National Highways did not meet its revised 2022 delivery plan enhancements commitments. The company agreed substantial changes to its commitments with government because of reasons outside its control, such as statutory planning delays. However, it also missed four of its 21 in-year commitments because of factors within its control. Forecast costs have increased due to delays and inflation. As a result, the company faces ongoing risks to delivery for the remainder of the second road period. It must continue to demonstrate to us that it is improving its capability to deliver, learn, and appropriately assess and mitigate its risks.

The second road investment strategy enhancements portfolio, as published in 2020, has significantly changed and it is unlikely that the expected user benefits will be realised in the intended timescales.

2.1 National Highways did not meet all of its revised 2022 delivery plan start of works (SOW) and open for traffic (OFT) commitments.

2.2 Some of National Highways’ unachieved commitments were due to reasons beyond its control, such as statutory planning delays. The company used formal change control processes to agree with government new delivery date commitments for these schemes.

2.3 However, some of National Highways’ unachieved commitments were due to factors government deemed to have been within the company’s control and have been recorded as missed commitments. For its commitments due in the reporting year, the company missed one of its nine SOW commitments and three of its 12 OFT commitments. In total for the second road period (RP2), there have been seven schemes that have been classified as missed commitments (two for SOW, three for OFT and two schemes declared that they will miss their OFT commitments). Information provided by the company suggests that the majority of these missed commitments are as a result of procurement issues, specifically linked to supply chain management and commercial contract management. We are seeking action from the company to ensure that it learns lessons and embeds them into its business.

2.4 Since the start of RP2, we have seen several risks affect National Highways’ delivery of its enhancements portfolio and its ability to achieve its SOW commitments. We anticipate that these risks will continue for the remainder of RP2 and beyond. The key risks to portfolio delivery over the reporting year were:

- schemes gaining planning consent, in particular development consent orders (DCOs). Several schemes had legal challenge. The key reasons for the challenges were around the consideration of cumulative carbon for the portfolio and localised environmental concerns. Whilst these issues are likely to be outside of National Highways’ control, they cause scheme programme delay that could require the company and government to agree further changes to the delivery plan. We will continue to hold the company to account to deliver any revised commitments; and

- National Highways forecasts that the total outturn costs for delivering the second road investment strategy (RIS2) enhancements portfolio rose by 13% (from £25,388 million to £28,613 million) in the reporting year. This was primarily caused by delays and inflation. The company, in-line with a DfT ministerial statement, has mitigated the cost pressure on the RP2 budget by moving the delivery of some schemes into the third road period (RP3). These scheme delays and rescheduling have meant that the company underspent its capital budget in the reporting year. However, in-line with its governance, it moved £357 million (10%) of funding into later years of RP2 to align with anticipated construction programmes.

RIS2 enhancements portfolio overview

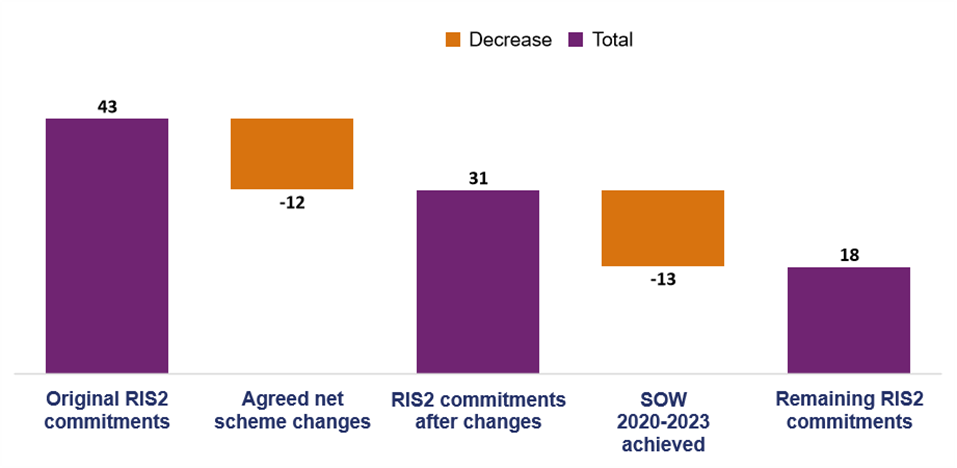

2.5 At the start of RP2, National Highways committed in its 2020-2025 delivery plan to:

- achieve SOW on 43 RIS2 schemes;

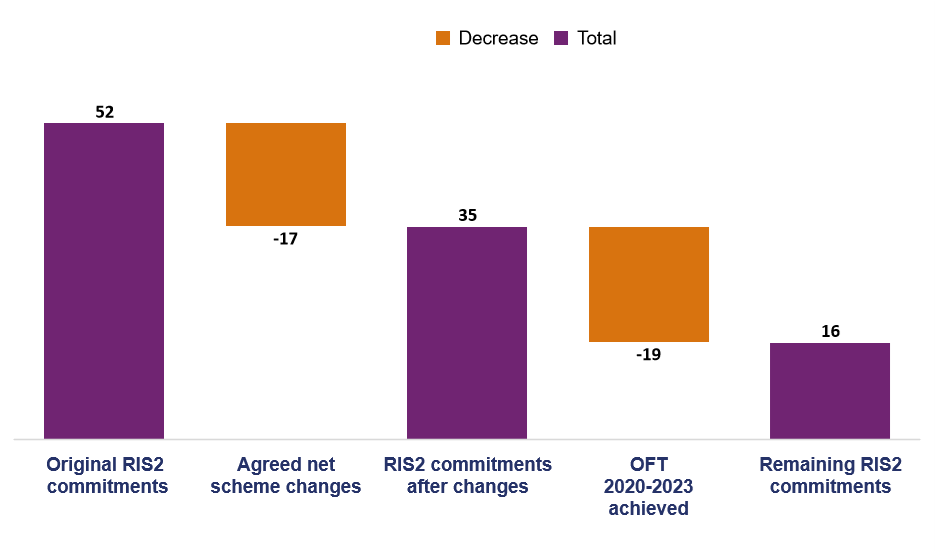

- achieve OFT 52 RIS2 schemes; and

- support the delivery of nine third party and Housing Infrastructure Fund (HIF) scheme commitments. As National Highways is not delivering these schemes they are not included in this assessment’s analysis.

