This is the accessible version of the Office of Rail and Road annual report and accounts for 2021 to 2022.

Report presented to Parliament pursuant to section 74(1) of the Railways Act 1993.

Accounts presented to the House of Commons pursuant to section 6 of the Government Resources and Accounts Act 2000.

Accounts presented to the House of Lords by Command of Her Majesty.

Preface Collapse accordion Open accordion

About this Annual Report and Accounts

This document integrates performance and financial data to help readers gain a better understanding of the work of the Office of Rail and Road (ORR). It covers the activities of ORR from 1 April 2021 to 31 March 2022 and is split into three main sections:

The Performance Report includes a summary of progress achieved in 2021-22 in delivering our strategic objectives and service standards (the Performance Overview), followed by a fuller review of delivery of our strategic objectives (the Performance Analysis).

The Accountability Report is split into three sub-sections and includes:

- A Corporate Governance Report, which includes the Directors’ Report, the Statement of Accounting Officer’s responsibilities and a Governance Statement;

- A Remuneration and Staff Report, which includes pay and benefits received by Executive and Non-Executive Board members and details of staff numbers and cost; and

- A Parliamentary Accountability and Audit Report, which allows readers to understand ORR’s expenditure against the money provided to it by Parliament by examining the Statement of Outturn against Parliamentary Supply, and includes a copy of the audit certificate and report made to Parliament by the head of the National Audit Office, setting out his opinion on the financial statements.

The Financial Statements show ORR’s income and expenditure for the financial year, the financial position of ORR as of 31 March 2022, and additional information designed to enable readers to understand these results.

Chief Executive’s Report Collapse accordion Open accordion

This annual report shows another year of significant delivery across our functions, protecting the interests of current and future rail and road users.

As well as supporting the rail industry with managing Coronavirus (COVID-19) risk as circumstances changed, this year we continued to deliver on those key day-to-day activities which are core to our role. Those include, among other things, our safety inspections and authorisations, monitoring rail operators’ compliance with their obligations to passengers and holding to account the companies we oversee.

We also carried out a number of activities which were either ‘one-off’ activities or are perhaps areas of our work that are less well-known to stakeholders. These included:

- facilitating the safe return to passenger service of Hitachi trains after their withdrawal due to the identification of cracks, and then providing assurance of Hitachi’s remedial programme and leading a review with affected industry stakeholders so that lessons could be learnt for the future;

- providing, at the Secretary of State’s request, independent analytical assurance on the evidence base for the safety of National Highways’ All Lane Running motorways. This was a complex and controversial area, with our recommendations supporting positive changes in the interests of road users;

- maintaining our constructive challenge on Network Rail’s and National Highways’ efficiency. Pleasingly, we expect this to be the third year running in which Network Rail will have met its efficiency target. And similarly we expect National Highways to meet its target for the second year of road period 2;

- continuing to support the UK Government’s work on rail reform, providing advice at the request of the Department for Transport as it developed its more detailed plans for implementing the Williams-Shapps Plan for Rail; and

- supporting the work of the Channel Tunnel Safety Authority (CTSA) in reviewing the safety issues relating to Eurotunnel’s new high voltage interconnector project (ElecLink). Following extensive engagement and challenge, CTSA was able to give sufficient assurance to the Intergovernmental Commission for it to grant consent to the project.

The year also saw us relocate our Birmingham office to new modern premises. Our regional offices are key to how we operate, giving us a national reach and enabling us to recruit from a broader base. This move – delivered within budget – provides our staff based there with a better-equipped environment in which to work effectively.

Finally, my thanks go to all of ORR’s staff for what they have achieved in another busy year.

John Larkinson

Chief Executive and Accounting Officer

Chair's Report Collapse accordion Open accordion

2021-22 has been another year of challenge for the industries that we oversee, set within the wider context of COVID-19. While passenger rail services have been gradually increasing, passenger revenue remains significantly lower than before the pandemic. On roads, National Highways faced major challenges both with securing development consent orders for its projects and in relation to its All Lane Running motorways.

In the rail sector in particular, the scale of challenge is not going to get any easier. Rail reform brings the prospect of more effective ways of working, reducing fragmentation and delivering a better service for customers. But the reorganisation it heralds and the need to respond to current financial pressures means the rail industry faces significant change at a time when it needs to continue to provide a rail service that meets the expectations of those it serves.

Against this backdrop, ORR continues to have an important role. This year has seen us again carry out our job effectively – monitoring, challenging and supporting those companies we oversee, providing crucial assurance on health and safety, and giving honest, independent, expert advice to government on both rail and road. As the pace of reform increases over the coming year and the rail industry is reshaped, the continuity of the oversight and assurance that ORR brings will be vital, particularly in the current financial circumstances.

Reflecting this, it is essential that ORR continues to remain relevant to rail and road users and well-equipped to take account of both reform and broader economic and social change. We remain open to challenge from stakeholders to help us with this, and we continue to review and improve the capability and capacity of ORR to perform its role effectively, both now and in the future.

In this respect I was pleased in January to welcome Catherine Waller, Daniel Ruiz and Xavier Brice to the Board as new non-executive members. They bring skills and experience in digital and data analytics, sustainability, and delivery of large-scale programmes and projects – areas that will be particularly important in rail and road over the coming years.

On other Board matters, Graham Mather, Michael Luger and Stephen Glaister stood down from the Board during the year, as their terms expired. I am grateful to them all for their service and valuable contribution to the office over recent years. It was with great sadness that the Board learnt in March that Michael Luger had since passed away.

Lastly, ORR could not achieve anything without the professionalism and commitment of its staff. I would like to thank them all for their continued dedication over the last year.

Declan Collier

Chair

Performance report

Performance overview Collapse accordion Open accordion

This overview sets out our purpose and our strategic objectives.

Who we are and what we do

The Office of Rail and Road (ORR) is an independent, non-ministerial UK government department, established by, and accountable directly to Parliament. We protect the interests of current and future rail and road users, overseeing the safety, value and performance of the railways and monitoring the performance and efficiency of England’s strategic road network.

We regulate Network Rail, including setting the targets it has to achieve, and report regularly on its performance. We regulate health and safety standards and compliance across the whole rail industry. We oversee competition and consumer rights issues – driving a better deal for rail passengers and taxpayers. We also regulate the High Speed 1 link to the Channel Tunnel.

We hold National Highways to account on its commitments to improve the performance and efficiency of England’s strategic road network.

As an independent regulator, we operate within the framework set by UK legislation and are accountable through Parliament and the courts. We are an independent statutory body, with powers vested by Parliament in our governing board, which is responsible for setting our strategy and overseeing its delivery. Members are appointed by the Secretary of State for Transport for a fixed term of up to five years.

ORR comprises some 330 professionals, spanning engineering, railway safety, economics, competition, statistical analysis and management, operating from six offices across the country.

Our team of Executive Directors is responsible for delivering the business plan to meet our strategic objectives.

Our strategic objectives

Our business plan summarises what we aim to achieve each year and provides detail around our strategic objectives.

In 2021-22 our strategic objectives continued to be:

- A safer railway

- Better rail customer service

- Value for money from the railway

- Better highways

Our performance against the business plan

In our 2021-22 business plan we set out a number of key commitments under each of our strategic objectives. These were underpinned by a number of internal milestones, defined during our annual business planning round. We also published a series of service standards in our business plan (set out in 'Delivery of Service Standards'). The Board reviews progress against business plan commitments and service standards on a quarterly basis. The Executive reviews progress against internal milestones monthly.

The work we have carried out in the year to meet our priorities is set out in each of the ‘Strategic Objective’ chapters. We have delivered or made good progress on all of our priorities.

