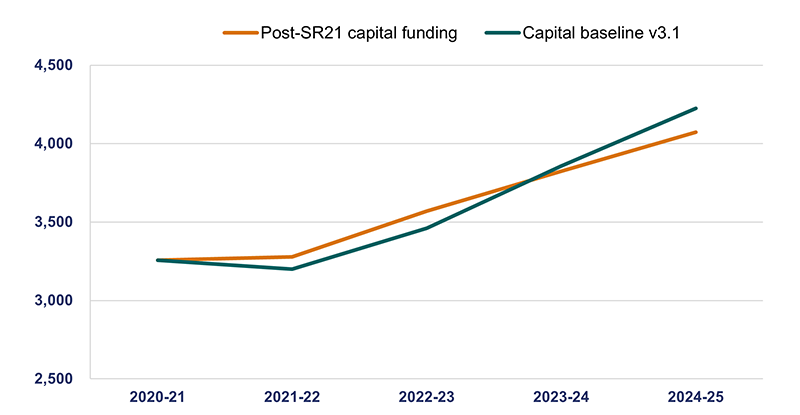

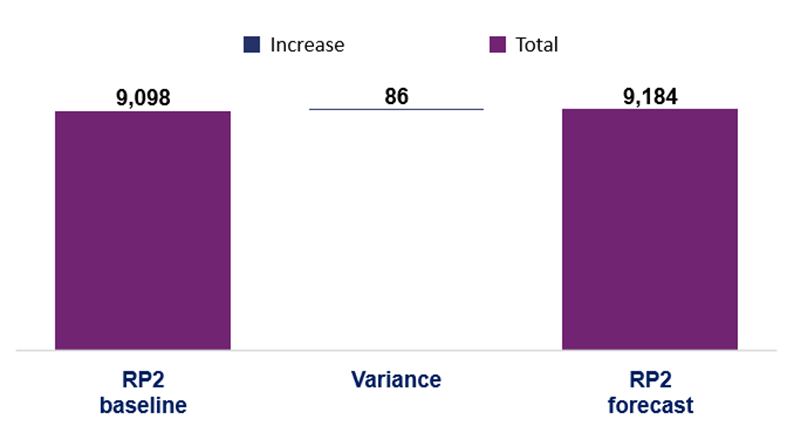

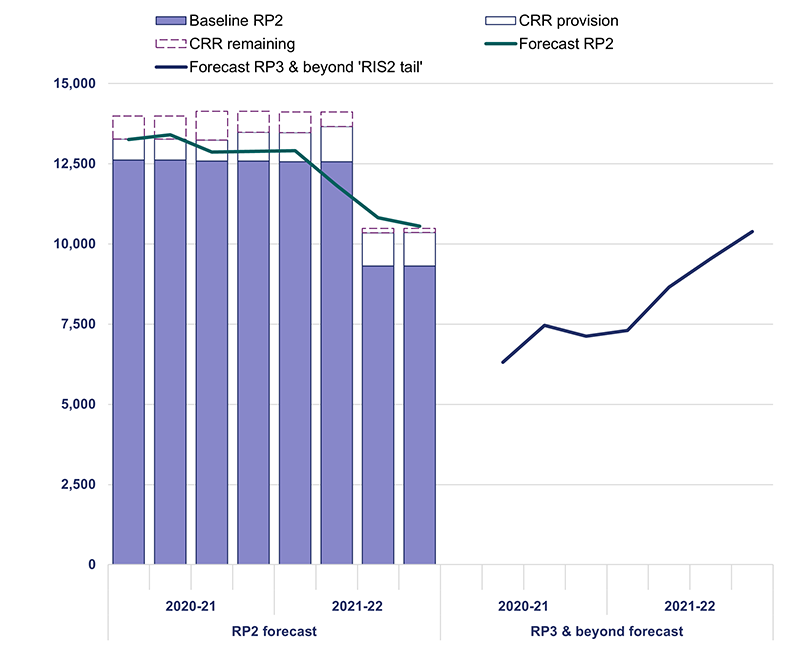

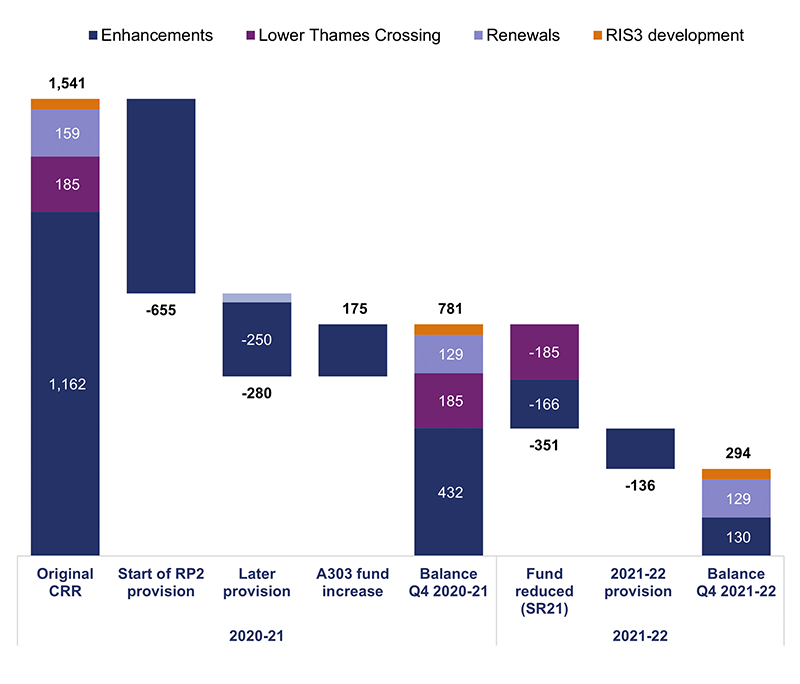

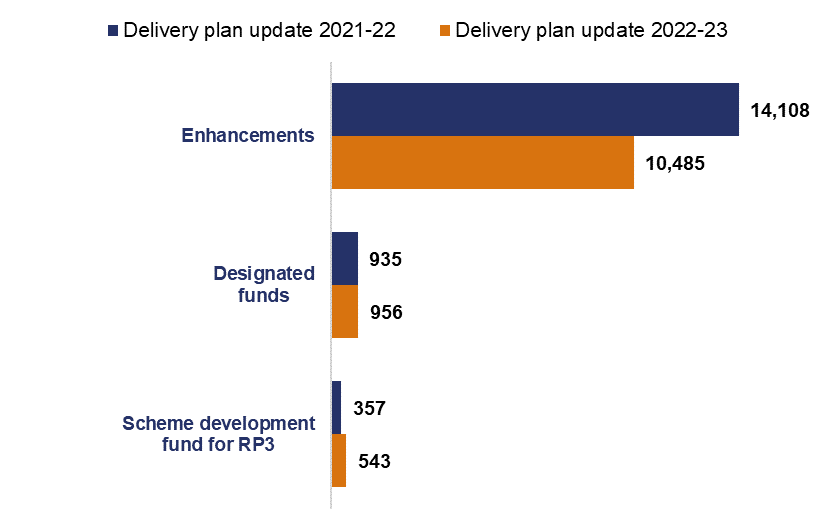

- This decision came when National Highways and government were still working through changes to the capital programme following Spending Review 2021 (SR21) that removed £3.5bn from the RIS2 budget. The SR21 changes resulted in a smaller RIS2 delivery portfolio and a reduction in the efficiency target, compared to the requirements that the government set for the company at the start of RP2.

- Alongside these changes, the company worked to improve its asset management maturity and set baselines on all environmental key performance indicators (KPIs) for RP2.

- This overall picture is supported by four key messages.

Key message 1: safety Collapse accordion Open accordion

Safety remains National Highways’ priority. The company is working towards meeting its 2025 commitment and its zero harm ambition by 2040. It must maintain its focus as traffic levels return to normal. The company has made good progress on delivering the safety-focused smart motorway action plan. However, we remain concerned about its ability to deliver the action on faster traffic officer response times to incidents.

- National Highways' forecast for its safety performance in terms of killed or seriously injured (KSI) road users on the SRN is higher than 2020, but below pre-pandemic averages. This forecast indicates that the company is on track to meet its 2025 target of a 50% reduction in people killed or seriously injured on the SRN, compared to the 2005-09 average. This position will not be confirmed until the Department for Transport (DfT) publishes the relevant safety data (STATS19) in autumn 2022.

- Traffic on the SRN recovered to 94% of pre-COVID-19 pandemic levels in March 2022, from 68% in March 2021. As road usage and traffic increases, it will be challenging for National Highways to sustain its safety performance and meet its safety targets. Over 2022-23, the company intends to work with government and stakeholders to improve safety and develop an action plan aligned to its 2025 safety target and its 2040 zero harm ambition. We will review this plan.

- A key element of National Highways' safety work is its activity on smart motorways. In particular, the delivery of DfT's safety-focused Smart Motorway Safety Evidence Stocktake and Action Plan. Looking forward, the company will work with us to support DfT to address the TSC’s nine recommendations in its report on the roll-out and safety of smart motorways.

- In 2021-22, National Highways delivered six actions, as scheduled. At year-end 2021-22, the company had completed a total of 15 of the 22 actions. Within the plan, National Highways also set itself a series of milestones and delivery dates for each action.

- Our main safety-related concern throughout 2021-22 was about National Highways' ability to achieve action 3 – faster attendance by traffic officers. This is a critical element in providing visible management of incidents and improving road user safety. The company missed its July 2021 milestone to achieve a 10-minute average traffic officer response to live lane incidents on sections of all lane running motorway with emergency areas more than one mile apart.

- In 2021-22, we required National Highways to provide us with further data and information on its activities. This it did. We also visited the company's regional operations centres. These visits gave us insight and understanding as to how the company is managing response times locally. It has helped to improve our relationships across the business and built confidence in the company’s performance.

- At the time of writing, the average traffic officer response time was 10m 45s. We continue to engage with and hold the company to account to ensure that it does everything that can be reasonably expected of it to achieve its September 2022 target and sustain its performance.

- We will hold the company to account for how it uses international road assessment programme (iRAP) star ratings in more areas of its business (ratings are based on road inspection data and provide a simple and objective measure of the level of safety that is ‘built-in’ to the road for all road users).

Key message 2: asset management Collapse accordion Open accordion

During 2021-22, we saw some progress in National Highways' asset management maturity. However, the company is yet to provide us with sufficient evidence that it is executing its asset management policy consistently and effectively. The renewals work it delivers must be targeted at the right asset at the right time in its lifecycle. National Highways must urgently take steps to demonstrate compliance with its own policy. It must provide us with assurance that it is not compromising the long-term efficiency of its network or road user benefits when taking asset management decisions.

- In 2021-22 we saw an increase in National Highways’ focus on asset management. However, the company is still developing its maturity as an asset management organisation, including how it renews its assets. It must improve its asset management renewals capability, and evidence its improvement through reporting. This reporting will provide greater assurance to us that the company is efficiently delivering the right work to the right asset at the right time. This will lead to improved long-term outcomes for road users, for whom safe and reliable journeys are a key priority. This is directly linked to the quality of the highway asset, in particular road surfacing.

- The company published an updated asset management policy in May 2022 and implemented a governance framework. This enables it to make consistent planning and delivery maintenance decisions. However, we are yet to see sufficient evidence that the company is delivering that policy effectively and consistently in the asset renewals work it delivers across the country.

- National Highways’ current reporting shows that it met its road surface condition KPI target in 2021-22. It also shows how many asset renewals the company delivered and the money that it spent. However, this does not adequately convey whether the company is addressing the right asset need, at the right time. For example, National Highways delivered an output of 566.5 kilometres of safety barrier, against its planned output of 384.6 kilometres. However, we do not know if that was the right asset to invest in and/or if it was the right time to do it. Incorrect investment decisions will result in inefficiencies and reduced road user benefits in the future.

- In our 2020-21 annual assessment, we described the work we had done with the company to trial reporting that showed the extent to which it delivered planned renewals schemes and the reasons for changes across a region. Between April 2021 to March 2022, the company provided limited data for two further regions and was unable to provide sufficient detail and evidence across the whole of its network. The company is now creating a digital tool to help satisfy its renewals reporting requirement.

- However, we are yet to be convinced that National Highways fully understands our ongoing concern about its renewals asset management capability and how it can effectively demonstrate that going forwards. We will assess the roll-out of the company’s new digital tool and hold it to account for how it develops its renewals asset management reporting. The company needs to demonstrate the long-term value it is adding from its asset management capability, through the capital renewals work it delivers.

Key message 3: environmental performance Collapse accordion Open accordion

National Highways' performance against its environmental targets is varied. In 2021-22 the company made good progress with its corporate carbon, noise, and air quality targets. However, we are concerned that it does not have a robust plan to achieve its target of no net loss in biodiversity by 2025. We require the company to provide evidence it is working quickly to rectify this and produce a robust plan.

- In 2020-21, National Highways made good progress on its RIS2 commitments to reduce corporate carbon emissions by 75%, mitigate noise impacts on 7,500 households, and bring air quality on sections of its network into compliance with legal limits in the shortest possible time. The company will need to sustain its performance over the remainder of RP2 to meet these targets.

- However, we have challenged National Highways on its biodiversity delivery programme. We want to ensure that it is accurate, deliverable and will achieve the company's KPI target of no net loss in biodiversity by 2025. At the end of 2021-22, the company forecast a biodiversity net loss by 2025. Given this, and additional future impacts linked to enhancements funding and/or scheme schedule changes, we require National Highways to provide sufficient evidence that it is working quickly to rectify this position. We want to see a robust plan from the company by September 2022 setting out how it will achieve the KPI target by the end of RP2.

- We will continue to scrutinise and challenge National Highways’ environmental plans and processes for delivering ongoing improvements and to meet the new requirements in the Environment Act 2021. We will report back on the company's progress in our 2022-23 annual assessment.

