In our last annual assessment, we challenged National Highways to demonstrate to us that it is optimally renewing its network. This has been a concern of ours for several years as it affects the longer-term efficiency and sustainability of the strategic road network. In the reporting year the company introduced a new reporting tool that improved the information we see about the decisions that it takes regarding its renewals on the network. This is a big step forward. Later in 2023, we expect to be able to draw firmer conclusions on whether the company is optimising its renewals decisions.

3.1 In our last annual assessment, we raised concerns that National Highways’ reporting of capital renewals was based on asset volumes renewed against its annual delivery plan targets and spend. This provided us with an indication that work was delivered, but it did not tell us whether the work addressed an asset need. We were concerned that the company might compromise long-term efficiency and asset sustainability in pursuit of short-term benefits and challenged it to demonstrate the alignment between its policy and what it delivered.

3.2 In July 2022, we made it clear to National Highways that we would hold it to account to produce its new renewals reporting tool: the Capital Delivery Management Tool (CDMT). In September 2022, the company produced its first national report that showed renewals scheme delivery data across all its regions. These deliverables provide us with greater confidence that the company is adopting a best practice approach to managing the lifecycle of its assets.

3.3 However, we note that in the reporting year we only received three quarterly reports. This is not sufficient to establish a robust baseline performance level because it does not capture delivery seasonality. To ensure that we reach that position as soon as possible, we will continue to work with National Highways to support the further development and maturity of its reporting. A baseline of at least one full year of reporting will provide us with a better understanding of the company’s renewals scheme delivery. Continued, regular, reporting will strengthen our ability to hold the company to account to deliver its renewals programme.

3.4 Pavement renewals are a good example of the need for National Highways’ renewals reporting to demonstrate best practice whole-life asset management. In January 2023, National Highways forecast that it would miss its pavement condition key performance indicator (KPI) target. The company used updated asset condition information to adjust its renewals programme, recovered its position and met its target. We asked the company to demonstrate to us, using the renewals reporting tool, how it responded to the risk of missing the KPI target. The company provided output data from CDMT showing changes made to the pavement renewals programme and its approach to data processing. By using data from the renewals reporting tool, the company was able to demonstrate its maturing approach to asset management.

3.5 National Highways has stated that a reason for the reduction in the pavement condition forecast was due to the impact of extreme hot weather experienced in July 2022. Therefore, the company needs to demonstrate in its asset management reporting evidence that it is delivering network resilience, including to account for the ongoing impacts of climate change.

3.6 Going forward, we will continue to hold National Highways to account to build on what it has done to improve the intelligence available to support asset management decisions. The company must also demonstrate its ability to forecast, mitigate risks and plan for changing asset need.

Outcome: a well-maintained and resilient network

3.7 National Highways has one targeted key performance indicator (KPI), four performance indicators (PIs) and two commitments in this outcome area.

KPI: pavement condition

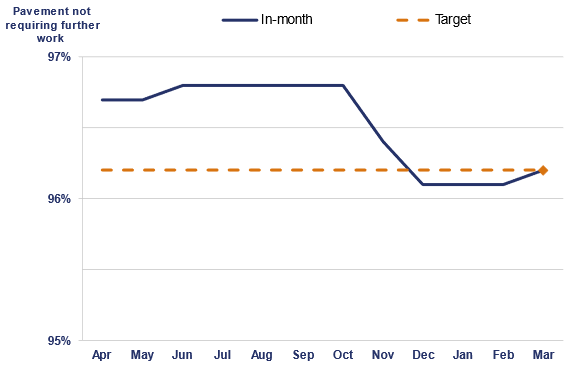

3.8 In the current reporting year, National Highways met its target of 96.2% of pavement requiring no further investigation, despite challenges in-year. Figure 3.1 shows the performance in the reporting year.

3.9 In April 2022, National Highways implemented an improved metric to assess pavement (road surface) condition, as committed in the second road investment strategy (RIS2). The updated metric measures the condition of all lanes, compared to the old metric that only considered the condition of lane one (the first lane on the left). This provides a better representation of National Highways’ management of overall road surface condition on the strategic road network (SRN).

3.10 In January 2023, National Highways notified ORR that it was at risk of missing its year-end target of 96.2%. At that point, the company was forecasting an end of year position of 96.1%. It cited an increased rate of deterioration due to the extreme heat in July 2022 as the main factor in the reduction in its forecast.