How we are funded

ORR’s rail functions are funded almost entirely by the railway industry – broadly, passenger train and freight operating companies, plus Network Rail. We work within a defined budget and charge the industry via a safety levy and an economic licence fee. We also cover our regulatory costs relating to the Channel Tunnel, HS1 and Northern Ireland by charging the relevant organisations. Our charges are based on a full economic cost model, therefore without profit. Our combined charges and other income meet our rail-related costs in full, except for a token resource budget of £2,000 provided by Parliament.

We receive grant funding from the Department for Transport (DfT) for our highways function and have a token resource budget of £1,000 provided by Parliament.

We had a Capital Departmental Expenditure Limit (CDEL) of £720,000 for 2020-21 and 2021-22.

Summary of financial performance

The table below shows our gross costs for 2021-22 compared to budget and prior year outturn.

Table 1: Gross costs outturn against 2021-22 budgeted gross costs and 2020-21 outturn

| Funding stream | 2021-22 gross costs outturn (£000) | 2021-22 gross costs budgeted (£000) | 2020-21 gross costs outturn (£000) |

|---|---|---|---|

| Economic regulation | 15,866 | 16,639 | 13,688 |

| Health and safety regulation | 17,377 | 18,706 | 16,154 |

| Highways monitoring | 2,652 | 2,889 | 2,483 |

| Total | 35,895 | 38,234 | 32,325 |

Variances against budget and 2020-21 are analysed under Financial performance.

Key risks and uncertainties

Our risk management strategy and the key issues and risks that could affect us in delivering our strategic objectives are set out in the Governance Statement.

Performance analysis Collapse accordion Open accordion

The Performance Analysis provides a more detailed analysis of how ORR has performed against its strategic objectives during 2021-22.

Strategic objective 1: A safer railway Collapse accordion Open accordion

ORR is the health and safety regulator for all of Britain’s rail industry. Our strategic objective is to enforce the law and ensure that the industry delivers continuous improvement in the health and safety of passengers, the workforce and public, by achieving excellence in health and safety culture, management, and risk control.

In 2021-22 the railways performed well during the pandemic, with front-line colleagues delivering the service throughout unprecedented circumstances. The industry continued to work in a highly collaborative way, supportive of ORR and our efforts to issue Covid-related guidance that could respond swiftly and appropriately to changing situations.

The industry had some big issues to prepare for that it will be managing over the next two to three years – recovery from the effects of the pandemic, a significant drop in passenger numbers and financial pressures, and major reorganisations of the industry that will need to be well-managed. It is clear that to get us through the pandemic there has been reduced activity in key areas like training, assessment and management assurance. Towards the end of 2021-22 we sent a firm message that these situations need to recover as quickly as possible and that the connections between the top and bottom of industry organisations need to improve. It remains vital that everyone maintains focus on the day job, including throughout any changes.

Our business plan for 2021-22 outlined a number of health and safety priority areas for the year. These included the management of extreme weather risk; track worker safety; preparing for the trial operation of Crossrail; promoting safety by design; the management of the Platform Train Interface; leadership in the heritage sector; and supporting the Light Rail Safety and Standards Board in delivering its objectives in the tram sector.

We also set out plans to ensure appropriate arrangements were in place to support effective safety regulation of the Channel Tunnel (following the UK’s exit from the EU at the end of 2020); to enhance our train driving licensing processes and guidance; to improve data capture from our proactive inspections; and to publish new guidance on principles for managing level crossing safety.

During the year, we pursued our key themes of:

- Managing for the future: Demonstrable, strong, visible leadership, seeing through reform of the railways, continuing to promote health and safety by design as a key element of building back better, and managing the key challenge climate change is having on the ageing infrastructure with new and better ways to manage these risks going forward.

- Supporting people: Managing and supporting people through pandemic recovery and restart, continuing to tackle the mental health taboo, supporting key events such as Rail Wellbeing Live, new campaigns launched by Network Rail in partnership with Chasing the Stigma, and the industry’s longstanding partnership with the Samaritans.

- Technology: The Network Rail Task Forces on earthworks and weather management provided a good example of how technology could lead to a step change, not just in risk reduction but customer experience, and could help bring further efficiencies to the rail network. This theme also reflects the importance of human factors and quality risk assessment so that the human interface is well- managed.

We continued to drive these themes, together with the priorities set out in our strategic risk chapters, through our inspection, permissioning, and investigation and enforcement work.

Network Rail

Network Rail embarked on a series of changes reflecting the challenges to industry finances following the pandemic. During 2021-22 it reduced managerial grade headcounts in parts of its business by around 20% and has begun framing significant changes to the ways it carries out maintenance in order to achieve more efficiencies in the future. Further, a substantial programme of work was drawn up to address the continuing test of making the network more resilient to extreme weather. Finally, there was excellent sustained progress in complying with ORR’s Improvement Notices on workforce safety by reducing reliance on assisted human lookout warnings. Overall safety and health performance was maintained, despite these potential distractions to routine business.

Much of our proactive work continued to target the key risks of management of earthworks and structures, weather resilience and risks to track workers. We monitored Network Rail’s response to recommendations from the task forces it commissioned around earthworks and drainage management as well as its operational responses to extreme weather events. There is an ambitious, prioritised programme of action plans across Network Rail. It will be a continuing challenge to ensure co-ordinated oversight of so many complex and inter-dependent work streams, which now include the recommendations from the Rail Accident Investigation Branch (RAIB) Carmont report. In this context, we note that weather-related issues include those leading to poor adhesion – such as the conditions that led to the signal passed at danger and subsequent collision at Salisbury on 31 October 2021.

Our work on occupational health and safety concentrated on continuing to assess improvements in the safety of trackside workers as a result of our enforcement notices. The year has seen a pronounced move away from Victorian methods of protection using flags and horns to safer alternatives. By the end of the year, work relying on unassisted lookout warning had reduced to 0.5% of all hours worked. Following a number of incidents, we also took action to improve safety of workers near overhead line equipment during maintenance work. Our monitoring of this continues.

On occupational health we continued to monitor Network Rail’s progress in managing risks from asbestos as part of a national priority programme, with a focus on ensuring a risk-based approach to asbestos surveys, and the provision of adequate training to workers who could accidentally disturb asbestos during their work. We continued to assess Network Rail’s progress in improving its standards for control of welding fumes and respiratory crystalline silica, with evidence of improvements in engineering and organisational controls. Continued reports of new and worsening cases of Hand Arm Vibration Syndrome (HAVS) remain a concern and we continue to challenge Network Rail on how their investigations of diagnosed cases supports better HAV risk management.

With the prospect of major changes to Network Rail’s role and how the mainline network will be run, we began our engagement with all stakeholders to ensure that effective health and safety management remains at the heart of thinking around the future of the network.

Mainline operators

We have completed the first year of a two-year programme looking at rolling stock asset management with all passenger operators. Challenges for operators assuring the work of suppliers delivering maintenance is a common theme. In May 2021 the Hitachi Class 800 trains were withdrawn from service because of cracking in the vehicle bodies. We reviewed the operators’ risk assessments for managing the return of trains to service and found robust challenge of Hitachi as part of operators’ assurance. A safety lessons learnt review was completed by ORR and published, identifying the root causes and finding excellent collaboration by the industry to manage the return of trains to service.

Through our active involvement with Rail Delivery Group’s Passenger Operators Safety Group, Rail Safety Standards Board’s (RSSB) People on Trains and Stations Risk Group and the Train Accident Risk Group, we are seeking assurance that emerging risks, such as the use of mobility scooters on platforms and expectations around management of the Platform Train Interface (PTI), are being managed as far as is reasonably practicable. We have brought the sector’s attention back to the important work of reviewing the RSSB PTI risk assessment tool, as well as undertaken further inspections around PTI management. We have investigated accessibility issues at stations and our action has led to improved provisions for step-free access.

