National Highways has delivered significant enhancements to the strategic road network (SRN) for road users across the second road period (RP2). The company started work on 17 major enhancements schemes and opened 30 schemes for traffic.

National Highways has not achieved everything that it originally planned in RP2 for reasons both within and outside its control. It ultimately missed 11 of its enhancements commitments for reasons within its control. The company identified the causal factors for this, and we support its plans to improve in these areas. We will hold it to account to demonstrate success.

The forecast cost of completing enhancements increased significantly during RP2. However, delays and cancellations meant that the costs within the period were below originally expected levels.

Overview of RP2

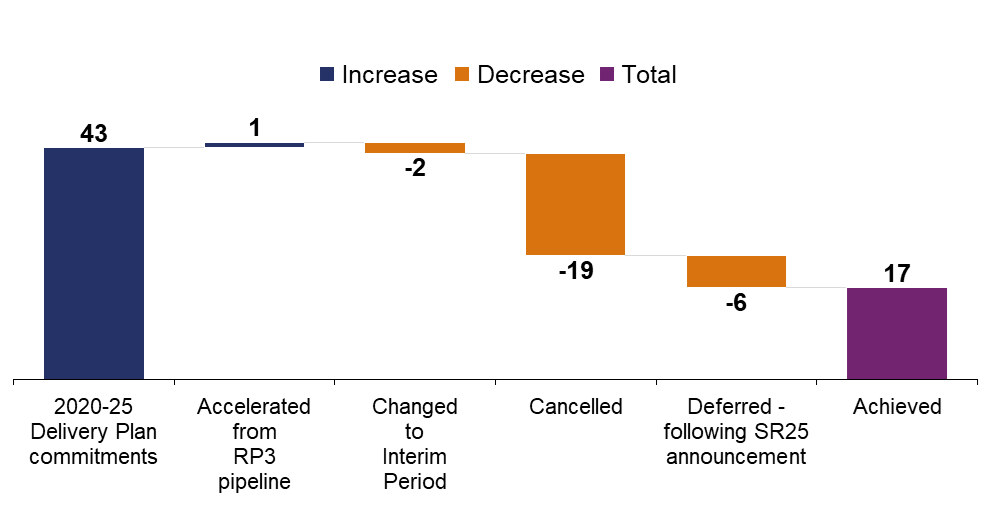

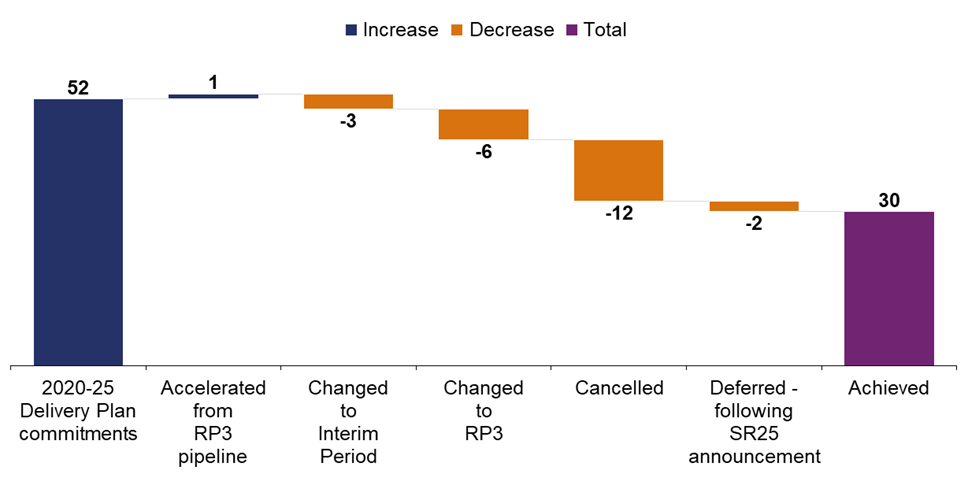

National Highways committed in its 2020-2025 delivery plan to start construction, known as start of works (SOW), on 43 schemes, and open for traffic (OFT) 52 schemes. These commitments reduced across RP2 due to government changes that were outside of the company’s control.

National Highways successfully started construction of 17 enhancements schemes and opened 30 schemes to traffic in RP2, as shown in Figure 3.1 and Figure 3.2 below. This included the company achieving its 2024-2025 delivery plan commitments. In the final year of RP2, it successfully started work on three enhancements schemes and opened seven schemes to traffic.

