Analysis in this section is based on draft financial information provided by Network Rail. We will report more fully on these matters in our Annual Efficiency and Finance Assessment (AEFA) of Network Rail, which examines the company’s financial performance in relation to its CP7 delivery plan. The AEFA is scheduled for publication this autumn.

Network Rail delivered £325 million of efficiency in Year 1. However, wider financial performance declined.

In the first year of CP7, Network Rail achieved £325 million in efficiency savings, exceeding its original delivery plan target of £263 million by £62 million (24%). Despite facing numerous challenges throughout the year, including financial pressures and funding constraints, Network Rail successfully achieved these efficiencies through a series of initiatives, as detailed in the table below.

Top 5 key efficiency initiatives, annual data, April 2024 to March 2025

| Top 5 efficiency initiatives (£ million) | Eastern | North West & Central | Scotland | Southern | Wales & Western | Non-region | Total | Percentage of Year 1 delivery (%) |

|---|---|---|---|---|---|---|---|---|

| Contracting strategies/packaging/rates | 22 | 19 | 2 | 2 | 17 | 21 | 83 | 25% |

| Modernising Maintenance | 16 | 14 | 4 | 9 | 5 | 0 | 48 | 15% |

| Resource Management | 15 | 6 | 1 | 4 | 6 | 13 | 45 | 14% |

| Delivering same output for lower activity/volume | 8 | 4 | 1 | 6 | 11 | 10 | 40 | 12% |

| MVP (Minimum Viable Product) | 9 | 12 | 4 | 3 | 8 | 4 | 39 | 12% |

Source: ORR analysis of Network Rail data

The efficiency initiatives in the table include:

- Improved contracting strategies, involving negotiating contracts with improved terms or rates, enhancing market research and monitoring contracts more effectively;

- Modernising maintenance, aiming to improve staff rostering and deployment of the workforce;

- Resource management, involving managing staff related costs and headcount levels;

- Delivering the same output with lower activity or volume, involving streamlining processes, using automation, and enhancing performance to maintain output levels while using fewer resources;

- Minimum Viable Product, involving a framework for scoping and undertaking a project from the concept stage through to delivery, against the minimum requirements to meet the objectives of the project.

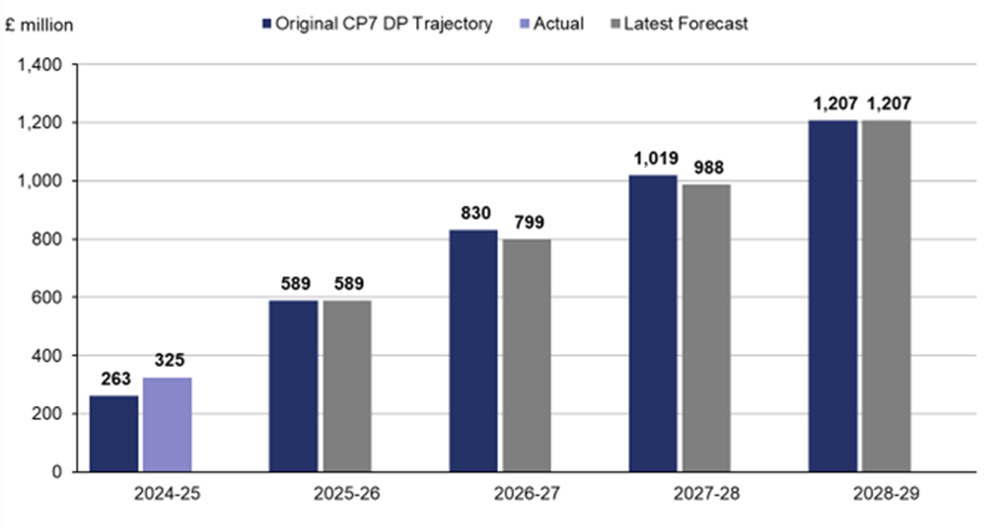

Throughout CP7, Network Rail aims to achieve £3.9 billion in efficiency savings, in line with our PR23 final determination. The company is confident it will deliver these savings through improved supplier engagement, increased output with reduced activity, workforce reform, and improved workbank planning.