Inspection activity looking at the capability of control staff to manage operational incidents commenced as part of a two-year plan looking at all passenger operators. We found common issues around the management of fatigue and competence management. Inspection of operators’ management of Signals Passed at Danger (SPADs) has focused on the capability of driver managers. Workload management was a recurring theme across operators assessed and there was evidence that in some organisations training was not provided to driver managers around investigating SPADs.

Inspection of the management of legionella bacteria found significant gaps in risk assessment and control. We served three Improvement Notices on two train operators to improve the management of legionella bacteria in on-train water supplies to toilets and handwashing facilities. An Improvement Notice was also served on a contractor for failing to manage vehicle movements putting workers and the public at risk.

In the freight sector, a SPAD management inspection focused on the role of driver managers in monitoring SPAD performance and investigating incidents. Inspections found that duty holders had suitable arrangements for the selection, training and ongoing management of competence of driver managers and overall, the driver manager role is integral to managing SPAD risk. However, excessive driver manager workload appears to be a consistent theme in all inspections. An inspection of welfare facility provision for mobile staff such as drivers and ground staff found that freight duty holders were largely doing everything that was reasonably practicable in terms of the law but highlighted this is an area where operators need to focus on doing more than just comply with the law.

An inspection into rolling stock maintenance in the freight sector showed that duty holders have suitable arrangements in place to manage risks associated with rolling stock asset condition, including management of contractors where maintenance functions are delivered by third parties. The Llangennech derailment and fire has highlighted the importance of ensuring that rolling stock is maintained in a safe condition. The National Freight Safety Group’s “Condition of Freight Vehicles on the Network” work will be essential in identifying what operators and maintainers can do to further reduce the risk of serious train accidents.

Non-mainline operators

On trams and light rail, we continued to monitor the sector’s implementation of the Sandilands RAIB recommendations and have secured commitments from all tramways on the procurement and implementation of speed control and driver attentiveness systems to implement these recommendations. We concluded our investigations into the fatal tram derailment at Sandilands, launching prosecutions of the tramway infrastructure manager, operator, and tram driver for alleged breaches of the Health and Safety at Work etc Act 1974. We carried out the first independent review of the Light Rail Safety and Standards Board (LRSSB) in order to assess whether it was fulfilling its intended purpose to better manage safety, standards and good practice across the sector. Our published report set out our findings that the LRSSB has been effective in adding value to the light rail sector and assisting in the delivery of recommendations for safety improvements made by RAIB. Our review made six recommendations which are intended to ensure that the light rail sector maintains a structured and formal approach to the continuous improvement of safety standards.

We provided regulatory oversight of the heritage sector as it recommenced operations following a period of extended shutdown associated with COVID-19. Our proactive and reactive work during 2021-22 focused on the management of assets and operational staff competence. We served two enforcement notices on the latter topic where our inspectors found that legal requirements had not been met by the duty holder. We also worked with the Heritage Railway Association as it outlined its proposals to develop an independent Heritage Safety and Standards Board to take on the role of developing standards and guidance for the heritage sector.

Our work with Transport for London’s rail operators included the periodic reassessment of London Underground Ltd’s non-mainline safety certificate and authorisation, as well as the safety authorisation for the Docklands Light Railway infrastructure manager. On London Underground our inspection work continued to examine the management of assets, focusing on the arrangements for the management of track assets. We continued our liaison with the Crossrail project, as it moved into a phase of intensive trial running prior to the opening of the Central Operating Section and carried out an inspection of the Crossrail train operator’s emergency planning arrangements.

On safety by design, ORR continues to engage with companies across the rail industry to emphasise the importance of early-stage design thinking in reducing long term health and safety impacts. We have worked with Network Rail, TfL, and train operators as well as major projects such as HS2 and Crossrail.

Policy and strategy

We delivered a range of policy and strategy work in 2021-22 to support our drive to continuously improve our health and safety policies and processes.

We published Principles for Managing Level Crossing Safety and supported animated case studies which will support improvements in level crossing safety by encouraging better collaboration between those involved in managing level crossings and highways, and greater emphasis on understanding level crossing users. We completed a Post Implementation review of the Railways and Other Guided Transport Systems (Safety) Regulations 2006 (ROGs) which was published by DfT in September. The review confirmed that ROGs are continuing to work well but that interfaces between ROGs and other legislation and standards are not always clearly understood, and that guidance on these interfaces would be helpful for stakeholders. This work is being taken forward alongside the outcomes from the more recent Railways (Interoperability) Regulations 2011 Post Implementation Review.

We published a new series of frequently asked questions and answers on the Train Driving Licences and Certificates Regulations 2010 (TDLCR) to provide easier access to information on the requirements of the regulations and our policies on handling licence applications. As some of the licensing requirements in TDLCR have been in place since 2011, we published new guidance on our policy and process for renewing train driving licences when they expire after 10 years. We worked with the developer to introduce an improved electronic system for managing licence applications and holding licence details which will provide benefits and efficiencies for ORR and train operators when it is implemented later in 2022.

The emerging post EU exit legislative landscape required a number of practical measures and consideration of next steps. For example, in the run up to the ending of mutual recognition of EU and UK train driving licences on 31 January 2022 we issued new guidance for the cross-border operators on the licence requirements for cross border drivers operating services through the Channel Tunnel and processed new licence applications for affected drivers. We published an updated version of our Guide to ROGs to explain the changes made to ROGs following our exit from the EU and, as requested by stakeholders, published a consolidated version of the ROGs legislation showing the various changes made by EU exit legislation. We were also involved in negotiating a number of bilateral agreements between the UK and France to enable continued smooth operations through the Channel Tunnel.

We continued to keep our own internal Quality Management System processes under review, undertook a project to review and improve our risk prioritisation and Strategic Risk Chapter processes, continued our drive to improve the quality of the data that underpins our work, and commissioned work to create an RM3 e-learning solution that provides an introduction to RM3 (and demonstrates the wide reach of the model across both the rail industry and non-rail industry) and looks at the theory and application of the model in three bitesize sections. We also brought the training of ORR’s health and safety inspectors fully in house.

We continued to chair the Railway Industry Health and Safety Committee, which brings together representatives of employers, employees, passengers, and government bodies to discuss and contribute to health and safety matters, and we worked with other health and safety regulators to share best practice.

Channel Tunnel

Throughout the year, we continued to provide leadership, expert advice, and secretariat support to the Intergovernmental Commission (IGC) and supporting Channel Tunnel Safety Authority (CTSA). In particular, the CTSA continued to monitor Eurotunnel’s approach to safety-related issues in respect of its new ElecLink HVDC interconnector project and provided a level of assurance to the IGC which enabled consent for commercial operation to be granted.

The CTSA has also delivered statutory assessment activities to amend Eurotunnel’s safety authorisation and renew safety certificates for Eurostar and DB Cargo Limited. CTSA continued to work closely with Eurotunnel on its plans to modernise its passenger shuttle fleet and reviewed plans for the carriage of lithium-ion batteries through the Tunnel to ensure that risks are identified, assessed, and appropriately mitigated. The CTSA has also held Eurotunnel to account over its safety leadership and change management arrangements to identify shortcomings and drive improvements in these areas.

Regulation and certification

ORR grants a range of rail-related health and safety permissions and approvals and, in some cases, we have statutory deadlines to meet in terms of processing requests and issuing our decisions. These deadlines were all met in 2021-22. Volumes vary each year, depending on demand. In 2021-22 we:

- Issued 1,434 new train driving licences, which was more than double the number for 2020-21. 294 of these were to support the post-EU exit licence requirements for cross border drivers operating services through the Channel Tunnel.

- Processed 170 train driving licence renewals. As the requirement to hold a licence first came into force in 2011 and licences are issued for ten years, this was the first year that any required renewal.

- Recognised a further 2 doctors, 16 psychologists and 1 training and examination centre and added them to our registers as required under the Train Driving Licences and Certificates Regulations.