2.6 By the end of the reporting year, National Highways had:

- SOW 13 RIS2 schemes;

- agreed with government a net reduction of 12 SOW commitments (one scheme accelerated from the third road investment strategy (RIS3) pipeline, one scheme cancelled due to poor value for money (VfM), nine smart motorways programme (SMP) schemes cancelled and three* schemes changed to RP3 SOW);

- OFT 19 RIS2 schemes; and

- agreed with government a net reduction of 17 OFT commitments (one accelerated from RIS3 pipeline, seven SMP pre-construction schemes cancelled, two SMP schemes already under construction cancelled, two schemes that missed their OFT commitment rescheduled to RP3 and seven* schemes changed to RP3 OFT).

*Excluding the addition of A47 Great Yarmouth Vauxhall Junction to the portfolio. Government agreed that the scope of the original A47 Great Yarmouth Junctions scheme should be split into two projects - A47 Great Yarmouth Harfreys Junction and A47 Great Yarmouth Vauxhall Junction to enable progress of the overall Great Yarmouth improvements which includes the Third River Crossing being delivered by Norfolk County Council.

2.7 For the remaining two years of RP2, the company has a commitment to achieve:

- 18 RIS2 schemes SOW; and

- 16 RIS2 schemes OFT. This does not include the Mottram Moor Link Road and A57 Link Road scheme as this was originally a RP3 OFT commitment.

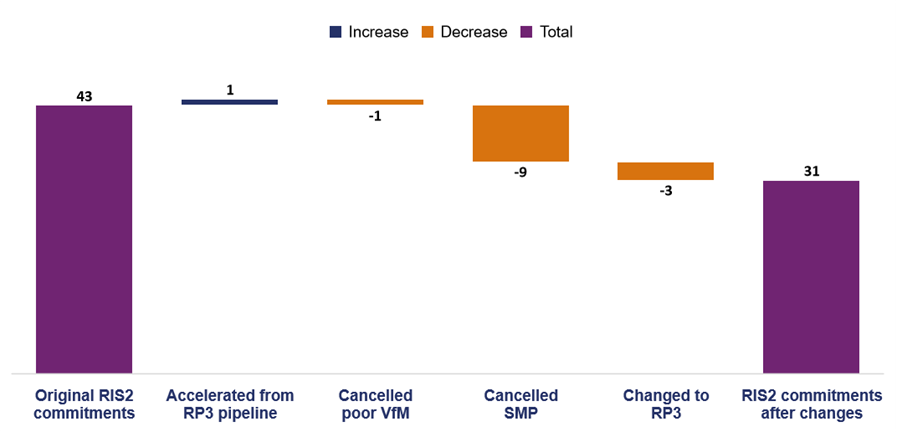

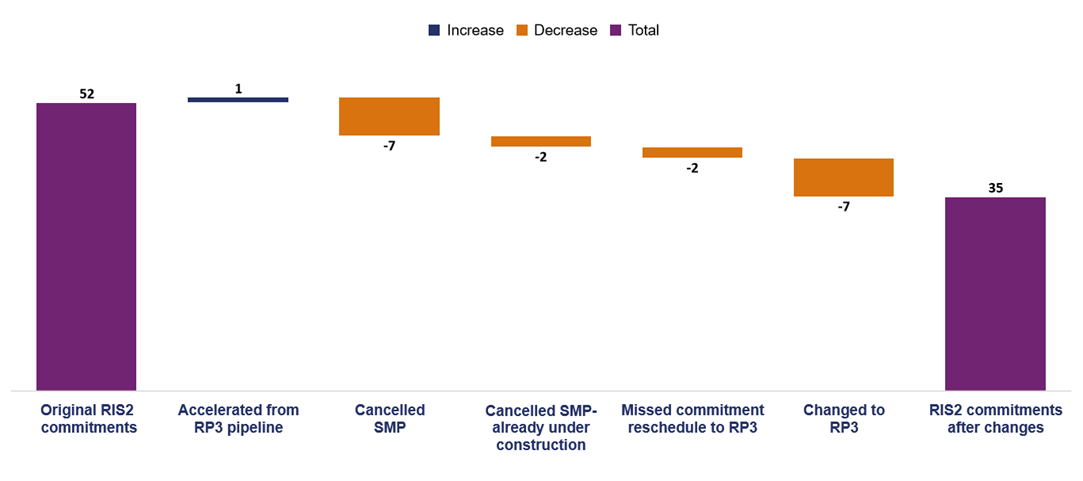

2.8 Figures 2.1 and 2.2 show the remaining RIS2 commitments. Further detail can be found in Tables B1 to B8. Paragraphs 2.33 and 2.34 show the impact of these changes on the original commitments.

Figure 2.1 RIS2 SOW commitments at end of third year of RP2

Figure 2.2 RIS2 OFT commitments at end of third year of RP2

2.9 Of the remaining RIS2 commitments, nine SOW and four OFT commitments have not been allocated revised dates yet. These dates will be determined following the outcomes of DCO decisions and legal challenges. The four OFT commitments exclude the Mottram Moor Link Road and A57 Link Road scheme as this was originally a RP3 OFT commitment.

2.10 If a change or delay to the delivery of RIS2 or delivery plan commitments is primarily a result of something within National Highways’ control, the change will normally be classed as a missed commitment. In RP2 to date, the company has reported seven missed commitments. Four of these missed commitments were in this reporting year. These figures exclude the A417 Air Balloon scheme which the company had declared as a missed commitment but has since recovered and met its original SOW commitment.

