Whether you're developing a new station, sidings, depot, electrification scheme or contributing to a broader regeneration project, understanding how to navigate the rail investment process is critical.

The investment pathway below provides an illustrative guide to the typical steps an investor may take from concept to delivery. It highlights where Network Rail (NR), ORR and other industry stakeholders play a role. Based primarily on ORR’s Rail Network Investment Framework, it is designed to bring greater clarity, transparency and predictability to third-party investment in the rail network.

It should be noted that every investment project is different and the investment pathway described here is illustrative only. Actual steps, requirements and timelines will vary depending on the scope and complexity of the scheme.

For further details on the mechanisms and processes that may apply, please refer to the Rail Network Investment Framework.

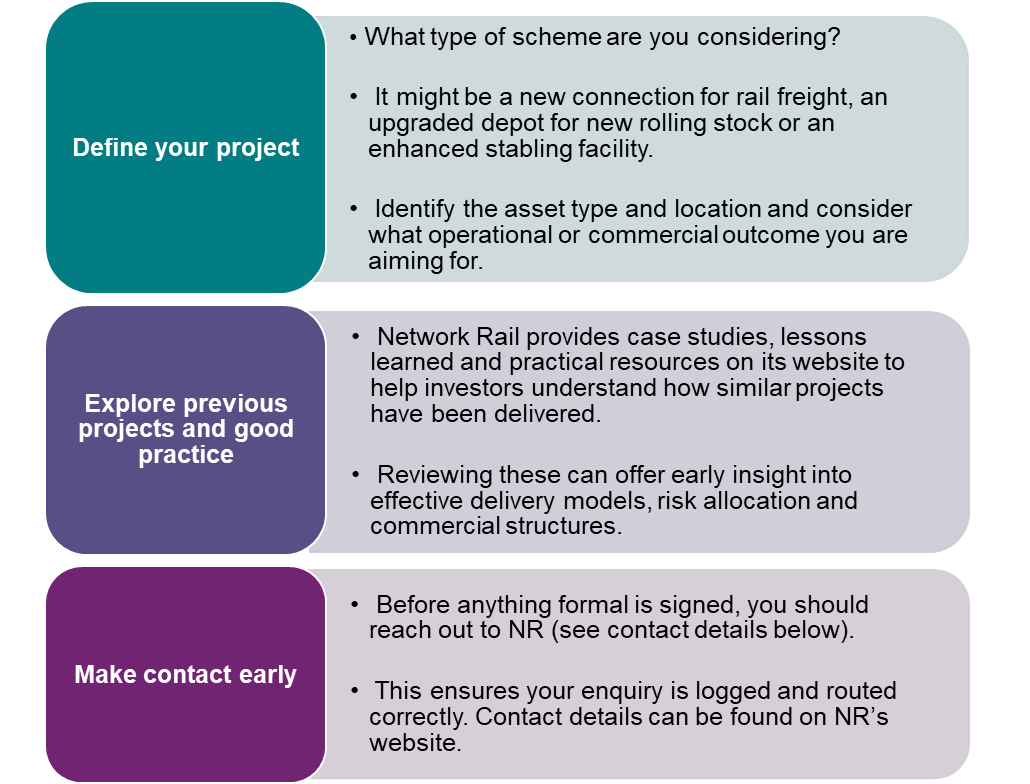

1. Pre-feasibility and market exploration

1.1 Successful infrastructure investments start with a clear idea and a robust rationale. For this initial stage:

For a full list of Network Rail contacts, along with access to their lessons learned and case study libraries, please visit Network Rail’s Investing in Rail webpage.

