National Highways is responsible for the operation, maintenance and renewal of the strategic road network (SRN).

Throughout the second road period (RP2), National Highways has demonstrated effective operation of the SRN. The early years of RP2 were marked by significant operational challenges, due to the pandemic. Despite these pressures, the company upheld service continuity. However, the company needs to address longer term priorities, including improving the climate resilience of its drainage infrastructure and enhancing the reliability of critical operational technology.

To keep the SRN functional National Highways maintains it. Across RP2 there were drops in the time taken to rectify urgent defects. However, in the last year of RP2, the company improved its performance to above its target level. The company also improved its performance in rectifying non urgent defects and delivering its cyclic maintenance programme. This achievement was in the context of an increasing number of defects reported, highlighting that the need for maintenance is rising on the SRN. It is imperative that the company delivers maintenance effectively, mitigating the risk to road user safety, as it continues to manage a degrading asset.

National Highways made commitments to deliver specific volumes of key asset renewals in RP2. It successfully delivered three of the five committed volumes. The other two were missed commitments for reasons within the company’s control. More generally, across all asset types, the company had significant fluctuations when comparing its planned programme at the start of the year to the volumes it delivered. Generally, this was through over delivery when utilising additional funding. It was also through having incomplete asset data that led to assets unexpectedly reaching a life expired state and necessitating a renewal. This is an area for improvement in the third road period to ensure efficient delivery.

Operations

National Highways is responsible for ensuring the effective operation and safety improvement of the SRN. This includes operational activities such as the management of severe weather events and improving the reliability of operational technology systems.

Drainage resilience

Surface water on the SRN is a safety risk to road users and can detrimentally impact asset integrity. National Highways manages the risk through understanding its drainage resilience. It has a performance indicator (PI) that measures the percentage of drainage catchments that have high-risk flood hotspots. This provides an indication of the susceptibility of the SRN to flooding.

At the end of RP2, National Highways’ PI reported an eight percentage point improvement from year 4 of RP2 performance to 72% of the SRN’s drainage as resilient. This is means that 28% of the SRN is susceptible to flooding.

However, it should be noted that a five percentage points increase comprised of a change to the way that the company calculated its catchment model, to more accurately represent the drainage network and using higher resolution data, resulting in the numbers and lengths of catchments changing. A further two percentage points improvement were included to account for increased rainfall intensity due to climate change being included in the calculation (i.e. rainfall events that exceed a 1-in-5 year rainfall event). Taking this into account, we therefore consider that at the end of RP2 33% of drainage catchments on the SRN have a significant susceptibility to flooding.

Whilst there has been an in year performance improvement compared with year 4 of RP2, performance has worsened across the road period since data collection began in 2022 and performance was at 72% resilience. Therefore, we can infer that by considering the data modelling increases, drainage resilience worsened by five percentage points when considering all rainfall events at the end of RP2.

It is important that National Highways considers how it prioritises improvement in this area so it can effectively and efficiently manage surface flooding on the SRN. The company must also continue to work on understanding whether its drainage asset offers appropriate climate resilience, as we experience periods of more intense rainfall, and how it can respond to this challenge. Noting that removal of 1-in-5 year rainfall events from the PI can mask the true performance of the SRN’s drainage asset experienced by the road user.

In the final year of RP2, we worked with National Highways to understand its approach to drainage asset management. The company recognises both that drainage asset information is one of its least mature asset datasets and the importance of delivering a sustainable long term plan. Therefore, it has created a National Drainage Strategy Programme Board to deliver several workstreams including improvements to drainage inventory data and systems, flooding incident reporting, and asset interventions.

We will continue to engage with National Highways in the next reporting period and hold it to account for the delivery of its National Drainage Strategy Programme.

Technology availability

The availability of technology, such as variable message signs and signals, on the SRN is a high priority for road users. National Highways uses technology assets to support its operation of the SRN. These include CCTV, electronic signs and weather stations. The technology availability performance indicator (PI) measures the percentage of time that roadside technology assets on the entire SRN are available, functioning and unaffected by faults or outages. Although this metric was untargeted in RP2, the company set an internal target of 95% availability. At the end of RP2 it reported an availability of 89.95%. It should be noted that the availability of technology on smart motorways is reported separately in our annual assessment of safety performance on the SRN.