2.11 Commitment changes agreed with government reduced the number of schemes that will SOW and OFT during RP2. This means there will be less enhancement construction in the remainder of RP2 with these works moving into RP3 and beyond.

2.12 The reduction in the delivery of the enhancement programme will result in the original programme benefits not being realised in this road period. This may have a negative impact on road users experiencing congestion and increased levels of delay on the network.

2.13 The forecasted cost of delivering RIS2 enhancements increased significantly during the reporting year due to high inflation and scheme delays. However, in RP2, forecast costs remained broadly static due to inflation being offset by several schemes that had construction take place later than planned. The cost impact is greater for RP3, as inflation and scheme schedule delay mean some challenging decisions will be required.

2.14 RIS2 contains four third party schemes and five HIF schemes, which National Highways is required to support, and they are not included in this assessment’s analysis. These schemes are associated with both commercial and residential developments. However, the HIF specifically targets unlocking housing developments. Table B9 lists the status of these schemes.

Key challenges for RP2 delivery

2.15 Our key message reflects that the substantial change in the RIS2 enhancement portfolio has affected National Highways' ability to achieve the enhancement portfolio benefits. These changes are a consequence of several challenges including:

- obtaining planning consent;

- government's response to the Transport Select Committee (TSC) recommendations on the roll-out and safety of smart motorways;

- higher inflation than originally planned for; and

- achieving the VfM threshold.

2.16 We will set out how each challenge has affected the company's ability to deliver its enhancements programme.

Planning consents

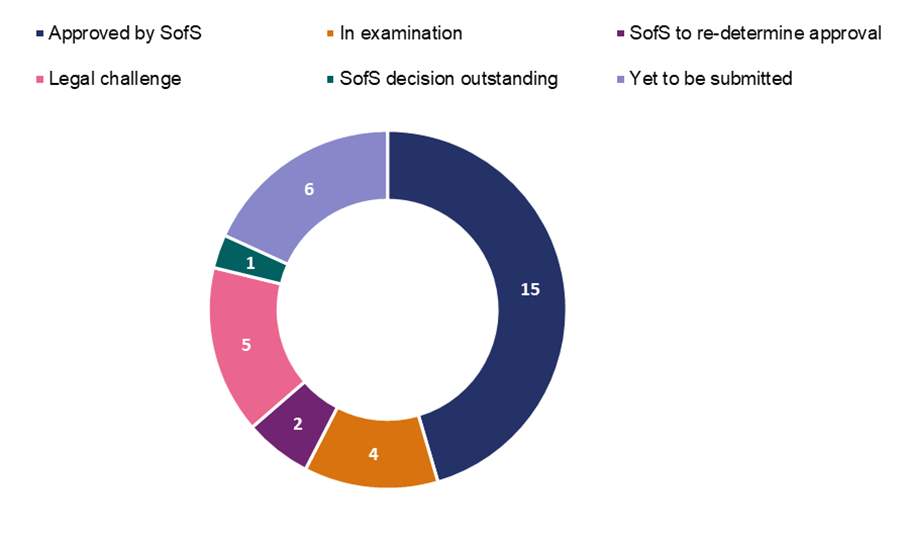

2.17 The original RIS2 portfolio had 33 schemes that required a DCO. At the end of March 2023, 15 had been approved by the Secretary of State (SofS) without legal challenge, 13 of which have started work.

2.18 Of the remaining SOW schemes yet to receive consent, 18 are at different stages of the DCO process. We consider schemes which require a DCO to be approved are at risk until the legal challenge period has elapsed. However, National Highways only considers that 12 of these schemes are at risk of meeting their SOW commitments.

2.19 Figure 2.3 shows the status of DCO applications and decisions at the end of the third year of RP2. Table B10 provides more detail on each scheme.

Figure 2.3 Status of schemes that require a DCO

2.20 During the reporting year, National Highways planned to submit seven DCO applications. Of these applications:

- four were submitted (Lower Thames Crossing, M3 Junction 9, A12 Chelmsford to A120 and A66 Northern Trans-Pennine);

- one was delayed to allow the SofS sufficient time to assess the scheme (A358 Taunton to Southfields);

- one was delayed to ensure that its design did not breach the government’s commitment to TSC’s recommendations to not to introduce any new All Lane Running (ALR) sections of Motorway (M60/M62/M66 Simister Island Interchange); and

- one has been deferred until RP3 (A27 Arundel Bypass).

2.21 The SofS approved ten National Highways DCOs in this reporting year. Five have subsequently been legally challenged. The risk of decisions being challenged is now greater than the risk of not being consented.

Government response to the rollout and safety of smart motorways programme (SMP)

2.22 In January 2022, government paused the roll-out of 11 RP2 ALR smart motorways schemes. On 15 April 2023 government announced that all smart motorways schemes not yet in construction will be cancelled due to financial pressures and lack of confidence felt by drivers. This cancellation consists of the 11 schemes already paused and three schemes scheduled for construction during RP3. Table B11 lists the status of the SMP.

2.23 Two smart motorway schemes already in construction will be completed and converted into ALR smart motorways (M56 Junctions 6-8 and M6 Junctions 21A-26).

2.24 National Highways will continue to manage and improve existing ALR sections of the strategic road network, including:

- improving stopped vehicle detection (SVD) performance;

- improving the performance of operational technology;

- delivering TSC commitments, including its national emergency area retrofit (NEAR) programme; and

- continuing to monitor, analyse and publish data relating to the safety performance of smart motorways.

Higher inflation than originally planned for

2.25 National Highways experienced increased enhancements costs in the first three years of RP2 and in its forecast for RP3. This is primarily due to the impact of planning delays. However, in this reporting year, the company was exposed to a higher level of inflation than was expected and funded for within RIS2. This is discussed further in paragraphs 2.54 to 2.69.

