This chapter examines how London St. Pancras Highspeed has managed its network’s assets. We have focused our review on the following aspects:

- progress on addressing our and DfT’s PR19 recommendations;

- asset performance, availability, condition and data;

- asset management maturity;

- renewal planning and delivery;

- progress on research and development (R&D); and

- environmental sustainability.

We recently completed our periodic review of London St. Pancras Highspeed (PR24) and the work done in the year by the company shows a strong commitment to improving in the key areas identified in PR24. In particular, the company sought to address underlying causes of asset issues and to improve asset management maturity. The priority moving forward needs to be the pace and agility of its asset management improvements, to deliver benefits right from the start of CP4.

Delivery of PR19 asset management recommendations

This year, London St. Pancras Highspeed successfully closed out its final three commitments:

- Provide a PR24 submission to document and demonstrate assurance activities that it has undertaken on NR(HS). This was evidenced during our PR24 deep dives, through London St. Pancras Highspeed’s assurance of the updated Specific Asset Strategies with arrangements for each asset group; and the build-up of work banks for CP4.

- Set out minimum asset data requirements against which to report annually; this was evidenced by London St. Pancras Highspeed’s data book which will form the cornerstone of its new Enterprise Asset Management System. This was a comprehensive overview of the data required to manage the assets and sits within a hierarchy that matches best practice asset management. There is further work to make this even more mature, and this was agreed in PR24 as a CP4 commitment.

- Review operations and maintenance risk ownership with funders. This was evidenced during the PR24 process, where risk levels were built into the way the plan was built up. -

Asset management maturity

London St. Pancras Highspeed achieved ISO55001 certification for its route and station assets last year. Having already held ISO55001 certification for route assets, NR(HS) also achieved this certification for its station and depot assets this year. Better understanding of assets is crucial to reducing system costs and delivering asset availability more efficiently. We welcome this additional step, which is in line with our PR19 recommendation that London St. Pancras Highspeed ensures its alignment with the principles of best practice asset management.

Line of sight between data-driven activity and asset renewal planning

This year, a new Enterprise Asset Management System (EAMS2) started its initial deployment and has been successfully deployed across Mechanical & Electrical (M&E) assets as part of a phased rollout plan.

This has enabled improved asset data and decision-making, lifecycle cost tracking, and performance monitoring. London St. Pancras Highspeed positions this at the centre of its asset management improvements in CP4 and we recognise this is a significant step forward to have rolled out one asset group by now. We agree with London St. Pancras Highspeed that this system is critical for both short term agility and also broader strategic decision-making for HS1 assets.

While we welcome and support these changes, as identified in PR24 for this work to keep up with the challenges of the HS1 system, the work must accelerate and deliver benefits in the lowest maturity asset groups (identified as Lifts, Escalators & Travelators; route Civils; Signalling; station Mechanical, Electrical and Plumbing) first.

Noting the significant safety incident at Ebbsfleet in November, there is an urgent need to push forward with work on EAMS2 in the stations environment. The work done on route M&E assets this year demonstrates the potential for this system to address priority issues, around understanding asset condition better and pre-empting failures, using data.

While the M&E module was deployed, rollout to other asset classes is pending. London St. Pancras Highspeed notes that effective use of the platform hinges on full-scale operational adoption by all delivery partners. We see this as an area where London St. Pancras Highspeed can take a clear leadership role for its infrastructure and find agile solutions to implementing the lessons learnt from the role out in M&E, to deliver the significant benefits in other asset groups such as the station’s assets.

We note that the platform being used for EAMS2 allows London St. Pancras Highspeed to connect data sets from different systems, providing a critical opportunity for improvement in the use of data capture technology to support asset management decisions. London St. Pancras Highspeed should maximise this opportunity to deliver the findings of our PR24 recommendation, to improve asset management maturity and hence deliver greater resilience against incidents like the Ebbsfleet escalator failure that occurred in period 9 this year.