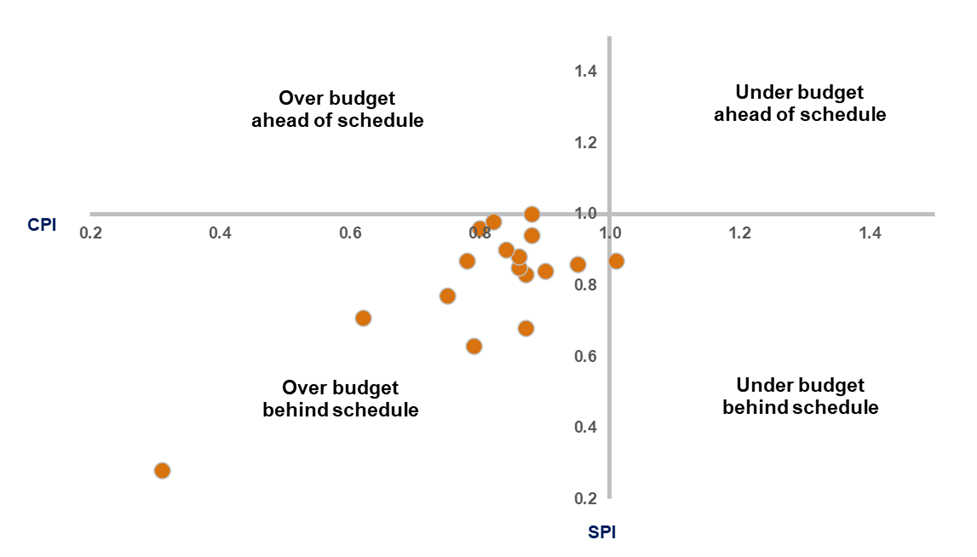

Key message 4: enhancements Collapse accordion Open accordion

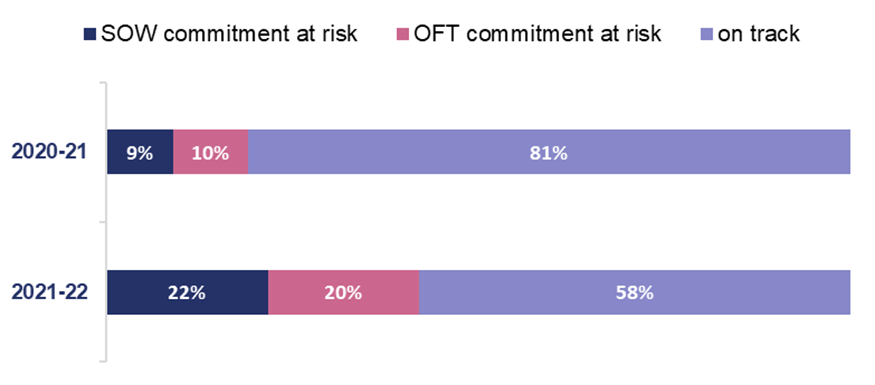

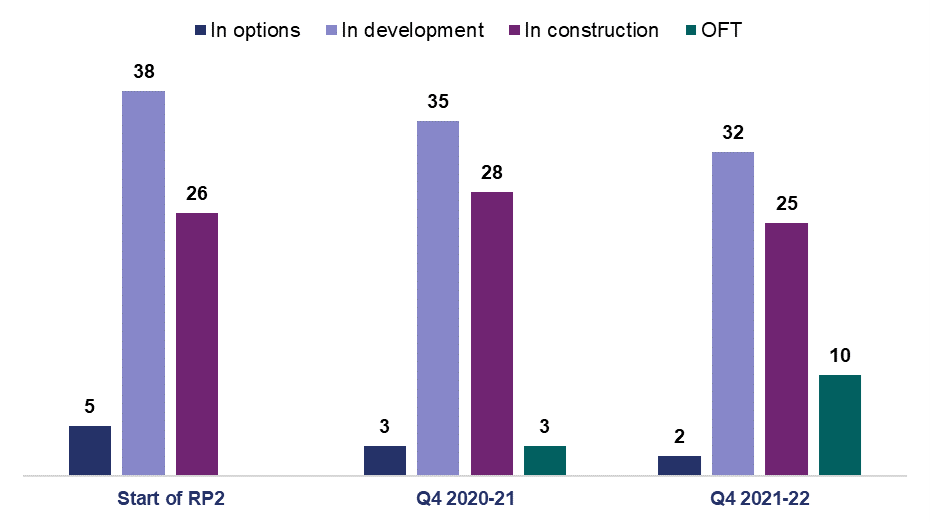

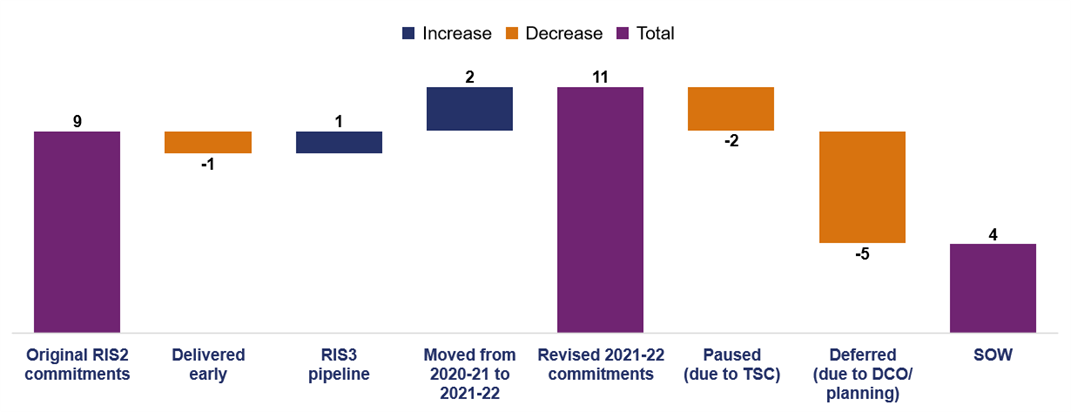

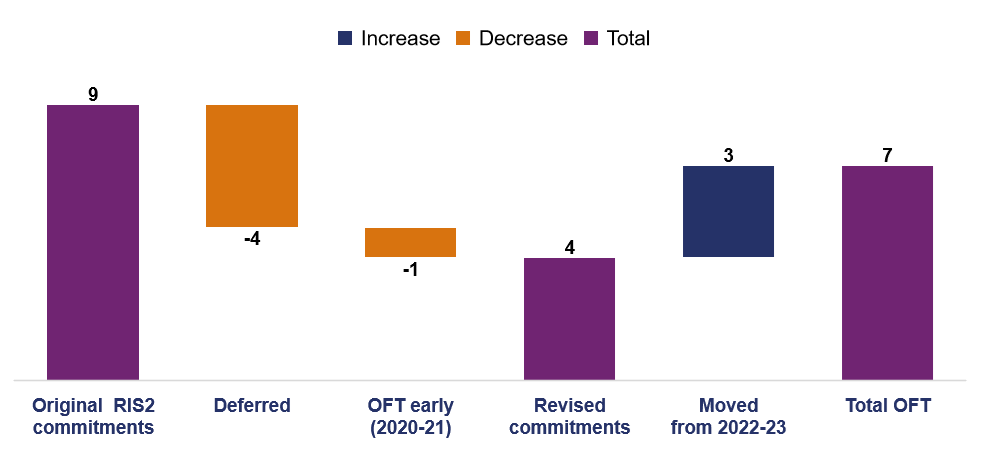

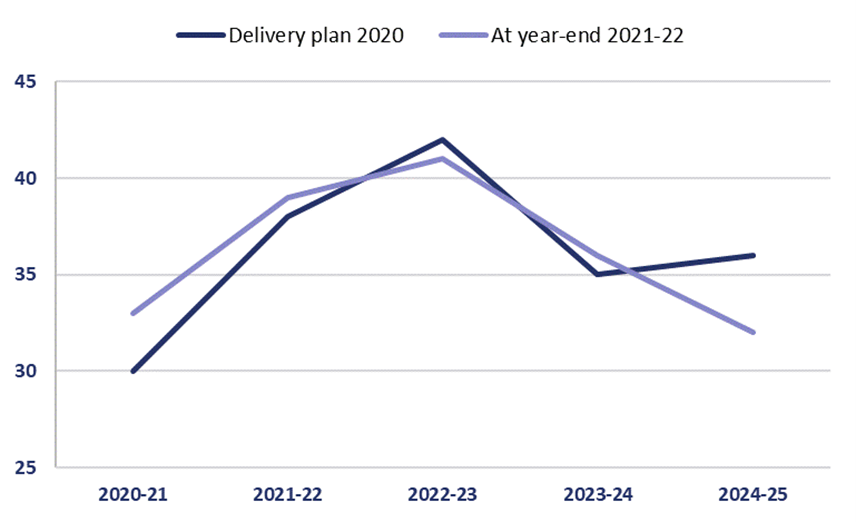

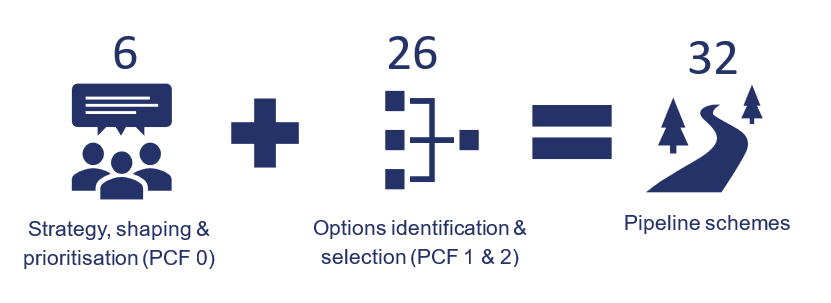

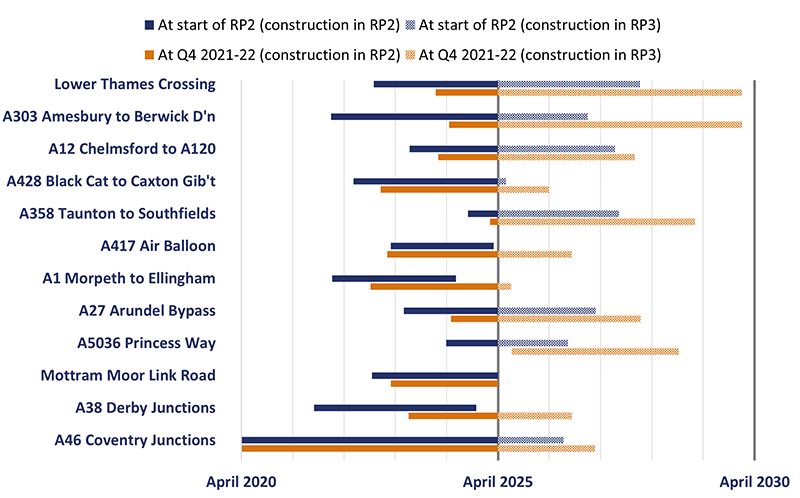

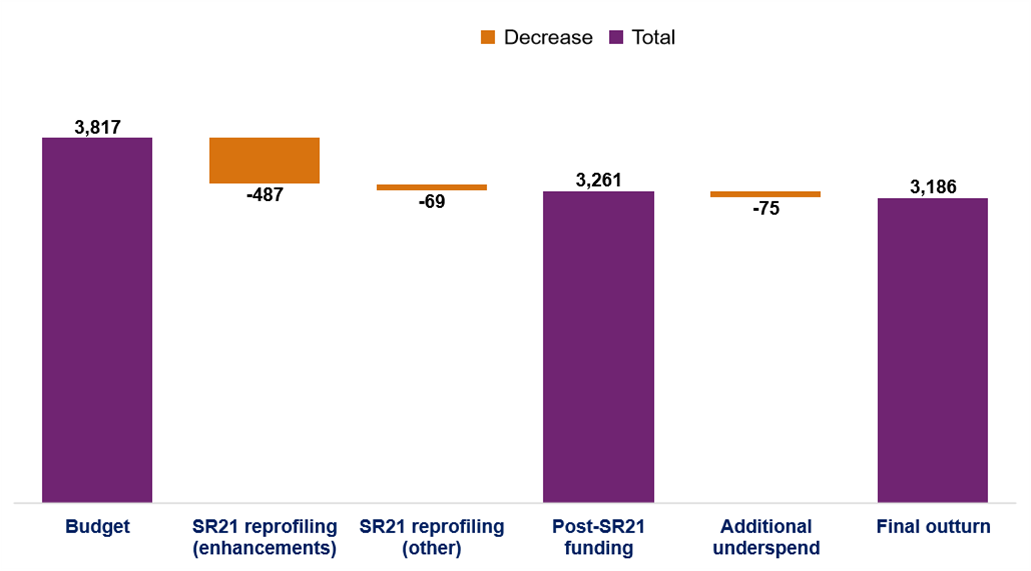

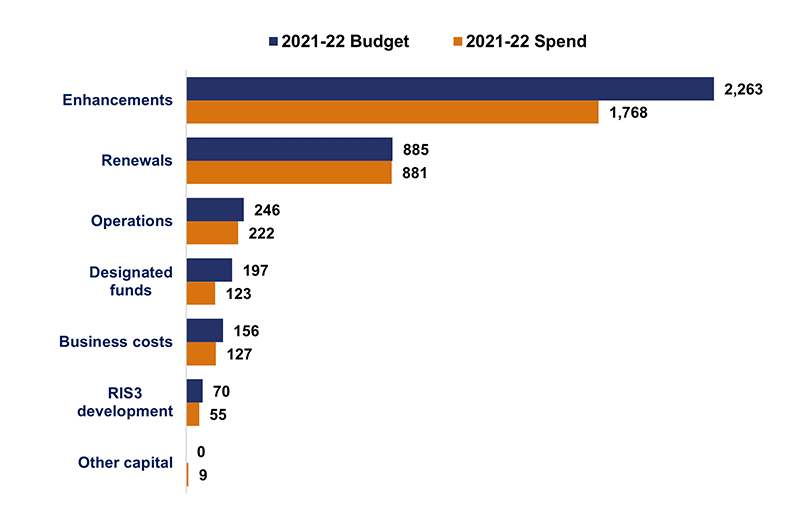

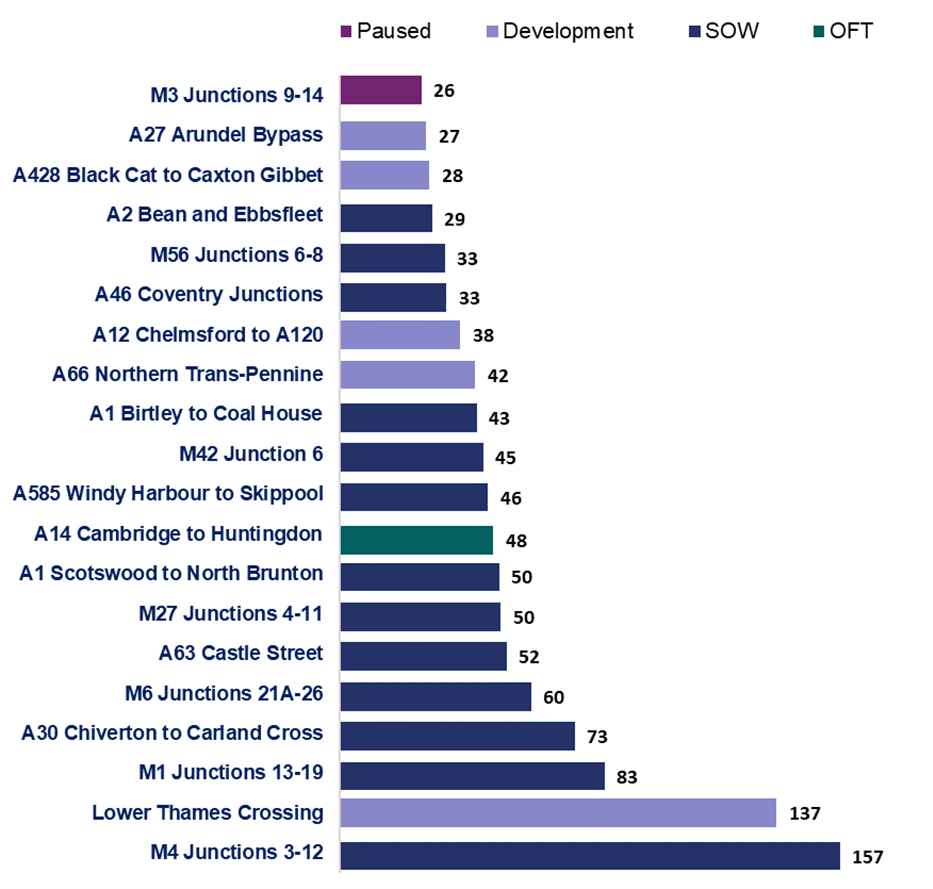

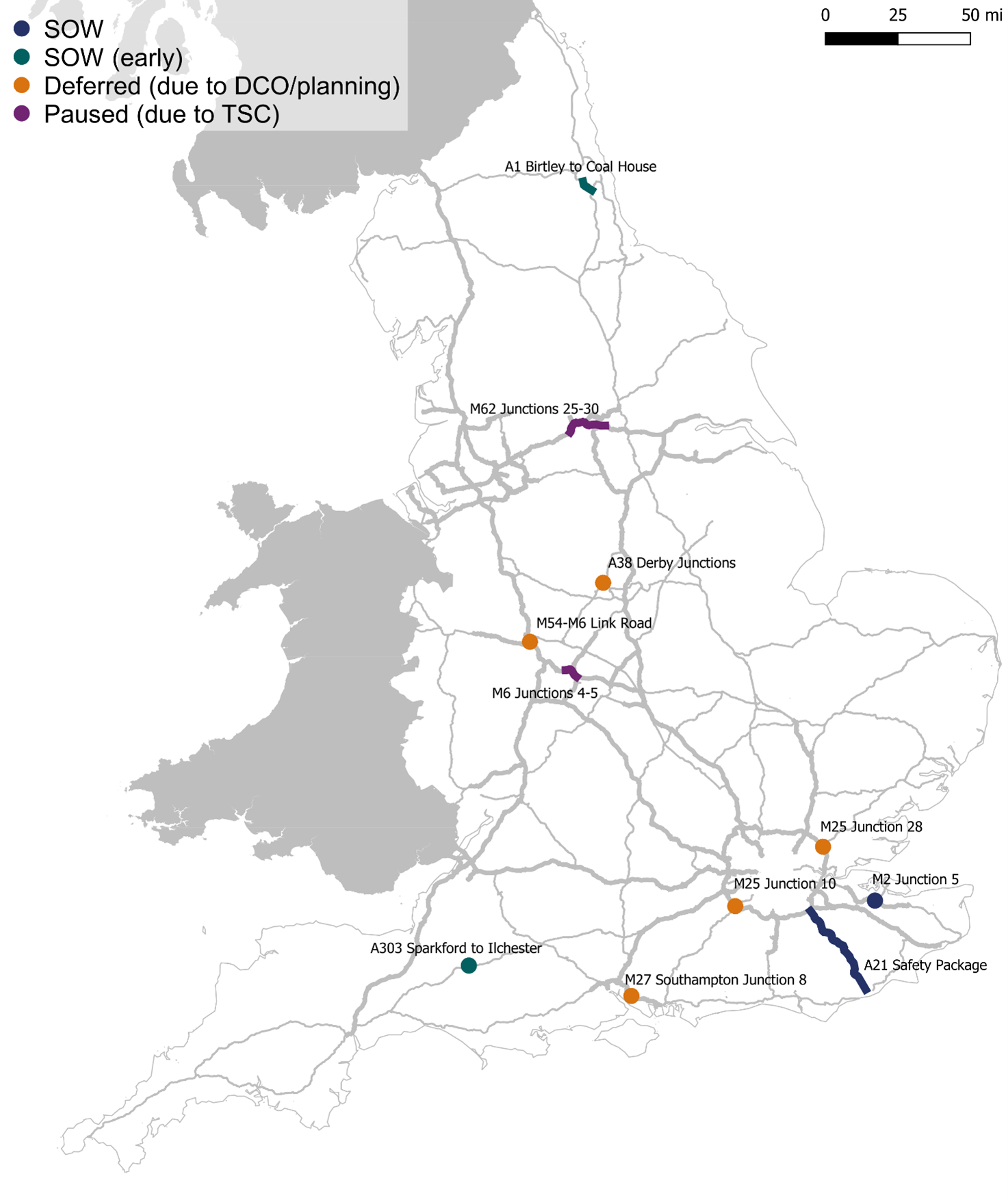

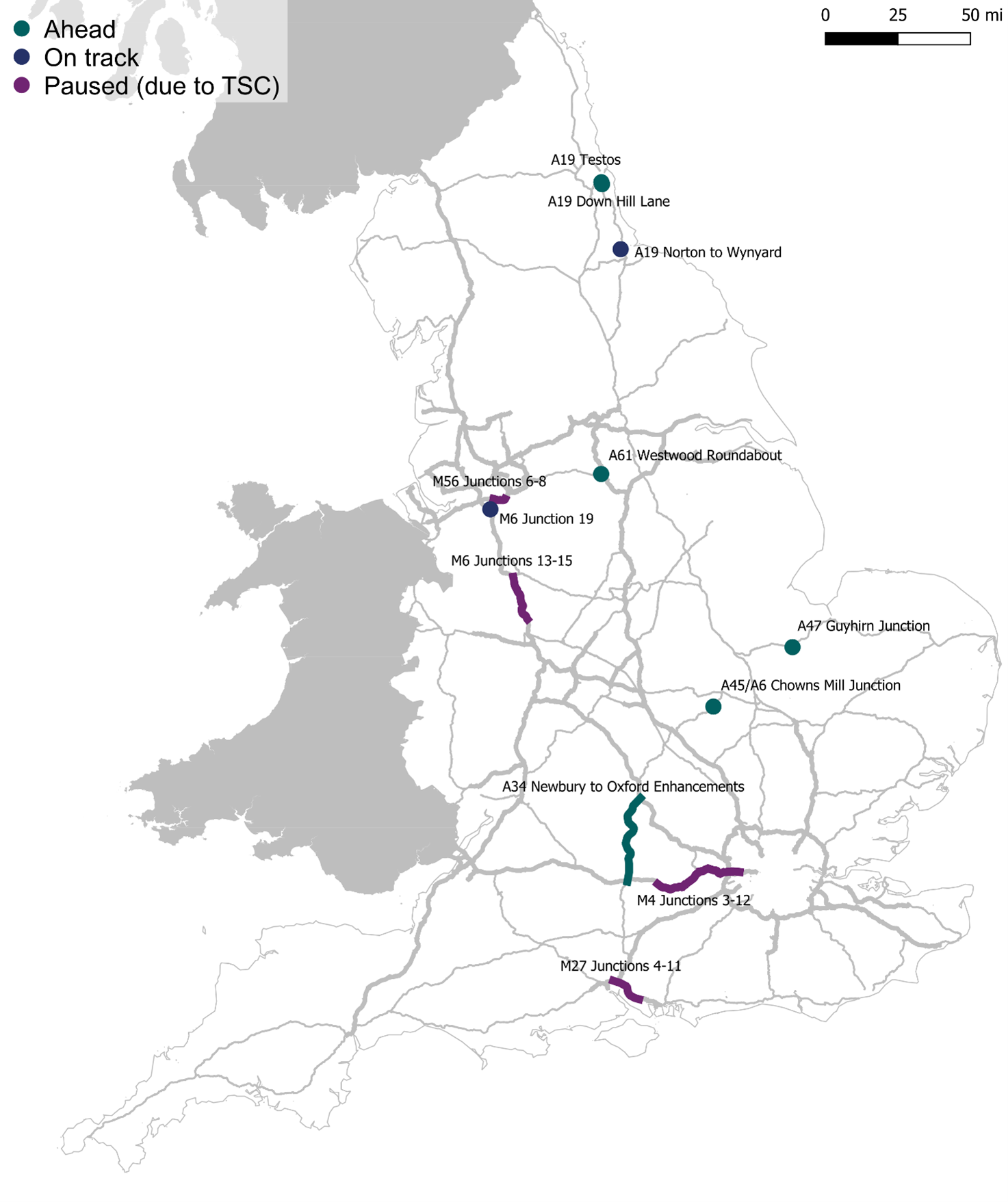

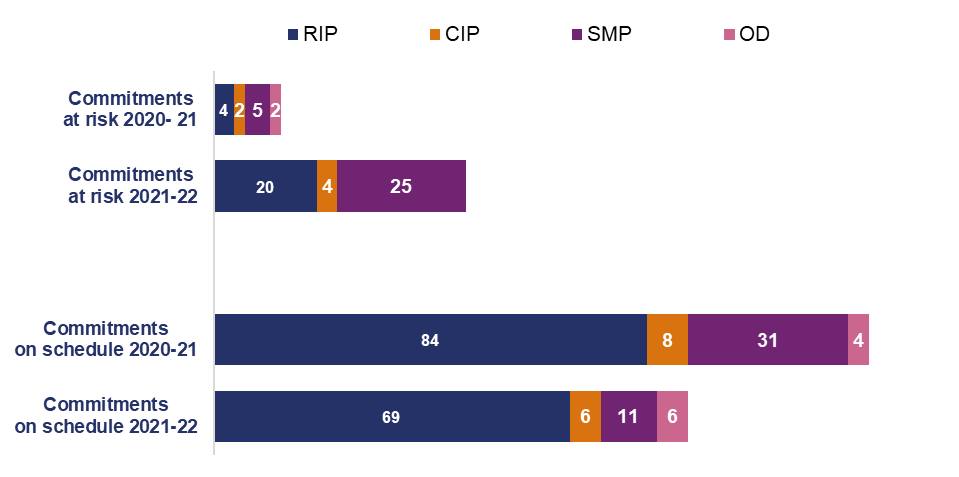

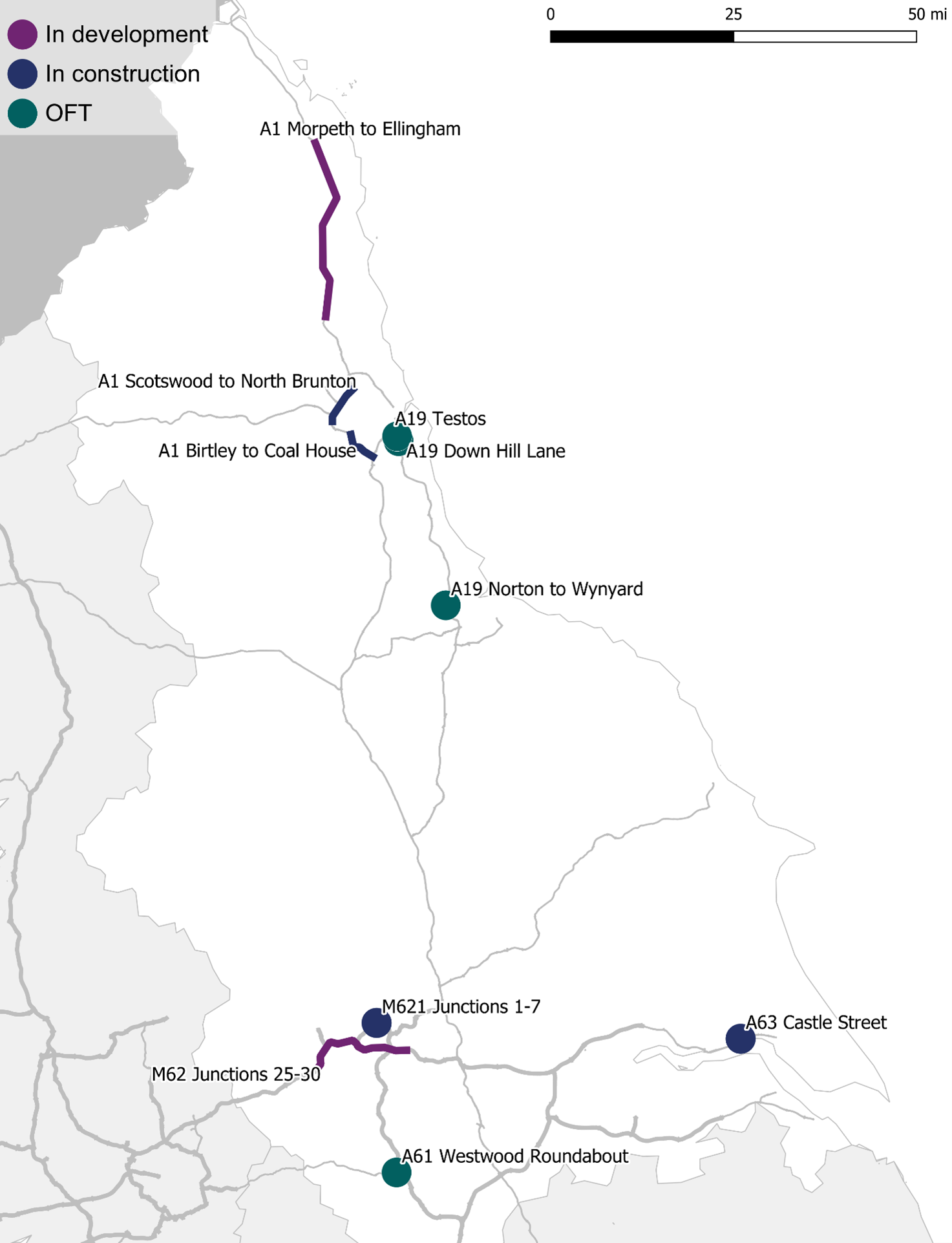