- Attended a hearing following a driver’s appeal against ORR’s decision to withdraw a train driving licence.

- Delivered 21 Level Crossing Orders, 5 Variation Orders, 1 Revocation Order, 4 Directions and 3 Authorisations for Traffic Signs, which was similar to 2020-21 volumes.

- Issued 49 mainline safety certificates and safety authorisations and 9 non-mainline safety certificates and safety authorisations. The number of mainline safety certificates issued was significantly higher than the 30 issued last year but this was as a result of amendments needed to reflect a change in legal denomination.

- Processed 6 applications to exempt non-mainline duty holders from the requirement to hold a safety certificate and safety authorisation whilst operations were being carried out above 25mph on their infrastructure.

- Issued one exemption from regulation 3 of the Railway Safety Regulations 1999.

- Reported to RAIB on a total of 119 recommendations, with 78 having been implemented; 22 reported as implementation ongoing, 18 reported as progressing and 1 reported as other public body.

Investigation and enforcement

During the year we served 1 Prohibition Notice and 10 Improvement Notices and, where appropriate, prosecuted duty holders in the courts to ensure compliance with the law. As prevention is always better than addressing issues after an incident has occurred, the 10 Improvement Notices were served when we identified serious breaches of the law and required changes to be made.

We successfully concluded a number of health and safety prosecutions:

In April 2021 Tyne and Wear Metro operator, Nexus, was fined £1.5 million after pleading guilty to an offence under the Health and Safety at Work etc. Act 1974 (HSWA) for failing to ensure the safety of staff. This followed the death of a Nexus employee at the company’s South Gosforth depot in July 2014 whilst he was working at height carrying out maintenance work on high voltage overhead cables.

In May 2021 QTS Group was fined £12,000 after a contract rope access technician broke his arm when it became entangled in a drilling rig they had provided. The technician was assisting the drilling rig operator with the installation of soil nails to a railway cutting slope.

In July 2021 WH Malcolm Limited, the operator of Daventry International Rail Freight Terminal near Rugby, was fined £6.5m and ordered to pay costs after being found guilty of negligence over the death of an 11-year-old boy in 2017 who easily gained access to the depot with his friends to retrieve a football, and was able to climb on top of a stationary freight wagon, where he received a fatal electric shock from the overhead line. WH Malcolm was charged with, and found guilty of, two health and safety offences under HSWA for failing to ensure, so far as is reasonably practicable, that persons not in their employment were not exposed to risks to their health and safety through the conduct of their undertaking and the Management of Health and Safety at Work Regulations 1999 for failing to undertake a suitable and sufficient assessment of the risks to the health and safety of persons not in their employment.

In November 2021 Amey Rail Limited was sentenced after pleading guilty to an offence under HSWA for failing to ensure lifting operations involving lifting equipment were properly planned, supervised, and carried out in a safe manner. This followed ORR’s investigation into an incident in October 2018 outside Market Harborough station on the Midland Main Line when a road-rail excavator vehicle overturned during an unsafe lift. Amey was fined £600,000 after pleading guilty to the offence and ordered to pay full costs.

Strategic objective 2: Better rail customer service Collapse accordion Open accordion

We have a key role to improve the rail passenger experience in the consumer areas for which we have regulatory responsibility and take prompt and effective action to improve the service that passengers receive where it is required.

In fulfilling our role, we primarily focus our efforts on the four areas for which we are responsible:

- The provision of assistance to passengers who require additional support to make their journey.

- The provision of passenger information, including when there is disruption.

- The provision of an accessible, effective, and efficient complaints handling service, including providing compensation where passengers are subject to delay.

- Ticket retailing, specifically the ease with which passengers can buy, use and, where necessary, receive a refund for their ticket.

We do not have a regulatory responsibility for punctuality from a consumer perspective. ORR’s work in this area is limited to holding Network Rail to account.

Our business plan for 2021-22 outlined three priority areas for the year: monitoring compliance with accessible travel policy requirements; monitoring the industry’s plans for improving the quality of information provision to passengers; and progressing our reviews of complaints handling and delay compensation processes.

Impact of COVID-19

The challenges faced by train operators as a result of COVID-19 have at times over the past year had an impact on their ability to meet regulatory obligations. We maintained engagement with operators to understand how they were meeting the needs of their passengers.

The pandemic also saw us continuing to deliver our role in relation to the Government’s response to the virus, which required us to monitor Eurostar and Eurotunnel’s adherence to the Government’s COVID travel regulations. This required working closely with Border Force and the other transport regulators (CAA & MCA). We issued fixed penalty notices for failures to ensure that passengers had met the required COVID test, vaccine, and locator form requirements before travel. This work was paused when Government lifted the COVID Travel Regulations in March 2022.

Accessibility

During 2021-22 we have established and developed a working relationship with DVSA, the monitoring and enforcement body for accessibility standards in road-based public transport. We have worked collaboratively to monitor compliance with the Public Service Vehicle Accessibility Regulations (PSVAR), including where Rail Replacement Services either meet the accessibility requirements or have a valid exemption from DfT.

In March 2022 we approved the Accessible Travel Policies (ATPs) for Arriva Rail London, TfL Rail, and London Underground. The approved ATPs reflect the specific circumstances of these operators.

In March 2022 we also completed an annual review of the ATPs for all other mainline train operators. This process helps ensure that the documents are kept up to date, and accurately reflect the improvements to accessibility that have been made throughout the year. The key improvement that we have required is the reduction in the notice period for passengers when booking assistance for travel. Until 2020 passengers had to give 24 hours notice. Our ATP guidance required a phased reduction down to two hours notice from 1 April 2022. We have worked closely with operators to provide clarity on the requirements, and to get assurance that reliable systems, processes, and training are in place to provide this step-change in the provision of booked assistance.

Our ATP guidance requires train and station operators to deliver comprehensive accessibility training for all passenger-facing staff. The initial deadline for delivery of this training was 31 July 2021. Extensions were granted to five operators in light of the challenges they faced in delivering their training plans. Of these, one operator is still working to fully meet this requirement and we are continuing to monitor their activity.

Despite the challenges presented by COVID-19, operators have delivered accessibility training to over 30,000 frontline staff.

In December 2021 we completed an audit of the accuracy of passenger information about station accessibility. We commissioned a gap analysis between the information published by station operators online and the facts on the ground at a representative sample of stations. We have shared the findings with operators and required them to produce a plan for addressing discrepancies.

We have also renewed our assessment of train operator performance against ATP website accessibility requirements. This work was completed in March 2022 and was in three parts: a check of the availability of ATP documents; an audit of whether operator websites complied with the Web Content Accessibility Guidelines 2.0 accessibility standards; and in-depth user-testing. We will share the findings of this work with operators, requiring them to address any issues, and publish a summary of the findings.

Passenger information

We continued to engage with the industry’s Smarter Information, Smarter Journeys programme, which was established in response to our request that the industry work together to make tangible and enduring improvements to passenger information. Good work is underway in a number of areas which should deliver improvements in retailing, station information screens and onboard announcements amongst others. We welcomed the development and publication of Passenger Information Pledges and will be accepting them as regulatory commitments from 30 April 2022 so that we can hold train companies to account against best practice.

We have continued to monitor the industry’s performance in provision of appropriate, accurate and timely information to passengers when timetables are affected by engineering works. We have, in particular, sought improvements in the information provided by journey planners where industry is not meeting informed traveller timescales (T-12) and where blockades are planned when Network Rail closes the railway for engineering work for several consecutive days.

Complaints and redress

This year we have continued work on our review of ORR’s complaints handling guidance for train and station operators to ensure it remains fit for purpose and continues to reflect good practice. In August 2021 we launched a consultation on replacing our guidance with a new Complaints Code of Practice with which train and station operators’ complaints handling procedures would have to comply.