National Highways recognised that it was challenging to meet the internal performance target for its technology in RP2 following an issue with its spares supply and repair contracts. Consequently, we asked the company to set out actions it was taking to improve performance. It set out several actions, including the creation of a new spares supply and repair contract, alongside a working group to manage the backlog and prioritisation.

It is vital that National Highways continues to take action to improve technology availability so that it can better monitor its roads and improve its operational decisions for road users. Consequently, this will ensure users have better and more accurate information when travelling on the network. We will continue to report on its progress in the interim period and future road periods, and we will hold the company to account for delivering its committed planned improvements.

Operational continuity during the pandemic

National Highways performed well to uphold operational continuity, despite the challenges of the pandemic in the first year and into the second year of RP2. The company adapted quickly to remote working and implemented Coronavirus-safe practices on its construction sites and single crewing of its traffic officer vehicles. It adapted its plans and delivery in response to ongoing challenges and changes to working requirements whilst maintaining service standards and delivery commitments despite the prolonged effects of the pandemic.

Severe weather planning

National Highways defines severe weather as including a variety of weather events such as rain, high winds, snow and ice, elevated temperatures and fog. In year 4 of RP2, we engaged with the company to understand its approach to severe weather planning, management and service (SWPS). This year, we reengaged with the company’s SWPS team to ensure that lessons were being learnt and that its plans were taking account of climate change. We reaffirmed it as a mature severe weather operator providing a quality service with a high level of compliance with its policies, processes and procedures.

Maintenance

National Highways’ maintenance activities aim to keep the SRN safe and serviceable by rectifying defects and undertaking routine cyclical maintenance work, such as cutting vegetation and clearing drains.

Urgent defects

Defects are classified as urgent if they could affect the safety of road users, in accordance with National Highways’ standards. The company’s 2023-2024 delivery plan update and 2024-2025 delivery plan updates included a commitment to rectify 90% of defects that it identified as urgent within 24 hours.

In our 2024 annual assessment, we reported a continued decline in National Highways’ urgent defect rectification performance. It ended that year below target. We challenged the company to improve its rectification of urgent defects and conducted region specific engagement to understand the reasons for poor performance.

Following our intervention, the company demonstrated an improvement to its urgent defect rectification rate performance to 94.7% in the final year of RP2. This is above target and demonstrated the success of its recovery plans, and a reduction in the number of urgent defects which are not rectified in time.

Over RP2, the number of urgent defects increased year on year. There was a total increase in urgent defects reported annually between year 1 to year 5 of 5,723. This is a 33% increase over RP2. However, year 5 of RP2 saw a reduction in the number of urgent defects, whereas the previous three years saw year on year growth. National Highways does not have a full understanding of the causes of this reduction, however it is reasonable to conclude that the mitigations it has put in place have contributed. The company should continue to work to quantify the benefits that its interventions are responsible for.

Non urgent defects

Non urgent defects do not meet the threshold to be classified as urgent and therefore do not have an immediate safety risk. However, if non urgent defects are not rectified within the required timescales there is potential for urgent defects to increase and an increased rate of asset health deterioration. National Highways does not stipulate a delivery plan target for non urgent defects.

In the final year of RP2, the rectification rate for non urgent defect rectification performance improved to 93.4%. This was a 7.5% improvement from the previous year.

Over RP2, the amount of non urgent defects increased year on year. The total increase between year 1 to year 5 was 11,395 non urgent defects, which is a 28% increase over RP2.

National Highways has demonstrated its ability to maintain the SRN and rectify both urgent and non urgent defects. However, across RP2 there was a significant increase in the number of urgent and non urgent defects reported. This is a leading indicator that demonstrates a deterioration of the overall asset condition and an increasing demand on the company to keep its asset safe and serviceable in future road periods. The company needs to ensure that its future plans take account of this trend.

Pavement defects

The pavement asset is critical to the road user and has an associated key performance indicator (KPI). In the final year of RP2, 55% of all defects reported were pavement defects. Therefore, it is necessary to understand National Highways’ defect management performance, regardless of urgent or non urgent category, that is specific to this asset type.