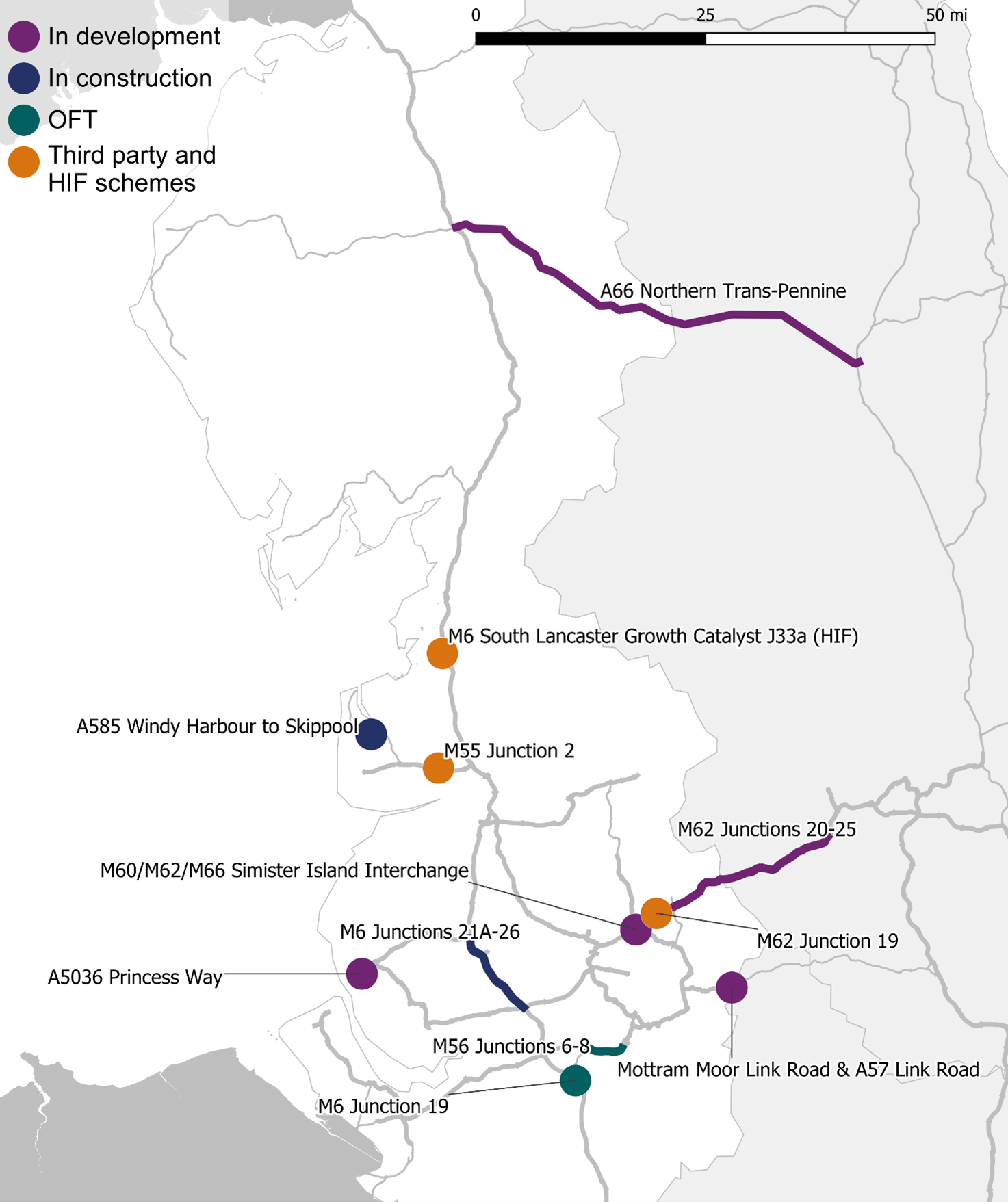

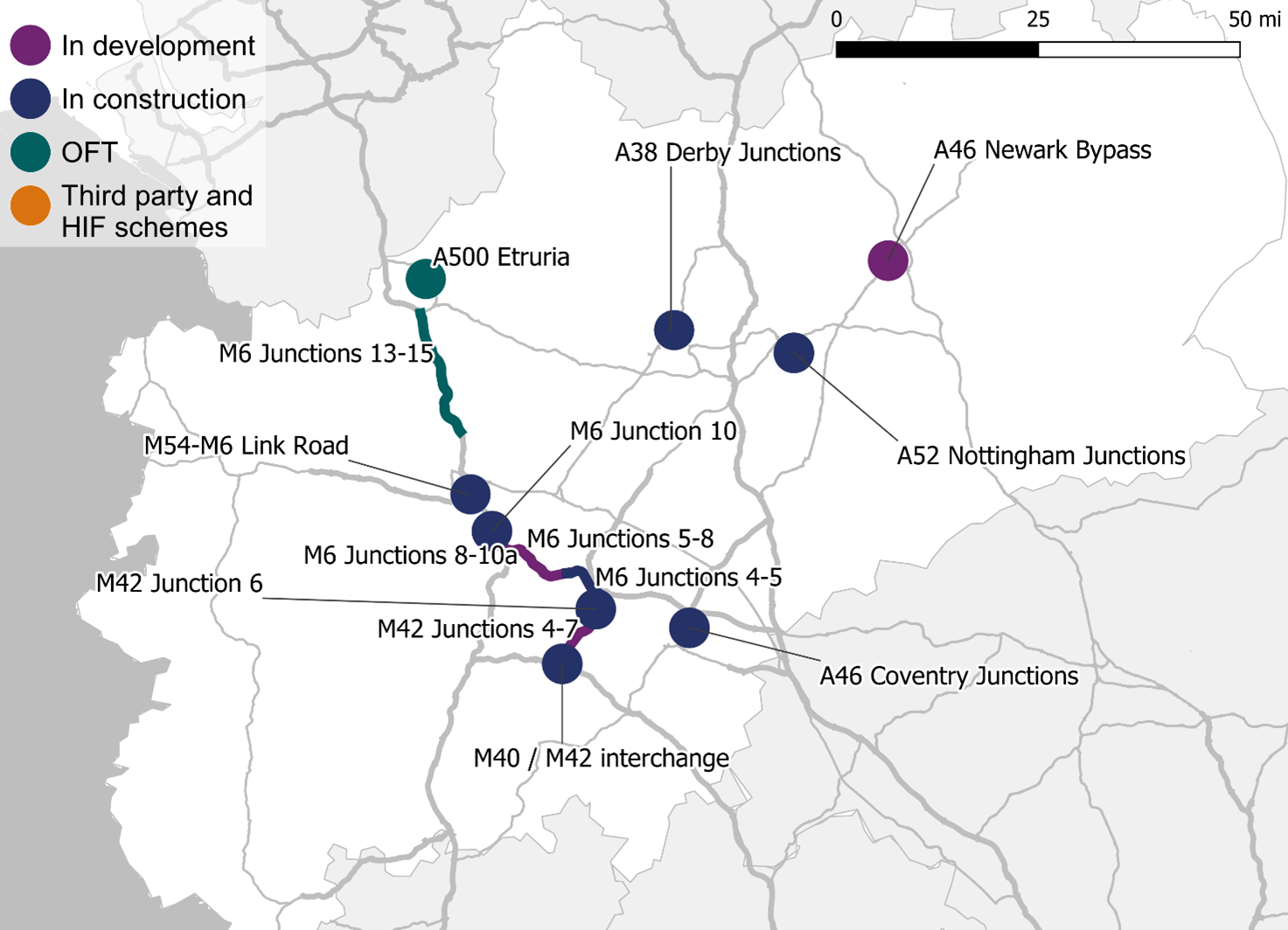

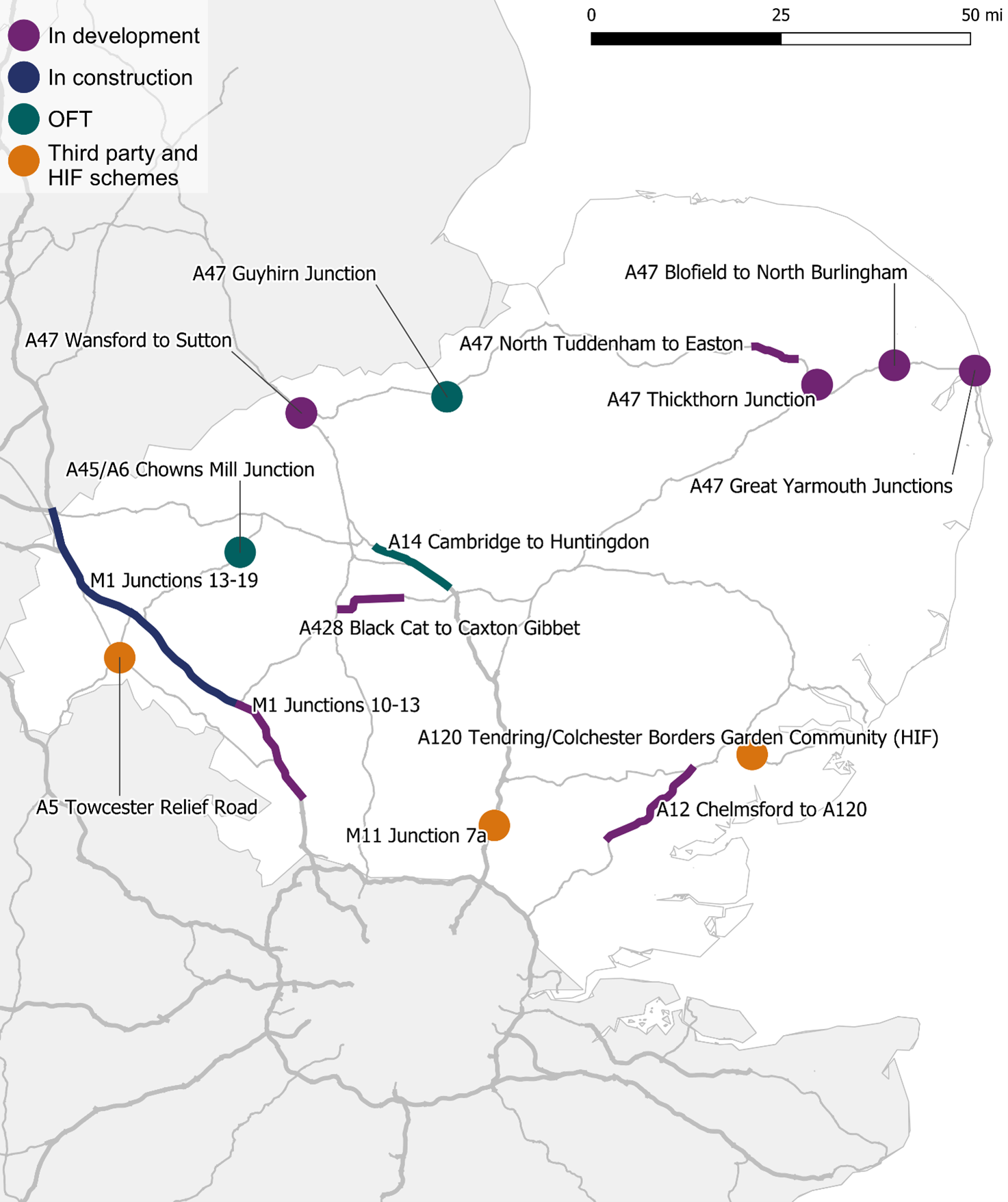

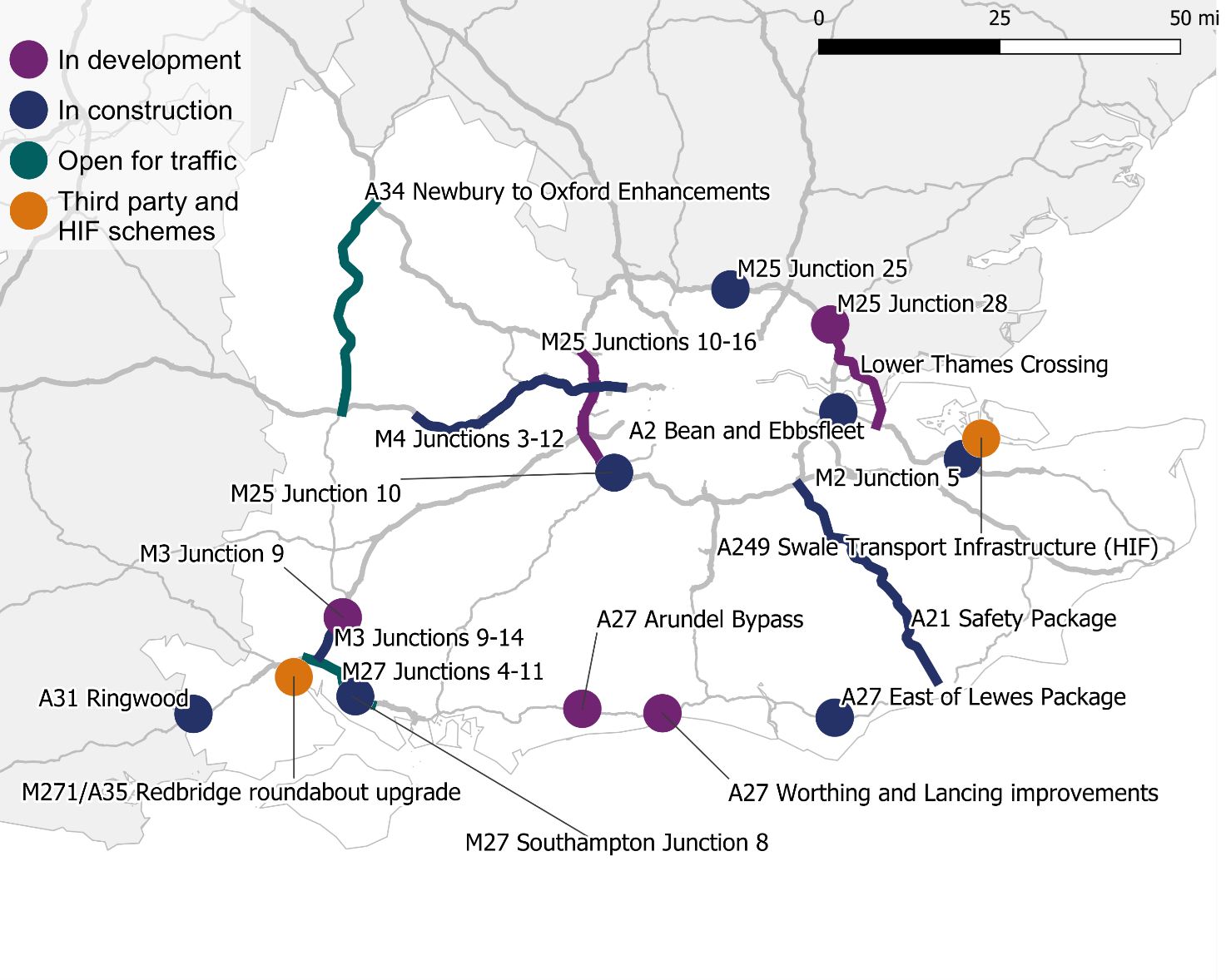

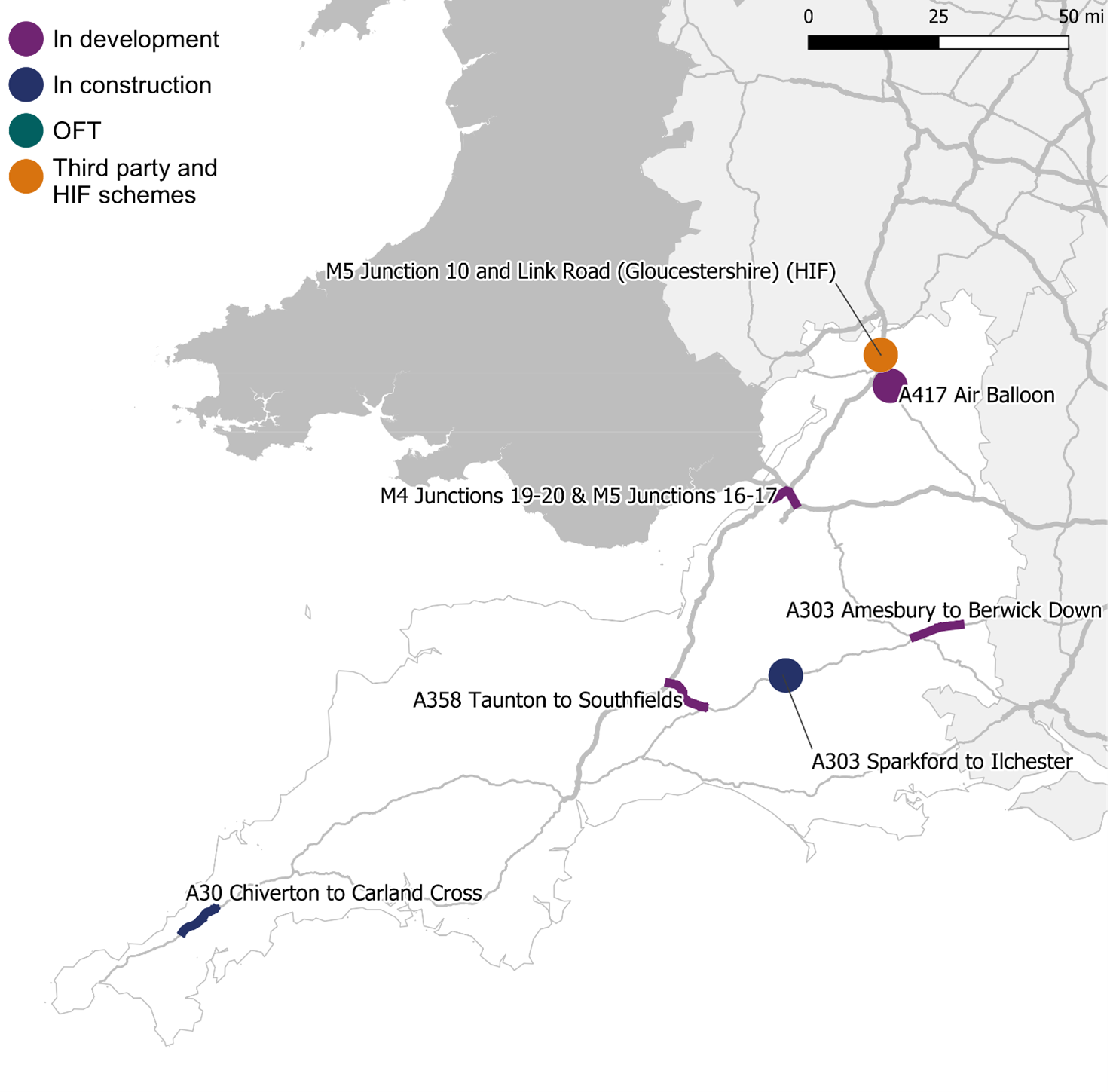

National Highways faced several challenges in 2021-22, but it met its in-year revised delivery commitments to start work on four schemes and open for traffic seven schemes. The company faces ongoing risks to delivery, such as planning issues, and needs to demonstrate that it is mitigating these. Otherwise, it will be challenging for it to deliver the remainder of its enhancements portfolio and other commitments on time and to budget, with the appropriate efficiency savings.