Achieving the VfM threshold

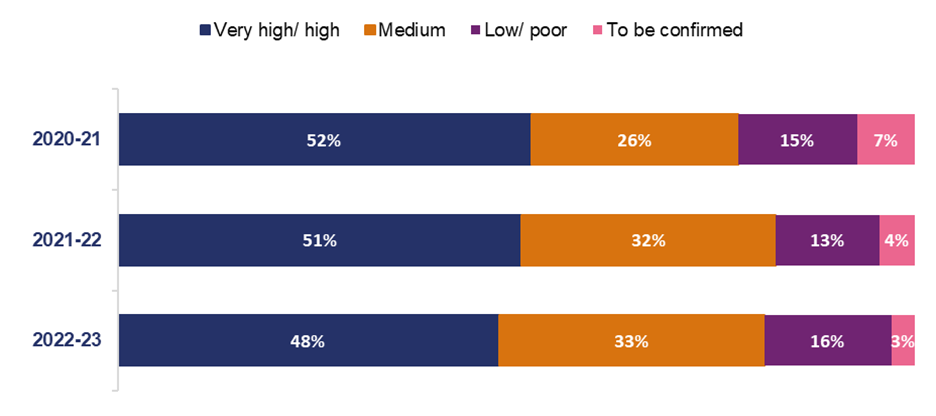

2.26 The enhancements portfolio VfM assessment for the reporting year shows that 48% of the portfolio is considered to have a very high or high VfM assessment.

2.27 There are 11 schemes identified as having a low or poor VfM rating, with one scheme cancelled due to its poor VfM assessment (A5 Dodwells to Longshoot). Of the 11 schemes, eight are regional investment programme (RIP) schemes, two are complex infrastructure programme (CIP) schemes and one is a SMP scheme).

2.28 National Highways will undertake further analytical assurance of these schemes as they progress through the options and development stages. We will assess the impact of low or poor VfM status on portfolio commitments in the next reporting year. Figure 2.4 shows variation to VfM for the enhancement portfolio.

Figure 2.4 RIS2 enhancement portfolio VfM during RP2

Case study: A417 Air Balloon - DCO stakeholder engagement

A large number of National Highways’ enhancement schemes require a Development Consent Order (DCO). The process requires extensive consultation with stakeholders. Effective management of the process is key to reducing risks to delivery of the RIS2 programme. This case study demonstrates the scale of engagement required to mitigate the risk.

National Highways is improving the section of the A417 which links the Brockworth bypass and Cowley roundabout in Gloucestershire. The scheme has many environmental and engineering challenges. It’s within the Cotswolds Area of Outstanding Natural Beauty (AONB), and the scheme is a “Nationally Significant Infrastructure Project” under the Planning Act 2008. This means that the scheme requires a DCO.

Given the environmentally sensitive nature of the scheme, the company needed to work closely with key stakeholders, including the Cotswolds Conservation Board, National Trust and Gloucestershire Wildlife Trust. The scheme was developed in collaboration with a strategic stakeholder panel (three main conservation groups and three local authorities) to advise and guide the scheme.

The company produced six options, but only two provided VfM. Responses to these options were collated in 2018. Over 2,000 people attended scheme events and 1,958 responses were received via questionnaires (online and freepost), email and letters. In 2019, consultation took place on the preferred route and its outline design. The consultation events were attended by 1,520 people, with approximately 1,000 responses received.

The Coronavirus (COVID-19) pandemic created a new risk for face-to-face consultations. In response, and to ensure that the scheme remained on target to start work, the company used alternative methods, for example, a virtual exhibition, webinars, live web chats and access to telephone call back.

National Highways worked with the Planning Inspectorate before submitting the DCO application. While the iterative cycle of consultation and engagement with stakeholders during the pandemic was challenging, National Highways took positive steps to overcome these challenges. The consultation and planning process took four years and despite these challenges the scheme was approved and started work on time in February 2023.

Changes to the RIS2 portfolio

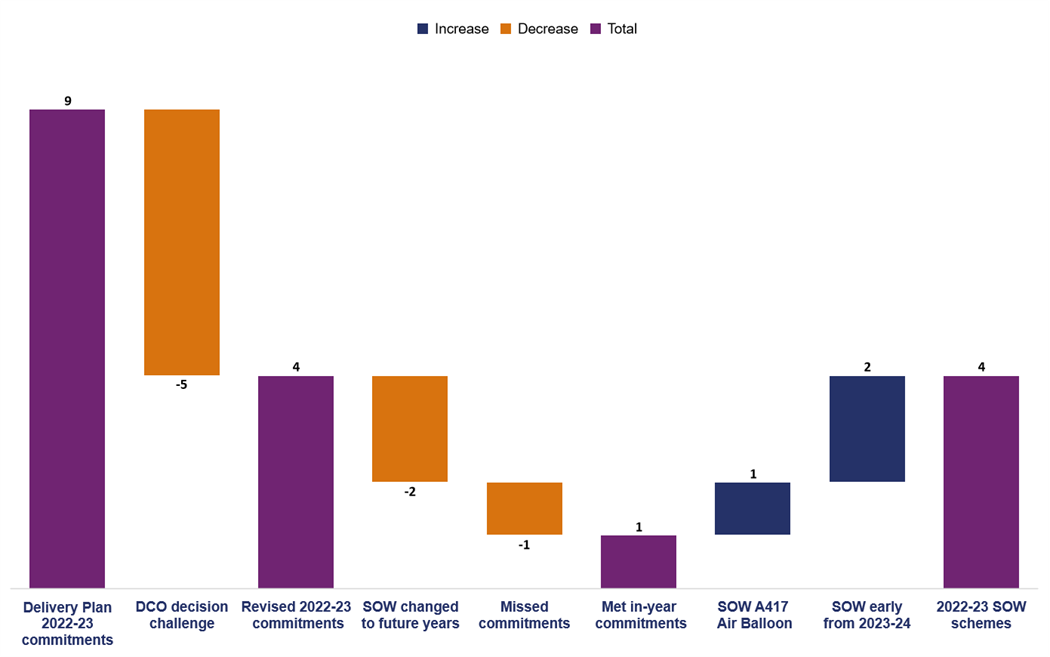

2.29 Figure 2.5 shows government agreed changes to SOW commitments. RIS2 listed 43 schemes committed to achieve SOW during RP2. During the first three years of RP2, government agreed to reduce the number of schemes committed to 31 schemes. This does not include two SMP schemes (M3 Junctions 9 to 14 and M40/M42 interchange) that had already started work and were subsequently cancelled.