3.11 We challenged National Highways on its plans to improve performance and achieve its target by the end of the reporting year.

3.12 Between January and April 2023, we worked more closely with National Highways at all levels to understand the root cause of this issue and the company’s plan to deliver additional work to improve performance. Following this additional scrutiny and engagement from ORR, the work delivered by National Highways resulted in the company achieving its target of 96.2% by the end of March 2023.

3.13 We will continue to work with the company in 2023 to better understand the plans it has in place to reduce the risk of similar performance issues occurring in the future.

Figure 3.1 Pavement not requiring further investigation between April 2022 and March 2023 (%)

PIs: a well-maintained and resilient network

3.14 PIs are untargeted metrics. They enable us to scrutinise more aspects of National Highways’ network performance beyond the headline KPI.

Structures condition

3.15 The condition of structures (for example, culverts, gantries, retaining walls and bridges) is measured by three performance indicators:

- the average condition of the stock (SCAV);

- the condition of the assets’ most critical elements (SCRIT); and

- the percentage of structures that have been inspected and rated as ‘good’ (SCI).

3.16 Table 3.1 shows the reported numbers for all three PIs have increased slightly which aligns with the company’s aim of maintaining a ‘steady state’ condition for its structures assets.

Table 3.1 Structures PI scores for the first three years of RP2

| RP2 Year | SCAV score | SCRIT score | SCI score |

|---|---|---|---|

| April 2020 to March 2021 | 85.4 | 63.3 | 81.2 |

| April 2021 to March 2022 | 85.3 | 63.5 | 81.0 |

| April 2022 to March 2023 | 85.4 | 63.7 | 81.4 |

Technology availability

3.17 This indicator measures the percentage of time that roadside technology assets on the SRN are available and functioning. This includes assets such as cameras, electronic signs and weather stations. As shown in Figure 3.2, in this reporting year, 95.31% of technology assets were available and functioning. This is a reduction of 1.57 percentage points compared to the end of March 2022.

3.18 National Highways is conducting a deep dive to establish the different factors that contributed to the reduction. One known factor is that the company became aware of a coding error in February 2023, within its reporting database which had been present since 2018. This led to an over-reporting of the PI by 0.5 percentage points. The company has now rectified this error and applied improved processing controls. It is carrying out a detailed lessons learned analysis and will share its findings with us once completed.

Drainage resilience

3.19 As at March 2023, 69% of the SRN did not have an observed significant susceptibility to flooding. This is two percentage points worse than the previous year. This means that 31% of the SRN has drainage catchments that have high risk flood hotspots within.

3.20 National Highways is working to minimise the impact of flooding on the network. The company has improved the quality of its reporting and analysis by putting together a flood taskforce team, to review and enhance its internal processes and practices such as training and operational requirements. Improved reporting increases the likelihood of more flood events being recorded. Therefore, it is considered to be the main reason for reduced performance of this metric in the reporting year.

Geotechnical condition

3.21 This PI captures the percentage length of National Highways’ geotechnical assets that are in ‘good’ condition or better. Geotechnical assets include earthworks that support other highway assets and adjacent land. In the reporting year, the company reported that 99.65% of its geotechnical assets achieved at least a ‘good’ rating. This is 0.06 percentage points better than the previous reporting year; indicating that the condition of the geotechnical asset portfolio is not deteriorating.

Commitments: a well-maintained and resilient network

3.22 Commitments are priorities that are not suited to metrics, such as developing new metrics, publishing reports on specific performance items or improving reporting for future years.

Implement the Asset Management Development Plan (AMDP) for the second road period (RP2)

3.23 In the first road period (RP1), National Highways transferred the milestones it had set out in its AMDP into an Asset Management Transformation Programme (AMTP). The company met those milestones for the first year of RP2.

3.24 Delivery of the milestones in its AMTP remains an important part of how National Highways improves its asset management capability. In the reporting year, the company met 17 milestones. As we reported in our last annual assessment, two milestones were missed in the second year of RP2:

- the development of a new ride quality metric; and

- the Asset Data Governance Model.

3.25 The work on the new ride quality metric is now complete and National Highways is reporting on this metric as a non-targeted PI.

3.26 National Highways changed the scope and timescale for the Asset Data Governance model, reporting that this was to align with existing work on data governance. In the reporting year, the company delivered:

- a vision for the Data Governance Framework; and

- validation of the Data Governance and Plan.