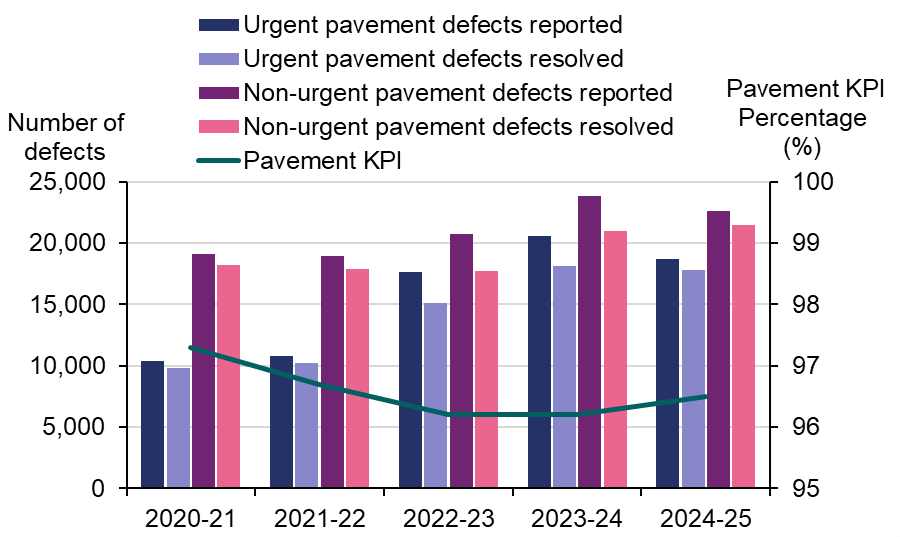

The number of pavement defects increased throughout RP2, from 29,468 in the first year to 41,344 in the last year. This meant that National Highways had to intervene more regularly to ensure that the pavement remained safe and in good condition to meet its pavement KPI. For further data please refer to our interactive dashboard.

Figure 4.1 Pavement condition performance and pavement defect rectification in RP2, annual data

This increase in pavement defects aligns with National Highways’ pavement condition KPI performance. Figure 4.1 shows that in years 3 and 4 of RP2, the combined amount of urgent and non urgent defects were at their largest. Simultaneously, the company’s pavement KPI performance dropped to the minimum performance level permissible , 96.2%. In year 5, the number of defects reduced, and the pavement KPI performance level rose to above target. Therefore, the number of pavement defects in the future could impact the company’s future performance of the pavement KPI if not proactively managed.

4.30 The company needs to continue to closely monitor the defect rate on its road surface asset, the type and geographical location of defects that occur. This will allow it to identify trends and help with long term asset management, through to the prioritisation of its renewals works in future road periods.

Cyclic maintenance

Cyclic maintenance is activity that National Highways schedules to ensure that the SRN is serviceable. Non completion of cyclic maintenance does not have an immediate safety risk. However, if the company’s cyclic maintenance programme is not fully completed, there is potential for urgent defects to increase and an increased rate of asset health deterioration. Consistent under delivery of cyclic maintenance has a direct long term impact on asset condition that could worsen road user safety risk and reduce asset life, thereby also reducing efficiency and value for money.

National Highways sets a baseline frequency for its cyclic activities that it delivers through its maintenance response plans. The company varies these frequencies according to factors such as asset risk, maintenance history and reactive repairs to defects such as potholes.

In our 2024 annual assessment, we highlighted a decline in National Highways’ performance in delivering its programmed cyclic maintenance. The company completed 83.2% of its cyclic maintenance programme. During year 5, we worked with the company to identify areas where improvements could be made to cyclic maintenance. These areas focused on improvements to defect definition, data capture and commercial consistency. At the end of year 5, cyclic maintenance completion improved to 90%. This was a significant improvement across RP2, from 77% at the end of year 1. Further details can be found in our interactive dashboard.

We will continue to work with National Highways to ensure that it considers its maintenance requirements plans as part of a whole life cost approach to managing its assets. These plans should also be delivered in a timely manner to achieve value for money, and effective management of delay. The company should also ensure that where it makes deviations from the baseline frequencies it is able to evidence its decisions through risk assessments and explain the long term impact on the SRN and road users, in terms of performance and cost.