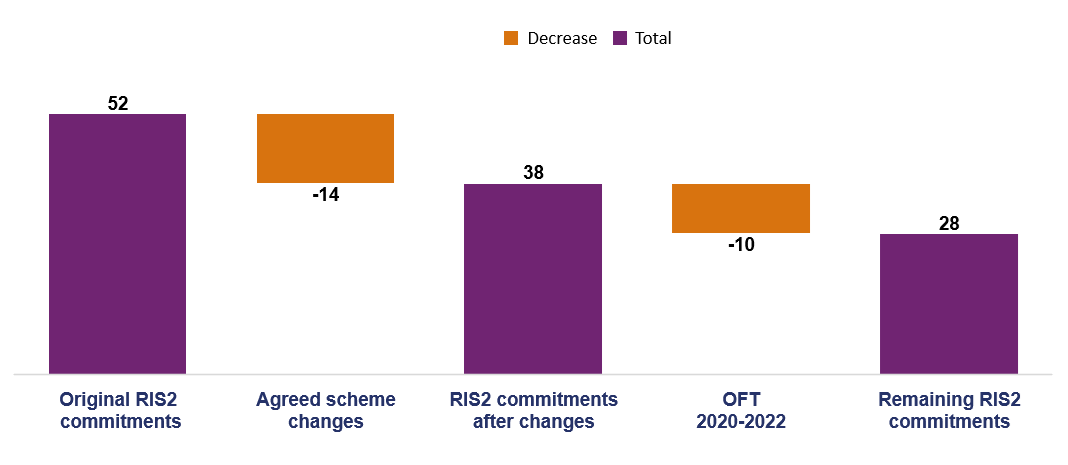

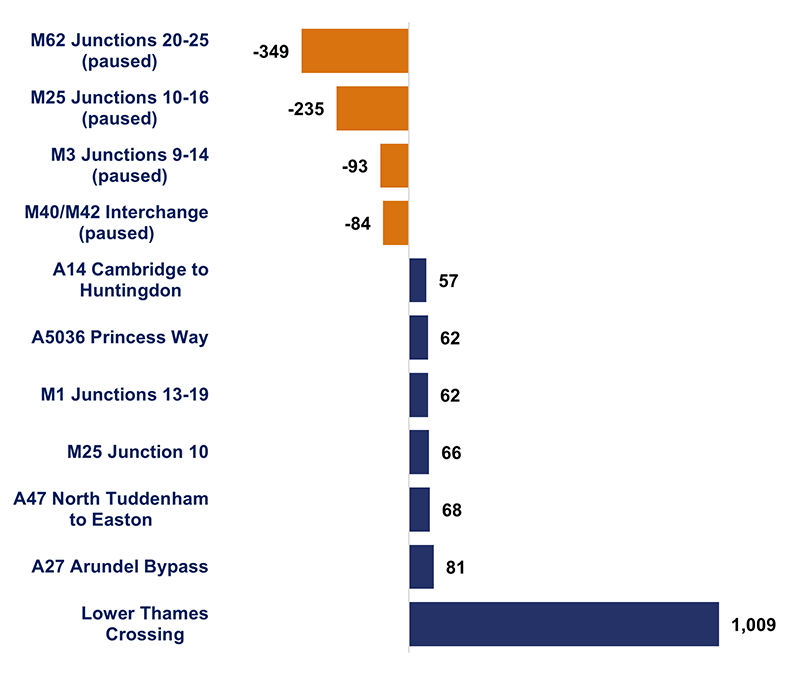

- In our 2020-21 annual assessment, we reported on the delivery risks to National Highways’ RIS2 enhancements portfolio caused by planning issues (particularly Development Consent Orders, or DCOs) and the accompanying underspend for RP2.

- Some aspects of these ongoing risks are not directly within National Highways’ control. However, it will need to mitigate them by engaging closely with stakeholders and the Planning Inspectorate to efficiently deliver the remainder of the RIS2 enhancements portfolio and its other commitments on time and to budget.

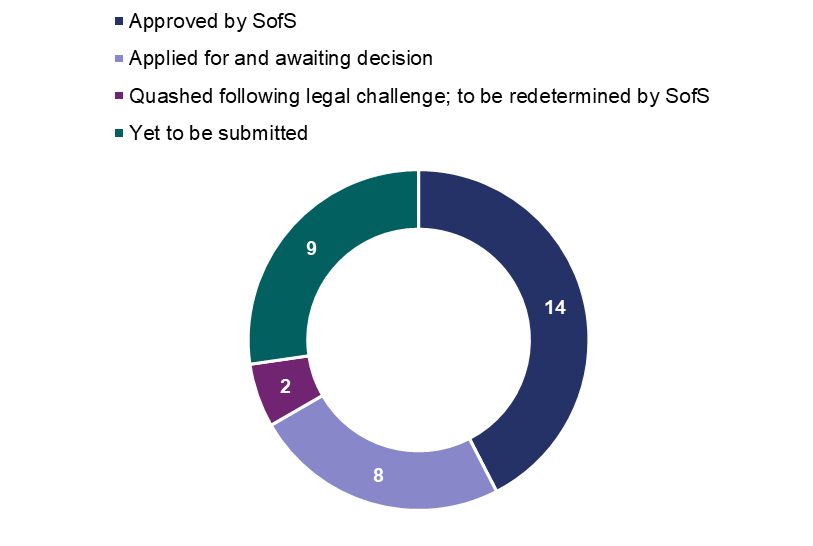

- In the first quarter of 2022-23, the Secretary of State approved four DCOs, three of which had progressed through the six-week period during which the decision may be legally challenged.

- We will continue to hold National Highways to account for its enhancements delivery, ensuring that it appropriately manages planning-related delivery risks across the remainder of RP2.

Looking ahead to 2022-23 Collapse accordion Open accordion

- Throughout 2022-23 we will maintain a focus on the issues discussed in this report. We will report back on in these matters in our 2022-23 annual assessment. In particular:

- We will publish a report on National Highways’ safety performance later in 2022. It will set out the company’s performance against its safety KPI.

- On the safety of smart motorways, we will continue to hold National Highways to account to deliver the smart motorway action plan, including the 10-minute traffic officer response time by September 2022. We will work with DfT and the company to deliver the recommendations from the TSC’s report on the roll-out and safety of smart motorways.

- On asset management, we will continue to challenge National Highways in RP2 and through our advice to government on the development of the third road investment strategy (RIS3). We will hold the company to account for the roll-out of its new renewals reporting tool by September 2022.

- We will continue to challenge National Highways to produce a robust biodiversity plan by September 2022 to achieve its RP2 KPI target.

- National Highways must ensure that its enhancements programme remains deliverable. We will continue to hold the company to account to ensure that it is doing everything it reasonably can to deliver its commitments.

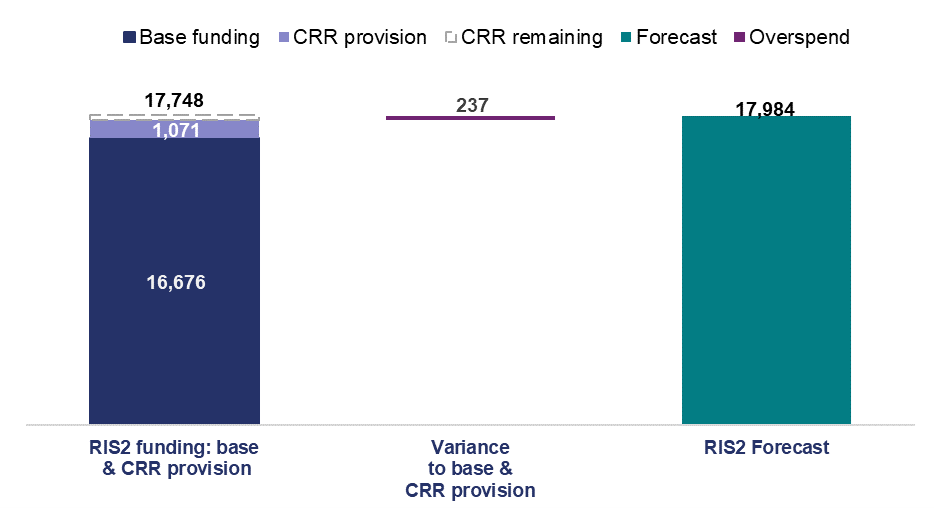

- We will require National Highways to address the most serious financial risks it faces in 2022-23 and across the remainder of RP2, including how it utilises its Central Risk Reserve.

- We expect National Highways to improve its reporting of efficiency evidence in 2022-23 and place a greater focus on its forecast performance against its KPI. We will scrutinise the company’s progress in this area.

- We will examine how National Highways manages delay on its roads that serve ports and airports. This could include the impact of disruption on the network if post-EU exit border controls on goods entering the country are phased in.

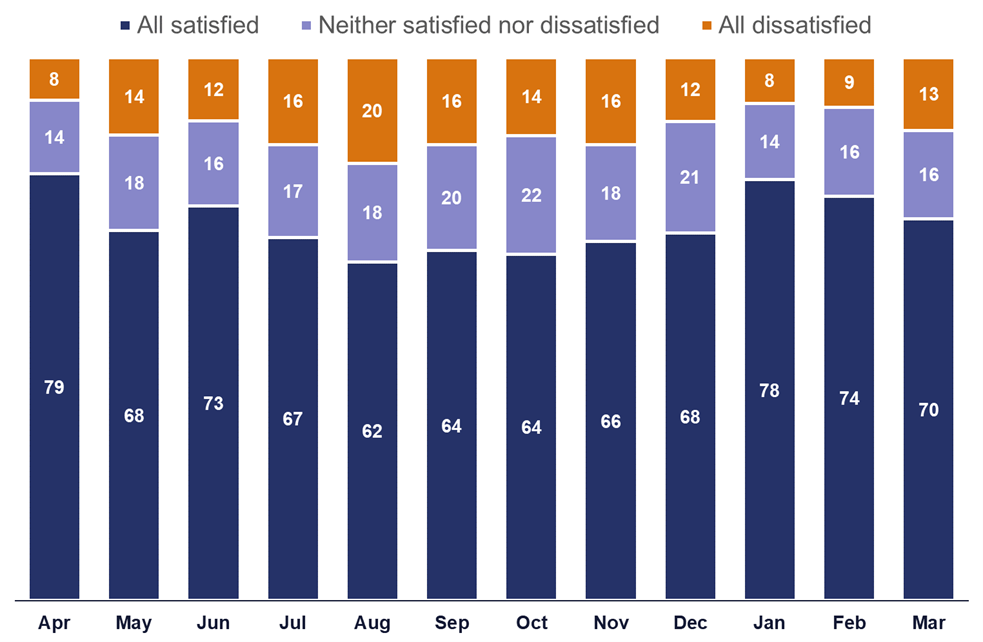

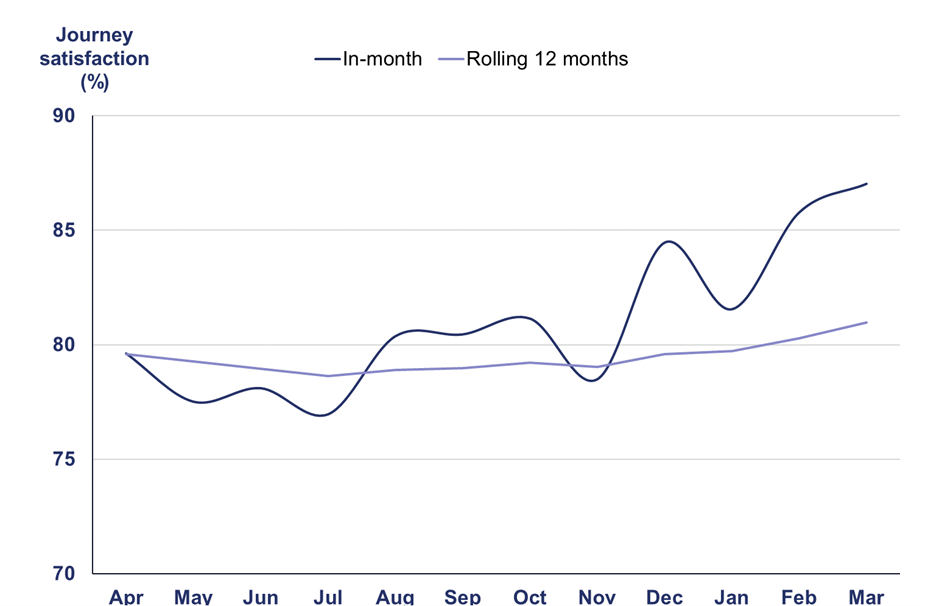

- With the strategic roads user survey (SRUS) target suspended for 2022-23, the third year in a row, we will work with National Highways and Transport Focus on the reintroduction of a target for 2023-24.

- We will hold the company to account for its progress in delivering its designated fund projects across the remainder of RP2.

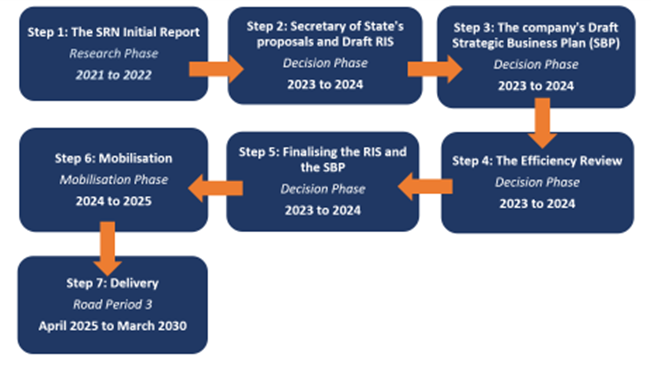

- In 2022-23, National Highways will start preparing its RIS3 draft Strategic Business Plan. We expect the quality of the company’s plans to reflect its maturity as a company entering the RP3. In summer 2022 we will set out guidance on the evidence we expect National Highways to include in its draft plan and will continue to work closely with the company, and other key parties, to ensure the success of the RIS3 process.

KPIs and targets Collapse accordion Open accordion

- The content below summarises National Highways’ 2021-22 performance against its KPIs and targets.

Outcome: Improving safety for all

KPI and target

- Killed or seriously injured (KSI) - 50% reduction by end of 2025 compared to 2005-2009 baseline

- 2021-22 performance: 1,397 KSI in 2020, a 54% reduction on the baseline. The forecast indicates that National Highways is on track to meeting its target. DfT will publish 2021 data in autumn 2022.

Outcome: Fast and reliable journeys

KPI and target

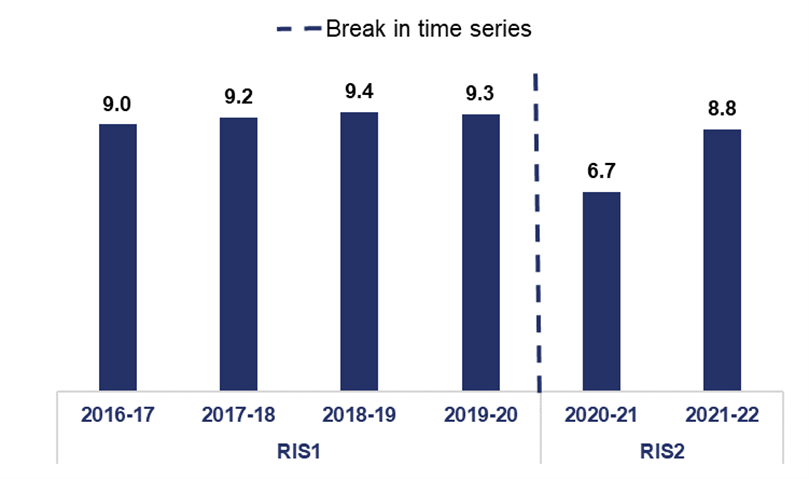

- Average delay - No worse than 9.5 seconds per vehicle mile

- 2021-22 performance: National Highways met its target. Average delay was 8.8 seconds per vehicle mile.

- Network availability - Not to exceed 43 million in 2021-22

- 2021-22 performance: National Highways met its target. Network availability was 42.7 million, a metric based on the length and impact of roadworks.

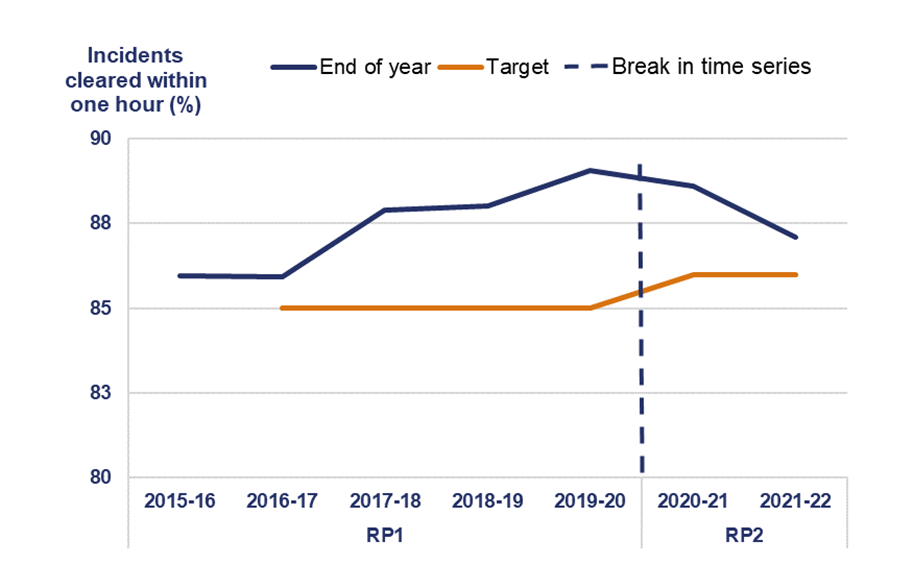

- Incident clearance rate - 86% of motorway incidents impacting on traffic flow cleared within one hour

- 2021-22 performance: National Highways met its target. 87.1% of incidents were cleared within one hour.

