Executive summary

In this report, we focus on the financial and efficiency performance of Network Rail in the first year of Control Period 7 (CP7). Network Rail’s funding and requirements for this five-year control period were set out in our 2023 periodic review (PR23). In this we determined what Network Rail should deliver in respect of operating, maintaining, and renewing its network, and the funding necessary to do this for the period from 1 April 2024 to 31 March 2029.

Network Rail delivered £325 million of efficiency improvements in the first year of CP7 (April 2024 to March 2025). Nevertheless, the company financially underperformed by £243 million against its CP7 delivery plan. This means, that, net of income, Network Rail spent £243 million more than originally planned, despite delivering efficiency improvements. We explain the reasons for this difference later in the report.

This efficiency and financial performance are against a backdrop of £14.5 billion of total expenditure on the national rail infrastructure in the last year, £9.9 billion if we focus on operations, support, maintenance and renewals alone.

Key findings

The key findings from our assessment are:

1. Network Rail outperformed our efficiency target for Year 1 of CP7, but faces significantly higher targets for the remainder of the control period

Network Rail delivered £325 million of efficiency improvements in the first year of CP7, 24% ahead of our PR23 target of £263 million. These efficiencies are discussed in Chapter 2.

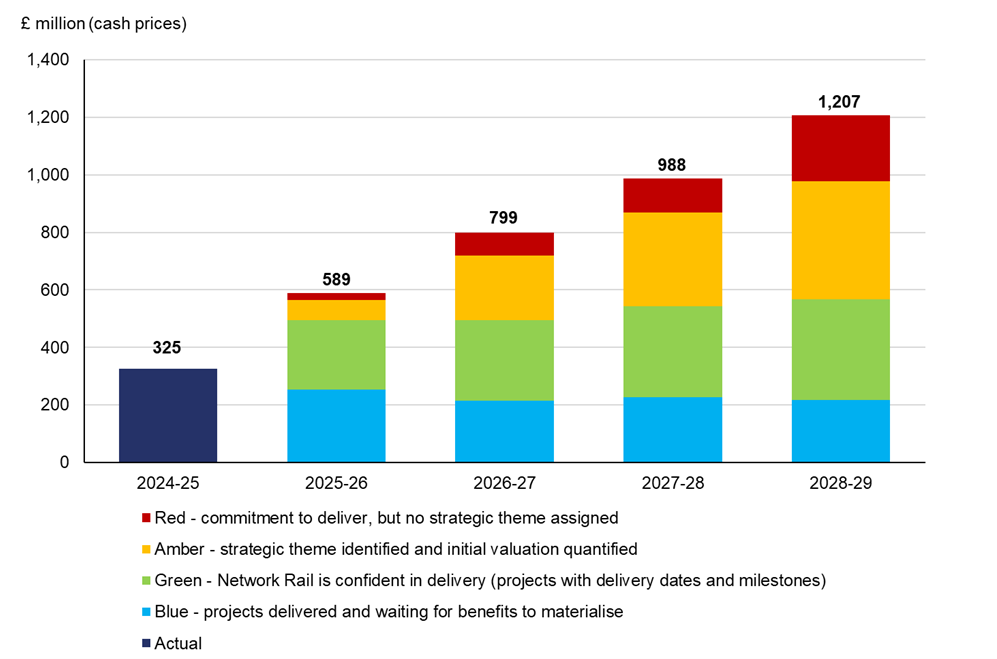

Figure 1: Network Rail’s actual and latest CP7 forecast efficiency improvements, April 2024 to March 2029

Source: ORR analysis of Network Rail’s data

Our PR23 determination set Network Rail a target to deliver £3.9 billion (cash prices) of efficiency improvements in CP7. At the start of Year 1 we commissioned Nichols Group to assess Network Rail's preparedness to deliver its efficiency plans. Nichols found that Network Rail was well positioned to deliver Year 1 and Year 2 efficiency targets, but that it should aim to go further to de-risk delivery of the significantly more challenging targets for Years 3 to 5 (see Figure 1).

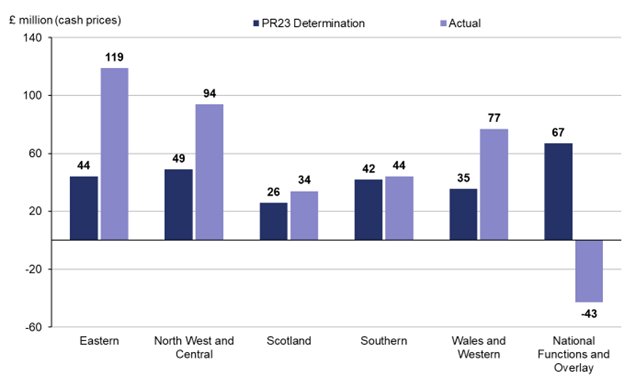

As shown in Figure 2, all five of Network Rail’s regions exceeded their Year 1 efficiency targets.