Planned inspections

National Highways delivers a wide ranging programme of planned inspections of its assets to understand the asset condition and if any interventions are required. Failure to carry out scheduled inspections has the potential to lead to reduced asset intelligence. Subsequently, there is a risk of a less robust assessment of asset need, and a reduced ability to proactively plan interventions. This in turn can lead to increased costs and disruption for road users.

In the final year of RP2, National Highways did not deliver the full programme of planned asset inspections for its structures (by 1.2% or 40 inspections) and vehicle restraint systems (by 8.8% or 450 inspections). The company reported that challenges with access to the network and delays in the reporting process were the causes of the non completions. These inspections were reprogrammed and prioritised for completion.

National Highways over delivered its inspection programme for three asset types (Geotechnical, Traffic Signs and Technology and Lighting). The company reported that over delivery was due to utilising other schemes’ booked road space to allow inspections to be carried out at the same time, demonstrating efficient planning. Our interactive dashboard shows the percentage completion rates for each asset inspection.

Operations and maintenance finance summary

National Highways spent £2,444 million on operations and maintenance during RP2. Spend was relatively consistent in the final three years of the road period, ranging from £462 million in year 3 to £474 million in year 5. This was down slightly from spend of over £500 million in both year 1 and year 2. The company continued to provide a consistent level of maintenance and operational service throughout RP2, despite spend remaining steady and constrained, as it managed factors outside of its control such as inflation pressures.

Renewals

Assets on the SRN, such as road surfacing and bridge structures, are renewed when they have reached the optimum asset life or are life expired and need significant intervention to restore them to provide the function that is required of them.

Final year renewals delivery

National Highways delivered a national programme of renewal activities in the final year of RP2 across all its asset types.

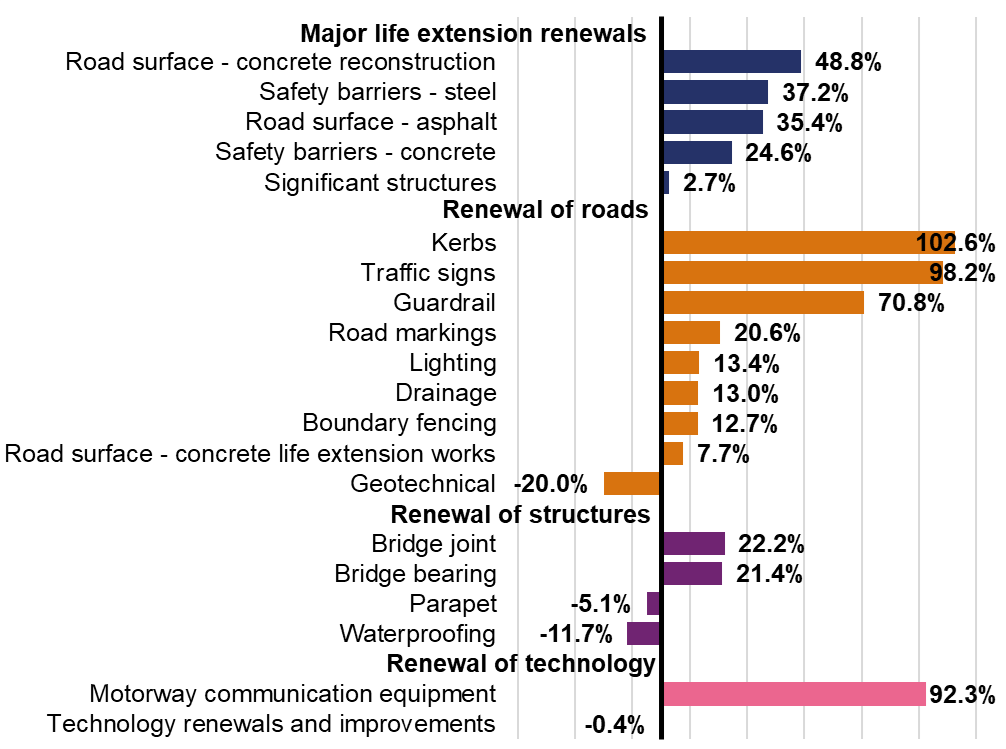

In the final year of RP2, National Highways over delivered on all five key asset types of planned major renewals and on 11 of its 15 other non-key cyclical asset renewal types, including a variance of more than double on kerbs (102.6%). Further data can be found in our interactive dashboard.