Outcome: A well-maintained and resilient network

KPI and target

- Pavement condition - 95% of road surface does not require further investigation

- 2021-22 performance: National Highways met its target. 95.5% of road surface did not require further investigation.

Outcome: Delivering better environmental outcomes

KPI and target

- Noise - 7,500 households mitigated in noise important areas by the end of RP2

- 2021-22 performance: National Highways is on track to meet its target. The company mitigated 1,067 households. It has achieved 42% of its RP2 target after two years.

- Biodiversity - No net loss of biodiversity by the end of RP2

- 2021-22 performance: National Highways is not on track to meet its target. The company has forecast a net loss by the end of RP2.

- Air quality - Bring links (sections of SRN between junctions) into compliance in the shortest time possible

- 2021-22 performance: 31 links exceed legal levels for nitrogen dioxide. DfT accepted 17 links have no additional mitigation available. Nine links are forecast to become compliant this year. Updated data is expected by the end of 2022.

- Corporate carbon - 75% reduction in corporate CO2 by 2025 compared to 2017-18

- 2021-22 performance: National Highways is on track to meet its target. The company has reduced its carbon emissions by 59% compared to the baseline.

Outcome: Meeting the needs of all road users

KPI and target

- Road user satisfaction - Target suspended for 2021-22

- 2021-22 performance: Target suspended.

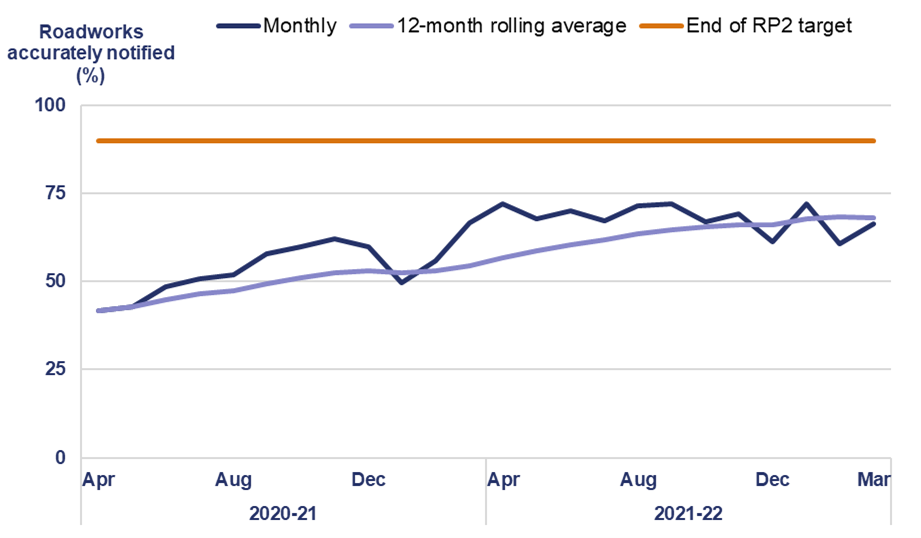

- Roadworks information - 90% of overnight road closures correctly notified 7 days in advance

- 2021-22 performance: Based on the rate of improvement from 2020, National Highways is on track to meet its target. The company reported 68.1% of overnight road closured accurately 7 days in advance.

Outcome: Achieving efficient delivery

KPI and target

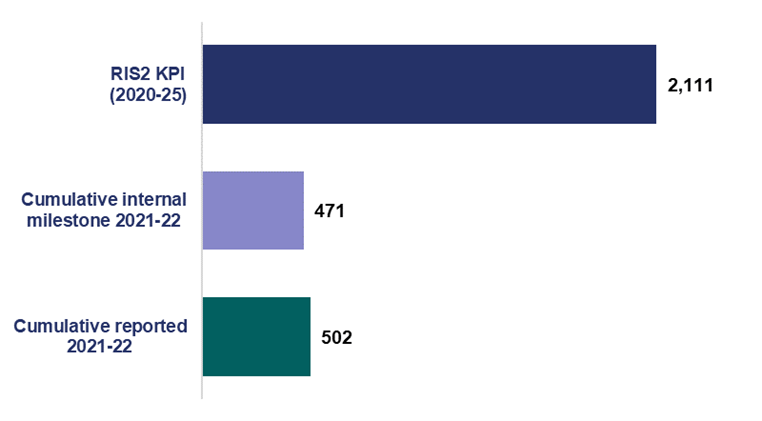

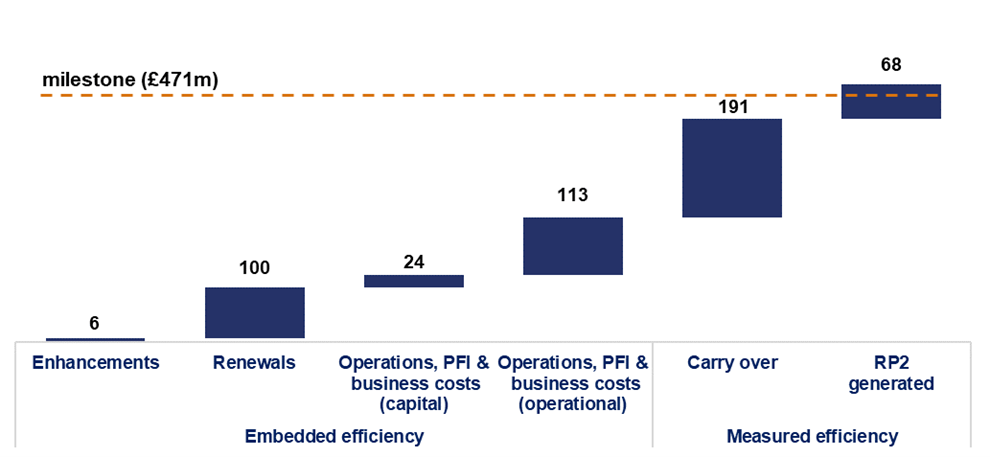

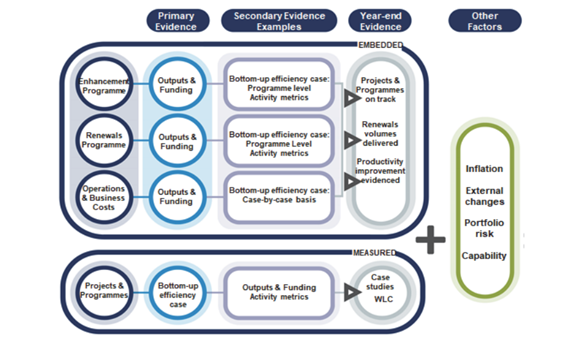

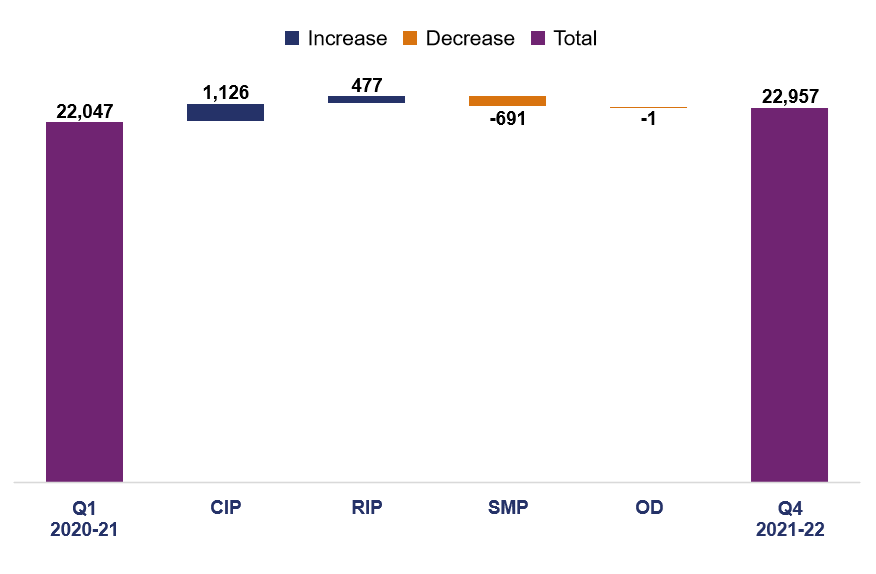

- Total efficiency - £2.11bn of operational and capital expenditure efficiency by the end of RP2

- 2021-22 performance: National Highways has reported a total of £502m efficiency savings, ahead of its plan. However, it needs to improve evidence supporting its claim.

1. Key message: safety

Safety remains National Highways’ priority. The company is working towards meeting its 2025 commitment and its zero harm ambition by 2040. It must maintain its focus as traffic levels return to normal. The company has made good progress on delivering the safety-focused smart motorway action plan. However, we remain concerned about its ability to deliver the action on faster traffic officer response times to incidents.

1.1 National Highways' forecast for its safety performance in terms of killed or seriously injured (KSI) road users on the strategic road network (SRN) is higher than 2020, but below pre-pandemic averages. This forecast indicates that the company is on track to meet its 2025 target of a 50% reduction in people killed or seriously injured on the SRN, compared to the 2005-09 average. This position will not be confirmed until the Department for Transport (DfT) publishes the relevant safety data (STATS19) in autumn 2022.

1.2 Traffic on the SRN recovered to 94% of pre-coronavirus (COVID-19) pandemic levels in March 2022, from 68% in March 2021. As road usage and traffic increases, it will be challenging for National Highways to sustain its safety performance and meet its safety targets. Over 2022-23, the company intends to work with government and stakeholders to improve safety and develop an action plan aligned to its 2025 safety target and its 2040 zero harm ambition. We will review this plan.

1.3 A key element of National Highways' safety work is its activity on smart motorways. In particular, the delivery of DfT's safety-focused Smart Motorway Safety Evidence Stocktake and Action Plan. Looking forward, the company will work with us to support DfT to address the TSC’s nine recommendations in its report on the roll-out and safety of smart motorways.

1.4 In 2021-22, National Highways delivered six actions, as scheduled. At year-end 2021-22, the company had completed a total of 15 of the 22 actions. Within the plan, National Highways also set itself a series of milestones and delivery dates for each action.

1.5 Our main safety-related concern throughout 2021-22 was about National Highways' ability to achieve action 3 – faster attendance by traffic officers. This is a critical element in providing visible management of incidents and improving road user safety. The company missed its July 2021 milestone to achieve a 10-minute average traffic officer response to live lane incidents on sections of all lane running motorway with emergency areas more than one mile apart.

1.6 In 2021-22, we required National Highways to provide us with further data and information on its activities. This it did. We also visited the company's regional operations centres. These visits gave us insight and understanding as to how the company is managing response times locally. It has helped to improve our relationships across the business and built confidence in the company’s performance.

1.7 At the time of writing, the average traffic officer response time was 10m 45s. We continue to engage with and hold the company to account to ensure that it does everything that can be reasonably expected of it to achieve its September 2022 target and sustain its performance.

1.8 We will hold the company to account for how it uses international road assessment programme (iRAP) star ratings in more areas of its business (ratings are based on road inspection data and provide a simple and objective measure of the level of safety that is ‘built-in’ to the road for all road users).

Outcome: improving safety for all Collapse accordion Open accordion

1.9 National Highways has one targeted key performance indicator (KPI), five performance indicators (PI) and two commitments under this outcome area.

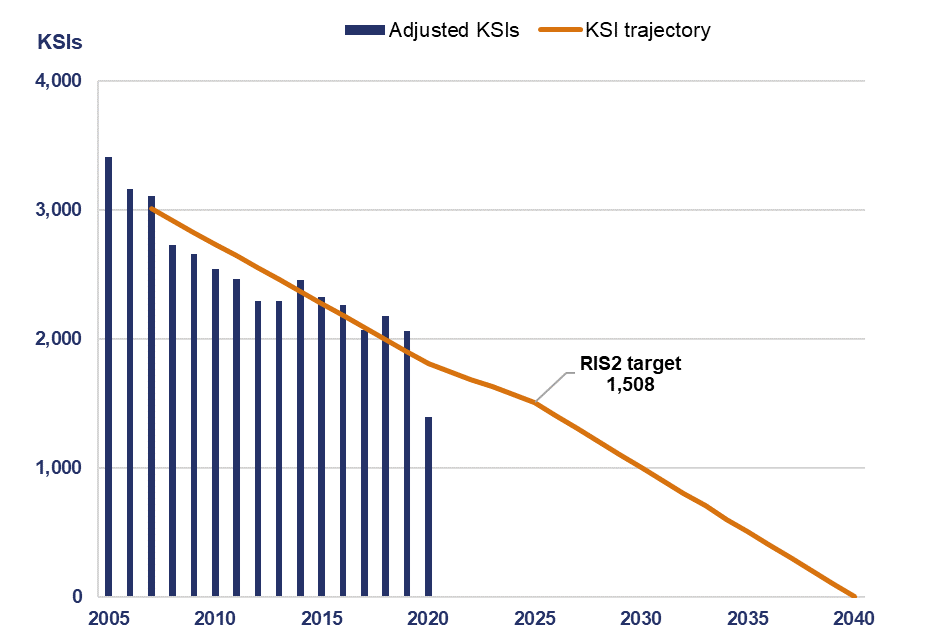

KPI: number of people killed or seriously injured on the SRN

1.10 As detailed in our November 2021 safety update, National Highways met its first road period (RP1) target to reduce the number of people killed or seriously injured on its network by 40% by 2020, compared to 2005 to 2009 levels. STATS19 reported an overall reduction of 52%. Figure 1.1 shows that in 2020 1,397 people were killed or seriously injured on the SRN. This number is adjusted to account for different reporting between police forces. Further details on adjusted data are available in our autumn 2021 safety update.

1.11 National Highways’ estimate for people killed or seriously injured in 2021 shows an increase compared to 2020. However, it is still fewer than the number that the company reported before the pandemic. The company has three years left in which to reach its 50% reduction target. If the company maintains this trajectory, then it would be on track to meet its target. DfT will publish STATS19 to validate this position in autumn 2022.

Figure 1.1 National Highways’ safety performance and target trajectory

PIs: improving safety for all

1.12 PIs are untargeted metrics. They enable us to scrutinise more aspects of National Highways’ network performance beyond the headline KPIs.

1.13 All injury and collision PIs (paragraphs 1.14-1.16) are based on STATS19 data. We are reporting on data for 2020, where injuries and collisions were below pre-pandemic levels due to lower levels of traffic on the SRN. Data for 2021 will be published by government in autumn 2022.

Total number of people killed or injured on the SRN

1.14 The most recently published data shows that in 2020, 7,873 people were killed or injured on the SRN. This PI includes the ‘slight injury’ category that is excluded from the KPI.

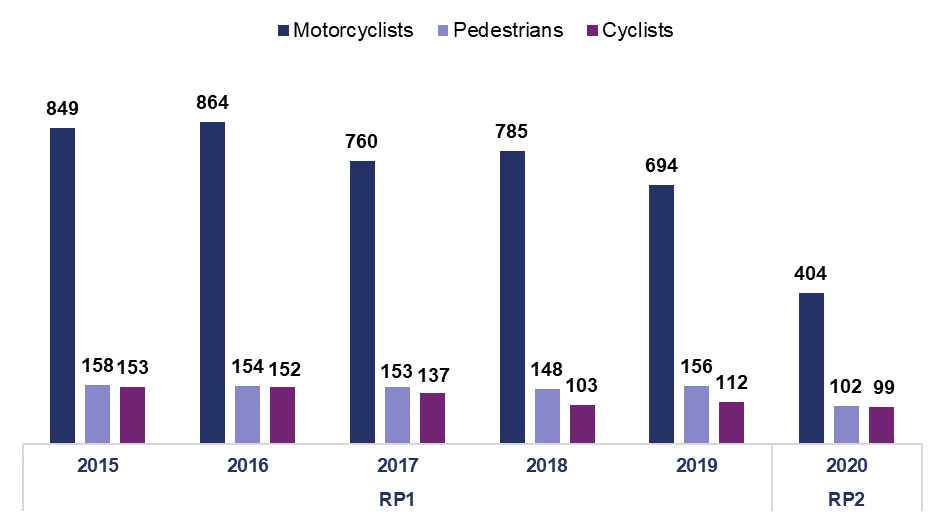

Number of non-motorised and motorcyclist users killed or injured on the SRN

1.15 In 2020, a total of 605 non-motorised and motorcyclist users were killed or injured on the SRN. Figure 1.2 shows a breakdown by user type.

Figure 1.2 Number of non-motorised and motorcyclist users killed or injured on the SRN

Number of injury collisions on the SRN

1.16 In 2020, 5,267 collisions were recorded on the SRN that resulted in at least one injury of any severity. This is a new indicator for RP2. It differs to the PI on number of people killed or injured as it reports the number of collision incidents only.

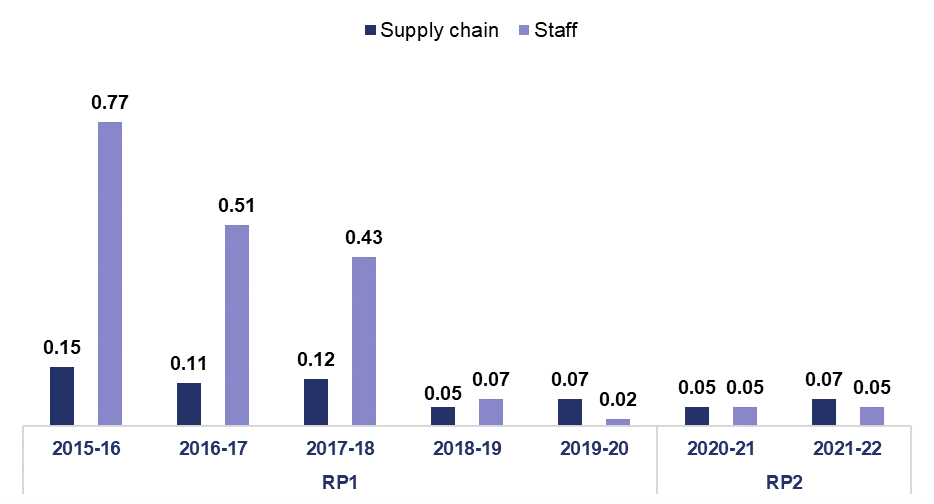

Accident frequency rate for National Highways’ staff and supply chain

1.17 For National Highways’ staff, there were seven RIDDOR (Reporting of Injuries, Diseases and Dangerous Occurrences Regulations 2013) reportable incidents on the SRN in 2021-22. This equates to an accident frequency rate of 0.05 reportable incidents per 100,000 hours worked (the same as 2020-21).

1.18 For National Highways’ supply chain, there were 27 RIDDOR reportable incidents. This equates to 0.07 incidents per 100,000 hours worked. This is higher than 2020-21 when the incident rate was 0.05.

1.19 Figure 1.3 shows an improvement in overall accident frequency rates since 2015. However, improvements have stalled in RP2, with the supply chain accident frequency rate rising back to the same level as 2019-20.

Figure 1.3 Accident frequency rate for National Highways’ supply chain and staff

Percentage of traffic using iRAP 3-star or above rated roads

1.20 iRAP is a way to measure how safe a road network is. This is done with a 5-star rating for each section of road. The roads with the highest risk to road user safety are rated one star and roads with the lowest risk are rated five stars.