There were eight RIS2 schemes that were held subject to Spending Review 2025 (SR25). The government subsequently decided to fund and progress six of these schemes and cancel two. The six funded schemes are shown in Figures 3.1 and 3.2 as “deferred – following SR25 announcement”. Further data can be found in our interactive dashboard.

Figure 3.1 2020 to 2025 delivery plan SOW commitment status at the end of RP2

Figure 3.2 2020 to 2025 delivery plan OFT commitment status at the end of RP2

Commitment changes

Throughout RP2, National Highways’ enhancements programme was subject to change. This resulted in alterations to the SOW and/or OFT committed dates of many second road investment strategy (RIS2) enhancements schemes. Therefore, the programme agreed at the start of the period was significantly different to the one that the company delivered.

Often, these changes, agreed by government, were due to factors that fell outside of National Highways’ control. However, in some instances they were due to reasons within its control. These are known as missed commitments.

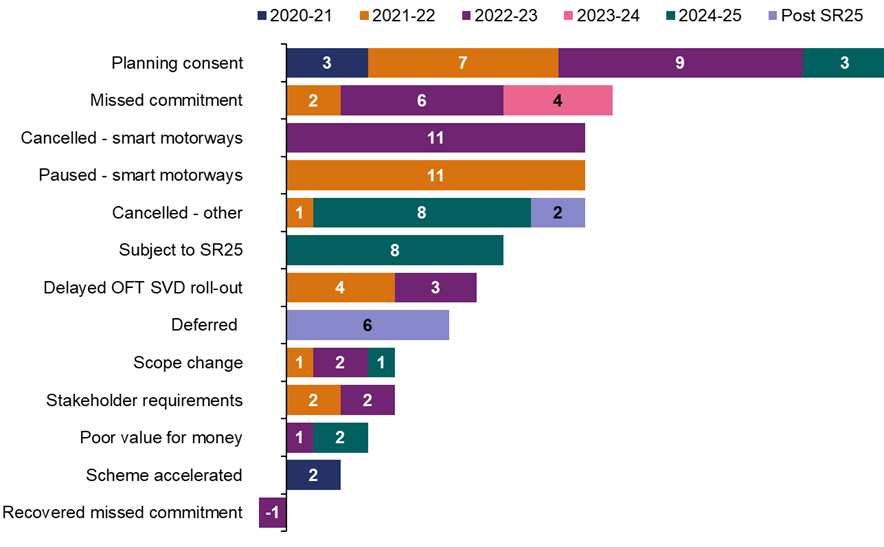

The reasons for these changes and the year of RP2 in which they took place is set out in Figure 3.3 and further detail can be found in our interactive dashboard.

Figure 3.3 Government agreed changes and National Highways’ missed commitments to 2020 to 2025 delivery plan enhancements schemes by reason, annual data, April 2020 to March 2025

In total, there were 89 government agreed changes to the RIS2 capital enhancements portfolio. These changes impacted the cost, schedule and original intended benefits of National Highways’ RIS2 enhancements portfolio.

In addition to formal change control, the previous government required that the national emergency area retrofit (NEAR) programme be delivered by National Highways during RP2. The company was able to adopt this additional work through the utilisation of resources and funding made available by government’s cancellation of the smart motorways programme.

Change outside of National Highways’ control

Figure 3.3 shows that the biggest cause for enhancements portfolio changes in RP2 was due to development consent planning issues.

In the early years of RP2, securing development consent orders (DCOs) for enhancement schemes was a significant problem for National Highways. There were 22 scheme start dates that were changed because of DCO delays, with some schemes altered more than once. The company worked collaboratively with the Planning Inspectorate to understand the reasons for these delays, learn lessons and put in place actions to reduce the risk of further problems. As a result, there were fewer DCO issues in the latter years of RP2.

In year 3 of RP2, the previous government decided to cancel the rollout of 11 smart motorway schemes. Additionally, during RP2 successive governments cancelled a further nine schemes for affordability and value for money reasons, as shown in Figure 3.3. National Highways reported that a total of £523 million of spend was written off as a loss and the original intended benefits of these schemes will not be realised.

Additionally in July 2025, following SR25, government took the decision to cancel a further two RIS2 schemes. National Highways expects to report losses from these two schemes in its 2026 annual report and accounts.

Missed commitments

A missed commitment is classed as an alteration or delay to the delivery of a RIS2, or delivery plan, commitment that was deemed by government to be caused by something within National Highways’ control.

There were 12 missed enhancements commitments at the end of RP2 in total. However, one of these declared missed commitments was ultimately delivered on time to its original commitment date. Therefore, we consider that National Highways missed 11 commitments. This was more than the first road period, when the company missed five of its enhancements commitments. However, in the final year of RP2, the company improved on previous years and did not miss any commitments, see Figure 3.3.