We have continued to engage closely with train and station operators as part of our monitoring of complaints handling performance, including engaging with industry on the challenges brought about by the COVID-19 pandemic.

Building on our independent review of the Rail Ombudsman, we contributed to the governance of the ombudsman through our place on the Rail Ombudsman Scheme Council and the Ombudsman’s Rail Sector Liaison Panel. ORR also performed the role of secretariat to the Ombudsman Scheme Council.

We have also been developing our plan for how ORR will take on sponsorship of the Rail Ombudsman, delivering a commitment in the Williams-Shapps Plan for Rail.

We introduced a new passenger train operator licence condition to improve access to delay compensation. This includes a new code of practice designed to tackle the key barriers to delay compensation: awareness and ease of process. The new licence condition formally came into effect on 1 April 2022.

Consumer law

The Department for Transport (DfT) asked us to review the administration fees for ticket refunds in the National Rail Conditions of Travel. We published our findings in February 2022 and encouraged DfT and RDG to consider whether the maximum caps for administration fees, particularly the £10 cap in respect of ticket refunds, should be amended to provide additional protection for passengers.

We also:

- Continued our day-to-day monitoring and compliance work, for example monitoring the quality and timeliness of train operator passenger information during spells of adverse weather, and information arrangements for passengers for periods of planned line closures;

- Continued to seek input from our Consumer Expert Panel on a range of issues including complaints handling, delay compensation, and Network Rail stakeholder engagement; and

- Published our ‘Annual Rail Consumer Report’ for 2020-21. This report illustrates the breadth and depth of our work across the consumer areas for which we are responsible.

Strategic objective 3: Value for money from the railway Collapse accordion Open accordion

We support the delivery of an efficient, high-performing rail service that provides value for money for passengers, freight customers, governments, and taxpayers. We also regulate other significant elements of the national rail infrastructure, including High Speed 1 (HS1) and the UK portion of the Channel Tunnel.

In addition, we have a number of roles that help secure a better deal for rail users now and in the future.

Our business plan for 2021-22 outlined three priority areas for the year: maintaining a pragmatic approach to holding Network Rail to account while the effects of the pandemic remained present, launching our next Periodic Review (PR23) which will set the funding that the railway receives for Control Period 7 (2024-29) and what it should deliver in return, and concluding our GB signalling market study which was paused during the previous year.

Holding Network Rail to account

One of the key ways in which we support value for money from the railway is by holding Network Rail to account for its efficient delivery. For example, we monitor how it is maintaining and renewing its assets, how it is supporting a reliable and punctual train service and whether it is delivering safely and efficiently. We hold it to account against its obligations in its network licence and against its committed targets set for the five-year control period (CP6) and through its business plan.

April 2021 to March 2022 was the third year of CP6. During the year, COVID-19 has continued to present challenges to Network Rail and the wider rail industry. It has affected staff availability, working practices and passenger usage. In light of this, we have continued with a more qualitative approach to assessing Network Rail’s performance and service delivery.

In our last annual assessment of Network Rail, we highlighted a clear risk that the strong train service performance seen from April 2020 to March 2021 would decline as passengers and services returned. At that time, we said that Network Rail should continue to work across the industry to retain as much as possible of the performance uplift. Between April 2021 and March 2022, train service performance (both passenger and freight) declined. In November 2021, we wrote to Network Rail setting out our views on its delivery of this in the first half of the year. We concluded that work to embed improvements across the business has continued and overall progress has been good, but there were some regional variations, and we raised particular concerns about worsening performance in the Wales and Western region.

In November 2021, we also concluded our investigation into Network Rail’s impact on poor performance in the North West and Central region. The purpose of this investigation was to assess whether the region had identified key factors impacting on train service performance and whether it had set time-bound plans to mitigate them. We concluded that the region had substantively addressed all 25 recommendations. It had fulfilled the intended outcomes of our 2020 investigation and was progressing implementation of its plans as part of its business-as-usual activities.

We also published 16 Targeted Assurance Reviews looking at various aspects of the way that Network Rail approaches the management of its assets.

Periodic review 2023

In June 2021, we formally launched our periodic review 2023 (PR23) programme, which will establish Network Rail’s funding and outputs for its operations, maintenance, and renewals (OMR) activities for the five-year period starting from 1 April 2024 (known as control period 7 (CP7). PR23, including governments’ decisions about the level of funding the network should receive, will be made in light of the prevailing fiscal context, as well as wider challenges facing the rail industry and the transition to rail reform. However, we expect Great British Railways to be held to account for the commitments entered into in PR23.

Since we launched PR23, we delivered against key milestones on the programme’s timeline, including consultations on the Schedule 8 performance regime on 17 June 2021; the Schedule 4 possessions regime on 30 September 2021; and Network Rail’s access charging framework on 28 October 2021. The purpose of these consultations was to ensure that the views of the rail industry were considered. The responses received enabled us to set out refined proposals for how the charging framework and performance and possessions regimes should be set in CP7. We identified small incremental changes that we are minded to take forward, such as an opt-out mechanism to Schedule 4, and removing the ‘wash-up mechanism’ for the fixed track access charge (FTAC).

One of the programme’s key tasks is to advise the UK and Scottish Ministers on the level of funding the rail network needs ahead of the development of the ‘High Level Output Specification’ (HLOS) and ‘Statement of Funds Available’ (SoFA). As an early input to this process, we reviewed Network Rail’s early submissions on potential CP7 funding over summer/autumn 2021 and provided our views on this to funders. To help provide clarity on this work to external stakeholders, we also published guidance on how Network Rail’s CP7 funding and outputs are determined on 30 March 2022.

To support our work and reflecting the fact that PR23 is a cross-industry process, we have established robust, external governance arrangements with the UK Government, Transport Scotland, and Network Rail to help make decisions and provide a steer on key elements of the programme.

Access, licensing and capacity

Our work ensures that railway companies are fit to operate and that access to the rail network is fair. Our role ensures that users and funders of the railway are not disadvantaged by the monopoly power of the networks we oversee.

During 2021-22, whilst recognising the uncertainty created by the coronavirus pandemic for the railway and the customers it serves, we took a forward look with the upcoming access and capacity projects in mind. These included: the Network Rail approach to use of access rights, its approach to timetabling production, including the major projects on the East and West Coast Mainlines. We also continued to challenge it to: improve the clarity of evidence and information available for its access decisions; and work with industry to improve the timeliness of access applications.

We also completed a full factual update of our guidance on access to the network, including to take account of changes flowing from Brexit legislation.

The arrangements for regulatory co-operation in the Channel Tunnel have proved adaptable to the UK’s exit from the EU. Working closely with our colleagues in the French Transport Regulation Authority (ART), we have made significant progress in our assessment of Eurotunnel’s long-term cost recovery charges.

In 2021-22 the volume of access and licensing casework continued at similar levels to the previous year. However, industry continued to submit applications near timetable change dates, which meant that sometimes we evaluated and approved cases to meet industry needs much quicker than our statutory requirement of six weeks. We:

- Reviewed and approved just under 100 new and amended track access contracts for passenger and freight operators, within our statutory timescales.

- Reviewed and approved over 400 access contracts for stations, depots, freight terminals, other service facilities and connecting networks, again, within our statutory timescales.

- Issued ten licences or licence exemptions for operators of railway assets, meeting our timescale commitments to industry.

- Reviewed 11 Network Rail-proposed land disposals, consenting to nine of them, and consenting to one application under the financial ring-fence condition.

- Completed our annual audit of Network Rail’s land disposals to time, identifying no major issues overall but it needs to be clear to third parties how they may get in touch to register their interests in land, if they wish to do so.

- Reviewed and recommended improvements for the annual network statements published by Network Rail, Eurotunnel, High Speed One, Northern Ireland Railways, and for the Core Valleys Lines (in Wales), promoting consistency between them.