Figure 2.5 Government agreed changes to SOW commitments

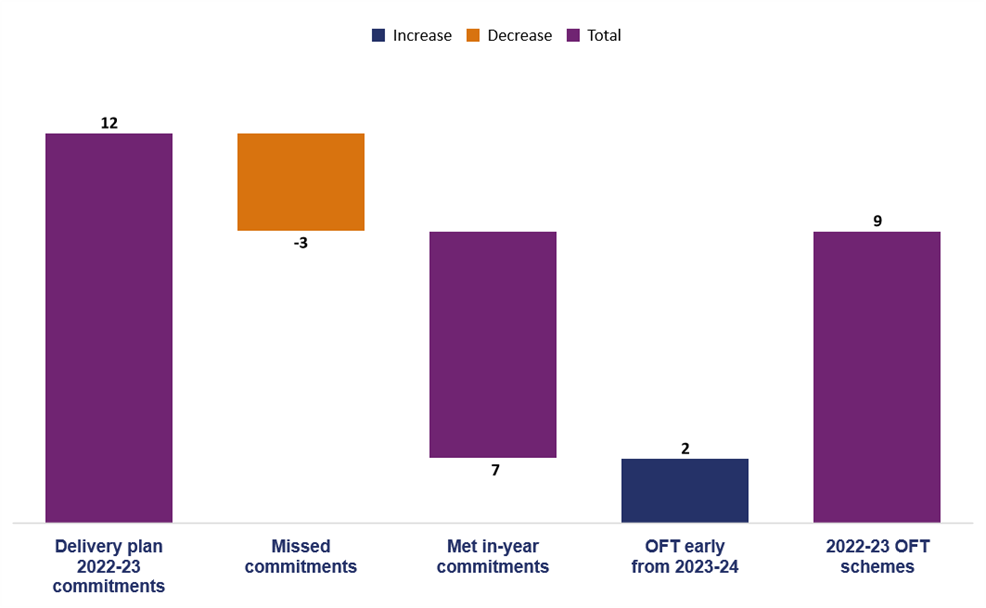

2.30 Figure 2.6 shows RIS2 listed 52 schemes committed to OFT in RP2. During the first three years of RP2, government agreed to reduce the number of schemes committed to 35 schemes.

Figure 2.6 Government agreed changes to OFT commitments

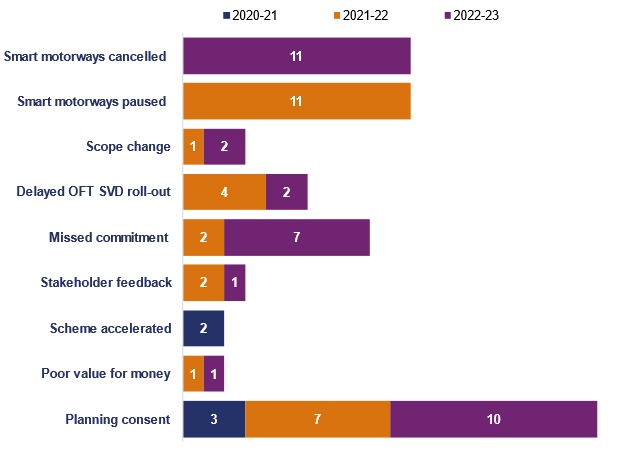

2.31 The total changes to the RIS2 enhancement portfolio (changes to the number of schemes committed in RP2 and changes that affect the schemes within RP2) led to 67 enhancement scheme changes. During RP2, government agreed five changes in the first year, 28 changes in the second year and 34 changes in the third year. Figure 2.7 shows the different reasons for these changes. Table B12 provides further details about the changes and reasons for the changes.

Figure 2.7 Government agreed changes to RIS2 enhancement schemes by reason

2.32 Government agreed to split the A47 Great Yarmouth Junctions scheme into two schemes (A47 Great Yarmouth Harfreys Junction and A47 Great Yarmouth Vauxhall Junction) to enable progress of the overall Great Yarmouth improvements scheme (including the Third River Crossing being delivered by Norfolk County Council).

2.33 The A47 Great Yarmouth Harfreys Junction will achieve SOW and OFT in RP2, whilst the A47 Great Yarmouth Vauxhall Junction is scheduled for delivery in RP3.