National Highways reported that four asset renewal types were under delivered in the final year of RP2, with geotechnical being the most under delivered asset type. However, the company explained that the primary reason for this under delivery was due to a single scheme where it was able to develop an alternative vehicle restraint system solution that negated the need for a geotechnical asset intervention.

In the final year of RP2, National Highways delivered a volume of renewals output that exceeded its initial plan. While this over performance is notable, it raises concerns regarding the robustness of the company’s planning processes at the start of the financial year. Following engagement with the company, we have reviewed the underlying factors contributing to this variance and are satisfied that the over delivery is primarily attributable to the acceleration of renewal schemes originally scheduled for future years. This acceleration was funded by in year underspends from the enhancements programme that was repurposed for renewals. We consider this reallocation to be an efficient use of available funding. It enabled the company to bring forward beneficial works, thereby delivering value to road users and maintaining its level of service.

Figure 4.2 Variance of asset renewals outputs delivered against planned, between April 2024 and March 2025

RP2 renewals delivery

National Highways delivered a national programme of renewals for each year of RP2 for each of its asset types. This programme was significantly bigger than the previous road period.

National Highways spent £4,915 million on renewals during RP2, £80 million higher than its revised RP2 funding of £4,835 million. This spend increased in each year of the road period, with 48% of the spend occurring in the final two years when funding also increased. During the latter part of RP2, the company repurposed some enhancements funding to help meet cost increases from inflationary pressure in renewals which resulted in spend above the revised RP2 funding.

Renewals – key asset major renewals commitments delivery in RP2

At the beginning of RP2, National Highways published its 2020-2025 delivery plan. The plan set out five key asset renewals commitments to be achieved during the road period.

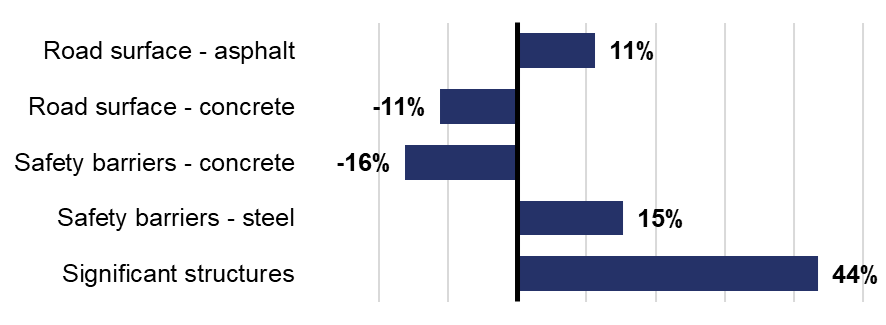

By the end of RP2, National Highways had achieved three out of five of its key asset renewals commitments, as shown in Figure 4.3. The company did not meet its commitments for reconstructing concrete pavements and installing concrete safety barriers. This data is held in our interactive dashboard.

Figure 4.3 Variance of outputs delivered against planned key asset renewals during RP2

Key asset major renewals missed commitment – reconstructing concrete pavements

National Highways’ delivery plan renewals commitment for concrete pavement was to fully reconstruct sections of legacy concrete road surface with new asphalt surface, in accordance with current standards. The company missed its commitment by 14 lane kms (11%). This shortfall was due to one overrunning scheme, the M27 J5 to 7, that it did not complete in RP2. Because of the complexity of the work and its programme, the company stated that there were no opportunities to bring forward other schemes to achieve the committed RP2 output volume. This scheme is now scheduled to complete in the interim period.