Asset performance, availability, condition and data

Stations

Lift, Escalator & Travelator (LET) assets presented ongoing performance challenges for London St. Pancras Highspeed this year, especially regarding reliability and availability. This is an area of high stakeholder and regulatory concern. It is also an area identified in PR24 with need for asset management maturity improvement.

Stakeholders continue to express concern at the time taken to deliver projects and the way in which the overall fault rectification system works. Examples provided included:

- LET availability is measured over an entire station which can obscure the impact on passengers from a single asset being out of service;

- issues with the quality of maintenance, including problems with heat exchange plates, cooling systems, and chiller units; and

- fault reporting and recovery times, as well as how stakeholders best engage with London St. Pancras Highspeed in the process (having no contractual relationship with NR(HS) themselves).

All of these concerns align to our action through our PR24 periodic review, where London St. Pancras Highspeed accepted a commitment to accelerate improvements in its asset management maturity and stakeholder communication / governance. We will track London St. Pancras Highspeed’s performance on these improvements through CP4, but we have already started to see evidence of London St. Pancras Highspeed changing its approach in this area.

For example, London St. Pancras Highspeed initiated benchmarking against TfL (Transport for London) to better understand and contextualise fault rates, highlighting a need for system-wide renewal planning and enhanced contractor performance.

We welcome the benchmarking work and note the areas where London St. Pancras Highspeed could learn most relate to remote condition monitoring and asset performance dashboards. We note that London St. Pancras Highspeed has identified this need as a key driver for station asset performance and we will track commitments in this area through the year ahead.

Asset delivery in the LET portfolio has improved over the last year. All renewals projects have been delivered, with the exception of Lift 4.2 at London St. Pancras International which is being maintained at a high availability at present. The level of investment is planned to step up in future years and London St. Pancras Highspeed must continue to develop governance and reporting to meet stakeholder needs as well as building capacity in their renewals supplier (NRHS) to ensure these accelerated plans are delivered.

While delivery of planned renewals was generally positive, we note that the Ebbsfleet escalator which failed this year was not in the 2024/25 delivery plan. This continues to highlight the need for greater asset management maturity to ensure that condition issues and down-time are predictable and that the right assets are prioritised in each year. This year’s challenges further reinforce the need for EAMS2 and faster deployment of analytics to the LET asset base.

London St. Pancras Highspeed notes that challenges have arisen this year with delays in asset hand back and some equipment being taken out of service shortly after commissioning. London St. Pancras Highspeed and NRHS have responded to these incidents by strengthening hand back procedures and improved testing and commissioning processes. In the coming year, we will seek clarity on performance for recently renewed assets.

Ebbsfleet escalator incident

We were extremely concerned by this incident and engaged closely with London St. Pancras Highspeed in terms of both Health & Safety regulations and asset management best practice. Our position is that the root cause is a lack of asset management maturity, including data and tools to manage these assets proactively and mitigate risks. In the last year, we have set out our expectations for improvement through PR24 and we will hold London St. Pancras Highspeed to account against its commitments.

Route

For route asset availability, we look at two areas: power availability, and operational availability – with the latter defined as the percentage of time that a specific asset group is available for operational use, excluding planned maintenance. London St. Pancras Highspeed has met its targets for route asset availability in these areas, and we have no significant concerns.

This year the route incurred approximately 763 minutes delay due to asset issues, down from 5,230 delay minutes last year.

The network experienced just five major incidents, (defined as those that led to more than 200 minutes delay), compared to 13 in the previous year and 10 the year before.

