Why it’s an opportunity

2.1 Track infrastructure and new connections, including sidings and new junctions, are often key enablers of wider economic, freight and resilience benefits. Common benefits include:

- Freight Growth and Modal Shift

- New rail connections to terminals, quarries, ports or industrial estates can reduce HGV use;

- Investors may benefit from access charge recovery or property value uplift.

- Network Resilience and Diversionary Routes

- Additional track capacity can support operational resilience and contingency planning;

- Strategic projects may attract public funding support (for example, from local authorities).

- Unlocking Development Land

- New links can make brownfield or underused land viable for mixed-use or regeneration;

- Landowners or developers may co-invest in connection infrastructure.

2.2 These projects are typically capital-intensive and can offer stable returns over the long-term (primarily via access charges to users). They may also align well with local and regional growth agendas, making them a potential opportunity for co-funding from both public and private sources.

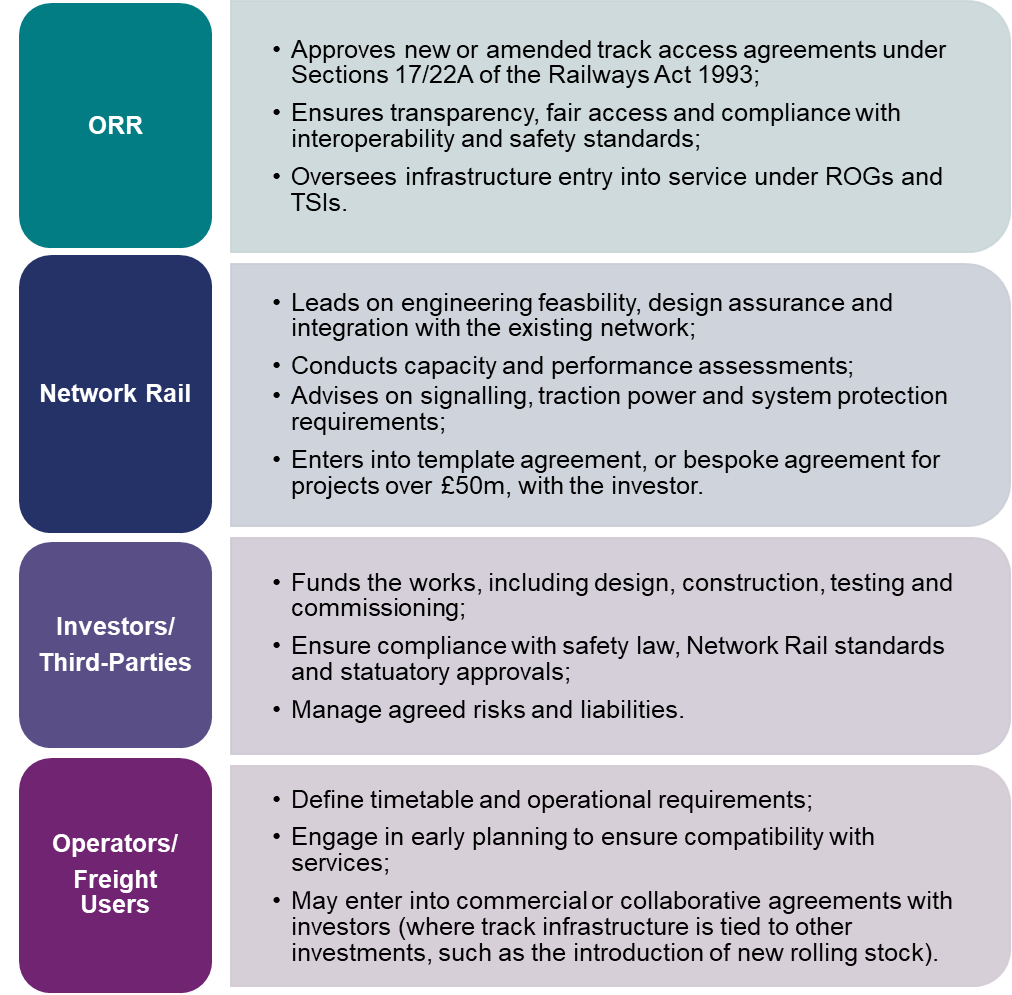

Key Stakeholders – Roles and Responsibilities

2.3 Below are examples of some of the common responsibilities of key stakeholders when investing in track infrastructure, although this may vary depending on the scope of the investment scheme:

Key Considerations for Investors

| Theme | Details |

|---|---|

| Capacity & Integration | Network Rail will need to assess capacity impact, signalling changes, power supply capability and timetabling feasibility. |

| Safety & Compliance | Projects must comply with ROGS (Railways and Other Guided Transport Systems (Safety) Regulations 2006) and TSIs (Technical Specifications for Interoperability); derogations may be required for non-standard infrastructure. |

| Land & Interfaces | Third-parties typically secure land and planning; interface risk must be addressed contractually. |

| Cost Recovery & Revenue | Options may include track access charges, cost sharing with operators, or wider land development returns. |

| Risk Allocation | Clarify responsibilities for cost overruns, project delays and operational performance. This will typically be set out in the contractual agreement between NR and the investor. |

Regulatory and contractual considerations

2.4 Below is an example of how investment in track infrastructure and new connections can be facilitated, along with some of the common regulatory requirements in this area:

2.5 Early development and feasibility

Network Rail may be engaged under a Development Services Agreement (DSA) to explore technical feasibility, network capacity, operational constraints and access rights at an early stage.

2.6 Delivery arrangements

If the scheme is feasible, it typically progresses to a delivery-phase agreement, either an Asset Protection Agreement (APA) where works interface with operational assets, or an Implementation Agreement (IA) where Network Rail delivers works on behalf of the investor. The choice depends on project complexity and scope.

2.7 Regulatory approvals

The investor and Network Rail must engage with ORR to secure required track access approvals and authorisation for entry into service, ensuring compliance with statutory, operational and safety requirements.

Investor checklist

2.8 Investors should consider the following when developing a track infrastructure project:

- Has a clear operational or commercial need been identified (e.g. freight access)?

- Has capacity on the mainline been assessed and confirmed by Network Rail?

- Have land and planning risks been accounted for?

- Are risk liabilities and delivery milestones clearly defined in the contract?

- Are access rights, revenues and long-term responsibilities agreed and documented?

- Have ORR agreed the regulatory pathway for bringing the scheme into use?