At the start of RP2, National Highways acknowledged that the treatment of concrete roads would be a steep learning curve. This has become apparent as the programme has been delivered. The company had no experience of delivering a similar programme and the work required to reconstruct concrete roads is challenging. The company stated that it has learnt lessons and its delivery of the future concrete roads programme in RP3 will improve by having a more capable and experienced resource, as well as planning a more resilient programme of work.

Although National Highways missed its delivery plan commitment for full concrete reconstruction in RP2, it successfully delivered 436 lane kms of concrete life extension works. This was 117 lane kms more than it planned to deliver. This extensive programme of repairs enables these sections to remain safe and extends its life until full reconstruction is unavoidable.

Key asset major renewals missed commitment – concrete safety barriers

National Highways had a delivery plan renewals commitment for concrete safety barriers. The company missed its commitment by 16%. However, the company exceeded the delivery volume of steel safety barriers by 15%.

During RP2, National Highways recognised that the extent of safety barriers that required renewal or repair to current standards exceeded the funding provided. To renew as much substandard barrier as possible, within its allocated budget, the concrete barrier renewal programme was reduced and more steel safety barrier was installed, utilising departures from standard. Steel safety barrier is cheaper, easier and quicker to install than concrete safety barrier. However, concrete safety barriers have almost a twice as long expected service life and lower maintenance costs than steel safety barriers. Concrete safety barriers are also stronger on impact in the event of an incident, particularly heavy goods vehicle cross overs.

Although National Highways missed its commitment for concrete safety barrier renewals, the decisions it took meant that it was able to achieve 14% more renewal of the road safety barrier asset than it had originally forecast at the start of RP2.

National Highways was given a budget at the start of RP2 to deliver an agreed level of safety performance. The company decided to change its plans and therefore change the risk profile of the solution it was installing. The company did so without prior notification to the Department and ORR that it was unable to achieve its original commitment. However, the company was able to rationalise its decision and determine that the departures were an acceptable level of risk. The company must ensure that it informs ORR and the Department in a timely manner if it is unable to meet a commitment for which it has been funded.

Renewals – non-key cyclical asset delivery in RP2

At the start of the road period, National Highways did not publish forecast quantities for its 15 non-key cyclical asset type renewals to be delivered during RP2. Therefore, these asset types did not have overall RIS2 output quantities for which we were able to hold the company to account. To provide assurance of delivery, the company provided output quantities at the start of each individual year via its delivery plan updates and reported its outturn status at the end of each year.

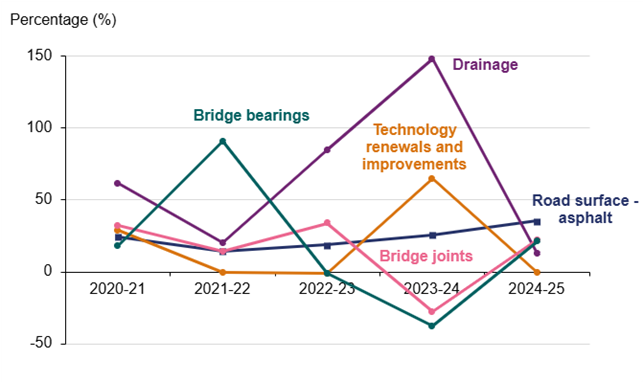

When each annual delivery plan update forecast outputs is compared with what was delivered there are typically significant disparities, both under and over delivery, see Figure 4.4. This data is held in our interactive dashboard.

As is the case with the committed volumes for key asset major renewals, this shows that National Highways is unable to robustly plan at the start of a year for the work it will undertake. Generally, in each year of RP2, the last quarter sees the biggest incremental delivery output that results in over delivery. The skew of renewals works at the end of the financial year is not an optimal approach for delivering capital works. It is likely to be inefficient and work carried out in the winter months is generally more expensive. Adverse weather can also limit the quality of the renewal delivered and therefore reduce its asset life. Multi-year funding settlements, that allow the company to better plan, are intended to avoid this occurrence.

Figure 4.4 Variance in volumes of renewals delivery compared to plan for a selection of assets, April 2020 and March 2025

Renewals forward look

Looking ahead to the third road period (RP3), National Highways must seek to have a better understanding of the condition of its assets and the likelihood and profile of additional funds being released, so that it can more accurately set its programme of renewals and be more efficient in its delivery. The company needs to ensure that it can demonstrate that the decisions it takes mean that the right asset is renewed at the right time in its lifecycle. The company should also ensure that it informs ORR and the Department in a timely way if it is unable to meet its obligated commitments for which it has been funded.

