Why it’s an opportunity

4.1 Depots represent a good entry point for private investment in rail infrastructure. Unlike rail lines or signalling systems, depots are:

- Clearly bounded and self-contained, limiting interface complexity;

- Associated with defined revenue streams from operator facility access or train servicing;

- Essential for traction modernisation and decarbonisation, supporting electric rolling stock and alternative traction power capabilities; and

- Integral to combined rolling stock and infrastructure investment deals, often initiated by private investors.

4.2 Depot investments are generally seen as commercially viable ventures with manageable delivery interfaces, making them an ideal starting point for expanding private sector capital in rail.

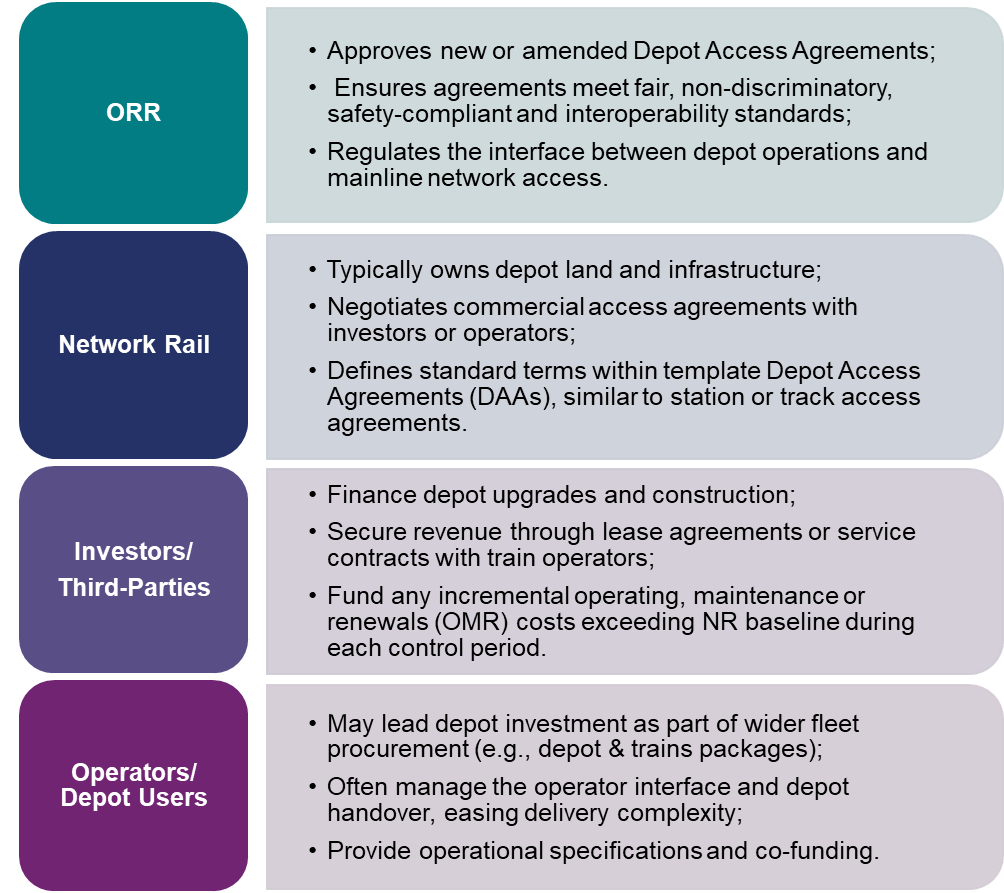

Key Stakeholders – Roles and responsibilities

4.3 Below are examples of some of the common responsibilities of key stakeholders, although this may vary depending on the scope of the investment scheme:

Key considerations for investors

| Theme | Detail |

|---|---|

| Compliance and Interoperability | Infrastructure must meet TSIs or obtain derogations if depot modifications affect train entry into service. ORR will be able to provide guidance on this. |

| Risk Allocation & OMR Charging | Investment costs, depreciation and maintenance charges (>£50k p.a.) must be clearly identified and borne by investors, with revisits each control period. |

| Revenue Mechanisms | Examine lease duration, access charge structure, performance incentives and commercial return on investment. |

Regulatory and contractual considerations

4.4 Below is an example of how investment in depot infrastructure can be facilitated, along with some of the common regulatory requirements in this area:

4.5 Access and regulatory approvals

Depot projects that interface with the operational railway require an ORR-approved Depot Access Agreement under the Railways Act 1993. Where a new or modified network connection is proposed, corresponding track access rights or connection agreements may also be needed.

4.6 Contractual frameworks

The form of agreement with Network Rail depends on project scale and complexity:

- Smaller schemes (typically under £50 million) may use standard Development Services and Asset Protection Agreements;

- Larger or more complex projects may require bespoke terms or an Implementation Agreement.

Network Rail will advise on the most appropriate contractual route.

4.7 Assurance

All depot schemes must meet Network Rail’s technical and safety assurance requirements to ensure safe integration with the wider network.

Early engagement with Network Rail is strongly recommended to confirm the appropriate approvals and delivery pathway.

Checklist for depot investors

4.8 Investors should consider the following when developing a depot investment project:

- Have TSIs, approvals and interoperability implications been reviewed with ORR?

- Have all interfaces with Network Rail and the operating network been mapped and agreed?

- Are risk allocations and liabilities clear?

- Does the financial model have a strong basis (e.g., long-term lease)?