Figure 2: Regional contributions to efficiency improvements in April 2024 to March 2025

Source: ORR analysis of Network Rail’s data

We use leading indicators, prepared by Network Rail to evaluate the company’s readiness for its efficiency delivery for the year ahead (Year 2). Overall, these point to Network Rail being in a good position to deliver on the Year 2 targets, consistent with the direction of travel from the Nichols report published last year. Regional plans show that 84% of initiatives have either been delivered or have well developed plans (see blue and green markers for Year 2 in Figure 1). However, Network Rail is facing financial pressures that pose a risk to delivering its efficiency plans for later in the control period – which we explain further in this report.

2. Network Rail has financially underperformed due to inflationary pressures, additional maintenance activities and compensation payments for declining train performance

While Network Rail outperformed its efficiency target for the first year, it underperformed on the financial performance measure (FPM) by £243 million. This means that, net of income, the company spent £243 million more on what it delivered (in terms of operating, maintaining and renewing the railway) than it was funded to deliver (approximately 2% of its annual expenditure). This compares to an annual financial underperformance of around £550 million in CP6 (in cash prices).

Despite exceeding its efficiency targets, Network Rail’s financial performance was affected by several factors including:

- renewals projects experienced higher than expected inflationary pressures. Cost increases were also associated with delivery issues across several major signalling schemes from project delays, access constraints and reprioritisation of projects. These factors collectively contributed £259 million to financial underperformance;

- maintenance costs also exceeded budget. This included additional reactive maintenance activities and staff recruitment costs, and unplanned costs arising from training delays. Pay awards for front line staff were also higher than CPI inflation. These contributed £106 million to financial underperformance;

- poor train performance resulted in £71 million of underperformance in Schedule 8 compensation payments to train operators. This was a result of higher than expected cancellations, delays, trespass and cable thefts throughout the year;

- However, these negative trends were partially offset by financial outperformance on Schedule 4, the incentive regime for managing planned disruption (£122 million), support costs (£69 million) and enhancements (£47 million).

Exceeding the efficiency target but underperforming on FPM – as happened this year and in CP6 – can be explained by the structural differences between the two measures which are explained in Annex B. Most significantly, FPM encompasses most of Network Rail’s income and expenditure, and assesses whether Network Rail has delivered its required activities for more or less than it was funded to deliver them. Efficiency examines the drivers of cost changes over time (and not changes to income – which is part of FPM) in the areas of operations, support, maintenance and renewals (but not enhancements – which are also part of FPM).

3. Capital expenditure has reduced and uncertainty about volumes of work in CP7 is causing concerns for Network Rail’s supply chain

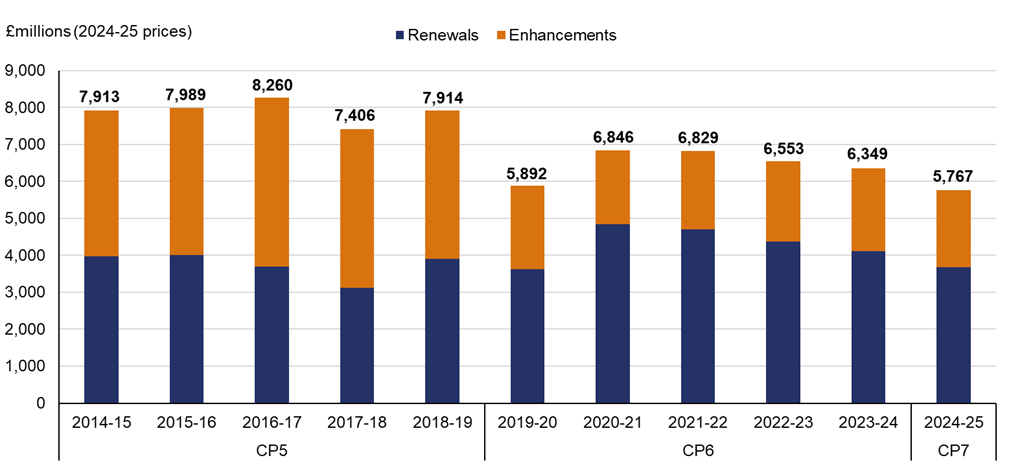

Network Rail spent £5.8 billion on renewals and enhancements in the first year of CP7. As shown in Figure 3, this represents a 9% year-on-year decrease.

The reduction in capital expenditure was primarily driven by lower than planned expenditure on the European Train Control System (ETCS) programme (which aims to replace traditional lineside signals with in-cab signalling), delays to traditional signalling renewals and lower property investment – all of which we explain in Chapter 2.

Figure 3: Renewals and enhancement expenditure, April 2014 to March 2025

Source: ORR analysis of Network Rail’sdata

Network Rail’s supply chain has expressed concerns about lower than anticipated renewals and enhancement work commissioned by Network Rail since the start of CP7. We have discussed these concerns with Network Rail and reiterated the importance of the company communicating effectively and consistently with its supply chain during the control period.