Operational technology modernisation and refresh

In November 2022, National Highways committed £105 million to renew existing operational technology assets on its all lane running sections of the smart motorway network. This activity was over and above its 2020-2025 delivery plan.

The ambition set for the investment was to deliver an average of 97% availability for CCTV, MIDAS, signs and signals on all lane running smart motorways. Knowing that age and obsolescence are the two biggest contributors to availability, National Highways targeted those assets that had already reached end of life and/or had become obsolete.

Average availability across all four assets at the end of year 5 was 94.3%. This includes average availability for signs and signals in year 5 of 91.2% and 94.0% respectively.

National Highways did not fully deliver its programme of technology renewals that it set out in November 2022, and this is reflected in the overall availability performance. One of the reasons for lower availability scores was following a change made by the company in how it records fault data.

National Highways cited several other challenges that impacted its delivery programme, including procurement and contracting issues for new and replacement technology. The roll out of the national emergency area retrofit (NEAR) programme in the final year of the road period, covered in detail in our latest safety report, also affected the company’s ability to carry out works. These challenges meant that not all aspects of the company’s modernisation and refresh programme were delivered in RP2. This work will be carried over into the interim period.

With a likely increase in technology renewals in RP3, the company must improve its asset management knowledge in this area, and enhance its technology commercial and procurement capabilities, if it is to achieve its plans and reliability of its operational technology assets.

Designated funds programme delivery

The designated funds (DF) programme consists of capital investments intended to deliver measurable improvement to the SRN. Ring fenced funding is provided to support projects that deliver a range of benefits for road users, neighbouring communities, the environment and the economy. These include initiatives such as enhanced roadside welfare facilities for freight drivers; replacement of street lighting with LED lanterns; various congestion relief; and safety improvement schemes.

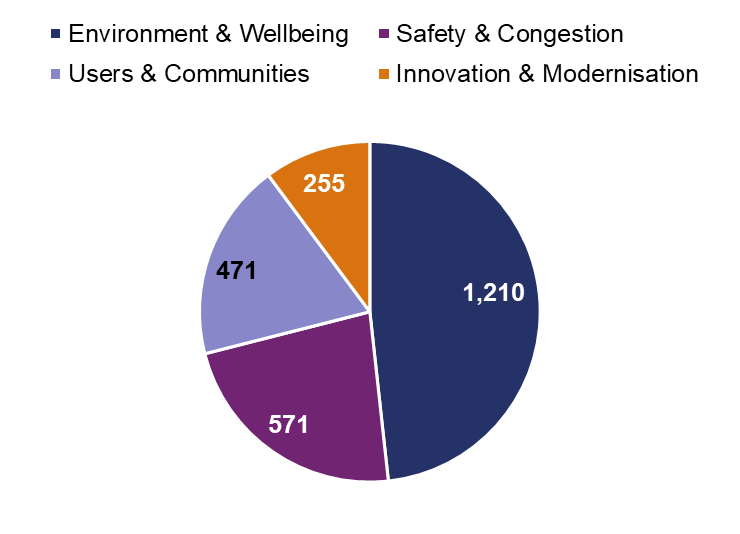

A total of 2,507 DF schemes had allocated funding in RP2, broken down as shown in Figure 4.5.

Figure 4.5 Number of schemes invested in during RP2 for each designated fund

National Highways needs to improve the way in which it captures and reports data on the successful delivery of DF schemes for which funding has been allocated. This will allow the company to better understand and evidence the benefits of the DF programme and improve the allocation of funds going forward.

We understand that National Highways is undertaking a monitoring and evaluation exercise to determine the success of its DF programme. This work will measure the benefits achieved for road users; understand what lessons can be learnt; and to inform the programme for RP3.

Business improvement and preparation for the future

Part of our wider role is to understand how National Highways seeks to improve its capability and preparedness for future years. In the final year of RP2 we looked at several key themes.