1.21 National Highways committed in RIS1 to ensure that by the end of 2020, 90% of travel on the SRN was on roads rated three stars or better (using model v1). The company conducted a survey and published a report in March 2022 indicating that 96% of travel on the SRN was on roads rated three stars or better in the iRAP model, exceeding its RIS1 target.

1.22 iRAP introduced an updated model (v3.02) following several years of development. It has more demanding requirements for 3-star roads as it includes ten times as many attributes to record, such as pedestrian and cyclist flows.

1.23 In its report, National Highways said that by the end of 2020, 89% of travel on the SRN was on roads rated three stars or better against the v3.02 model. This was an improvement compared to 82% of travel in 2015 that would have been on 3-star roads under that model.

1.24 We will review National Highways’ use of iRAP data in more parts of its business, such as enhancements design, walking and cycling schemes and road upgrades. This is to satisfy ourselves that the company is using the data effectively to improve safety on the network.

Commitments: improving safety for all

1.25 Commitments are priorities that are not suited to metrics, such as developing new metrics, publishing reports on specific performance items or improving reporting for future years.

In 2021 establish an iRAP baseline and 2025 forecast, based on latest iRAP methodology

1.26 National Highways has met this commitment (see paragraph 1.21). The company is forecasting that 89% of travel in 2025 will be on roads rated three stars or better against the v3.02 model. The company has explained that this is unchanged from the 2020 baseline because it is undertaking network improvements to reduce risks on 3, 4 and 5-star rated roads.

Work with Transport Focus to investigate a rate-based measure for non-motorised user casualties

1.27 In April 2022, government approved National Highways’ request to cease the development of a rate-based measure for non-motorised user casualties. This was due to difficulties gathering the required data.

Safety of smart motorways Collapse accordion Open accordion

1.28 We hold National Highways to account for the delivery of the safety-focused smart motorway action plan. In January 2022, government agreed to take forward the TSC’s nine recommendations on the roll-out and safety of smart motorways. We are working with government and the company to implement and deliver the recommendations.

1.29 In October 2019, the Secretary of State (SofS) asked DfT to carry out an evidence stocktake of smart motorway safety. The report was published in March 2020, as the Smart Motorway Safety Evidence Stocktake and Action Plan. The SofS asked us to hold National Highways to account for the delivery of these actions. The company has since published two annual progress reports, with the second year progress report published in May 2022. For each action, it set itself a series of milestones and delivery dates. These progress reports also contain safety data for specific types of smart motorway that we independently quality assured.

Delivery of the smart motorway action plan

1.30 In 2021-22, National Highways completed six of the 22 actions in the plan. The company reported that it did the following:

- evaluated live lane stops to see if additional M25 emergency areas had reduced the rate;

- investigated accident clusters and implemented changes where necessary;

- contributed to the update of the Highway Code;

- communicated with road users on using smart motorways;

- created a national programme to install more emergency areas on existing smart motorways; and

- enabled satnav providers to show places to stop in an emergency.

1.31 National Highways completed nine actions in 2020-21 and it plans on delivering five actions in 2022-23. This would leave one action for the company to deliver between 2023 and 2025 to meet its commitments. Table 1.1 lists all outstanding actions.

1.32 In January 2022, National Highways paused delivery against its action to end the use of dynamic hard shoulders (DHS). This followed government’s decision to pause the upgrade of these motorways to ALR in response to recommendation eight of the TSC’s November 2021 report on the roll-out and safety of smart motorways.

Table 1.1 Outstanding actions against the smart motorway action plan

| Action | Action completion date |

|---|---|

| Ending the use of DHS (upgrade of DHS to ALR) | Paused following TSC recommendations |

| Faster roll-out of stopped vehicle detection (SVD) | September 2022 |

| Faster attendance by traffic officers where emergency area (EA) spacing is more than one mile | March 2023 |

| Monitor smart motorway performance | March 2025 |

| More traffic signs giving the distance to the next place to stop in an emergency | September 2022 |

| Displaying 'report of obstruction' messages | March 2023 |

| Complete upgrade of enforcement cameras (HADECS3) to enforce Red X | September 2022 |

1.33 National Highways also created seven follow-on actions. The company judged follow on actions to be necessary to either complete a main action or because of a main action. It completed four of these actions on time in 2021-22. Table 1.2 lists the follow-on actions and their completion dates.

Table 1.2 Smart motorway action plan: follow-on actions

| Follow-on actions | Follow-on action completion date |

|---|---|

| Smart motorways in construction will open with SVD | September 2022 |

| Evaluation of live lane stop rates to see if additional M25 EAs have reduced the rate | Complete (February 2022) |

| Deliver a programme of measures identified to enhance the safety across the four locations | March 2023 |

| Making emergency areas more visible - follow on activity | Complete (June 2021) |

| Launch eCall public information campaign | Complete (September 2021) |

| Identify and deliver a programme of works for widening EAs identified as being feasible and appropriate | March 2025 |

| Use the Driving for Better Business campaign to urge businesses to always switch on Automatic Emergency Braking to reduce likelihood of rear end collisions involving lorries. | Complete (February 2022) |

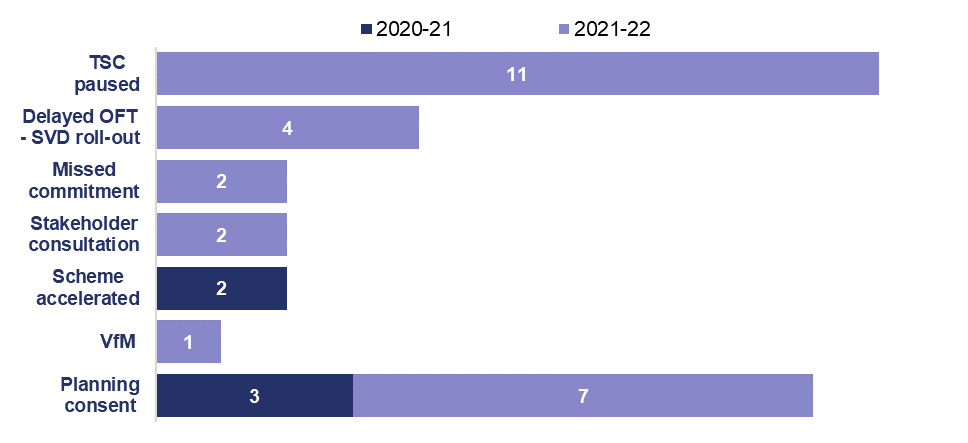

Pausing the roll-out of smart motorways

1.34 As set out in paragraph 1.28, government accepted the TSCs recommendation to pause the roll-out of smart motorways until five-years of safety data is available to evaluate the safety of smart motorways introduced before 2020.

1.35 National Highways has a standardised method of post opening project evaluations (POPEs) for enhancements schemes. A POPE evaluates the actual impact of a scheme compared to expected impacts. The company currently evaluates each scheme it delivers at the one- and five-year milestones after it opens for traffic.

1.36 We are scrutinising the company’s POPE publication plan for smart motorway schemes. Nine of these are due to be completed in 2022. In July 2021, the company published the five-year POPE for the M1 junctions 10 to 13 dynamic hard shoulder running scheme.

1.37 It is imperative that National Highways improves its delivery timescales of POPEs. This would enable the company to provide five-years of safety data evidence and properly evaluate smart motorway schemes in-line with the TSCs accepted recommendation.

Traffic officer 10-minute response time

1.38 Action 3 of the smart motorway action plan is for faster attendance by National Highways traffic officers. In March 2021, the company set a milestone of July 2021 to achieve a 10-minute average response time for traffic officers responding to live lane stops on sections of ALR where places to stop in an emergency are more than one mile apart.

1.39 In May 2021, we commissioned an external review of five critical smart motorway actions. The review, published in August 2021, made recommendations on how we should hold National Highways to account for its delivery against the action plan. It concluded that a metric for traffic officer response times would help us to measure the company’s progress.

1.40 National Highways missed its July 2021 milestone. We escalated our concerns. We wrote to the company on 13 August 2021 to request additional disaggregated regional data on the following three areas:

- the staffing levels it needs to meet the 10-minute response time and an assessment of how existing levels compared;

- its traffic officer recruitment, absence and attrition rates; and

- its performance against the 10-minute response time.

1.41 National Highways responded to our letter on 18 August 2021. It began to send us the requested data monthly from September 2021 onwards. We have been using this information, alongside our regular engagement, to hold National Highways to account for its delivery of the action.

1.42 We wrote to National Highways again on 13 January 2022 following the company's failure to provide a revised milestone date and to reflect our ongoing concerns about the company’s ability to achieve the action. National Highways responded to our letter on 19 January 2022 setting out:

- a new target date of September 2022 to achieve the milestone;

- a list of 'levers' that it intended to deploy for each of its regions to achieve the action, together with the likely impacts of these levers across each region, based on a high, medium and low assessment;

- its plan to assess the success of these levers at weekly and monthly review meetings both regionally and nationally;

- recognition that the labour market was challenging, and the company had difficulty with recruitment in certain regions;

- that the two largest risks to achieving the target time will be the acceptance of single vehicle crewing and the delivery of additional traffic officer vehicles; and

- a detailed programme for the roll-out of an updated incident management system for the ROCs, and SVD, a system of radar technology that can detect a stopped vehicle in a live lane.

1.43 After receiving this information from National Highways, we visited each of the company’s ROCs. We talked to senior staff at each ROC to better understand what the company is doing to improve response times and the issues and risks to achieving the 10-minute response target. We discuss this further in the case study.

Case study: ORR visits to Regional Operations Centres (ROCs)

National Highways deals with around 1,500 reports of incidents on the strategic road network (SRN) on a typical day. Approximately 200 daily incidents impact a live lane. One in four of these are on smart motorways and are included in the company’s 10-minute response time target.

National Highways manages incidents from its ROCs, where operators answer calls from road users and emergency services and dispatch traffic officers to assist. Since November 2021, when the company reported average response times of 11m 35s, we have visited all the company’s ROCs. We arranged these visits to understand what it was doing on a regional basis to reduce traffic officer response times.

National Highways employs around 900 traffic officers who patrol the SRN, and 400 ROC operators. On the visits we challenged the company to provide further details of its recruitment processes and existing vacancies. Staff told us that the company had moved to a modular training process. This enabled it to fill vacancies faster. This gave us confidence that the company was managing its staffing levels in a way that would help it reach its 10-minute response time target.

We saw each region’s patrol strategies. These are designed to achieve the fastest possible response time by allowing for variations in time of day and traffic flows. The company uses a bottom-up approach, where traffic officers input their thoughts on the strategy. This level of maturity increased our confidence that regional teams are taking steps to reduce their local response times.

We saw stopped vehicle detection in operation. The control room is alerted when a stopped vehicle is detected on a section of all lane running (ALR). It also sets a ‘report of obstruction’ sign for drivers. The system automatically displays a camera feed facing the detected vehicle. ROC operators then acknowledge the alert and either confirm it is a stopped vehicle or remove the alert if it was a false alarm. If a stopped vehicle is confirmed, the signs and signals are set automatically, with speed limit changes and a lane closure if required. Traffic officers are then dispatched to attend the stopped vehicle.

Our visits allowed us to further understand how National Highways is using technology, ROC operators and traffic officers to achieve its 10-minute response time target. We will continue to assess the company’s progress. What we saw on the visits will also be useful for our future work in this area.

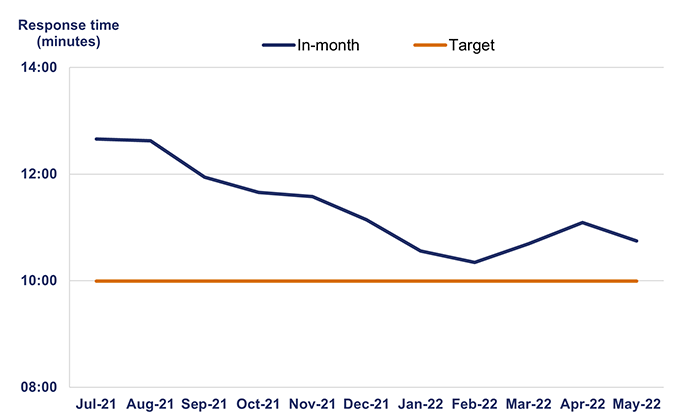

1.44 In May 2022, National Highways averaged 10m 45s for traffic officers responding to live lane stops on sections of ALR where places to stop in an emergency are more than one mile apart. This is an improvement from when the company started reporting response times to us in July 2021. Figure 1.4 shows the monthly changes in performance.

1.45 Between July 2021 to February 2022, National Highways improved its performance. This was due to improved patrol strategies, some additional traffic officer vehicles and recruiting traffic officers and ROC staff.

1.46 We scrutinised National Highways’ calculation of its traffic officer response times. Data before October 2021 had errors present for certain regions. The company fixed these errors and we are now satisfied that the data we receive is accurate and robust.

Figure 1.4 National Highways’ traffic officer response times

1.47 National Highways has told us that the two most significant risks to meeting its 10-minute target in September 2022 are:

- slower delivery and fitting out of new traffic officer vehicles, caused by supply chain issues during 2022; and

- the activation of Operation Brock.

1.48 National Highways is reporting that its roll-out of new traffic officer vehicles is running at half the expected rate. This is due to supply chain issues in importing the vehicles and associated equipment. The company is prioritising delivery of vehicles to regions that have higher average response times to help lower the average nationally.

1.49 Operation Brock was activated on 25 March 2022 and deactivated on 6 June 2022. The traffic management that forms part of the operation draws traffic officers from other parts of the network. This increased response times nationally. It was reactivated on 11 July 2022. The latest activation is likely to adversely affect traffic officer response times. The case study that follows discusses our visit to see Operation Brock and its impact on the 10-minute response target.

1.50 Based on National Highways’ June 2022 data, it has fewer traffic officers in recruitment and training, relative to the number of vacancies. However, the company has modularised its training programme and streamlined recruitment. This is likely to lead to faster on-boarding with no loss of competence.

1.51 We think that the revised milestone target date, of September 2022, is achievable if National Highways continues delivering additional traffic officer vehicles and focuses on recruitment of traffic officers. However, the activation of Operation Brock will negatively affect performance and the company will need to mitigate its effects successfully if it is to achieve the target. We will continue to closely scrutinise National Highways’ delivery of this milestone.

Case study: ORR visit to Operation Brock

Operation Brock is a traffic management measure designed to improve the resilience of the strategic road network (SRN) in the event of disruption to travel across the English Channel. It operates along a 10-mile stretch of the M20 in Kent, between Junctions 8 and 9. It enables National Highways to control the flow of continental Europe-bound lorries and manage lorry traffic on the SRN.

The Kent Resilience Forum, of which National Highways is a part, decides when to activate Operation Brock. We visited the control centre in May 2022 to understand the scale of the operation and the impact on smart motorway response times.

On our visit we saw National Highways’ constraints when operating the network in Kent and the lack of spare capacity to accommodate lorry traffic. This enabled us to understand the context for how the company deploys its traffic officers to run Operation Brock.

We discussed Operation Brock staffing requirements, the associated redeployment of traffic officers across the South-East and other regions, and the impact this had on the region’s 10-minute response time. The company also told us how it is driving continuous improvement by enabling traffic officers to patrol the carriageway in both directions.

We will continue to assess the impact of Operation Brock on traffic officer response times and challenge the company to improve its regional resilience when it is active.

Source: National Highways

2. Key message: asset management

During 2021-22, we saw some progress in National Highways' asset management maturity. However, the company is yet to provide us with sufficient evidence that it is executing its asset management policy consistently and effectively. The renewals work it delivers must be targeted at the right asset at the right time in its lifecycle. National Highways must urgently take steps to demonstrate compliance with its own policy. It must provide us with assurance that it is not compromising the long-term efficiency of its network or road user benefits when taking asset management decisions.

2.1 In 2021-22 we saw an increase in National Highways’ focus on asset management. However, the company is still developing its maturity as an asset management organisation, including how it renews its assets. It must improve its asset management renewals capability, and evidence its improvement through reporting. This reporting will provide greater assurance to us that the company is efficiently delivering the right work to the right asset at the right time. This will lead to improved long-term outcomes for road users, for whom safe and reliable journeys are a key priority. This is directly linked to the quality of the highway asset, in particular road surfacing.

2.2 The company published an updated asset management policy in May 2022 and implemented a governance framework. This enables it to make consistent planning and delivery maintenance decisions. However, we are yet to see sufficient evidence that the company is delivering that policy effectively and consistently in the asset renewals work it delivers across the country.

2.3 National Highways’ current reporting shows that it met its road surface condition key performance indicator (KPI) target in 2021-22. It also shows how many asset renewals the company delivered and the money that it spent. However, this does not adequately convey whether the company is addressing the right asset need, at the right time. For example, National Highways delivered an output of 566.5 kilometres of safety barrier, against its planned output of 384.6 kilometres. However, we do not know if that was the right asset to invest in and/or if it was the right time to do it. Incorrect investment decisions will result in inefficiencies and reduced road user benefits in the future.

2.4 In our 2020-21 annual assessment, we described the work we had done with the company to trial reporting that showed the extent to which it delivered planned renewals schemes and the reasons for changes across a region. Between April 2021 to March 2022, the company provided limited data for two further regions and was unable to provide sufficient detail and evidence across the whole of its network. The company is now creating a digital tool to help satisfy its renewals reporting requirement.

2.5 However, we are yet to be convinced that National Highways fully understands our ongoing concern about its renewals asset management capability and how it can effectively demonstrate that going forwards. We will assess the roll-out of the company’s new digital tool and hold it to account for how it develops its renewals asset management reporting. The company needs to demonstrate the long-term value it is adding from its asset management capability, through the capital renewals work it delivers.

Outcome: a well-maintained and resilient network Collapse accordion Open accordion

2.6 National Highways has one targeted key performance indicator (KPI), four performance indicators (PI) and two commitments under this outcome area.

2.7 National Highways’ performance against its road surface condition KPI is above target, as it was in the first year of the second road period (RP2). Its overall performance against other metrics within this outcome area continues to show improvement with no significant deterioration in comparison to the previous year.

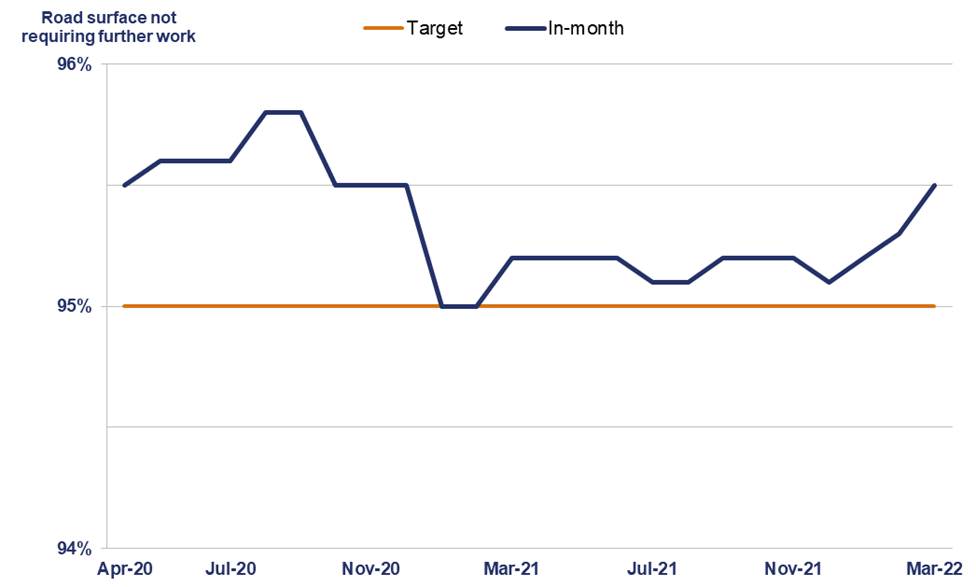

KPI: road surface condition

2.8 At the end of March 2022, the percentage of lane 1 road surface on the strategic road network (SRN) that did not require further investigation by National Highways was 95.5%. This has been consistent across the last five years and is an improvement of 0.3% on the company’s position at year-end 2020-21.