3.27 National Highways states these milestones are part of a charter to deliver a new Asset Data Governance Model comprising the development of an Asset Data Management Plan which will set out the scope, timeline and costs to implement appropriate data governance and improvement processes to increase confidence in its data.

3.28 National Highways is now entering the final two years of the AMTP. The company needs to provide assurance that the AMTP will be delivered and we will continue to hold the company to account against its progress next year to ensure it delivers its milestones and consistently demonstrates its asset management maturity development.

Investigate an improved structure condition metric and an alternative indicator for technology assets

3.29 National Highways is on track to deliver this commitment. The company is in the final stage of metric development and will complete its validation of the metric by July 2024.

Managing the SRN

3.30 We assess National Highways’ asset management of the SRN by analysing the company’s reported data sets. Asset management investment is typically split into two main categories:

- capital renewals: this is the renewal of assets that have reached the optimum asset life, or are life expired such as road surfacing and bridge structures that are part of the SRN; and

- maintenance: this aims to keep the SRN safe and serviceable by undertaking routine cyclical operations such as cutting vegetation, clearing drains, and reactive repairs to defects such as potholes.

3.31 These two categories are linked. For example, if National Highways does not adequately deliver maintenance, assets may fail prematurely requiring early renewal, and if the company does not undertake renewal activity in a timely manner, an asset may require increased maintenance to keep it safe for users. The range of different asset types that form the SRN and the impact of varying traffic levels and from different weather conditions across the country make this a complex challenge for the company to manage.

3.32 Maintenance and renewals are substantial parts of the overall asset management system that enables National Highways to maximise the value of the SRN to users and achieve the strategic requirements of the road investment strategy. As a minimum, the company must ensure that the SRN is safe for use and fit for purpose. It is therefore important that the company demonstrates that it is delivering against its asset management policy, strategy and plans. This will ensure it is maintaining, operating and renewing all its assets to safely and efficiently manage the SRN.

3.33 Paragraphs C1 to C17 contain a summary of maintenance and renewal reported data.

Capital renewals – planning and delivery

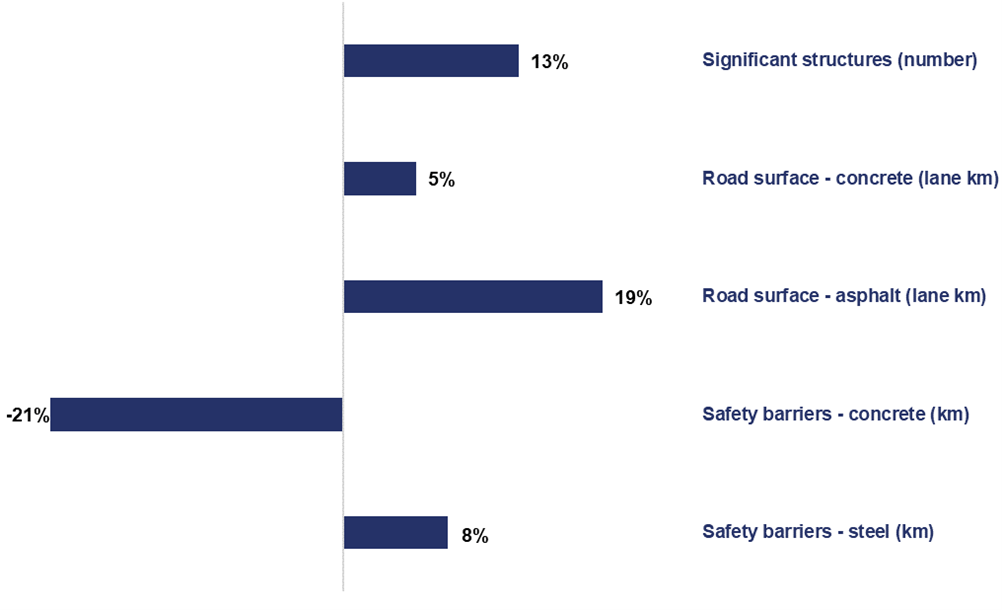

3.34 National Highways delivered four types of planned major life-extension renewals in the reporting year. However, it under delivered its planned renewal of concrete safety barriers by 21%. The company has reported that this was due to difficulties in agreeing financial sign off with a Design Build Finance Operate (DBFO) contractor for a large scheme in the Yorkshire and North East region; the scheme would have contributed 3,750 linear metres to the concrete safety barrier renewals reporting for the third year of RP2 and would have resulted in an over delivery of 9%. The whole scheme has commenced early in the fourth year of RP2 with a total planned output of approximately 10,000 linear metres.