Efficiency improvements profile across CP7, annual data, April 2024 to March 2029

Source: ORR analysis of Network Rail data

At the start of Year 1, we commissioned an Independent Reporter to assess Network Rail’s preparedness to delivery its efficiency plans for Years 1 and 2 of CP7. The review found that Network Rail’s efficiency plans were reasonable and broadly robust. However, one of the recommendations from the review was for both Network Rail’s National Functions and regions to increase their efforts on efficiency delivery early in CP7. By doing so, the company can mitigate risks associated with future delivery and exceed the CP7 annual targets.

Network Rail has done well in outperforming the Year 1 efficiency targets and in seeking to reduce risk to delivery in Years 3 and 4 as recommended by the Independent Reporter review. Even so, it must avoid complacency and continue to assure its efficiency plans for the later years of the control period as the delivery trajectory increases significantly in these years.

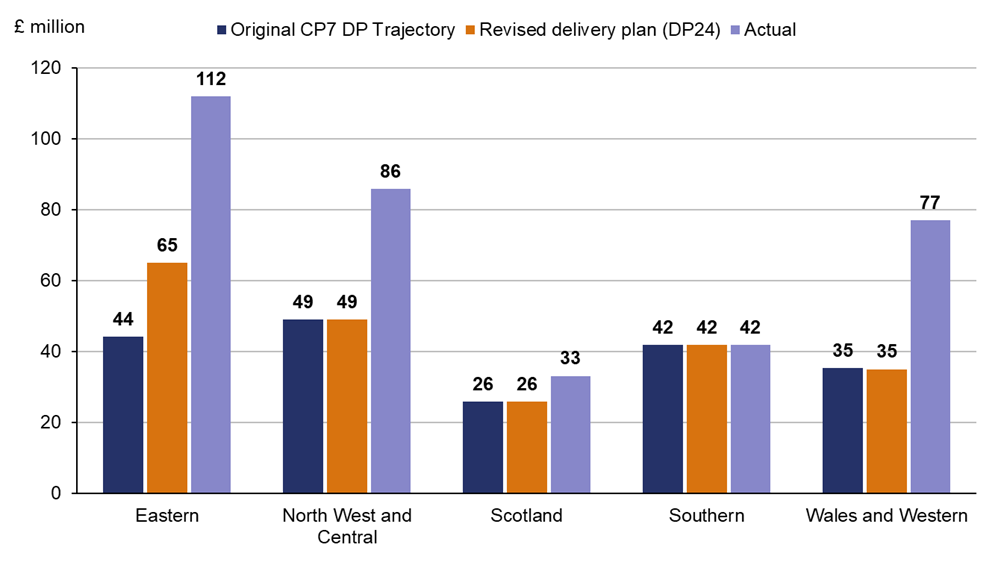

Four of Network Rail’s regions (Eastern, North West & Central, Network Rail Scotland and Wales & Western) exceeded their original CP7 delivery plan targets for Year 1, while Southern met its target of £42 million. The regions achieved additional savings through innovation and technology, workforce reform, supply chain savings, maintenance efficiencies and more efficient use of access.

Network Rail’s National Functions (which support the regions) achieved £67 million of efficiency in the year, exceeding their original plans by 26%. This was despite experiencing delays in the delivery of Project Reach (the deployment of new telecoms infrastructure along parts of the rail network). These delays resulted in a reduction in efficiency of £2 million in Year 1 and are projected to amount to a £50 million reduction in efficiency over CP7, which will have to be recovered elsewhere.

Regional contribution to efficiency improvements, annual data, April 2024 to March 2025

Source: ORR analysis of Network Rail data

Network Rail Scotland achieved £33 million in efficiency savings in Year 1 of CP7, exceeding its original CP7 delivery plan target of £26 million by 27%. These savings were realised through various initiatives, including more efficient use of access, modernisation of its maintenance function, improved workbank planning, and the benefits derived from minimal viable product efficiencies, which deliver the same level of work and volume with reduced activity.

Looking ahead, Network Rail's leading indicators of efficiency, which demonstrate the company’s readiness for renewals and efficiency delivery in Year 2, are in a reasonably positive position. 80% of regional plans are either complete or well-developed for Year 2 of the control period – which compares well to the position at the start of Year 1 and to the same point in time in CP6.