Asset management

During RP2, National Highways developed and published a series of companywide documents, aimed at improving its asset management approach. These documents provided strategic direction and set out specific business improvement actions.

We challenged National Highways to demonstrate how these actions would improve capability and ultimately its efficiency. We found that the company was not always able to consistently articulate how actions are being embedded and able to evidence the business benefits being generated or improvements for road users. We expect the company to be able to evidence how, through spending of public funds, these actions are generating business benefits, such as improving its capabilities, efficiency and performance. It is putting in place measures to address this.

In our 2024 annual assessment, we reported that National Highways achieved certification against the requirements of ISO55001. This standard provides a framework for organisations to deliver good asset management through actively managing risk to improve performance. Condition 5.11 of the company's licence states that it should adopt a long term approach to asset management consistent with ISO55000 standards. To have achieved certification is a notable success for the company and demonstrates that it is committed to improving its asset management capability. An external audit was completed in June 2025 that identified no non-compliances. Therefore, the company continues to meet the requirements of the ISO 55001 standard.

During RP2, National Highways improved how it reported and used its data related to the governance and delivery of renewals, following ORR’s intervention. Of note, the company developed its national programme stability report. It used this to demonstrate both the reasons and costs for changes that it made to its renewals programme in year. From this reporting we gained confidence that the right asset renewals decisions were made, efficiently.

Improving capability

We observed that individual directorates also delivered plans intended to improve directorate level asset management capability. For example, the Operational Excellence 2025 (OE2025) programme in the Operations Directorate. A budget of £50 million was allocated to this programme.

The ambition for OE2025 was to transform what National Highways does and how it works and achieves. The company reported that the programme achieved financial benefits of over £550 million and non financial benefits, such as improved safety and internally developing improved operational capabilities.

Whilst business improvement activities were taking place at both company wide and directorate level, National Highways determined that there would be advantage in having a more coordinated approach. Moving forward, the company established a dedicated team to direct and manage all its business improvements. The programme set up in readiness for RP3 is to facilitate the company’s intention to move from a builder/operator role to a customer service provider by 2030. The company should improve how it shows that these programmes directly lead to efficiency savings and performance improvements and demonstrating value for money for taxpayers. We will continue to work with it to gain assurance of the benefits being delivered through this programme of work and the efficiency it creates.

Large renewals governance

In our 2024 annual assessment, we reported that the SRN continues to age and is now at a point where a large and disruptive national programme of strategic renewals is required. It is expected that National Highways will need to deliver more strategic, larger, high cost and complex renewal schemes, such as significant structures and concrete roads renewals. The company has named such schemes ‘large renewals’.

Given this growing asset need and the risk of substantial on-network road user disruption, we engaged with National Highways to understand its governance approach for these strategic large renewals to ensure that it was commensurate with other capital schemes of this scale.

In December 2024, National Highways presented its proposed governance process to us. The company has combined elements of existing methods from two delivery directorates into a hybrid governance and assurance process. We will work with the company through the interim period to assess the application and embedment of these governance processes and any improvements required for RP3.

Design, Build, Finance and Operate (DBFO) contracts

Design, Build, Finance and Operate (DBFO) Contracts are private finance initiatives (PFI) used historically by National Highways. These contracts transfer responsibility for managing specific routes on the SRN to private companies.

There are eight DBFO contracts that were awarded in the 1990s that are ending in 2026 and 2027. This means that these routes will be handed back to National Highways. This amounts to an approximate 10% increase in the SRN road length and all other asset types will also return to the company’s direct management upon hand back.

We have worked with National Highways to gain assurance that these routes will be handed back to it in accordance with each contract’s hand back criteria and all programme dates will be achieved. The company’s approach is robust and well managed, and it continues to work with its DBFO contractors to ensure that the eight routes will be handed back to the company in an acceptable condition.

However, the DBFO contracts specify compliance to standards at the time they were agreed. Some of these standards have since changed. Therefore, National Highways may have to manage a step change in asset condition on these returning DBFO routes. We will continue to work with the company to hold it to account for the successful transfer of these DBFO routes back into its full control and that it has a plan, where required, to bring these assets back to the same level of performance as the existing network.