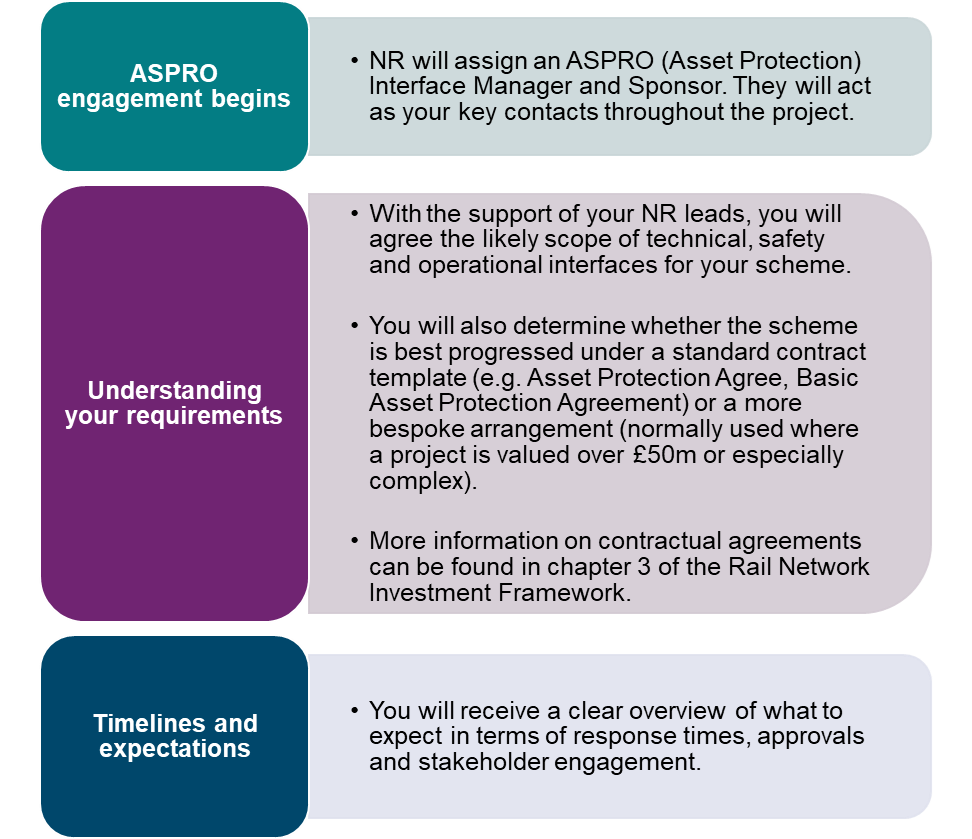

2. Initial Engagement and NR assignment

2.1 Once you have submitted an enquiry to Network Rail:

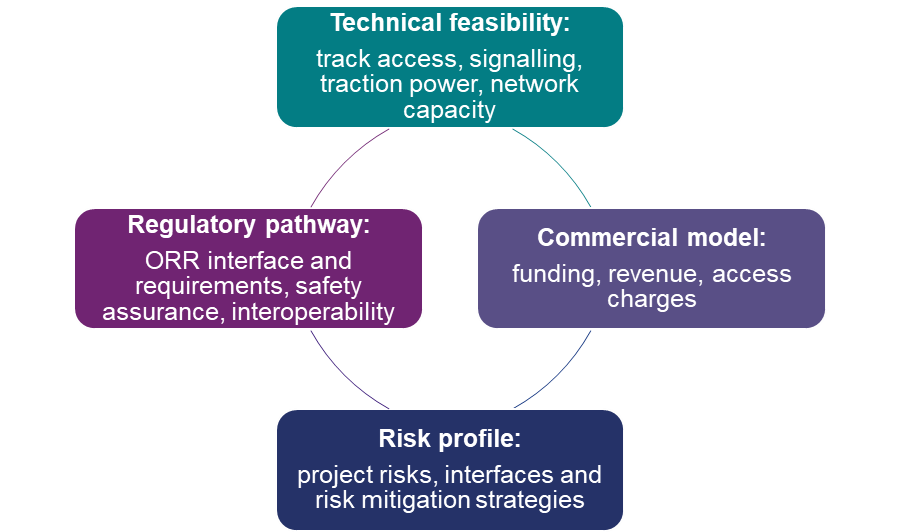

3. Feasibility and Development Services Agreement

3.1 To progress your project to the next stage, you will typically enter into a Development Services Agreement (DSA).

3.2 The DSA covers:

3.3 Fee Fund and Risk Provisions

- The output from the DSA will also confirm whether the Industry Risk Fund and Network Rail Risk Fee apply to your project.

- Please see chapter 3 of the Rail Network Investment Framework for further details on the risk funds.