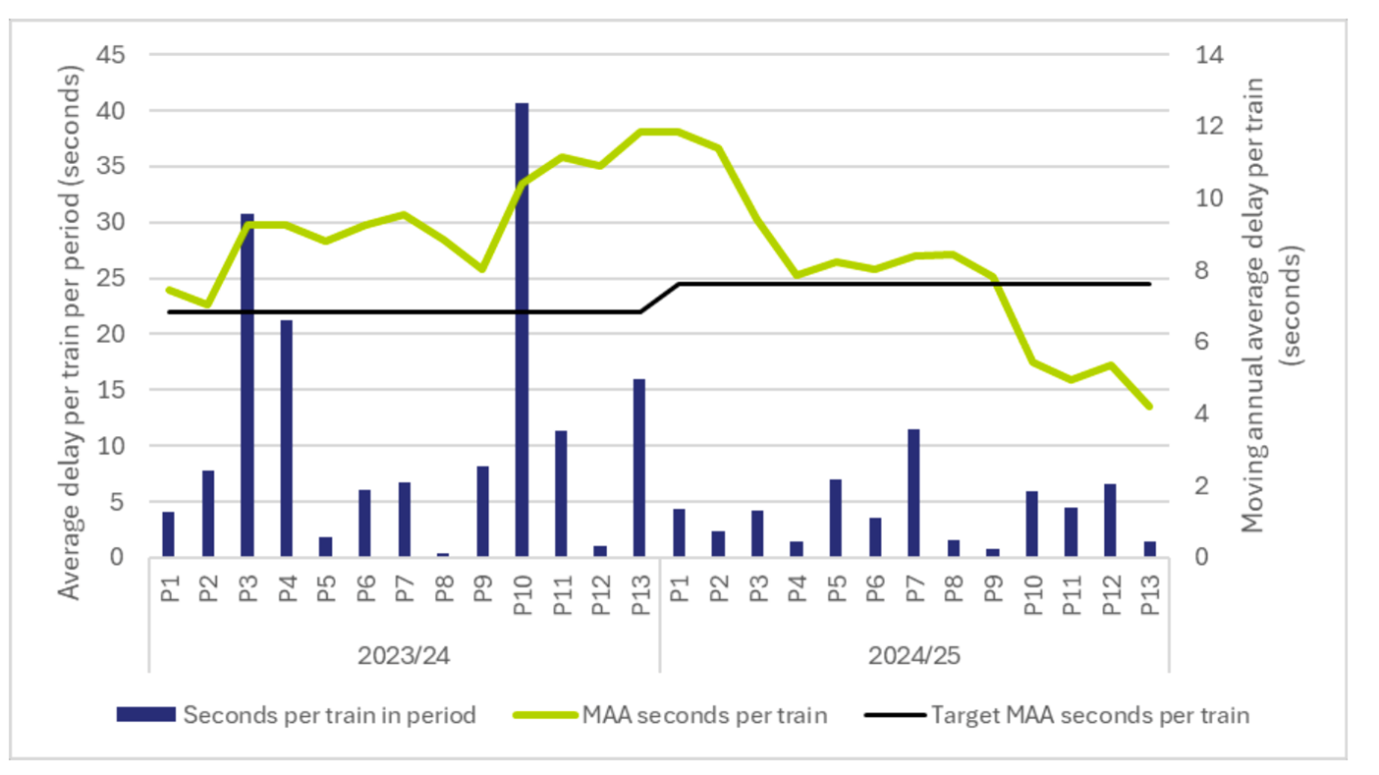

Figure 3.1 Delay per train and moving annual average by period, from April 2023 to March 2025

Source: London St. Pancras Highspeed AMAS, 1 April 2024 to 31 March 2025

Figure 3.1 shows that delays are not spread evenly over the year and are characterised by a small number of high-impact events. We have seen a trend over recent years of London St. Pancras Highspeed focussing on and successfully addressing ‘repeat’ incidents (notably points failures and trespass). But over the last few years there is still an ongoing issue with ‘first time’ incidents on the HS1 network.

These have often taken a long time to recover from, partly because the recovery plans were not well-practised, and because these incidents often involved interface with other asset owners. This year we have seen evidence that London St. Pancras Highspeed has produced a stranded trains protocol, and we note that it has plans to undertake recovery training exercises. These low-likelihood, high-consequence events need to remain a focus for London St. Pancras Highspeed and us over the coming year.