Network Rail's renewals planning is also in a strong position for Year 2. This is crucial as it helps manage and reduce costs while providing a stable work profile for the supply chain. Network Rail has issued, and its supply chain has accepted, 87% of remits for planned renewals in Year 2 of CP7. It has also secured 85% of required access to carry out the planned work. Both these measures compare well to the previous year and to the same point in CP6. Furthermore, Network Rail has issued 68% of financial authorisations – consistent with Year 1 of CP7 and the same point in CP6.

Network Rail needs to carefully manage future delivery of efficiency and core renewals in a constrained funding environment

While Network Rail is well placed to deliver its renewals and efficiency plans for the year ahead, the current economic environment could pose significant challenges to future delivery. Financial pressures, particularly general inflation, are of serious concern, especially given the significant funding challenges and the limited risk funding remaining in the control period to manage future financial risks.

Network Rail reported a financial underperformance of £228 million in the first year of the control period compared to its annual budget. This means, net of income, the company spent £228 million more on Year 1 deliverables than originally planned, despite exceeding its efficiency targets. The primary reason for this underperformance was rising costs of renewals projects, which contributed £255 million to overall underperformance in Year 1.

These cost increases were associated with access constraints, resulting in longer delivery times and associated compensation payments. Additionally, funding challenges and inflationary pressures led to reprioritisation of work across the regions, causing additional cost when projects were paused or cancelled.

These pressures resulted in both inefficiencies and headwinds. The inefficiencies are reflected in both financial performance and efficiency reporting while the headwinds, which are external cost drivers outside Network Rail’s control, impacted financial performance but fall outside the scope of efficiency reporting. These matters are further explored in our Annual Efficiency and Finance Assessment of Network Rail, scheduled for publication this autumn.

The financial performance incentive regime (Schedule 8) also contributed to financial underperformance, resulting in a £71 million shortfall. Worsening train performance levels, cancellations and delays, including those arising from external factors such as trespass, fatalities and thefts, led to costs exceeding their budget.

Our PR23 final determination allowed for £1.7 billion of risk funding (cash prices), which Network Rail has set aside for input price risk and unplanned costs within its CP7 delivery plan. During the first year, Network Rail drew down and allocated a significant portion of this fund due to unplanned costs arising from the increase in National Insurance contributions, costs related to the financial performance incentive regime (Schedule 8) and input prices, reflecting cost increases in construction in excess of consumer inflation.

Network Rail goes into Year 2 with £760 million remaining in its risk fund for CP7, a large portion of which has been set aside for input price effects. Risks remain in future years of the control period including potential for further costs related to performance, reform and the economic environment. Network Rail needs to carefully manage its financial risks in the remainder of the control period to lower the risk of having to reduce the scope of its delivery.

Our PR23 final determination allowed Network Rail Scotland £234 million (cash prices) of ring-fenced risk funding for unplanned costs and other risks in CP7. It has allocated a large portion of its risk fund due to unplanned costs arising from increases in National Insurance contributions, performance related costs and input prices. Network Rail Scotland enters Year 2, with a forecast of £102 million of risk funding available for the remainder of the control period.

Following our final determination, Network Rail’s cost forecasts increased resulting in a funding gap in its delivery plan for England & Wales. We wrote to Network Rail seeking this gap to be closed in the first six months of CP7 without reducing expenditure on core renewals and maintenance work on the mainline network.

We engaged Network Rail on how it is managing the funding gap throughout the year and it agreed to target a reduction to £450 million by the end of Year 1. It ended the year with a remaining funding gap of £488 million, missing its year-end target. This figure includes where regions have embedded further savings in their plans, but these have been largely offset by increased inflation and some renewals delivery issues causing cost overruns.

We wrote to Network Rail in January 2025 to acknowledge the steps taken to reduce the funding gap and stressed that it should continue to explore options to resolve the funding gap whilst maintaining the condition of the rail network.

We recognise the fiscally challenging environment in which Network Rail is operating in CP7 and accept that it requires time to make the right decisions to address the gap. We have informed Government funders of our concerns in our RF11 letter on Network Rail’s latest forecast.