High Speed 1

The number of trains operating on the HS1 network (which includes Eurostar services through the Channel Tunnel) continued to be impacted by COVID-19, but increased to more than 70% of pre-COVID levels, compared to 65% in 2020-21. We continue to work with HS1 Ltd and operators on mechanisms to manage the impacts.

COVID-19 has also impacted engineering works on HS1, resulting in under-delivery of renewals. We challenged HS1 Ltd and we have now received a plan to recover the renewals plan within this control period, which is important to protect safety, performance and efficient use of funding.

During the year we have also worked with DfT and HS1 Ltd to effect the transfer of the regulation of HS1 stations from DfT to ORR. Should this be successful it will allow ORR to regulate the HS1 route and stations together, providing more consistency and efficiency for stakeholders.

Information and analysis

ORR is the primary producer of official statistics for the rail industry. The majority of our statistics have been assessed by the Office for Statistics Regulation and have been designated as ‘National Statistics’. This means that they meet the highest standards of trustworthiness, quality, and value, as set out in the Code of Practice for Statistics.

Throughout the year we have continued to publish a range of quarterly and annual statistics on our data portal. These cover a range of key areas for rail, including train performance and usage (both passenger and freight), passenger experience (complaints, delay compensation, passenger assists), finance, emissions and safety. Our published statistics provide users with a summary of the latest results and trends, alongside a suite of data tables and interactive dashboards. The data portal is used by a wide range of people, for example, central and local government policy makers, passenger watchdogs and rail user groups, academia and consultancy, media, and the public.

Promoting competition

We have continued our work monitoring and taking action to promote competition and tackle anti-competitive behaviour in railway markets. We have used the range of our powers, from advising and influencing industry, where appropriate, through to using our formal enforcement tools to tackle illegal conduct.

In November 2021, we published the final report of our signalling market study, which we re-launched in November 2020. In the final report, we made a number of recommendations aimed at attracting more suppliers to the market in order to stimulate competition and achieve better value for money when procuring signalling equipment. Our recommendations set out how Network Rail can reduce reliance on the dominant suppliers and make the market more attractive to potential new suppliers by increasing suppliers’ confidence in the market and reducing costs.

In March 2021, we opened an investigation into suspected infringements of Chapter I of the Competition Act 1998, as we had concerns over entry to the market for psychometric testing for train drivers. Our concerns were around the lack of clarity and transparency in rules of industry body governing standards that applicants were required to meet. In April 2022, we published our commitments decision and closed our investigation. We consider that the commitments, made by the industry body responsible for the rules, address our competition concerns, and will reduce restrictions on entry to the market. The commitments include practical steps to improve transparency, including publishing the rules online, and ensuring objective criteria for membership are explicitly set out. Our intervention aims to send a clear signal to other trade associations within the sector to ensure that their rules do not restrict entry to markets and are compliant with competition law.

We have also continued our work monitoring open access markets following on from our publication of our ‘Open Access Monitoring Framework’ in February 2020 and April 2021. We published our most recent update report on how competition has developed in these markets on 28 April 2022.

Strategic objective 4: Better highways Collapse accordion Open accordion

National Highways operates the strategic road network, managing motorways and major roads in England. Our role is to scrutinise the company and hold it to account for its performance and delivery.

We report on National Highways’ delivery of around £5 billion of annual expenditure, providing transparency to funders, road users and wider stakeholders. We encourage National Highways to publish more information on its plans and performance. Importantly, improved transparency allows other stakeholders to play a more informed role in holding the company to account.

Our business plan for 2021-22 outlined two priority areas for the year: assessing the impact of COVID-19 on National Highways’ plans for the remainder of road period 2 (RP2) and preparing our advice on efficiency to the Secretary of State for Transport, as part of our work on the third road investment strategy.

Annual assessment of National Highways

We published our annual assessment of National Highways’ performance. This covered the first year of the second road period (2020-21). The report found that the company met all of its targets for its key performance indicators during extraordinary circumstances of responding to the impacts of the pandemic and the end of the transition period for the UK’s exit from the EU. However, National Highways needs to continue its focus on road safety to achieve its 2025 commitments and manage ongoing risks such as planning issues, to ensure future delivery of its RIS2 enhancements portfolio.

Smart motorways

We continued our monitoring of the company’s delivery of the Smart Motorway Action Plan, a plan agreed with the Secretary of State to improve safety on the smart motorway sections of the strategic road network. Through the year we have closely monitored the company to ensure that it is doing everything that can be reasonably expected of it to achieve the actions and sustain its performance.

We also undertook an independent review of the safety data and evidence associated with all lane running motorways commissioned by the Secretary of State for Transport, Rt. Hon. Grant Shapps MP. Drawing on our experience and expertise as the Highways Monitor, the safety regulator of Britain’s rail network and the publisher of official railway statistics, we delivered our All Lane Running report to the Secretary of State in June and it was published in September.

Benchmarking National Highways

We published our 2021 benchmarking report in which we benchmarked National Highways’ performance and spending across its regions. We also set out our plans for wider benchmarking against comparable organisations, including in other countries and sectors. As a result of ORR driving the need for greater transparency and data to be published, our annual benchmarking report for 2021 includes a greater number of performance indicators at a regional level.

While this is a considerable step forward, there continue to be significant regional differences and we expect National Highways to apply the lessons it has learned about what works well in one region to other parts of the country as part of the steps it will take to meet all national-level targets by 2024 25.

Transport Select Committee recommendations

Development of our advice for the third road investment strategy (RIS3) is underway. RIS3 will set out the funding available to National Highways for the Government’s five-year strategic vision for investment in, and management of, the strategic road network from April 2025 to March 2030.

In preparation for this process, we have published our consultation on our proposed approach to assessing the challenge and deliverability of plans for RIS3. This sets out how we intend to conduct our activities and the evidence we intend to use to inform our assessments.

We are currently collecting evidence to assist our assessment of the challenge and deliverability of the third road investment strategy. This includes studies on National Highways’ renewals planning, its approach to whole life cost and the performance framework for environmental outcomes.

Delivery of service standards Collapse accordion Open accordion

Much of ORR’s business-as-usual work involves providing services to those in the industry or others with an interest in our work.

As an organisation that is largely funded, directly or indirectly, by the public, it is essential that we publish service standards as part of our commitment to transparency.

The service standards below were published in our business plan for 2021-22. The table shows how we performed against each of these.

Table 2: Performance against service standards

| Provision | Service standard | Percentage achieved |

|---|---|---|

| Issue new or revised train driver licences | 100% of applications processed within one month of receipt of all necessary documentation | 100% |

| ROGS safety certificate and authorisations (Railway and Other Guided Transport Systems Regulations) | 100% determined within 4 months of receiving completed application | 100% |

| Report to Rail Accident Investigations Branch (RAIB) on the progress of its recommendations | 100% response to RAIB recommendations within 1 year of associated RAIB reporting being published | 100% |

| Efficient processing of technical authorisations | 100% of responses within 28 days of receiving complete submission | 100% |

| Access and licensing casework | 100% decided within 2 months of receipt of all relevant information | 100% |

| Freedom of Information requests | 90% of requests for information responded to within 20 working days of receipt | 96% |

| General enquiries and complaints, including adjustment to account for cases investigated | 95% of enquiries and complaints responded to within 20 working days of receipt | 95% |

| Prompt payment of suppliers’ invoices to ORR | 80% paid within 10 days of valid invoice | 86% |

| 100% paid within 30 days of valid invoice | 100% | |

| Publication of quarterly statistical releases | 100% published within 4 months after quarter end | 100% |

Note: Our inspectors spent 60% of their time on proactive inspection (against 50% target).