London St. Pancras Highspeed also has to invest significant time and resources in investigating these ‘first time’ incidents, which often involve complex contractual liabilities. Some examples of specific incidents are summarised in Figure 3.2.

Table 3.1 Notable significant incidents 1 April 2021 – 31 March 2025

| Year | Notable ‘One-Off’ or Large Disruption Events | Resulting Delay Impact |

|---|---|---|

| 2021/22 | Bird strike on OHL, multiple infrastructure issues >200 mins | 5 major delay events >200 mins |

| 2022/23 | Dewirement, asset faults, strike-related recovery constraints | Delay per train: 7.25s (vs 5.44s target) |

| 2023/24 | Severe Thames tunnel flood, cable thefts, signalling failures | Average delay: 11.8 sec per train |

| 2024/25 | Power supply incidents, Ebbsfleet escalator | Average delay: 4.20 sec |

As a result of working on its plans for the periodic review (PR24), London St. Pancras Highspeed has improved its ability to manage strategic asset uncertainty, particularly in long-term planning; improving agility; and investment prioritisation.

We support London St. Pancras Highspeed’s work to improve its Specific Asset Strategies, especially for Track assets. Outputs from this work have been put to use within the last year, demonstrating London St. Pancras Highspeed’s willingness to build and grow asset management thinking and maturity rapidly.

During the year London St. Pancras Highspeed has also implemented learnings from the previous year’s major flooding incident in the Thames Tunnel. We support the direction that it is taking for this tunnel but would like to see further work to apply learning across all drainage and civils assets and achieve a more mature approach to weather resilience. We set out our expectations for asset management maturity improvements in PR24 and we will monitor London St. Pancras Highspeed’s relevant commitments.

Our key areas of interest are:

- drainage capacity: this year, operational mitigations have been enhanced at the Thames Tunnel, and NR(HS) have reviewed other pumping locations for flooding risk; no tunnel drainage systems have required redesigned or upgraded post-incident but London St. Pancras Highspeed should keep drainage capacity under review in its weather resilience strategy;

- limited predictive monitoring: London St. Pancras Highspeed has improved its incident response and telemetry, there is still limited predictive capability (e.g. flood forecasting, water ingress early warning);

- climate risk escalation: the Thames Tunnel flood highlighted that historical weather models may be obsolete. We have not seen any indication that the asset’s design assumptions have been recalibrated to reflect new climate baselines.

Our summary of trends over the last few years shows improvement across route asset management, culminating in good performance in the reporting year. There is still vulnerability in the system and PR24 addresses this with our call for improved asset management.

Table 3.2 ORR summary of trends in route asset management

| Dimension | Assessment |

|---|---|

| Response Time | This is the strongest area where improvements have been seen with the main example being for speed of containment for potentially high impact events and service recovery in 2024/25 |

| Root Cause Investigations | Some areas are strong – such as points failures, but others are weaker (including drainage) |

| Preventative Culture | A key aspect of a high performing railway is the culture of prevention, and this area has stepped up in maturity but more needs to be done. PR24 sets out the need for this and London St. Pancras Highspeed has responded with clear commitments to improve asset data, develop use of AI, and an enterprise level asset management system - EAMS being increasingly used to pre-empt disruptions. |

| Historical Learning | There is evidence that these improved outcomes on preventing and responding to high performance impact events can be traced directly to lessons from prior years. (e.g. points failures) |

This year London St. Pancras Highspeed has made a significant impact on the previous years’ trend for major delays caused by trespass. The implementation of a trespass reduction strategy has been effective and helped to reduce trespass-related delay. Last year there were four significant (>200min delay) trespass events totalling 1,587 mins delay. That improved to two events totalling 997 mins delay this year. The trespass strategy includes the use of data to identify hotspots and the installation of cameras and remote monitoring alarms to quickly identify potential incidents. We support this data- and technology-driven approach.

