Train fare revenue for Great Britain’s rail network rose 8% to £11.5 billion between April 2024 and March 2025 when compared to the previous year, the latest statistics from the Office of Rail and Road (ORR) show. However, despite the number of passenger journeys approaching pre-pandemic levels at 1.7 billion, fare revenue continues to lag behind at 12% behind pre-pandemic levels.

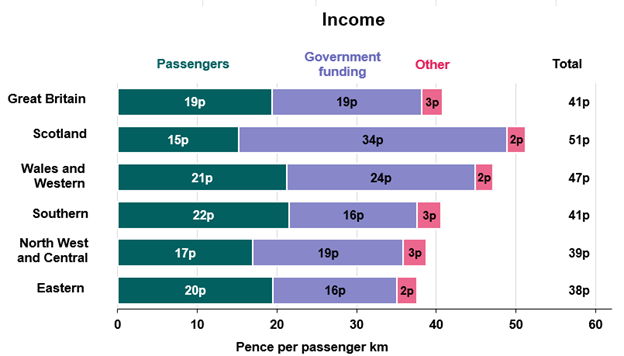

The rise in fare revenue contributed to a reduction in funding from the UK and devolved governments towards the operation of the railway. This fell to £11.9 billion in the year, down £0.9 billion from the previous year. Our statistics show that passengers in Scotland received the highest level of government support per passenger kilometre travelled compared with other regions.

Sources of industry income and government funding of the operational railway Great Britain, April 2024 to March 2025

ORR’s Rail Industry Finance (April 2024 to March 2025) statistics provide a breakdown of income, expenditure and government funding for the UK rail industry. The key findings include:

- Fares income is up year-on-year: Fares income was £11.5 billion, up 8% (£0.9 billion, adjusted for inflation) with fare income from regional journeys seeing the highest growth (11%).

- Despite this, overall industry income is slightly down: The industry as a whole received £25.9 billion of operational income in the latest year, a decrease of 1% (£151 million, adjusted for inflation).

- Expenditure is up: Operational industry expenditure increased by 1% to £26.0 billion. Excluding financing costs, expenditure was £23.5 billion, 2% higher than the previous year.

- Government funding reduced: The UK and devolved governments contributed a total of £11.9 billion for the day-to-day operation of the railway which is nearly half (46%) of the industry’s income.

- HS2 represents the majority of current railway investment: Investment in new and enhanced rail infrastructure and rolling stock reduced to £10.3 billion, down 4% (£0.4 billion) on the previous year. Most of this was invested into High Speed 2 (HS2) at £7.1 billion.

- Private investment increased: Private companies invested a total of £756 million in the rail industry during the year. An increase of 27% (£161 million) on the previous year.

- Dividends: 10 out of 20 public contracted train operators were expected to pay dividends totalling £164 million, down 3% on the previous year. Publicly owned operators accounted for 12% of this total.

- Rolling stock leasing: Net profit margins of rolling stock companies (ROSCOs) decreased 3 percentage points to 19%. ROSCOs paid £275 million in dividends to shareholders, a reduction of 19% (£64 million) compared with the previous year.

Will Godfrey, Director of Economics, Finance and Markets said:

Transcript Collapse accordion Open accordion

UK rail industry finance: April 2024 to March 2025

The railways of the United Kingdom provide an important service, helping bring people together, connecting businesses, and transporting freight.

There are many parts to keeping the railway running, and the majority of expenditure is associated to Network Rail and passenger operators, while a smaller percentage covers freight operators the highspeed line, London St. Pancras High-Speed, Northern Ireland Railway, and the Core Valley Lines in South Wales.

These costs are largely operational, including staff salaries, vehicle leasing, diesel fuel, traction electricity, operations, maintenance and renewals, and financing expenses.

Expenditure varies from year to year, depending on various factors, including inflation and global affairs.

In order to cover these costs, the industry receives different types of funding.

Passenger fares is one of the sources that contribute to the yearly income, yet not the only one.

Government funding and property income, for instance, also contribute to the total amount the network receives. Income also varies.

To give you an idea, in the year ending March 2025, passengers spent £11.5 billion pounds on train tickets.

That was more than the previous year, but lower than before the pandemic.

While income from passenger fares is lower than before the pandemic, government funding has increased, helping the network maintain consistent income levels to help cover its expenses.

As you can see, passenger ticket fares, funding from the government, and other sources contribute to the rail industry's yearly income, which is used to run and maintain the United Kingdom's railways.

To find out more about rail industry finance, visit the Office of Rail and Road's data portal.

Notes to Editors

- All data tables, a quality and methodology report and an interactive tool associated with this release are published on the rail industry finance page of the ORR data portal. Percentage changes above are reported to the nearest whole percent, exact changes are shown in the full report.

- Operational industry expenditure relates to the day-to-day costs of operating, maintaining and renewing the network and services. Including financing costs, operational expenditure was £26.0 billion, a 1.0% (£267 million) annual increase. The increase was mostly due to a rise in publicly contracted train operator costs (4.6%) as a result of increased headcount levels (4.6%) increasing overall staff costs by 6.1%.

- Total public funding for rail operations and infrastructure enhancements combined was £21.6billion, a 6% annual decrease, comprised:

- £11.9 billion for day-to-day operation of the railway (7% annual decrease).

- £7.1 billion towards the continued development of HS2 (5% annual decrease).

- £2.1 billion for Network Rail enhancements initiatives (10% annual decrease)

- £0.6 billion to other parts of the rail industry including East West Rail, Core Valley Lines and other funding outside of the core railway business (7% annual decrease).

- To account for inflation, historic data has been adjusted to April 2024 to March 2025 prices using the average quarter on quarter Consumer Price Index (CPI) for the year.