Figure 2.1 Pavement not requiring further investigation between April 2020 and March 2022 (%)

2.9 For the first two years of RP2, only lane 1 (left-hand lane) was considered as part of the KPI. This is because it is the lane most impacted by vehicles, especially lorries. Government and National Highways improved and updated the metric for the remainder of RP2 to include condition data from all the main lanes. This will better represent the overall condition across the network.

PIs: a well-maintained and resilient network

2.10 PIs are untargeted metrics. They enable us to scrutinise more aspects of National Highways’ network performance beyond the headline KPIs.

Structures condition

2.11 The condition of structures (for example, culverts, gantries, retaining walls and bridges) is measured by three performance indicators:

- the average condition of the stock (SCAV);

- the condition of the assets’ most critical elements (SCRIT); and

- the percentage of structures that have been inspected and rated as ‘good’ (SCI).

2.12 As shown in figure 2.2, the reported numbers show a continuous increase for SCRIT score and only a slight decline in the SCAV score and SCI score between March 2021 and March 2022. The reduction is less than a 0.5 percentage point difference.

Figure 2.2 Structures PI for RP1 and the first two years of RP2

Technology availability

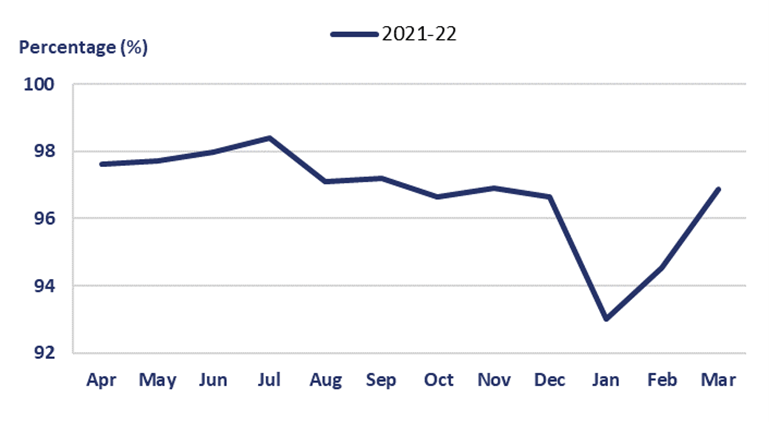

2.13 This indicator measures the percentage of time that roadside technology assets on the SRN, (for example, cameras, electronic signs and weather stations that observe and control traffic), are available and functioning. National Highways reported that the availability of its technology assets was 96.88% at the end of March 2022. This was an increase of 1.82 percentage points compared to the end of March 2021.

Figure 2.3 Roadside technology assets availability in 2021-22 (%)

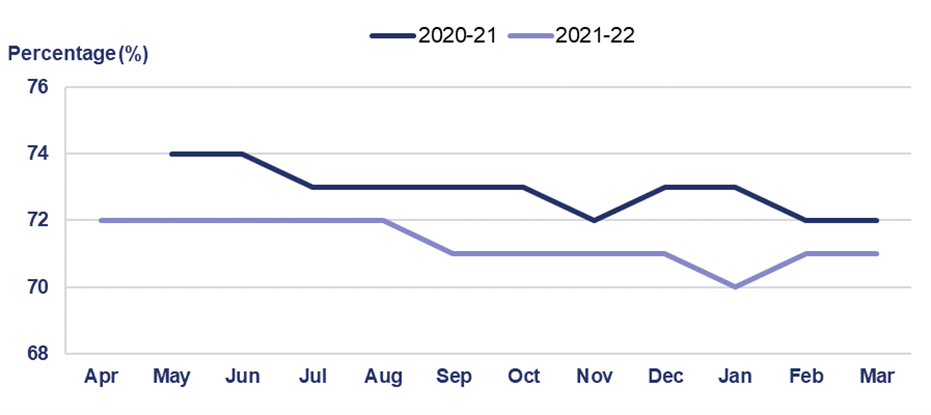

Drainage resilience

2.14 Drainage assets collect, move or store surface water runoff on the SRN. This indicator measures the percentage length of National Highways’ network that does not have an observed significant susceptibility to flooding. As at March 2022, the company reported drainage resilience of 71%. This was one percentage point lower than March 2021. This means that 29% of the SRN has areas that include high risk flood hotspots.

2.15 National Highways is working to minimise the impact of flooding on the network by improving its reporting process. This is to ensure that:

- in the short-term adequate preventative measures are in place for areas with high-risk flood hotspots when severe weather conditions are expected, such as clearing pipes; and

- in the long-term that remediations where possible are prioritised for the high-risk hotspots, such as replacement of drainage pipework.

Figure 2.4 Percentage length of SRN with no significant susceptibility to flooding in the first two years of RP2

Geotechnical condition

2.16 This PI captures the percentage length of National Highways’ geotechnical assets (earthworks that support other highway assets and adjacent land) that are in ‘good’ condition or better. As at March 2022, the company reported that 99.61% of its geotechnical assets achieved at least a ‘good’ rating. This was 0.01 percentage points lower than in 2021.

Commitments: a well-maintained and resilient network

2.17 Commitments are priorities that are not suited to metrics, such as developing new metrics, publishing reports on specific performance items or improving reporting for future years.

Implement the Asset Management Development Plan (AMDP) for RP2

2.18 Early in the first road period (RP1), National Highways transferred the milestones it had set out in its AMDP into an Asset Management Transformation Programme (AMTP). The company met those milestones for the first year of RP2 (2020-21).

2.19 In 2021-22 the company accelerated two milestones from 2022-23 to increase the total to 14. However, it missed two of these milestones.

2.20 The first of these missed milestones was to develop three metrics:

- ride quality – planned implementation from April 2022 was postponed until September 2022 because of delays to user trials due to the coronavirus (COVID-19) pandemic. Government, ORR, National Highways and Transport Focus agreed to the postponement;

- vulnerable structures – change of scope to align with the company’s RP3 investment case; and

- investigate and improve structures condition – achieved.

2.21 The second missed milestone related to the company’s asset data governance model. The company changed the scope and timescale. It reported that this was to align the activity with existing work on data governance.

2.22 Delivery of the milestones in its AMTP is an important part of how National Highways improves its asset management capability. It is important therefore that the company does not miss those milestones for reasons within its control. Milestone scope changes are appropriate given that they are subject to change control governance within the company. We will look at the milestones that have timescale changes into 2022-23 (ride quality metric and asset data governance model). We want assurance that they have been completed, in addition to those new milestones planned for the year ahead.

Investigate an improved structure condition metric and an alternative indicator for technology assets

2.23 In its year-end reporting, National Highways said that it was on track to deliver this commitment. The company reported that it had met its milestone to complete the feasibility stage of its metric investigations by Q2 2021-22 for both structures and technology assets. It is conducting detailed investigations of the feasibility recommendations into 2022-23.

Maintaining the SRN

2.24 We assess how well National Highways maintains the SRN by analysing the company’s reported data sets. Infrastructure maintenance is typically split into two main categories, determined by the funding source:

- routine maintenance keeps the SRN safe and serviceable by undertaking routine cyclical operations like cutting vegetation, clearing drains and graffiti, and reactive repairs to defects such as potholes. It is funded under resource budgets; and

- renewal of assets such as road surfacing and bridges that make up the SRN. This is funded under capital budgets.

Annex C contains a summary of data sets against each category.

2.25 While separately funded, the two categories are directly linked. If National Highways does not adequately deliver routine maintenance, assets may fail prematurely requiring early renewal, and if the company does not undertake renewal activity in a timely manner an asset may require increased routine maintenance to keep it safe for users. The range of different asset types that form the SRN and the impact of varying traffic levels and environmental conditions across the country make this a complex challenge for the company to manage.

2.26 However, this is a fundamental part of what National Highways’ is expected to do. It makes a significant contribution to how efficient the company is. As a minimum, the company must ensure that the SRN is safe for use and fit for purpose. Maintenance is a major part of the overall asset management system that enables the company to maximise the value of the SRN to users and achieve the strategic requirements of the road investment strategy (RIS). It is therefore important that National Highways demonstrates that it is delivering against its asset management policy, how it is delivering against that policy, and that it is efficiently managing the SRN.

Capital maintenance – renewals planning and delivery

2.27 National Highways delivered all its committed major life-extension renewals, and most of its cyclical renewals in 2021-22. The company failed to meet four of its 14 cyclical renewals commitments:

- it marginally missed commitments in two categories: bridge parapets and technology assets;

- it missed its commitment on bridge waterproofing by 25%; and

- it missed its commitments on lighting by 6%.

The company reported that it missed these commitments mainly because of contractual delays in the Yorkshire and North-East region that transferred to the AD contract model in 2021-22. It is positive that National Highways understands why it under-delivered and has processes in place to offset a shortfall in one region with over-delivery in other regions in-year. However, the Yorkshire and North-East region is one of the last regions to transfer to the AD contract model. We are concerned that lessons learned from earlier transfers did not enable a smoother contract mobilisation.

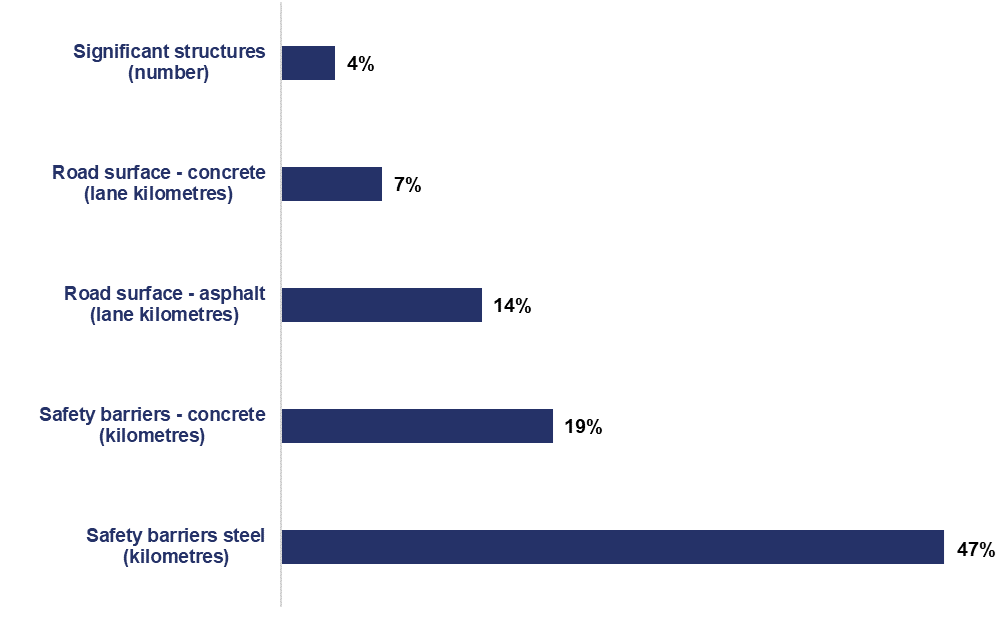

2.28 Figure 2.5 summarises the major life extension renewals volumes that National Highways delivered against its planned commitments in 2021-22. Annex C provides a full summary of renewals delivery.

Figure 2.5 Volumes of major life-extension renewals delivered compared to plan in 2021-22

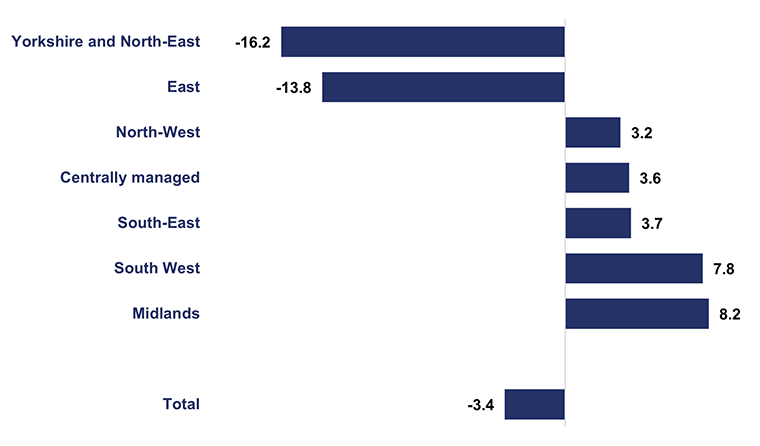

2.29 National Highways spent close to its 2021-22 funding to deliver its planned renewals commitments. Overall, the company underspent by £3.4m (0.4%). This was driven by structures and technology and partially offset by overspends on roads and winter maintenance assets. Regionally there was some variation, ranging from a £16.2m (12%) underspend in Yorkshire and the North-East to a £8.2m (6.6%) overspend in the Midlands. This was due to difficulties in rolling out the new AD approach (see paragraph 2.27).

Figure 2.6 Chart showing renewals expenditure variance by region in 2021-22 (£ million)

2.30 National Highways must deliver key asset renewal volumes in line with RIS2 assumptions, its delivery plans and within its funding. Delivering the RIS2 requirements within funding is an important part of the evidence of performance against the efficiency KPI for all areas of expenditure.

2.31 However, for renewals, we recognise that focusing mainly on volumes and spend can lead the company to take a short-term approach in its decision making. This could mean not always renewing the right assets at the right time in their lifecycle or providing a less complex, lower quality renewal. We saw this in several areas of National Highways’ renewals practice during the first two years of RP2. For example:

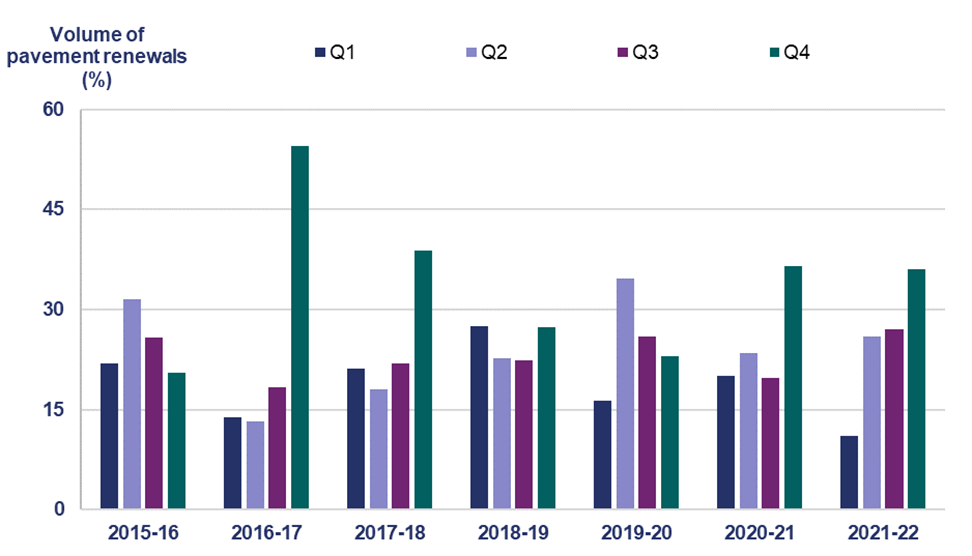

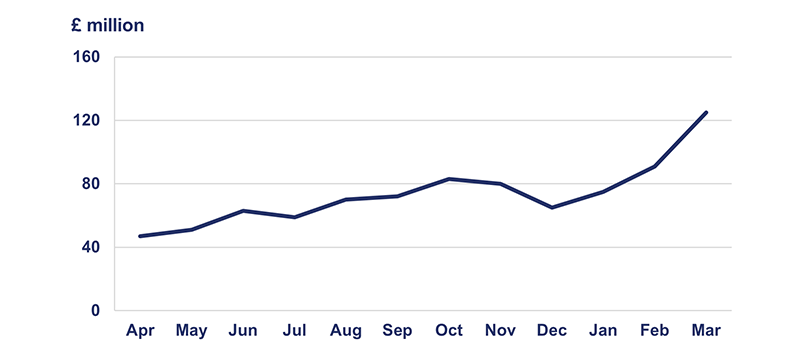

- slow delivery of renewals in the early part of 2020-21 and 2021-22 led to higher than planned delivery during the winter months when adverse weather can impact renewal quality (figure 2.7);

- completing ‘life extension’ concrete pavement renewals comprised of localised repairs, in place of full surface reconstruction. The company deferred the more complex and disruptive repairs to later years of RP2; and

- lacking evidence that it is delivering pavement renewals at the average depth levels of 54mm that it was funded to do within RIS2 to achieve reduced whole-life costs.

Figure 2.7 Renewals capital expenditure in 2021-22

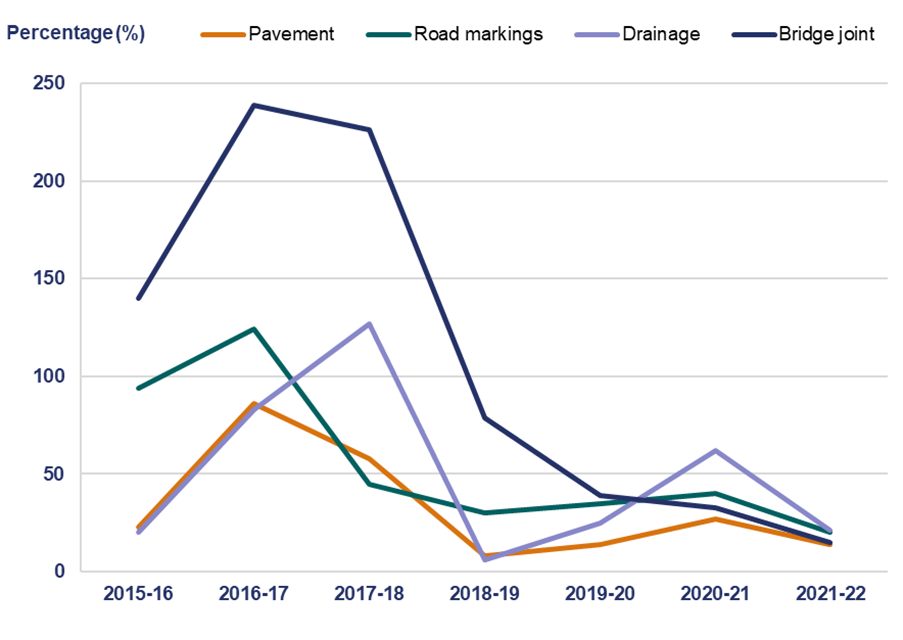

2.32 National Highways’ delivery of renewals in 2021-22 was closer to plan than in the first year of RP2. Fewer assets exceeded 50% output variance from the plan and the company avoided any significant variances from planned outputs. Compared with the early years of RP1, this demonstrates how the company has improved its delivery against its plans. Figure 2.9 shows how delivery of renewals has varied compared to plan since 2015 across a selection of assets.

Figure 2.8 Volumes of renewals delivered compared to plan for a selection of assets between April 2015 and March 2022

2.33 Our main concern with how National Highways reports its renewals outputs and its spend against budget is that it only tells us how many outputs were delivered and how much budget was spent. It does not tell us whether the outputs delivered were against those assets with the greatest need, or what value the company has added to the SRN. It does not tell us whether over-delivery reflects an asset in poorer condition, or whether under-delivery will result in safety risks to the user.

2.34 National Highways should not assume that delivering more outputs for the same money is automatically a good thing. It must seek to understand and report whether its work is addressing the asset need and adding value from a whole-life cost perspective. If the company’s reporting is limited to basic backward-looking counts, it will struggle to meaningfully show the impact of its asset management policy and governance and whether it is addressing the strategic requirements of the RIS, now and in the future.

2.35 RIS2 requires National Highways to report asset performance against a range of metrics (see paragraph 2.24 and annex C). This gives us an indication of the health of the SRN and the impact of the maintenance work the company has delivered. However, the company reports only limited aspects of performance and does not include all asset types. For example, the renewal of safety barriers is funded in RIS2 as part of the major life extension renewals programme, yet the company does not report how safety barriers perform. In 2021-22, the company reported that it had delivered 47% more steel, and 19% more concrete safety barriers than it had planned. However, this does not tell us whether this work addressed specific need, whether it improved road user safety or whether it was the best use of resource from a whole-life cost perspective.