Sustainability Collapse accordion Open accordion

Sustainability is becoming increasingly prominent within the rail industry, and teams across ORR continue to support this work. Building on the work we commissioned in 2020, we have consulted on our sustainable development policy and environmental guidance to railway licence holders, with broad support for updating our policy. Our updated policy will inform our activities and regulatory duties in road and rail. We will publish our consultation conclusions in the first half of 2022.

We have increased our staff resourcing to support our holding to account work. This involves holding quarterly liaison meetings with Network Rail’s Head of Environment and Sustainable Development and subject matter leads. This year, we have developed this further by holding meetings with the Head of Environment for each of Network Rail’s five regions, to understand and assure delivery of Network Rail’s Environment Strategy commitments at a regional and route level within Network Rail.

We have also explored how Network Rail is delivering its Low Carbon Ambition Plan. This will be an increasingly important area of focus going forward. We have used this year to build our capabilities and understanding of how best we can regulate the industry around decarbonisation, to build on existing reporting of CO2 emissions due to Network Rail’s operations, whilst also looking towards reporting of emissions produced by their supply chain.

We have challenged Network Rail to improve performance around the reporting of energy and carbon emissions. We have also provided feedback to guide Network Rail on the development of a new environmental sustainability indicator, which will be trialled in 2022-23.

We held liaison meetings with statutory environmental bodies across the three nations; this is a useful platform to understand permitting requirements for the industry, and to explore integrated opportunities for challenges such as climate change adaptation. We have also held meetings with Natural England, to discuss the requirement for ‘no net loss’ of biodiversity by 2024, and how the rail industry will need to plan for reporting this from 2024 onwards.

We continue to monitor how Network Rail is delivering against its biodiversity action plan and the first state of nature report was developed this year. We have also commenced an independent review of lineside vegetation management practices, to ensure these deliver operational safety but also respond to the recommendations of the Varley Review. The results of our work will be published later in 2022.

Through our engagement with industry working groups, we maintain oversight of decarbonisation, supporting on areas ranging from low carbon freight to action plans for decarbonisation across the industry. ORR has also been an observer to the development of a new Sustainable Rail Strategy for 2022-2050, which will inform priorities for sustainable development.

Managing the impacts of weather on the infrastructure continues to be a key part of our holding to account activities, with several notable storms affecting the railway. Network Rail provides progress updates on the actions set out in its Weather Resilience and Climate Change Adaptation plans.

We monitor National Highways’ progress against its commitment to deliver better environmental outcomes on the strategic road network. For the second road period, covering April 2020 to March 2025, this includes holding the company to account for its performance against key performance indicators on noise, biodiversity, air quality and corporate carbon emissions. We also monitor progress against several environmental performance indicators, covering supply chain carbon emissions, condition of cultural heritage assets, water quality and litter.

In our annual assessment of National Highways’ performance in 2020-21 we reported that:

- The company forecasted a shortfall in biodiversity at the end of the second road period, and we are continuing to challenge National Highways to produce a no net loss plan.

- National Highways mitigated noise at 2,111 noise important areas, which is ahead of their internal target

- The company had mitigated five of 31 links (sections of road between two junctions) which are above legal levels of nitrogen dioxide, a further 17 links were considered not viable to mitigate with any measures.

- The company agreed a baseline for corporate carbon emissions, with a target agreed to reduce emissions by 75% by the end of the second road period.

Our next annual assessment is due to be published in July 2022, when we will report on National Highways’ performance against these environmental metrics during 2021-22.

Procurement

Sustainable procurement involves the management of internal demand to ensure that only appropriate goods and services are obtained from third parties, selecting suppliers that have appropriate sustainability credentials where relevant to the contract, utilising eTendering and opening up procurements to small and medium enterprises (SMEs). We issue documentation for all tenders electronically and require all proposals to be submitted electronically. We encourage SMEs’ participation in tenders through highlighting the suitability of tender opportunities on ContractsFinder and ensure that liability and insurance limits are as low as practical within the contract.

ORR performance and policy

Our environmental performance in 2021-2022 is shown in the table below. We have presented the data as transparently as possible and have noted below where it has not been possible to obtain some information. Defra conversion factors are used. Building-related data is provided for our offices in London and Glasgow only. Our other offices, occupied as sub-tenants of other government departments’ premises, should be reported by the lead department. Most of our utilities are provided and controlled by our building landlords or lead tenants, therefore we do not set targets for the measures reported. The data on travel and paper consumption is for the whole of ORR.

Table 3 - Sustainability data on greenhouse gas emissions

| Emission Category | 2019-20 Greenhouse gas emissions (tonnes CO2e) | 2020-21 Greenhouse gas emissions (tonnes CO2e) | 2021-22 Greenhouse gas emissions (tonnes CO2e) |

|---|---|---|---|

| Electricity (scope 2) | 88 | 24 | 25 |

| Oil (scope 2) | 19 | - | - |

| Gas (scope 2) | - | - | 74 |

| Official business travel (car - personal vehicle) | 30 | 17 | 28 |

| Official business travel (air) | 58 | 1 | 9 |

| Official business travel (train) | 144 | 6 | 30 |

| Official business travel (car - hire vehicle) | 8 | 3 | 11 [note 1] |

| Gross emissions of official business travel | 240 | 27 | 78 |

| Total gross emissions | 347 | 51 | 177 |

Note 1: Quarter 4 data was not available and so an estimate has been calculated based on previous three quarters

Table 4 - Sustainability data on greenhouse gas related consumption and expenditure

| Related consumption and expenditure | 2019-20 | 2020-21 | 2021-22 |

|---|---|---|---|

| Non-renewable electricity consumption | 243,175 kWh | - | - |

| Renewable electricity consumption | 103,567 kWh | 88,734 kWh | 109,752 kWh |

| Oil consumption | 66,742 kWh | - | - |

| Total expenditure on energy | £73,896 | £75,411 | £77,007 |

| Expenditure on official business travel | £784,837 | £100,104 | £283,916 |

| Distance travelled by international business flights | n.a. [note 1] |

n.a. [note 1] |

10,213 km |

Note 1: Data not available

Greenhouse gas emissions from electricity and travel have increased in 2021-22 as a COVID-19 restrictions were lifted and staff were able to travel again. ORR no longer uses oil or has any non-renewable electricity source. The gas figure is for the London office only. This is the first year that we have been provided with a figure.

Table 5 - Sustainability data on waste and waste related expenditure

| Waste category and related expenditure | 2019-20 | 2020-21 | 2021-22 |

|---|---|---|---|

| Non-hazardous recycled | 20 tonnes | 1 tonnes | 3 tonnes |

| Non-hazardous incinerated/energy from waste | 36 tonnes | 5 tonnes | 7 tonnes |

| Total waste | 56 tonnes | 6 tonnes | 10 tonnes |

| Related expenditure, cost of waste collection | £36,415 | £1,795 | £3,242 |

The table above includes data for our London and Glasgow offices only. Waste figures were high in 2019-20 as a result of the London office move. In 2020-21 we only have available figures for our new London office from August 2020. Data prior to this has not been made available. Waste figures were low in 2020-21 and 2021-22 due to the offices being closed between April and September 2020 and the introduction of hybrid working.

Table 6 - Sustainability data on finite resource consumption and related expenditure

| Finite resource consumption and related expenditure | 2019-20 | 2020-21 | 2021-22 |

|---|---|---|---|

| Water consumption | 866 m3 | n.a | 971 m3 |

| Paper consumption | 995 A4 reams | 150 A4 reams | 100 A4 reams |

| Related expenditure | £2,628 | £1,992 | n.a |

No water consumption figures are available for 2020-21. The 2021-22 figure is for London only as the Glasgow figure is not available. Paper and water consumption were lower in 2020-21 due to the majority of staff working from home for most of the year. The water supply cost is not available for either London or Glasgow for 2021-22.

ORR is predominately a cloud-based organisation. During the year we have switched off two servers and moved them to the cloud. We dispose of IT waste through sustainable organisations, which ensures that where possible components are reused or recycled.