Throughout RP2, and as part of our 2024 investigation into National Highways performance and delivery, we challenged the company to identify the root causes of its missed commitments and to put in place plans to improve.

Following our intervention, National Highways identified the following recurring themes:

- commercial supply chain issues:

– issues/capability gaps regarding commercial practices and procurement;

– problems managing the supply chain. - scheme asset design data input:

– inaccurate asset data;

– insufficient technical and asset management expertise.

Subsequently, National Highways developed a set of interventions aimed at delivering improvements to the identified themes. This included improving how it captures and shares knowledge across the organisation. These interventions should help the company learn and avoid future related issues that lead to schedule and cost increases. We will continue to work with the company to ensure that these interventions are embedded in the business and deliver the intended benefits.

Forward look

National Highways did not miss any enhancements commitments in the final year of RP2. However, we continue to see delays to enhancements schemes beyond RP2. Notably, the M25 Junction 10 and A63 Castle Street schemes that were forecast to OFT in Summer 2025, are now not expected until 2026. The company has attributed delays to these schemes to scheme asset data, where schemes have been impacted by poor ground conditions and unexpected underground utilities.

National Highways must ensure that it continues to keep stakeholders and road users informed of changes to scheme commitment dates and that it has taken reasonable steps to manage risks that could cause schedule delays.

RIS2 enhancements financial performance

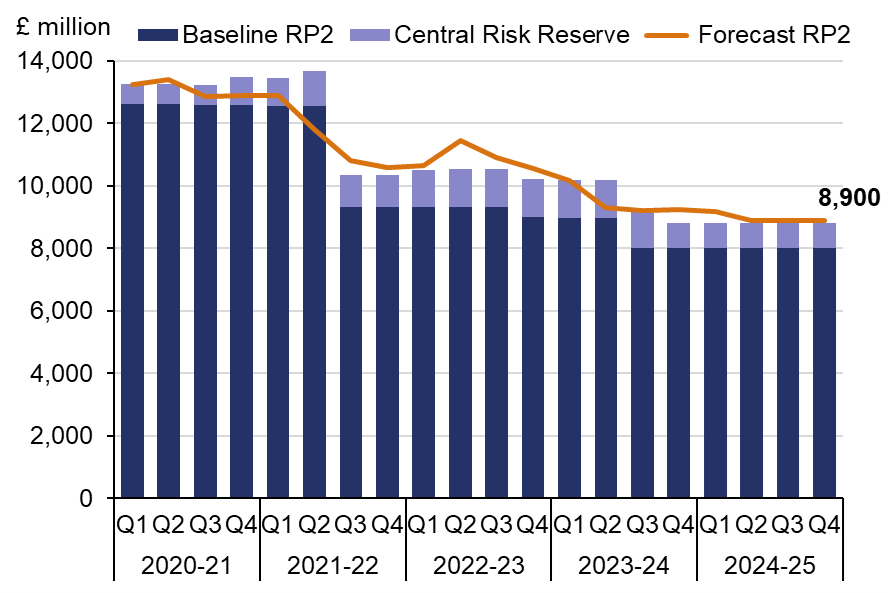

The overall forecast cost of completing RIS2 enhancements increased significantly during RP2. However, the costs within the period were below expected levels due to delays and cancellations of parts of the programme.

National Highways spent £8,900 million on enhancements in RP2 covering enhancement schemes and other enhancement expenditure, for example on smart motorways safety improvements. This was in line with its final funding. However, expenditure and RP2 funding both reduced from the levels originally expected. Figure 3.4 shows that the company’s forecast spending on enhancements during RP2 reduced from £13,256 to £8,900 million across RP2. This is £4,356 million (33%) less than was forecast at the start of RP2.

National Highways’ RP2 enhancements spending was impacted by some significant external factors affecting cost and delivery. Inflation was higher than expected during year 2 and 3 of RP2. However, delays in schemes achieving development consent (including Lower Thames Crossing), cancellation of some schemes (including the A303 Amesbury to Berwick Down (Stonehenge)) and cancellation of the smart motorway programme more than offset this impact. In addition, in the later years of RP2, government cancelled some lower value for money schemes to address cost increases and wider government spending pressures.