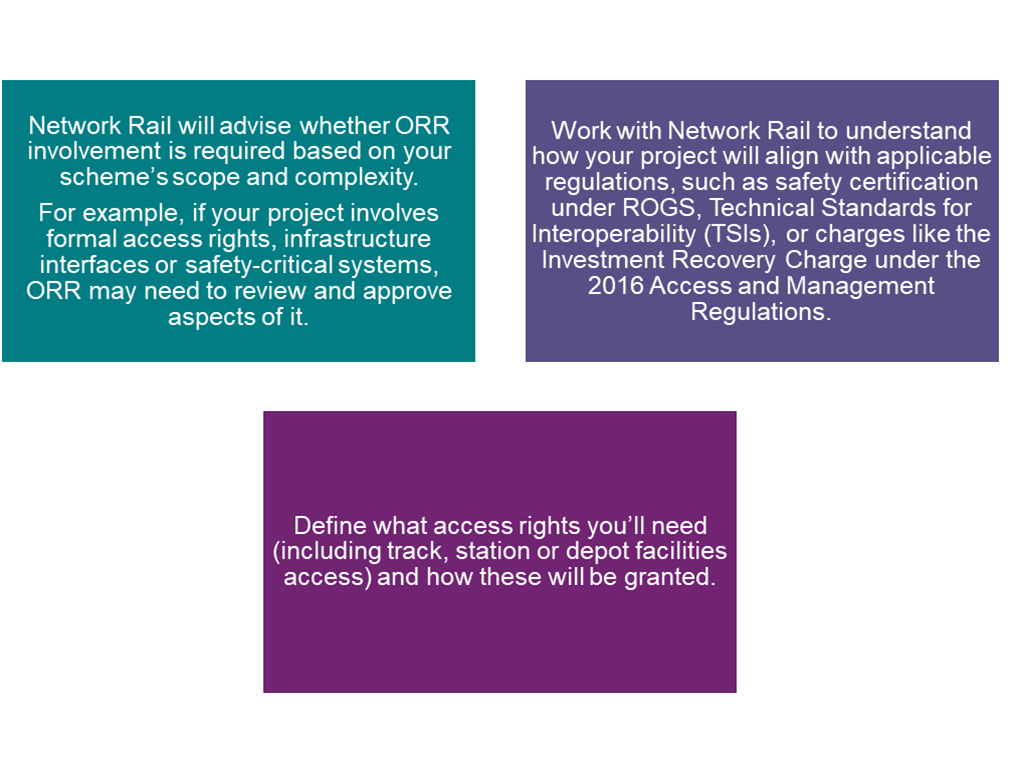

4. Regulatory Alignment and Access Planning

4.1 This stage focuses on setting up your project for regulatory and operational delivery.

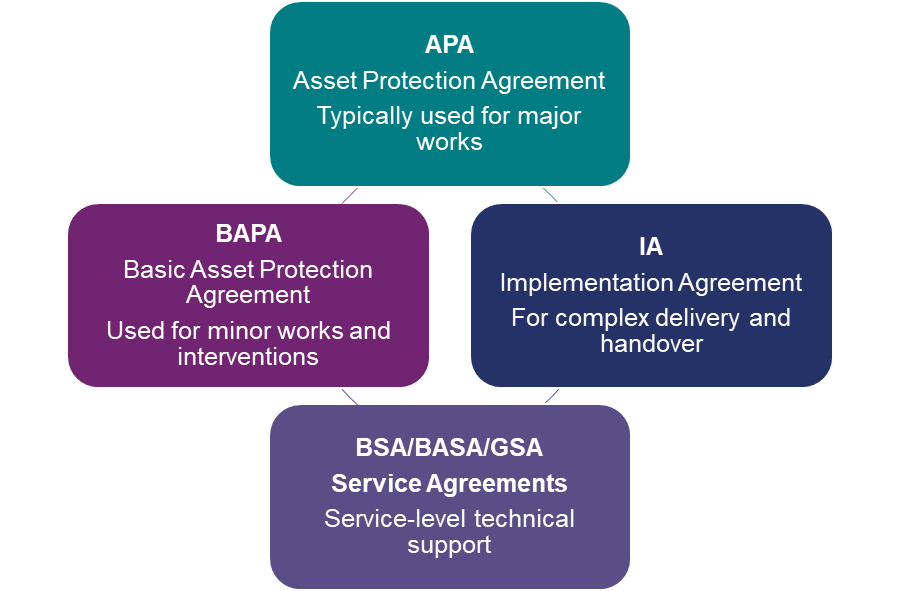

5. Template Contractual Agreement

5.1 Once your scheme is proven feasible, you’ll progress to the contracting phase. With NR’s guidance, determine the right template contractual agreement:

Template or bespoke contract?

5.2 Most projects use NR’s template contractual agreements, but schemes valued above £50m or with unique risks and complexities may require a bespoke agreement.

5.3 Options will be reviewed with NR’s legal and commercial teams.

6. Delivery Preparation and Contract Execution

6.1 With the commercial and regulatory frameworks in place:

6.2 Once contracts are signed, your project enters the delivery phase with a shared understanding of risk, responsibilities and the pathway to entry into service.