Risks to the delivery of the RIS2 portfolio

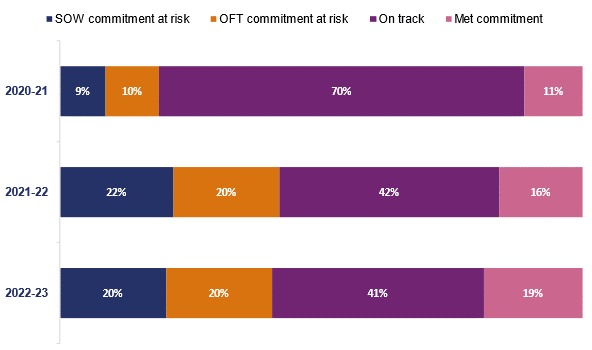

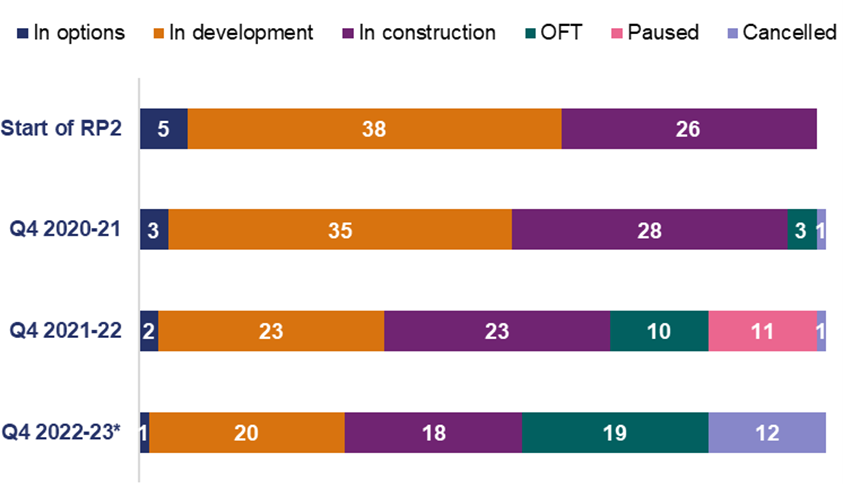

2.34 Despite the significant number of risks being mitigated through government agreed changes, the proportion of risks to the portfolio have increased compared with the start of RIS2. We would have expected the risk to the portfolio to reduce as the schemes are progressed through the development stages and identified risks being mitigated. Figure 2.8 shows our analysis of the changes to the portfolio risk profile across the first three years of RP2.

Figure 2.8 RIS2 enhancement scheme commitments status

2.35 We are concerned that the risks National Highways faces will continue in the next reporting year and beyond. This could ultimately impact the delivery of RIS2 key performance indicators (KPI) and portfolio road user benefits. The company must demonstrate that it has robust risk mitigations in place to minimise slippage to its programme. We will hold the company to account for the delivery of its commitments, reporting of early warnings and risk mitigations.

Missed commitments

2.36 As at March 2023, National Highways reported that seven committed schemes in its delivery plan are classified as missed commitments. The company has:

- missed two SOW commitments;

- missed three OFT commitments; and

- declared that two schemes will miss their OFT commitments.

2.37 In the last reporting year, National Highways reported that the A417 Air Balloon scheme would not achieve its SOW commitment in this reporting year and we reported it as a missed commitment. However, the company recovered this position and achieved SOW as per its original commitment. Therefore, we no longer consider this scheme to be a missed commitment.

2.38 We have seen evidence that National Highways is applying learning to improve its delivery performance and that is true in the case of some missed commitments. Additionally, the company has examined the causal factors for its missed commitments. Based on that information, we have determined that the key themes for the missed commitments since the start of RP2 were:

- project management capability;

- commercial and procurement capability;

- asset data quality;

- technical and asset management knowledge capability; and

- supply chain management capability.

2.39 Table B13 lists the schemes that missed their commitments during RP2.

Performance of enhancements delivery in the reporting year

2.40 Since the start of RP2, National Highways progressed schemes through its project lifecycle stages. It continued to develop and deliver a steady volume of schemes to start construction and has not focussed only on construction activities.

2.41 In this reporting year, National Highways progressed RIS2 schemes through its project control framework process, as shown in Figure 2.9.

Figure 2.9 Progress of enhancement schemes during RP2

* These numbers exclude the A47 Great Yarmouth Vauxhall Junction scheme

SOW commitments delivery performance

2.42 National Highways’ 2022 delivery plan committed the company to achieve SOW on nine schemes. In the reporting year:

- five schemes were affected by legal challenges to the DCO and will not meet their commitments. They are proceeding through the change control process (A47 North Tuddenham to Easton, A47 Thickthorn Junction, A47 Blofield to North Burlingham, A428 Black Cat to Caxton Gibbet and Mottram Moor Link Road & A57 Link Road);

- two schemes have been changed and will start in future years; one scheme was affected by the SofS’s DCO decision delay (A47 Wansford to Sutton) and has an agreed change of SOW to the next reporting year; and one scheme had its SofS DCO decision postponed until September 2023 and will therefore not start as scheduled (A1 Morpeth to Ellingham). Its SOW commitment is to be confirmed by government;

- one scheme missed its SOW commitment and a new commitment date is to be agreed with government (M54-M6 Link Road);

- one scheme met its SOW commitment (M25 Junction 10);

- one scheme (A417 Air Balloon) started work and met its original RIS2 commitment (March 2023) having previously been declared as a missed commitment; and

- two schemes scheduled for SOW in the fourth year of RP2 started early (A47 Great Yarmouth Harfreys junction and M25 Junction 28);

2.43 Figure 2.10 shows the progress made in delivering the SOW commitments for this reporting year. Table B14 lists scheme’s SOW status for the reporting year.

Figure 2.10 SOW delivery for the reporting year April 2022 to March 2023

OFT commitments delivery performance in the reporting year

2.44 National Highways’ 2022 delivery plan committed the company to OFT 12 schemes. In the reporting year:

- three schemes missed their commitments (M6 Junctions 21A-26, M56 Junctions 6-8, and M6 Junction 10);

- seven schemes met their commitments (A1 Scotswood to North Brunton, M6 Junctions 13-15, M1 Junctions 13-19, M4 Junctions 3-12, M27 Junctions 4-11, A2 Bean and Ebbsfleet, and A27 East of Lewes Package); and

- two schemes OFT ahead of their in-year schedule (M25 Junction 25 and A31 Ringwood).

2.45 Figure 2.11 shows the progress made in delivering the OFT commitments for this reporting year. Table B15 lists OFT schemes status for the reporting year.