Figure 3.4 Enhancement (including Lower Thames Crossing) cost forecasts for RP2 in total, as reported each quarter, April 2020 to March 2025, (£ million)

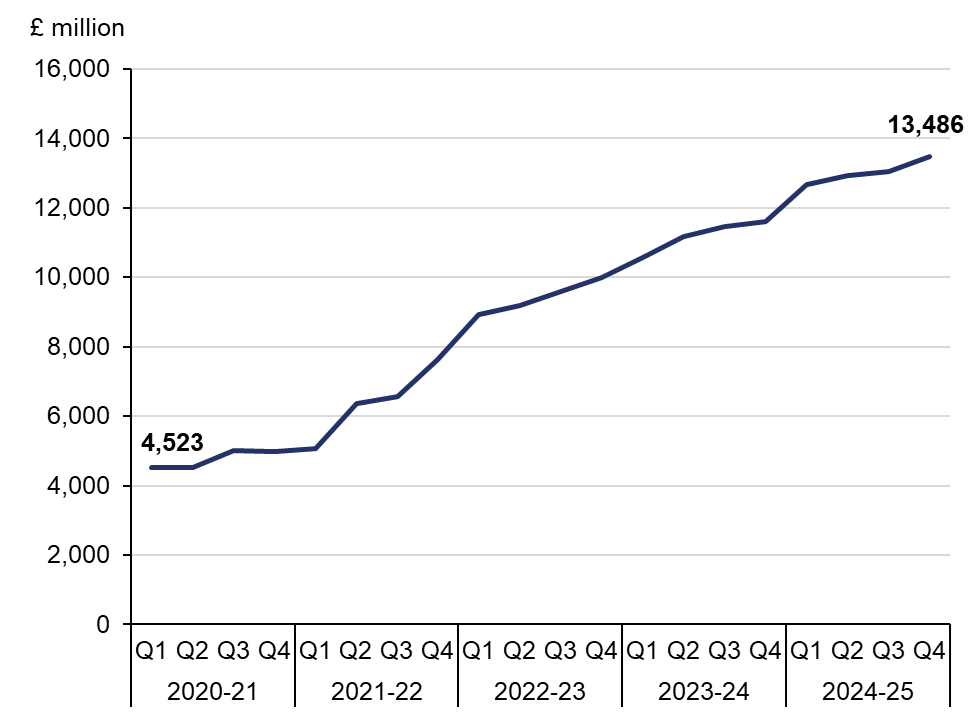

The forecast cost of enhancements schemes in future road periods (the ‘RIS2 tail’ cost, covering the interim period, the third road period (RP3) and beyond) continues to rise because of delays and cost increases. Figure 3.5 shows that over RP2 the expected cost of ‘RIS2 tail’ enhancement schemes increased significantly from £4,523 million to £13,486 million since the start of RP2 because of slippage, inflation and increased scope. These figures are presented on a like for like basis and exclude schemes cancelled during RP2, including A303 Amesbury to Berwick Down (Stonehenge), the further rollout of the smart motorway programme in year 3 of RP2 and the two schemes cancelled following SR25.

Figure 3.5 Enhancement scheme (including Lower Thames Crossing) cost forecasts for the RIS2 tail, as reported in each quarter of RP2, April 2020 to March 2025, (£ million)

The overall forecast cost of RIS2 enhancements (across all road periods) increased by £7,151 million (43%) on a like for like basis, excluding schemes that were cancelled in RP2 and following SR25. The costs of the Lower Thames Crossing scheme, the largest in RIS2, increased by £2,835 million (47%), the largest contribution to the overall increase.

During RP2, National Highways did several studies to understand the causes of its cost increases and how they compared to external benchmarks. While some of the identified reasons for the cost increases are outside the company’s control, it also identified a set of actions it could deliver to improve accuracy, such as increasing the risk contingency allowances in early-stage estimates. It should continue to implement, embed and monitor the effects of this action plan, to continuously improve its estimating and cost control, providing greater certainty to government and taxpayers.

