Why it’s an opportunity

7.1 Place-based investment integrates rail infrastructure with wider development and regeneration, supporting sustainable communities and long-term economic growth. These schemes often combine residential, commercial, civic and retail development centred around upgraded or new rail infrastructure.

7.2 This model allows private capital to participate in both transport delivery and surrounding development. Key drivers and benefits can include:

- Land Value Capture and Commercial Uplift

- Development around transport hubs can substantially increase land and property values;

- Long-term leasing and development rights can offer revenue for investors.

- Alignment with Levelling Up and Housing Policy

- Place-based regeneration supports national and local objectives for housing and jobs;

- Integration of Transport and Urban Design

- Transport oriented design principles create high-density, walkable communities centred on reliable rail access;

- Supports climate resilience and modal shift from cars to public transport.

7.3 Examples of successful projects include:

- King’s Cross: A major regeneration scheme anchored by rail infrastructure improvements.

- Brent Cross West: A new station forming the focal point of a large-scale housing and commercial masterplan.

- Stratford (London): Integrated transport and development hub supporting the Olympic Park and East London growth.

7.4 These schemes demonstrate how infrastructure investment, when aligned with commercial development, can deliver substantial long-term returns and public benefit.

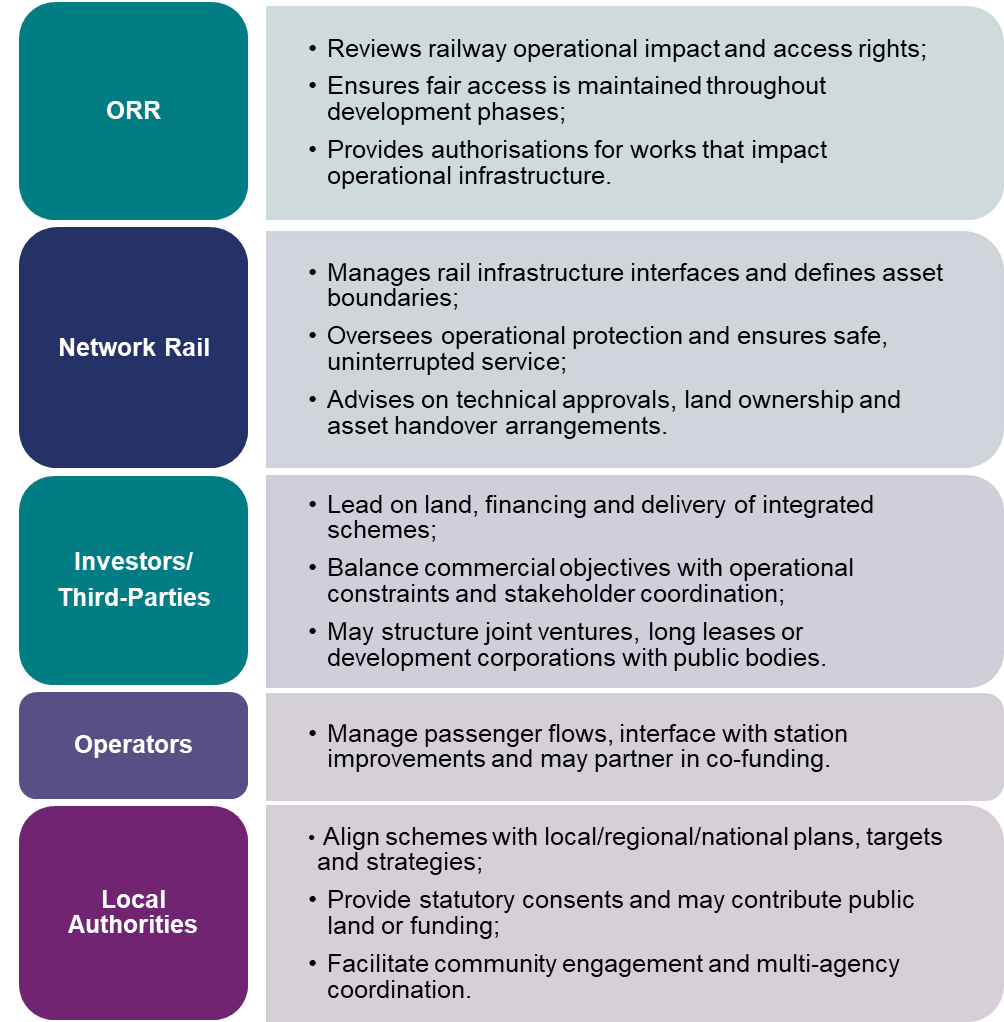

Key Stakeholders – Roles and responsibilities

Key considerations for investors

| Theme | Detail |

|---|---|

| Planning and Statutory Risk | Complex land assembly, approvals, and consultation processes can extend delivery timelines |

| Operational Interfaces | Boundaries between operational rail and commercial assets must be legally and physically defined |

| Value Realisation Timeline | Land value capture and rental income may be long-term; upfront capital is often required |

| Joint Governance Models | Shared ownership or risk-sharing may be needed to manage interfaces and long project lifecycles |

| Regulatory Pathway | Early regulatory dialogue reduces risk of rework and delays in access, safety, or commissioning |

Regulatory and contractual considerations

7.5 Below is an example of how investment in regeneration can be facilitated, along with some of the common regulatory requirements in this area:

7.6 Early development and feasibility

A Development Services Agreement (DSA) may be used to assess phasing, land use viability and interface requirements with the operational railway. This stage helps determine the extent of Network Rail’s involvement and any required protection or assurance activities.

7.7 Delivery arrangements

Where works affect operational assets, an Asset Protection Agreement (APA) or bespoke delivery agreement may be required to govern safety, access and asset assurance.

7.8 Regulatory and planning engagement

Early engagement with Network Rail, ORR and local planning authorities is essential to define regulatory pathways and align planning consents with rail operational requirements.

7.9 Access and interface agreements

Depending on the nature of the scheme, Station Access Agreement variations or new station/depot interface agreements may be required to support integration of commercial, transport and operational elements.

Checklist for place-based investors

7.10 Investors should consider the following when developing a place-based investment project:

- Is there a clear value proposition rooted in transport oriented design or mixed-use growth?

- Have planning, rail and access risks been scoped and phased?

- Are legal boundaries between railway and non-railway assets defined?

- Is there a viable delivery model (e.g. joint venture, special purpose vehicle, co-investment)?

- Are all stakeholders aligned on objectives and governance?