3.35 The company has told us that the impact on road safety of delaying the start of works on the scheme from the last quarter of the reporting year to the first quarter of the fourth year of RP2 is negligible.

3.36 National Highways failed to deliver against its plan for three of its 14 cyclical renewal types:

- it marginally missed its planned delivery for two renewal types: bridge bearings and technology renewals and improvements; and

- it missed its planned delivery for bridge waterproofing by 9%.

3.37 The company reported that the under delivery of bridge waterproofing was primarily as a result of under delivery in the Midlands and East regions. The under delivery in the Midlands region was due to challenges transferring to the Asset Delivery model, combining East and West Midlands into One Midlands, and programme re-prioritisation. In the East region, under delivery was due to a combination of delays on two schemes, and scope changes to another scheme where following further inspection waterproofing requirements were reduced from 2,300m2 to 900m2.

3.38 In the second year of RP2 reported waterproofing renewals were missed by 25%. Waterproofing is a key intervention to prevent asset deterioration and expensive bridge structure renewal. It is important that National Highways delivers on planned renewals, where required, to demonstrate efficient asset management.

3.39 National Highways over delivered against its plan for all other renewal types. High levels of over delivery against plan were reported for:

- kerbs (by 87%);

- drainage (by 85%); and

- asphalt road pavement (by 19%).

3.40 Over delivery against plan may provide an indication that National Highways’ planning abilities are limited. The company indicated the primary reason for over delivery is due to the secondary benefits of a renewal being realised. For example, a pavement renewal scheme is planned for, but the kerb renewal required as part of the pavement renewal is not recorded within the plan but is reported in the number of renewals delivered. Over delivery in general is a concern and potentially an indication that the needs of the asset portfolio were not adequately known at the planning stage. For example, over delivery could be an indication the asset need is worse than anticipated, or assets are being unnecessarily renewed, and as a result an indication that the company is investing inefficiently in its asset portfolio. CDMT reporting is key to illustrating what schemes are planned and subsequently delivered as part of the renewals programme.

3.41 Figure 3.2 summarises the major life extension renewals volumes that National Highways delivered against its planned commitments in the reporting year. Paragraphs C12 to C17 provide a full summary of renewals delivery.

Figure 3.2 Volumes of major life-extension renewals over or under delivered compared to plan between April 2022 and March 2023

3.42 In the reporting year, National Highways underspent its in-year funding against capital renewals. Overall, the company underspent by £14 million (1.5%). The budget included £36 million of renewals risk reserve; only £22 million was drawn down in year, resulting in the £14 million underspend. This funding will be rolled forward to be utilised when required over the remaining two years of the road period.

3.43 National Highways must deliver key asset renewal volumes in-line with the RIS2 specification, its delivery plans and within its funding. Delivering the RIS2 requirements within funding is an important part of the evidence of performance against the efficiency KPI for all areas of expenditure.

3.44 For renewals, we recognise that focusing mainly on volumes and spend could lead to the company taking a short-term approach in its decision making. This could mean not always renewing the right assets at the right time in their lifecycle or providing a less complex, lower quality renewal. We saw improvements in some but not all areas of National Highways’ renewals practice this reporting year. For example:

- the company provided evidence that it is delivering, on average, asphalt pavement renewals deeper than the average depth levels of 54mm that it was funded to do within RIS2 to achieve reduced whole-life costs. However, there is still work to do to gain assurance about how the depth delivered has been calculated;

- the company started to deliver some more complex full surface reconstruction repairs. However, the largest proportion of delivery was still of ‘life extension’ concrete pavement renewals comprised of localised repairs; and

- slow delivery of renewals in the early part of the reporting year led to higher than planned delivery during the winter months when adverse weather can impact renewal quality.