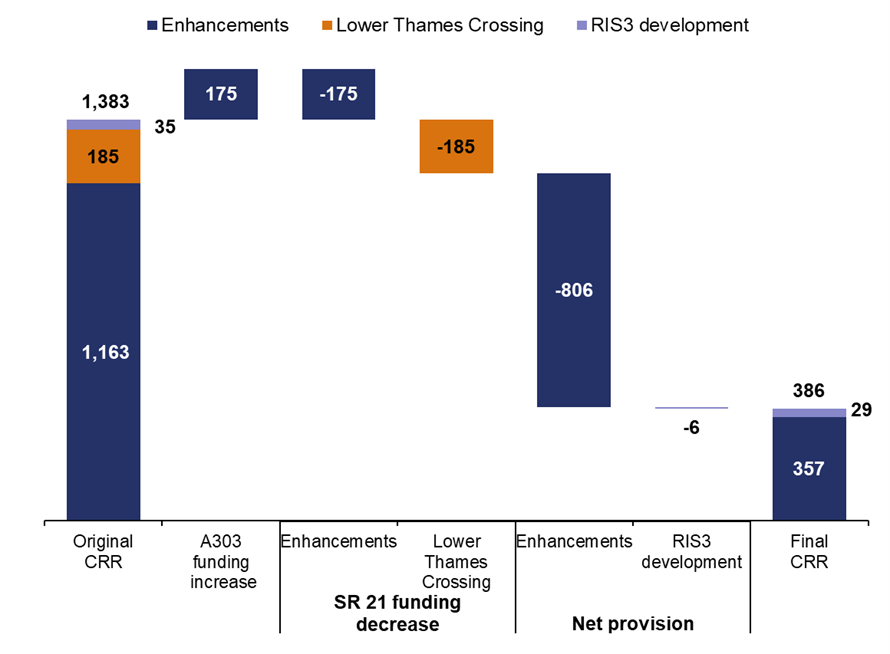

Use of Central Risk Reserve on enhancements

For RIS2, government allocated National Highways £1,383 million central risk reserve (CRR) funding for portfolio level risks on enhancements, Lower Thames Crossing and RIS3 Development. Additional risk funding, which had originally not been included in the CRR, for A303 Amesbury to Berwick Down (Stonehenge) was offset by an equivalent reduction in the CRR in Spending Review 2021, due to the delay and cancellation of schemes, alongside the removal of the Lower Thames Crossing allowance.

In year 2 of RP2, we commissioned a review of National Highways’ use of the CRR. This identified improvements that could be made to governance, monitoring and reporting in RP2. We worked with the company on implementation of the recommendations which delivered more transparency and assurance. We expect these to be carried forward and built upon in future road periods.

At the end of year 3 of RP2, National Highways had over allocated its enhancements CRR by £46 million as inflation impacted scheme costs. However, in a review of cost and schedule commitments at the end of year 4 of RP2 it was able to add back £403 million forecast underspends to the CRR. This was in part enabled by delays to schemes in RP2 pushing cost back to later road periods. In year 4 of RP2, the company made no further use of the enhancements CRR.

Overall, National Highways used £806 million of the CRR for enhancements and £6 million for RIS3 development (net values including the £403 million add back). This left a £386 million balance of CRR remaining on enhancements and RIS3 development. However, the funding reductions in year 4 of RP2 and inflation driven cost pressures elsewhere in the business meant this ‘underspend’ of the CRR was required to offset overspends on renewals and business costs. This ensured that the company spent within its overall RIS2 capital funding.

Figure 3.6 Use of CRR allocated to enhancements, Lower Thames Crossing and RIS3 development, (£ million)

Earned value metrics

Earned value metrics (EVM) are RIS2 performance indicators that measure National Highways’ supply chain performance against contractual cost and schedule commitments during construction. At the end of RP2, of the nine schemes in construction, the EVM reporting showed that six schemes were both above budget and behind schedule. Further detail can be found in our interactive dashboard.

During RP2, we worked closely with National Highways to assess the effectiveness of EVM as a performance indicator. Following a jointly commissioned consultancy review the company and ORR worked to develop improved reporting for EVM. This helped to give increased context to the metrics and a clearer line of sight between performance against contractual commitments and the delivery plan commitments. We welcome the company’s commitment to continuing this improved reporting in the interim period and beyond.

National Emergency Area Retrofit Programme

In October 2021, the Transport Select Committee report into smart motorways identified the importance of additional emergency areas (EAs) in providing public confidence that there is safe place to stop in an emergency on all lane running (ALR) sections of the smart motorway network.

National Highways was subsequently instructed by the previous government to build more EAs across ALR smart motorways to make them a maximum of one mile apart, decreasing to 0.75 miles apart wherever possible.

National Highways identified 400 locations that could potentially be a location for a new EA. Through a prioritisation exercise, 15 schemes were selected that would construct 151 additional EAs by the end of RP2. The company called this its national emergency area retrofit (NEAR) programme.

The delivery of this nationwide NEAR programme meant that at its peak, there were extensive roadworks covering 43% of the ALR smart motorway network. National Highways managed the NEAR programme well, given the constraints it had. It set up sound governance, risk mitigations and worked collaboratively with ORR on reporting its delivery progress.

National Highways delivered the NEAR programme and met its commitment to deliver 151 additional EAs by the end of RP2. This was a noteworthy success. It was a complex nationwide programme delivered to ambitious timescales, introduced during RP2, when the company was already delivering its challenging RP2 capital programme.