Figure 2.11 OFT delivery for April 2022 to March 2023

Enhancements delivery for the remainder of RP2

2.46 National Highways has worked to mitigate risks to its SOW commitments, but it still faces significant challenges both within and outside of its control, for example, achieving timely DCO approvals. Failure to successfully mitigate risks will likely result in the company requiring government approved changes or missing commitments and therefore starting work on more schemes later in RP2 or deferring works into RP3. This will mean some expected user benefits will not be fully realised in RP2.

Capability and capacity to deliver RIS2 enhancement portfolio

2.47 National Highways is taking positive steps to build the capability of its major projects directorate that delivers enhancements. The company established a major projects knowledge team to work across the enhancement programme to create a consistent approach to capturing, sharing and applying knowledge from scheme delivery to drive improvements. The company has initiated a broad framework of initiatives for deployment and use in RP2 that will drive capability improvements and efficiency in RP3. These initiatives include:

- single view of the customer: to establish a single common workflow for all capital projects across the business;

- delivering efficient projects: to improve value, reduce waste, optimise resources through improved contracting;

- innovation reapplied: to deliver projects with a focus on innovation, repetition and best practice to drive project productivity;

- net zero carbon: efficient delivery of low carbon assets; safer, quicker, cheaper and predictable; enable shorter construction; and

- digital by default: to create capabilities to deliver projects digitally end-to-end.

2.48 The number of missed commitments in RP2 has necessitated interventions by National Highways to improve deliverability and tackle the issues causing missed commitments. We worked with National Highways to understand the reasons behind the missed commitments. National Highways concluded that there are capability issues and has put in place a change plan to look at gaps in its capability and how to bridge these gaps.

2.49 We have been working with the company to assess how lessons are captured and shared, through the knowledge management initiative. We have established that the company has been taking positive steps to capture and share knowledge by:

- creating a team to work across the enhancement programme;

- creating a lessons learned log and knowledge portal; and

- having better engagement with the business to encourage knowledge sharing.

2.50 National Highways must demonstrate it is improving its capability to deliver, learn and appropriately assess and mitigate its risks. The company must provide us with assurance that processes for capturing learning and challenges are embedded in the business and are proactively acted on. We will continue to work with National Highways to assess progress and hold the company to account to enhance its capabilities and deliver the enhancements portfolio.

Enhancement scheme benefit realisation

2.51 In order for National Highways to understand if it is delivering its capital investment efficiently and successfully, including for its enhancement schemes, the company must have robust benefit realisation processes that:

- Identify and assess whether the expected benefits of capital schemes and programmes have been realised;

- assess how wider transformational work regarding capability development and maturity are impacting delivery; and

- apply lessons learned that improve delivery of current and future enhancement schemes and programmes.

2.52 An important process that National Highways uses to assess benefits achieved by its enhancement schemes are post opening project evaluations (POPEs). The company’s programme of publishing POPE reports is behind schedule. We have challenged the company to produce a robust and deliverable plan to publish POPE reports. In the next reporting year, we will scrutinise National Highways for the delivery of its POPE programme for the rest of RP2.