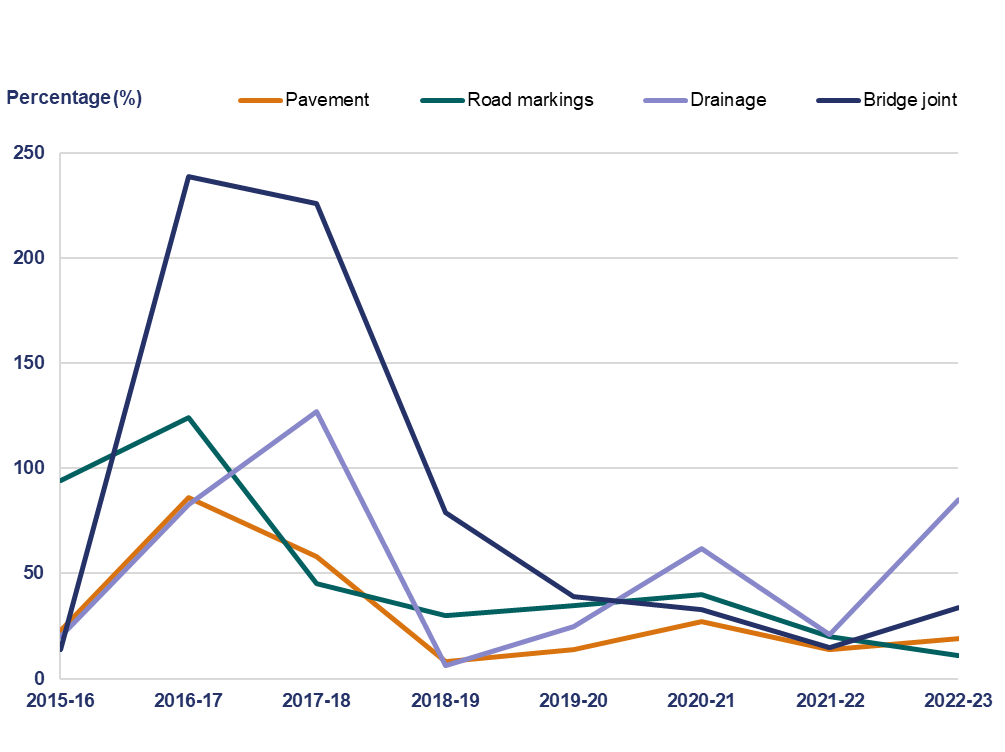

3.45 In our last annual assessment, we reported that National Highways’ delivery of renewals was closer to plan than in the first year of RP2. However, in this reporting year, more assets are reporting to have exceeded 50% delivery variance from the plan. This shows that the company is not yet able to demonstrate its ability to consistently deliver against its plans. Figure 3.3 shows how the company has performed against its delivery plan for a selection of assets since 2015. Whilst it has improved overall, the reporting year highlights a divergence from plans compared to the second year of RP2. Reporting continued divergence against plans provides further potential indication that the company is investing inefficiently in its asset portfolio. We will continue to hold National Highways to account for delivery against its plans to ensure the SRN’s assets are renewed safely and efficiently.

Figure 3.3 Volumes of renewals delivery compared to plan for a selection of assets between April 2015 and March 2023

3.46 It should be noted that in December 2022, National Highways’ delivery volume was below plan for all asset types, with the exception of kerbs. The average under delivery was 39% across all asset renewal types. By March 2023, the company reported an average over delivery of 20%, indicating that a significant volume of renewals were delivered in the last three months of the reporting year.

3.47 In our last annual assessment, we raised concerns that National Highways’ reporting of capital renewals was based on asset volumes renewed against annual delivery plans targets and spend. Whilst this provided us with an indication that work was delivered, it did not tell us whether the work addressed an asset need. Concerned that the company may compromise long-term efficiency and asset sustainability in pursuit of short-term benefits, we challenged it to demonstrate the line of sight, or alignment, between its policy and what is delivered. The company must continue to consistently demonstrate to us evidence of its asset management maturity development. Furthermore, the company should demonstrate its ability to forecast, mitigate risks and plan for changing asset need.

3.48 In July 2022, we made it clear to National Highways that we will hold it to account for delivering the reporting from its new renewals reporting tool (CDMT). In September 2022, the company used this tool to produce its national report showing renewals scheme delivery data across all regions. These deliverables provide us with greater confidence that the company is adopting a best practice approach to managing the lifecycle of its assets. However, it should be noted that in the reporting year, we only received three quarterly reports. That is not sufficient to establish a robust baseline performance level because it does not capture delivery seasonality. To ensure that we reach that position as soon as possible, we will continue to work with the company to support the further development and maturity of its reporting. A full year’s worth of data will allow us to robustly use this data in holding the company to account for the efficient delivery of its renewals programme.