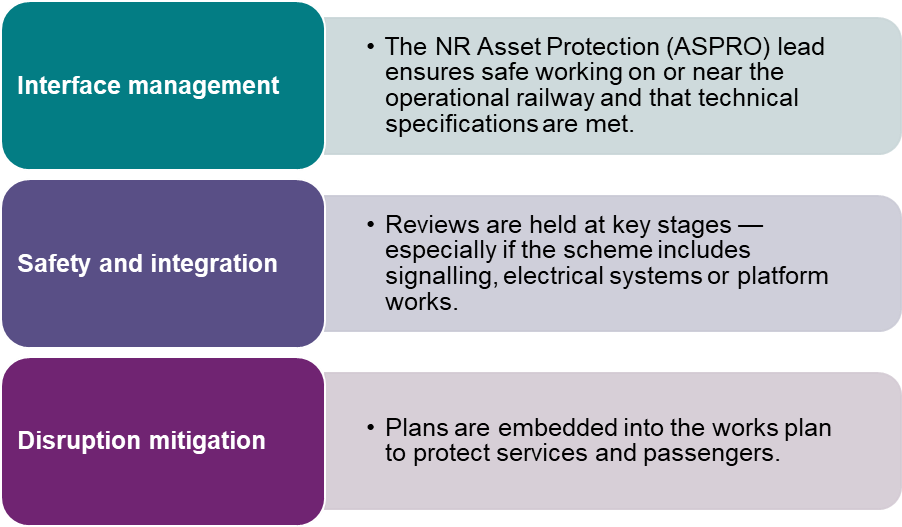

7. Construction and NR interface management

7.1 During delivery, you will work closely with NR to ensure safe and compliant works:

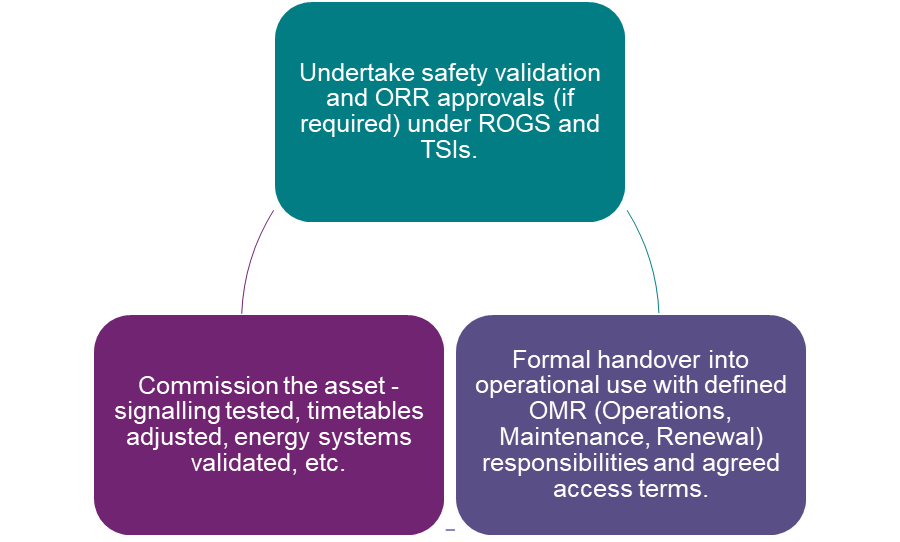

8. Testing, Handover and Entry into Service

8.1 Once construction is complete and your asset is built:

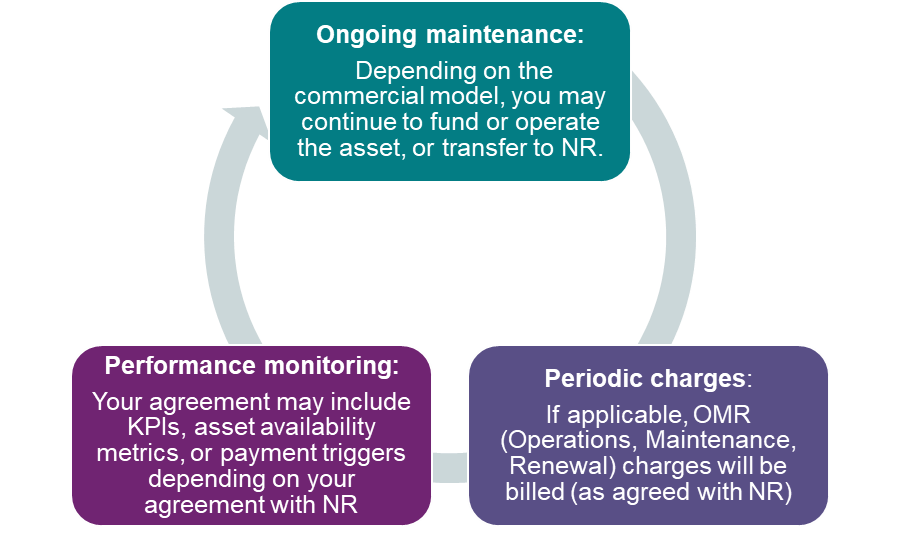

9. Operations, Performance and Ongoing Charges

9.1 After handover:

10. Summary checklist for investors

| Stage | Illustrative Key Actions |

|---|---|

| Pre-Feasibility | Define scope, explore market, contact NR |

| Engagement | Submit enquiry, get Network Rail contact |

| Feasibility | Enter DSA, assess risks, funding, compliance |

| Regulatory Planning | Engage ORR, clarify access, safety & recovery charge issues |

| Contracting | Choose APA/BAPA/IA template, define risk split |

| Delivery | NR oversees work, interface, and disruption planning |

| Entry into Service | Test, certify, commission, authorisation |

| Post-Handover | Monitor performance, manage OMR, review charges |