Strong supplier relationships are crucial for Network Rail both in terms of delivering its major capital programmes but also in terms of delivering future efficiencies. Approximately half of Network Rail’s annual expenditure is with suppliers and around £1.3 billion of efficiency improvements are expected to be achieved in CP7 through supply chain initiatives.

4. Network Rail faces difficult financial pressures in the rest of CP7

Our PR23 final determination provided for £1.7 billion of funding to cover unforeseen financial risk in CP7 (£1.5 billion for England and Wales and £0.2 billion for Scotland). Network Rail drew down and allocated 55% of this funding for unexpected cost pressures that it now expects to incur in CP7 (these include national insurance contributions, higher input prices and Schedule 8 payments). This means that Network Rail has substantially less risk funding available for other unforeseen financial risks that may emerge in the remaining four years of CP7.

Alongside these pressures, Network Rail’s CP7 delivery plan had a funding gap for England & Wales, which means that the company has identified that there is insufficient funding in CP7 to deliver its planned expenditure. In response to our concerns about this matter, Network Rail has made progress to reduce this funding gap. However, the funding gap at the end of Year 1 was close to £500 million and remains a concern, particularly due to inflationary pressures. Our January letter provides further details. We will continue to engage with Network Rail to ensure the gap is closed and that Network Rail looks at all available options for resolving the funding gap before it considers cutting back on planned renewals for core assets. These matters are explained further in Chapter 3.

5. Senior management headcount has continued to increase and staff costs have increased

At the end of Year 1, total headcount was 41,702 full time employees, a 1% annual increase. However, these changes included a 4% reduction in maintenance staff.

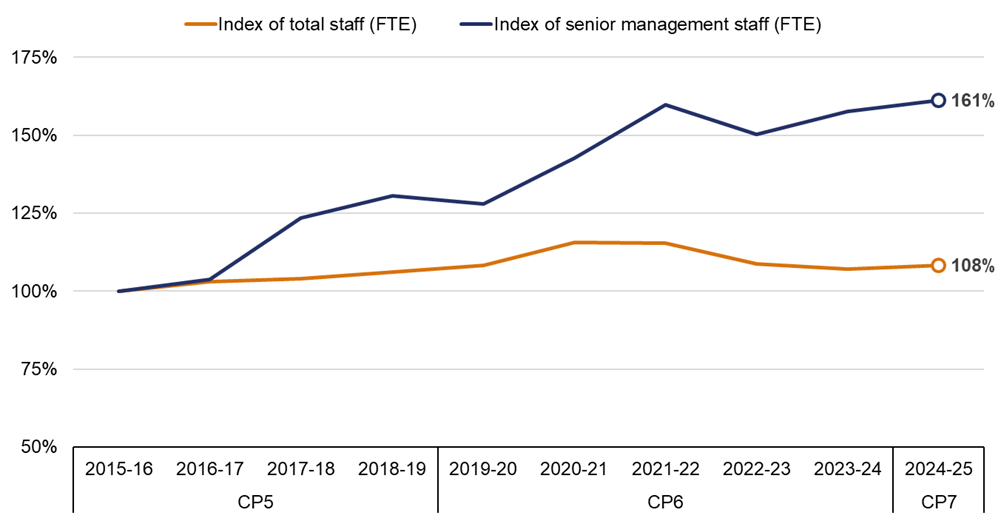

Network Rail had 661 employees working in senior management grades (director and Band 1) in the last year. As shown in Figure 4, headcount in senior management grades increased by 2%, continuing a longer-term trend that has seen senior management headcount increase substantially over recent years. This is in contrast to total headcount which has changed little over the same period.

Figure 4: Change in total staff (FTE) and senior management (FTE) headcount, April 2015 to March 2025

Source: ORR analysis of Network Rail’s data

Over the last year, total staff costs rose by 0.7% in real terms (i.e. above CPI inflation) to £3.0 billion. This represents 21% of the company’s annual expenditure, compared to 20% the prior year.

The average employment cost for a full-time employee (excluding agency staff) was £64,351, an annual increase of 0.2% and total reward for senior managers was £167,927 (including pensions, bonuses and allowances) an annual increase of 5%.

The increase in senior management headcount and remuneration indicates a shift in workforce structure and cost management over recent years. This growth in the cost and number of senior roles indicates a potential need for Network Rail to review its staffing strategy and cost of its senior management.

6. A stable plan in Scotland should support its CP7 delivery requirements, though significant risk funding has been required to manage cost pressures

Network Rail Scotland made a good start to CP7, exceeding its efficiency plans by 32% for Year 1 which was above the average for Network Rail nationally. However, to manage the various cost pressures it has faced (such as National Insurance Contributions and input prices), Network Rail Scotland drew down and allocated a large portion (56%) of its £234 million of its CP7 risk funds to cover these costs.

In contrast to England and Wales, Network Rail Scotland’s CP7 delivery plan does not have a funding gap. We consider that this is likely to increase the stability of Network Rail Scotland’s delivery plan and, in turn, may put it in a stronger position than England and Wales regions to deliver its asset management outcomes for CP7.