Another good area of performance improvement this year has been driven by London St. Pancras Highspeed’s Switches and Crossings Resilience Plan, which has led to a 91% decrease in delay minutes: there was one significant performance event in period 3 this year costing 249 mins compared with the previous year, where there were four significant events costing 2,867 mins. The key changes in this area include carrying out daily points swings in overnight engineering hours to test and check operation, plus training for maintainers and increased use of remote monitoring. We fully support this agile approach to managing asset faults which builds on previous years’ work in this field.

Renewal planning and delivery

Last year’s renewals plans included an element of ‘catch-up’ in renewals delivery from earlier CP3 shortfalls. The year saw a steady increase in delivery of renewals by London St. Pancras Highspeed, supported by positive changes to renewals governance and more integrated access planning.

There were 39 delivery milestones of which 28 were delivered as planned. Of the 28 that were delivered, London St. Pancras Highspeed demonstrated increased possession integration and strengthened delivery management.

For example, four additional expansion joints were installed, and one additional track crossing was completed in a multiple work-type possession on the track at the throat of St. Pancras station leading to seven of the completed milestones being exceeded from the baseline plan in terms of volumes delivered.

We are satisfied that the 11 milestones which were not delivered this year were delayed to later years for valid reasons. The asset base is not yet at such a position that delayed delivery will import significant performance risk so movements in the plan as asset knowledge grows and delivery planning improves are to be expected.

For example, on the track switches project a piece of detailed reliability work resulted in more detailed asset condition surveys being carried out which allowed reprioritisation to fit available access (see above example at St. Pancras) and smoothing of work into CP4. As assets were found to have sufficient life remaining to defer the renewal until a more efficient package of work can be put together. We support the focus this year on managing contractor capacity, funding envelopes, and interdependencies, rather than chasing in-year completions.

With rollover from this year, there will be 26 milestones for the 1 April 2025 – 31 March 2026 plan which is within the capability of London St. Pancras Highspeed to deliver.

London St. Pancras Highspeed has demonstrated maturity in managing slippage, but under-delivery still carries significant strategic and operational risks. It must now ensure that CP4 starts with agile, assured delivery and clear engagement with stakeholders to optimise access.

London St. Pancras Highspeed has not breached its minimum escrow funding thresholds, and the current balance is still within the acceptable long-term glide path.

Research and development

At PR19, we encouraged London St. Pancras Highspeed to implement a research and development (R&D) fund. Good governance of R&D funding is essential to ensure that investment is delivering real benefits; and that projects are stopped quickly if they are no longer viable. We note good control of research and development funding this year with London St. Pancras Highspeed meeting its planned milestones. We note that all CP3 R&D funds have now been spent or committed to schemes; there are no unspent funds to carry over to CP4. However, we note ongoing challenges between London St. Pancras Highspeed and train operators, to ensure R&D projects align with rolling stock plans and with operators’ priorities, where appropriate.

In our previous annual report, and through PR24, we asked to see greater evidence of turning past R&D into innovation and delivery of benefits. Where there are opportunities for wider system benefits, we expect London St. Pancras Highspeed to take responsibility for unlocking the system benefits with pace and agility.

Over the last year 18 R&D trials and initiatives were approved or in flight. Among these, nine projects are set to be transferred to year 1 of CP4. This includes two PhDs, one dynamic operational modelling initiative, an OLE Monitoring trial, two trials investigating the use of drones for Civils assets, and a few trials focused on track inspections.

Environmental sustainability

This year London St. Pancras Highspeed has progressed in line with its 2020 sustainability strategy, which set out six priority areas: transparency; climate change and adaptation; energy use; resource use and waste impacts; biodiversity; and social impacts. These plans are a good launching point for some of the further commitments in PR24 which aim to accelerate work in this space. More detailed action is needed specifically in the area of drainage management, and we note that plans for this are in place for CP4.