John Larkinson

Accounting Officer

Financial performance Collapse accordion Open accordion

The public sector budgeting framework

The budgeting system is designed to support the UK’s public spending framework. Estimates are the mechanism by which Parliament authorises departmental spending and are presented using the public sector budgeting framework. Through the Estimates process, Parliament is required to vote limits for different budgetary categories of spending. For ORR, these are the:

- Net Resource Departmental Expenditure Limit (RDEL) requirement.

- Net Capital Departmental Expenditure Limit (CDEL) requirement.

- Net Cash Requirement (NCR) for the Estimate as a whole.

A breach of any of these voted limits would result in an Excess Vote. Parliament must be asked to vote an actual amount for any control limit. Therefore, in ORR’s case, as our income fully covers our costs, the Estimate shows a token £3,000 to be voted.

A summary of our income and expenditure capital outturn compared to the 2021-22 Estimate and 2020-21 outturn is shown in the table below.

Table 7 - Outturn against 2021-22 financial control totals and 2020-21 outturn

| Outturn Category | 2021-22 outturn (£000) | 2021-22 estimate (£000) | 2020-21 outturn (£000) |

|---|---|---|---|

| Economic regulation income | (15,865) | (16,638) | (13,687) |

| Health and safety regulation income | (17,376) | (18,705) | (16,153) |

| Highways monitoring income | (2,651) | (2,888) | (2,482) |

| Total income | (35,892) | (38,234) | (32,322) |

| Staff costs expenditure | 25,508 | 26,818 | 24,577 |

| Other costs expenditure | 10,387 | 11,419 | 7,748 |

| Total expenditure | 35,895 | 38,237 | 32,325 |

| Net operating cost/net resource outturn (RDEL) | 3 | 3 | 3 |

| Net capital outturn (CDEL) | 619 | 720 | 593 |

| Net cash requirement (NCR) | (530) | 2,000 | 1,975 |

This table ties directly to the Statement of Outturn against Parliamentary Supply, a key accountability statement which is audited.

Variances between estimate and outturn

Income

All rail-related costs are recovered via licence fees or the safety levy which are invoiced based on estimated costs. Therefore any over-recovery is treated as deferred income and any under-recovery as accrued income, as set out in note 5 to the accounts. All highways-related costs are recovered in full from the Department for Transport.

Income from economic regulation comprises income from the licence fee, HS1 and our monitoring of Northern Ireland. Health and safety regulation income includes income from railway service providers and from the Channel Tunnel.

Expenditure

In 2021-22 we spent a total of £35.9m compared to £32.3m in 2020-21. Our overall gross budget for 2021-22 was £38.2m.

By segment, our spend breaks down as follows:

- £2.2m more on economic regulation than last year, at £15.9m (£0.8m less than budget).

- £1.2m more on safety regulation than last year, at £17.4m (£1.3m less than budget).

- £0.2m more on our highways monitoring role compared to last year, at £2.7m (£0.2m less than budget).

Our largest area of underspend was staff costs where we spent 5% (£1.3m) less than budget. We have experienced a higher staff turnover in 2021-22 than in 2020-21 (13.5% compared to 8.9%). We have had a number of senior level vacancies which have taken time to fill, and have experienced difficulty in recruiting specialist staff in a competitive market.

Staff costs accounted for £25.5m (71%) of total costs, compared to £24.6m (76%) in 2020-21. This reflects a return to pre-COVID levels of staff costs as a proportion of total spend, reflecting increased running costs in 2021-22. Our average staff cost per full-time equivalent (including employer’s National Insurance and pension contributions) in 2021-22 was £74,804 compared to £75,390 in 2020-21.

COVID-19 continued to impact on our travel and subsistence budget, and we spent 44% less than expected. The impact of COVID-19 was also seen in lower training costs than budgeted. Some of our office running costs were also lower than budgeted, and we received unexpected service charge rebates in 2021-22.

Long-term expenditure trends

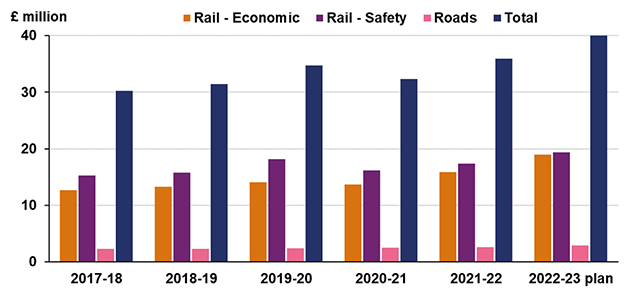

The chart below shows our spending pattern, in cash terms, over the last five years and for the 2022-23 plan, split by key work area. Our spend is expected to increase in 2022-23 as we support rail reform implementation and take over sponsorship of the rail ombudsman.

Chart 1: Spend by key work area over the last five years and 2022-23 plan

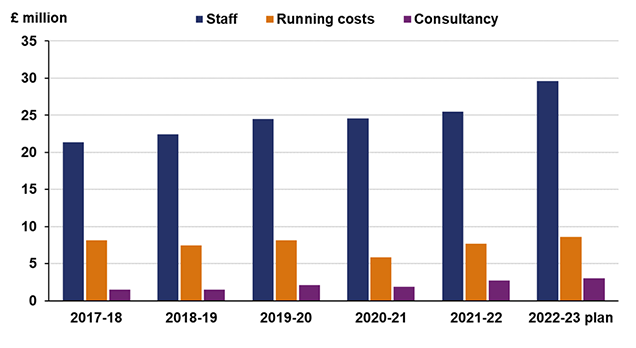

The following chart shows how our spending breaks down by category of spend over the last five years and for the 2022-23 plan.

Chart 2: Spend by category over the last five years and 2022-23 plan

Running costs have returned to more normal levels in 2021-22 following a decrease in 2020-21 caused by the pandemic.

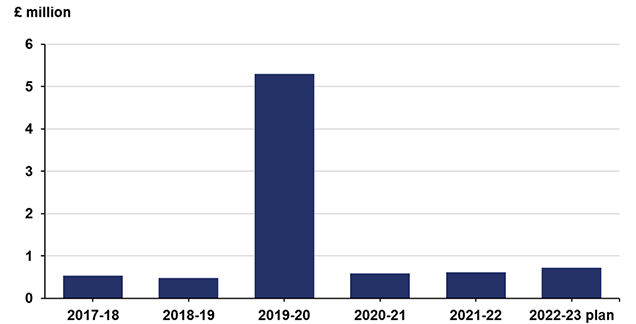

Capital expenditure

Net capital expenditure was £0.6m compared to £0.7m budget. Capital expenditure in 2019-20 was higher than usual at £5.2m, due to fit-out costs associated with the London office move. The chart below shows CDEL outturn for the last five years and for the 2022-23 plan.

Chart 3: CDEL outturn over the last five years and 2022-23 plan

Net cash requirement

We had a negative net cash requirement (NCR) of £0.5m compared to £2.0m requested in the Estimate. We request a NCR to cover timing differences. We did not need to use this in 2021-22.

Impact of the UK’s exit from the EU and COVID-19

ORR has not incurred any direct expenditure as a result of the UK’s exit from the EU. ORR’s activity in this area is set out in Performance Analysis.

A small amount of expenditure has been incurred in providing essential IT equipment, such as monitors, to staff to enable them to work from home effectively during the pandemic.

There have been no changes to ORR’s headcount as a result of EU exit or COVID-19. Two members of staff were loaned to other government departments to assist with the COVID-19 response in 2021-22. Both of these loans were for longer than six months, and in both cases the staff members went onto the host department’s payroll. We have not experienced a significant increase in staff sickness during the pandemic.

Accountability report

Corporate Governance Report Collapse accordion Open accordion