Why it’s an opportunity

6.1 Electrification and traction power infrastructure are central to achieving the UK’s Net Zero targets and decarbonising the railway. Key drivers and benefits may include:

- Net Zero and Decarbonisation Commitments

- Direct alignment with wider transport decarbonisation targets;

- Strong public support and potential co-funding from devolved or local authorities.

- Growing Market Demand

- Battery-electric and bi-mode fleets require new charging assets;

- Operators seek partners to deliver clean infrastructure at pace.

- Integrated Delivery Models

- Infrastructure can be bundled with new depots or rolling stock;

- Offers potential for long-term, availability-based revenue models.

6.2 Investment in these areas can be a vital enabler of new low-emission fleets and future rail growth. For private investors, this offers an opportunity to support green infrastructure with strong policy alignment and growing market demand from train operators and devolved authorities.

6.3 Traction power investments also complement rolling stock procurement and depot upgrades, making them well-suited to integrated project models.

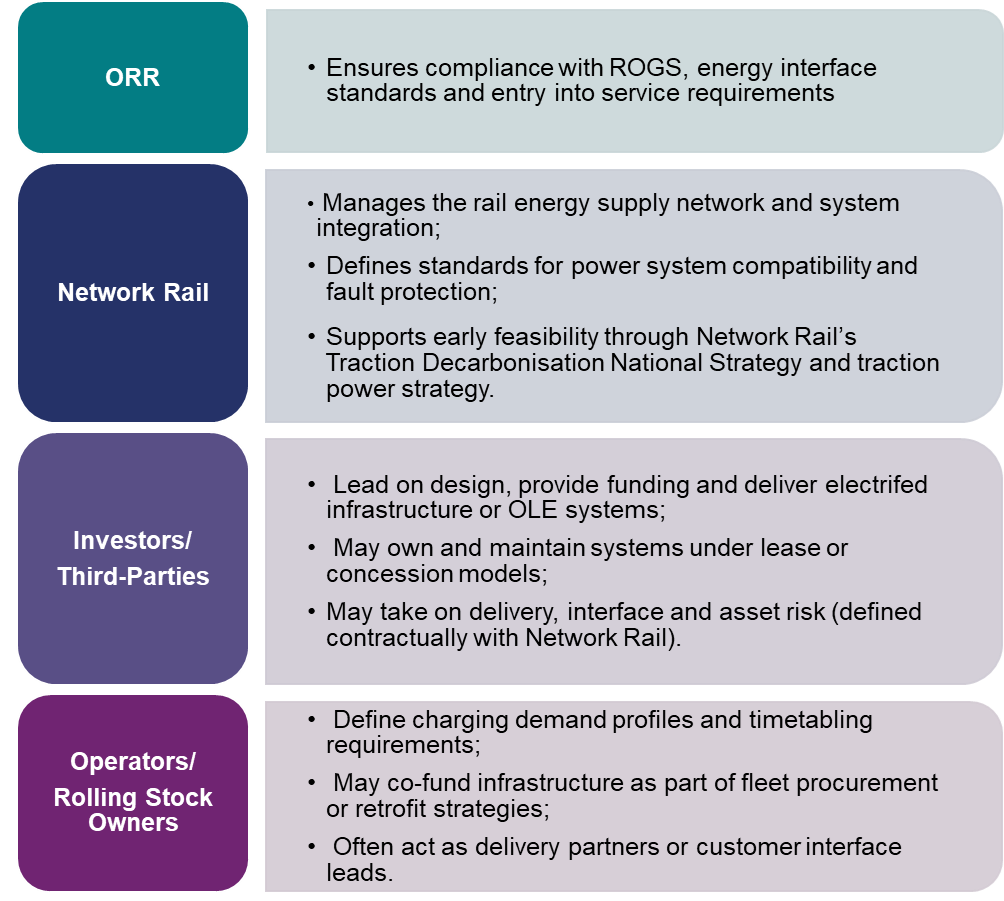

Key Stakeholders – Roles and responsibilities

Key considerations for investors

| Theme | Detail |

|---|---|

| Electrical Safety & Assurance | High-voltage works must comply with safety regulations and require staged assurance reviews. |

| System Compatibility | Infrastructure must integrate with NR’s power network. |

| Operational Risk | Failure of energy assets can affect train operation — backup systems may be needed. |

| Maintenance & OMR | Investors may be liable for long-term operation, inspection, and asset resilience. |

| Commercial Model | Leasing, availability payments or capacity-based charging can be used to structure returns. |

| DNO Supply | Have Distribution Network Operators been engaged to identify any supply constraints? |

Regulatory and contractual considerations

6.4 Below is an example of how investment in track infrastructure and new connections can be facilitated, along with some of the common regulatory requirements in this area:

6.5 Development and feasibility

A Development Services Agreement (DSA) may be used to assess power demand, network capacity, system integration and asset feasibility. This stage identifies existing supply constraints, required upgrades and compliance with Network Rail’s electrical safety and design standards.

6.6 Delivery arrangements

Projects progressing to construction usually do so under an Asset Protection Agreement (APA), which governs safety, assurance and delivery where works interface with operational infrastructure.

6.7 Contractual frameworks

Integrated fleet and infrastructure schemes or major electrification programmes often require bespoke contractual terms, particularly where shared assets or interfaces with rolling stock are involved. Such projects commonly exceed the £50 million threshold, above which standard template agreements are not generally used.

6.8 Regulatory and safety approvals

Safety and technical approval routes should be defined early with ORR and Network Rail, including compliance with the Railway Interoperability Regulations, Electrical Safety Management Standards, and ROGS requirements for authorisation into service.

Checklist for traction power investors

6.9 Investors should consider the following:

- Is the investment aligned with a defined decarbonisation strategy or fleet order?

- Has grid and timetable compatibility been confirmed with NR and operators?

- Are interface risks and OMR responsibilities contractually defined?

- Has safety assurance and testing been factored into the timeline?

- Is the commercial return model clearly structured?