3.49 RIS2 requires National Highways to report asset performance against a range of metrics, see paragraphs C1 to C17 for further detail. This gives us an indication of the volume of maintenance and renewal activities carried out on the SRN and the impact the activities have delivered. However, the company continues to report only limited aspects of performance and does not include all asset types. For example, the renewal of safety barriers is funded in RIS2 as part of the major life extension renewals programme, yet the performance of barriers is unknown. In this reporting year, the company reported an under delivery of 21% less concrete safety barriers than it had planned. However, this does not tell us about the impact on the SRN, for example whether road user safety is impacted.

Maintenance

3.50 National Highways reports maintenance performance against a range of metrics covering core maintenance activities, defect management, asset inspection and insurance claims.

3.51 In the second year of RP2, National Highways reported that it continued to improve its cyclical and reactive maintenance performance. However, in this reporting year, the company’s performance deteriorated. National Highways failed to address high priority defects across most defect types within its 24-hour target. Furthermore, its performance in addressing normal defects within required timescales decreased across most defect types. National Highways only addressed 62.5% of drainage and service ducts defects within the required timescale.

3.52 National Highways indicated that the impact on the SRN as a result of deteriorating maintenance performance is due to issues in transferring to the Asset Delivery contract model in the Yorkshire and North East, South East and Midlands regions. Last year we identified concerns that lessons learned from earlier transfers did not enable a smoother contract mobilisation and this trend continues into this reporting year, the company must embed the lessons it has learned.

3.53 National Highways spent £462 million on operations and maintenance in the reporting year. This was £42 million (10%) more than planned. The company overspent £31.6 million against routine maintenance due to unanticipated inflationary pressures, increased incidents and increased maintenance requirements following Asset Support Contracts transferring to the Asset Delivery contract model.

3.54 The company also paid £25 million relating to maintenance of detrunked sections of the former A14, following the completion of the A14 Cambridge to Huntingdon enhancement scheme. This is a handover payment agreed with Cambridgeshire County Council as set out in the scheme’s planning consent. This contributed to the overspend.

3.55 These overspends were offset slightly by underspends against pay where there was slower than expected recruitment. The company also received £17.3 million of additional income from a third party scheme.

Efficient delivery of the renewals programme

3.56 In our last annual assessment, we reported that National Highways had been unable to provide us with sufficient confidence that what it was delivering through its maintenance and renewals programmes is evidentially linked to its asset management policy. The company proposed to use a reporting mechanism to demonstrate renewals scheme delivery and the reasons for scheme changes using a new computer-based tool, the Capital Delivery Management Tool (CDMT). In September 2022, the company produced its national report showing renewals scheme delivery data across all regions; we received quarterly reporting in September 2022, December 2022 and March 2023.

3.57 The report shows the number of renewals schemes the company planned to deliver and by summarising changes to schemes across each region it supports our understanding of National Highways’ asset management approach. However, the maturity of reporting is limited. A total of 182 schemes (31%), were categorised as ‘other’ when reporting the reason for scheme change.

3.58 We will continue to scrutinise the new renewal reporting tool (CDMT) to support how we hold the company to account for its efficient management of its asset portfolio and establish a robust baseline of performance over the longer-term.

3.59 Last year we highlighted the importance of performance reporting beyond the data provided against RIS2 performance specification metrics. We want to be able to better assess the health of all of National Highways’ assets and to understand the impact of the asset interventions (renewals or maintenance) that the company delivers. We will work with National Highways to establish asset performance reporting to support the company’s ability to demonstrate the health of all its assets.

Design, build, finance and operate (DBFO) contract hand back

3.60 There are 11 routes across the SRN that are managed by private finance initiatives (DBFO contracts); eight of these will come to an end in RP3 and the routes will be handed back to National Highways on the following dates:

- M1-A1 Link Lofthouse to Bramham – 25 March 2026

- A1(M) Alconbury to Peterborough – 31 March 2026

- A417/A419 Swindon to Gloucester – 31 March 2026

- A69 Carlisle to Newcastle – 31 March 2026

- A50 Stoke to Derby – 30 June 2026

- A30/A35 Exeter to Bere Regis – 30 September 2026

- M40 Denham to Warwick – 5 January 2027

- A19/A168 Dishforth to Tyne Tunnel – 23 February 2027

3.61 There are various requirements set out in DBFO contracts to manage the hand back process. National Highways reported that the hand back programme is on track and that DBFO data for inclusion in RP3 will be included as part of RIS3 metrics. The company has reported it met the first key date of the first inspection and the exchange of hand back reports to determine the condition of pavements and structures for contract compliance. We will continue to examine how the company manages the transfer process in the following reporting year.