2.36 In 2021-22, National Highways reported that contractual delays associated with the roll-out of its AD contract model in the Yorkshire and the North-East region caused a shortfall in the company’s delivery of renewals in that region. However, this was offset by over-delivery elsewhere in the country. National Highways provides us with improved high-level regional commentary on its renewals delivery. This is helpful. However, its focus remains on renewal outputs delivered and spend. It is not possible to determine the impact of the company’s delivery against local asset need across its regions. The company’s reporting must provide assurance that delayed works do not have a detrimental impact on asset need or user risk or increase the requirement for routine maintenance works in regions where plans are disrupted.

2.37 In 2021-22, National Highways planned to deliver its first full reconstruction concrete road surfacing scheme. The company told us that the planned scheme start date was delayed and was reprogrammed to commence in financial year 2022-23. This generated an underspend in the 2021-22 financial year of approximately £70m, so the company brought forward other works to utilise the funding. This adjustment to a complicated programme meant that projects then clashed with the plans of neighbouring highways authorities, preventing the deployment of appropriate traffic management and limiting delivery of those adjusted renewals. National Highways’ reporting must show that it is using the five-year funding window provided by RIS2 to avoid the inefficiency associated with spending annual budgets, and to best manage the whole-life costs of the asset.

2.38 National Highways does not deliver renewals outputs solely through its maintenance schemes. It can also deliver these outputs through other programmes, such as enhancements or designated funds. These programmes typically have different outcome requirements to those of the renewals programme. Therefore, reporting that is focussed on outputs delivered may not necessarily demonstrate well-maintained and resilient network outcomes. It is important that National Highways makes clear in its reporting the value of the maintenance outcomes it achieves from the work it delivers.

Case study: Renewals capability

In August 2021 we commissioned a review of National Highways’ evolving approach to renewals investment planning for RIS3. We investigated six key asset groups that account for most of its expenditure on renewals: road surfaces, barriers, structures, roadside technology, drainage, and geotechnical assets. The review considered the quality of asset condition data, how the company determines whether an intervention is required, and how it balances factors such as traffic disruption, environmental impacts, and cost.

We assessed the maturity of National Highways approach against its own renewals planning capability framework. The framework is a staged process that builds towards the aim of ultimately implementing a ‘Service Value Driven’ approach that seeks to optimise the long-term social value of investment. We support the use of the framework, and the capability targets National Highways has set itself.

Overall, the review found a mixed picture. National Highways had met its own renewals planning capability targets for some assets, but elsewhere it had more to do in terms of the quality of data and evidence available. In 2021-22, the company worked on addressing the gaps identified and has made some progress. For example, the company has shared its plans for how it will enhance its asset knowledge for structures and roadside technology.

An important cross-cutting area of capability highlighted by the review was the extent and sophistication of National Highways’ whole-life cost assessment. This is an area where we would like the company to increase its focus. It is vital that, subject to a range of other considerations, the company plans renewals in a way that minimises the cost of maintaining the network in the long-term. During the RIS3 development process, we expect the company to demonstrate it has a good understanding of its plans.

Resource maintenance – routine maintenance

2.39 National Highways reports maintenance performance against a range of metrics covering core maintenance activities, defect management, asset inspection and insurance claims.

2.40 Throughout RP1 and into RP2, the company has been transitioning legacy maintenance contracts with its supply chain to the Asset Delivery (AD) contract model. Under the AD model, National Highways is in direct control of data collection and associated decision making. We expect the quality of the company’s reporting to improve alongside greater transparency of how it is maintaining the network and the value this is adding to reflect improved capability as the transition to AD nears completion.

2.41 National Highways reported that in 2021-22 it improved cyclical and reactive maintenance performance compared to 2020-21. The company also improved its performance in addressing high priority defects across most defect types, within its 24-hour target. However, its performance in addressing normal defects within the required timescale decreased across most defect types. Furthermore, the company reduced the number of categories it reports defects against in 2021-22. We are concerned that this reduces the transparency of defect management to assets that are important to road users, such as road signage. It also narrows our understanding of the impact National Highways’ maintenance work has made on the range of asset types. Annex C describes the reduced number of categories and defect performance.

2.42 In 2021-22, National Highways overspent its resource maintenance budget by £28m. The company told us that this additional spend is likely to have led to improvements across areas of maintenance performance, but it has been unable to explain what these improvements were. The company must improve its understanding of the relationship between its maintenance performance, levels of service and spend.

2.43 We are concerned that without this understanding, National Highways will struggle to define what resource budget investment levels it requires to achieve a target level of service for RIS3 and beyond, or to provide evidence to support an understanding of the impacts of increasing or decreasing funding. A better understanding of the link between performance and spend should also make clearer to the company the line of sight with capital maintenance need and delivery. For example, where reactive maintenance performance improves as tired and defective assets are renewed.

Efficient delivery of the renewals programme

2.44 National Highways’ reporting of its capital renewals activity to date has focused on the renewals outputs it has delivered and the budget it has spent. This may show that work was delivered, but not whether it was the right work to address the right needs across the network at the right time.

2.45 In January 2020, to comply with its licence condition, National Highways published its asset management policy and strategy. An accompanying governance framework sets out the company's approach to asset management and defines its processes and procedures for asset-based decision making. In May 2022, it revised and published its asset management policy alongside an accompanying approach to asset management document.

2.46 To date, National Highways has been unable to provide us with sufficient confidence that what it is delivering through its maintenance and renewals programmes across all regions is evidentially linked to its asset management policy and governance. This limits our ability to assess whether the company's maintenance and renewals activity is appropriate given SRN asset need, and to what extent its delivery of planned works has successfully addressed that need. This is an important input to our assessment of efficiency for RIS2.

2.47 In 2020-21, we developed a reporting mechanism that allowed us to assess the extent to which the renewal schemes that National Highways delivered were those it had planned. We trialled this with the company in its East Midlands region to provide proof of concept so that it could be rolled-out to all regions in 2021-22.

2.48 National Highways identified a named list of the renewals schemes it planned to deliver. For that selection, the company reported at year-end on the following:

- the delivery progress it had made;

- the schemes that it planned to deliver, but had not delivered, with broad categories of reasons (for example, asset need or constrained budget);

- additional schemes that it had delivered, but moved from another year in RP2 (that is, still within the overall plan for RP2 delivery); and

- additional schemes that it had delivered, but had not identified as requiring delivery in RP2, with broad categories of reasons (for example, asset condition or need).

2.49 National Highways stated that the resource burden for rolling out this mechanism was too significant to repeat nationally. The company instead proposed to use a new computer-based tool, the Capital Delivery Management Tool (CDMT). The tool will not be available to use until September 2022. The company committed to provide to us an example of the relevant reporting that the CDMT will produce. However, at time of writing we have not received anything. We need to have early sight of the tool's reporting capabilities, ahead of full CDMT roll-out and reporting in September 2022. The company has told us that the reporting will demonstrate the extent to which its delivery meets its plans.

2.50 We also worked with National Highways over 2021-22 to establish what asset performance reporting the company has beyond the data provided against RIS2 performance specification metrics. For example, safety barriers feature as a major life extension renewals type in RIS2 and yet asset performance is not directly reported. The reporting should ultimately reinforce our understanding of the company's asset management capability. We want to be able to better assess the health of all its assets and to understand the impact of the maintenance and renewal works that the company delivers. To do this, we need to be able to see the company’s asset performance reporting across the full range of its assets. At the time of writing, we have not seen this reporting.

Design, build, finance and operate (DBFO) contract hand back

2.51 Contractors manage 11 routes across the SRN as private finance initiatives (DBFO contracts). Eight of the 11 DBFO contracts will come to an end in RP3. The contractors who currently operate the routes will hand them back to National Highways on the following dates:

- M1-A1 Link Lofthouse to Bramham – 25 March 2026

- A1(M) Alconbury to Peterborough – 31 March 2026

- A417/A419 Swindon to Gloucester – 31 March 2026

- A69 Carlisle to Newcastle – 31 March 2026

- A50 Stoke to Derby – 30 June 2026

- A30/A35 Exeter to Bere Regis – 30 September 2026

- M40 Denham to Warwick – 5 January 2027

- A19/A168 Dishforth to Tyne Tunnel – 23 February 2027

2.52 The DBFO contracts contain specific requirements for the hand back to National Highways. The company told us that it had made progress against those requirements. In 2021-22 it:

- continued to undertake initial inspections of assets and used lessons learned from those inspections to improve efficiency for the second round of inspections;

- developed proposals for, and commenced, required renewals to ensure that assets are handed back in the required condition;

- included DBFO routes in its revised depot strategies;

- included provision for DBFO routes in its ongoing winter maintenance vehicle fleet replacement programme;

- planned the transfer of data from DBFO contractors to National Highways;

- planned the demobilisation of DBFO contractors and mobilisation of relevant National Highways AD regions, including the transfer of staff; and

- started estimating the costs of future route operations.

2.53 Some aspects of performance that National Highways reports, such as asset condition, do not currently include the assets from DBFO routes. It is important that as part of a smooth transfer of responsibility, the company ensures that it has the capability to manage these additional assets.

2.54 The transfer should allow National Highways to better quantify its future asset funding needs within RIS3 and beyond. We will continue to examine how the company manages the transfer process in 2022-23.

3. Key message: environmental performance

National Highways' performance against its environmental targets is varied. In 2021-22 the company made good progress with its corporate carbon, noise, and air quality targets. However, we are concerned that it does not have a robust plan to achieve its target of no net loss in biodiversity by 2025. We require the company to provide evidence it is working quickly to rectify this and produce a robust plan.

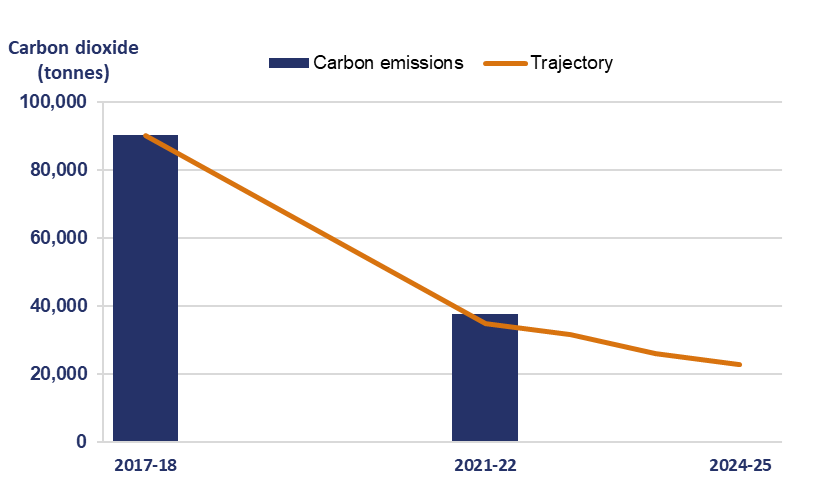

3.1 In 2020-21, National Highways made good progress on its second road investment strategy (RIS2) commitments to reduce corporate carbon emissions by 75%, mitigate noise impacts on 7,500 households, and bring air quality on sections of its network into compliance with legal limits in the shortest possible time. The company will need to sustain its performance over the remainder of the second road period (RP2) to meet these targets.

3.2 However, we have challenged National Highways on its biodiversity delivery programme. We want to ensure that it is accurate, deliverable and will achieve the company's key performance indicator (KPI) target of no net loss in biodiversity by 2025. At the end of 2021-22, the company forecast a biodiversity net loss by 2025. Given this, and additional future impacts linked to enhancements funding and/or scheme schedule changes, we require National Highways to provide sufficient evidence that it is working quickly to rectify this position. We want to see a robust plan from the company by September 2022 setting out how it will achieve the KPI target by the end of RP2.

3.3 We will continue to scrutinise and challenge National Highways’ environmental plans and processes for delivering ongoing improvements and to meet the new requirements in the Environment Act 2021. We will report back on the company's progress in our 2022-23 annual assessment.

Outcome: being environmentally responsible Collapse accordion Open accordion

3.4 National Highways has four targeted KPIs, four performance indicators (PIs) and two commitments in this outcome area.

KPI: noise

3.5 National Highways has mitigated 3,178 households since the start of RP2. The company mitigated 1,067 households in 2021-22. The company has delivered 42% of its RP2 target. It is on track to meet the target given there are three years remaining in RP2, and it has a mature process of mitigating noise through installing double glazing and using lower noise road surfacing.

KPI: biodiversity

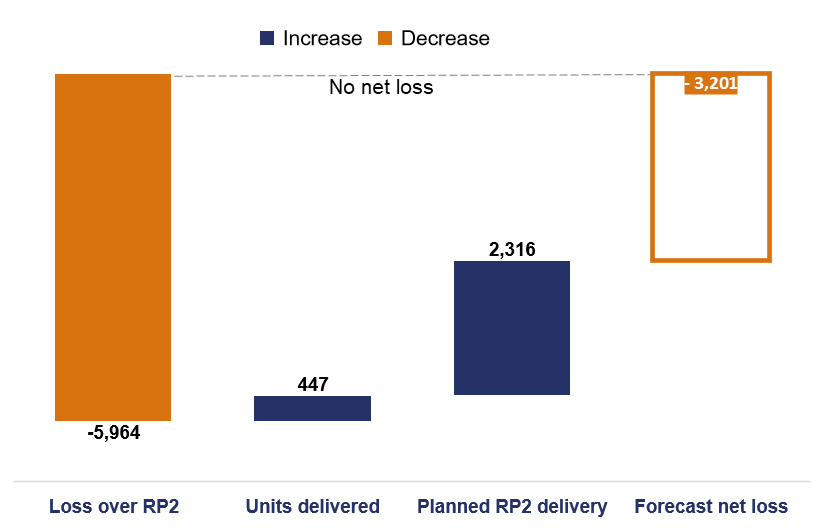

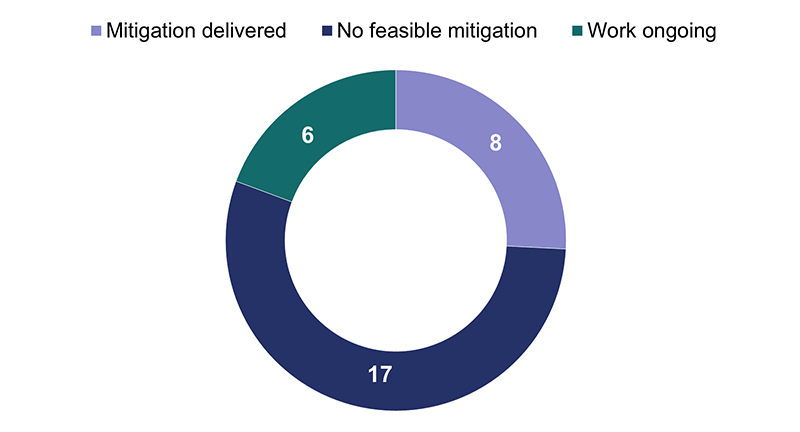

3.6 At the end of 2021-22, National Highways forecast a net loss of 3,201 biodiversity units for the end of RP2. We require the company to produce a robust a plan by September 2022 to deliver no net loss of biodiversity by 2025 and meet its KPI target.

3.7 A biodiversity unit is linked to the size, condition and location of a habitat or piece of land (see Natural England’s website). In 2020, National Highways calculated its biodiversity starting point of 130,848 units across its estate. This covers all the company’s land, including verges either side of the carriageway. The company then estimated the biodiversity loss from all enhancement schemes planned to start work in RP2, alongside a 1% degradation each year. This degradation accounts for loss from day-to-day renewals and maintenance activities and the operation of the network, such as noise and air pollution.

3.8 National Highways estimated what would happen if it carried out no additional biodiversity mitigation. Inclusive of the 1% degradation, there would be a loss of 5,964 biodiversity units over RP2.

3.9 We receive monthly biodiversity forecasts from National Highways that exclude schemes still in early design. As of March 2022, this forecast shows a net loss of 3,201 units by March 2025.

3.10 National Highways shared a biodiversity plan with us in January 2022 that includes schemes in early design. It estimated a net gain of 495 units. However, following delays to the largest single contributing scheme (Lower Thames Crossing), and a pause on the construction of new smart motorways following the Transport Select Committee recommendations, this plan would now produce a loss of 118 units by March 2025.

3.11 We require an updated plan from National Highways by September 2022, demonstrating how it plans to deliver no net loss by 2025. This plan must include what the company intends to do to improve biodiversity delivery and it must demonstrate that it has done everything reasonably practical to meet its KPI target.

3.12 Figure 3.1 shows that in 2021-22, National Highways delivered 300 biodiversity units, with a total delivery of 447 units since 2020. This is far below the amount needed to account for even the 1% degradation each year.

Figure 3.1 National Highways’ biodiversity performance (excluding schemes in early design)

Case study: Biodiversity – Network for Nature

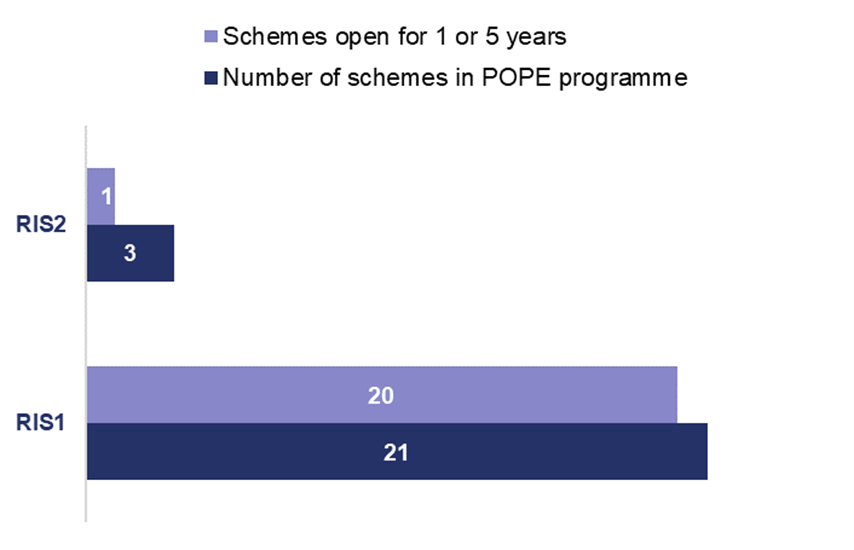

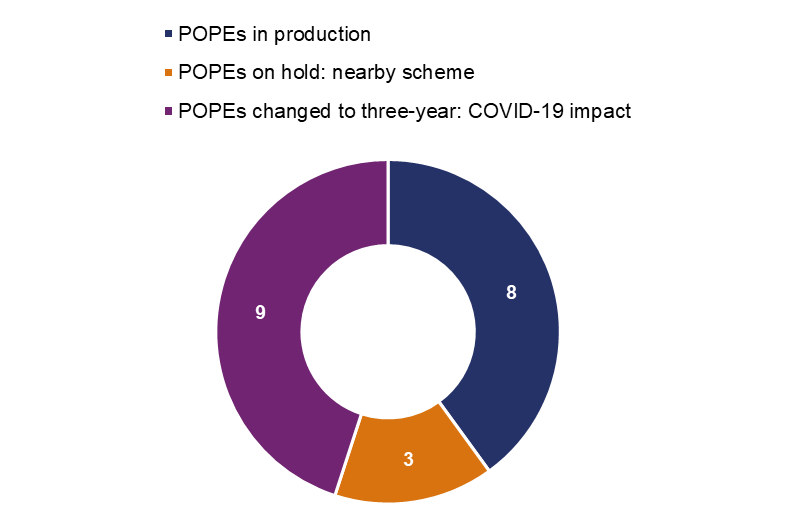

National Highways has a key performance indicator (KPI) target to achieve no net loss of biodiversity by 2025. To improve its biodiversity, the company is working in partnership with local wildlife trusts, managed by the Royal Society of Wildlife Trusts.