RIS2 enhancements financial performance

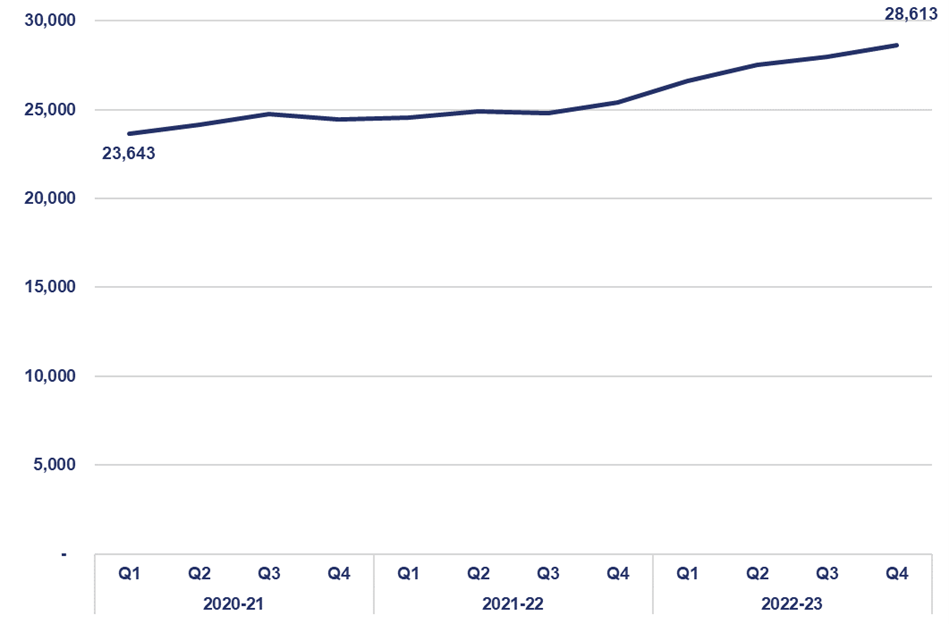

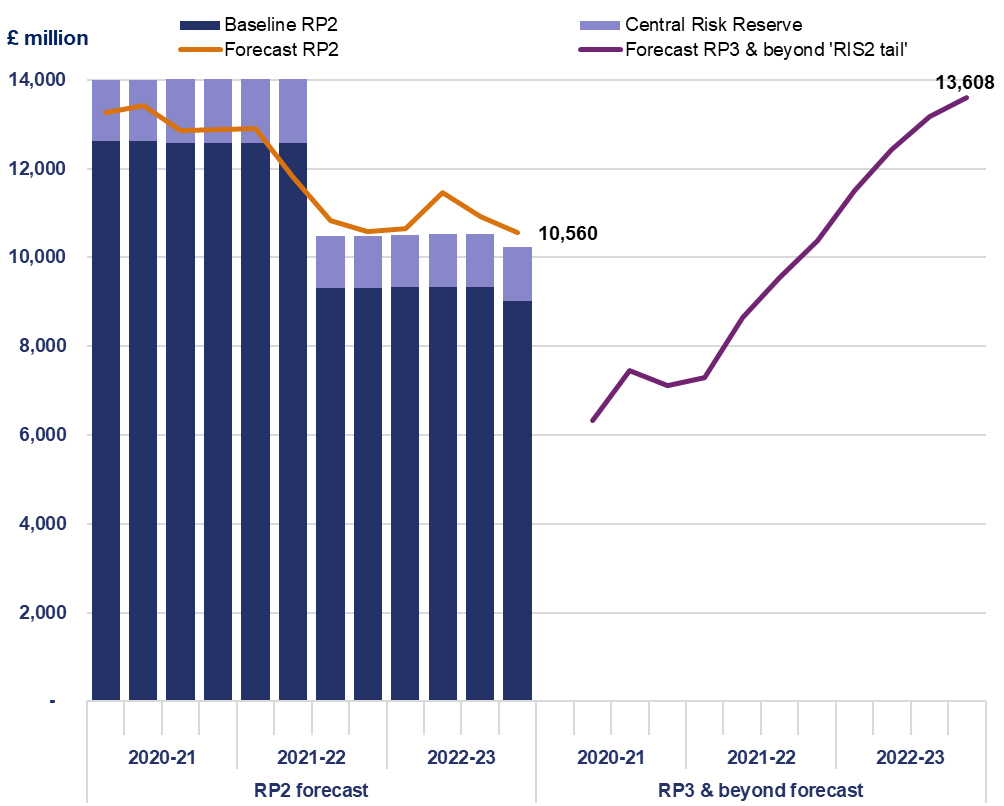

2.53 At the start of RP2, the expected cost of enhancements (schemes and other costs) was £23,643 million. As shown in Figure 2.12, this has since increased by 21% (£4,969 million) to £28,613 million. In this reporting year, the increase was 13% (£3,225 million). The figures exclude National Highways’ latest assessment of inflation impacting enhancements in RP3 that could add a further £600 million approximately to total capital costs.

Figure 2.12 RIS2 enhancements forecast cost since April 2020 (£ million)

2.54 On 15 April 2023 government announced the cancellation of all smart motorway schemes that were not already in construction. The overall cost increase for enhancement schemes, after excluding these smart motorway schemes, was 22.9% (£4,746 million). Cost increases have been caused by planning delays for large complex schemes throughout RP2 and more recently the impact of high inflation in this reporting year.

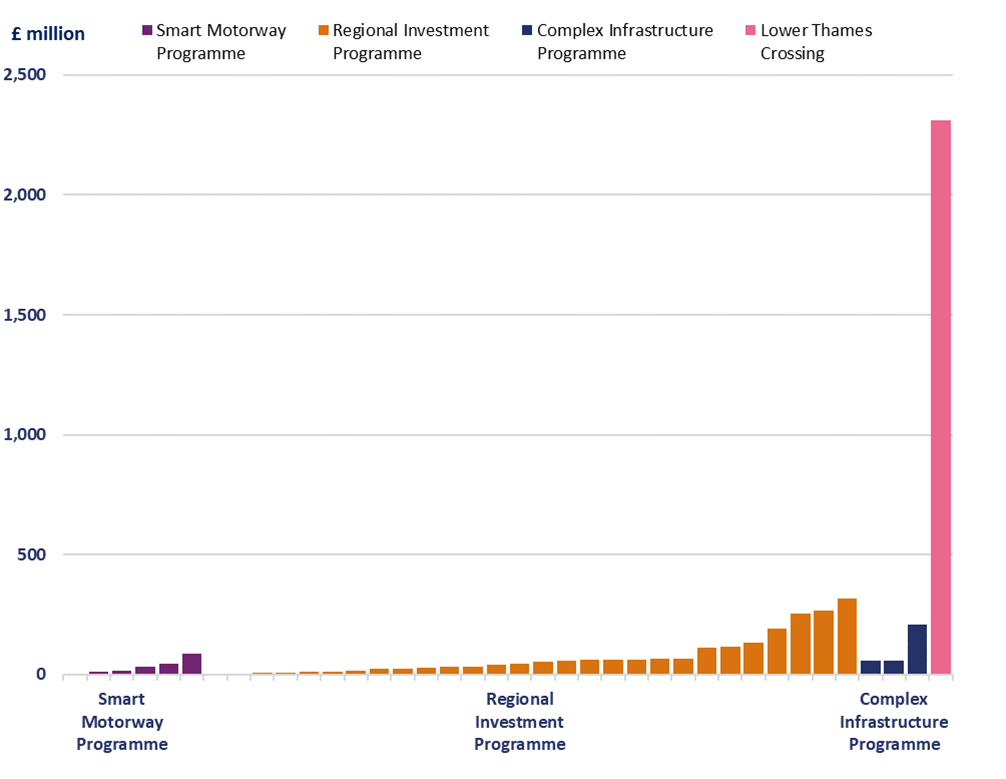

2.55 As shown in Figure 2.13, the Lower Thames Crossing (LTC) scheme had the largest forecast cost increase, of £2,312 million (39%) to £8,305 million. The increase was partly driven by the impact of inflation, additional land requirements, DCO related costs and other operating costs. However, other schemes have also seen large changes.

Figure 2.13 Change in forecast cost for large enhancement schemes (greater than £100m) since April 2020 (£ million)

2.56 Overall, the Complex Infrastructure Programme increased by 8% (£323 million). The Regional Investment Programme has increased by 23% (£1,925 million) and Smart Motorway Programme by 8% (£187 million).

2.57 Costs have decreased for some schemes where scope has been reduced. These include cancelled smart motorway schemes.

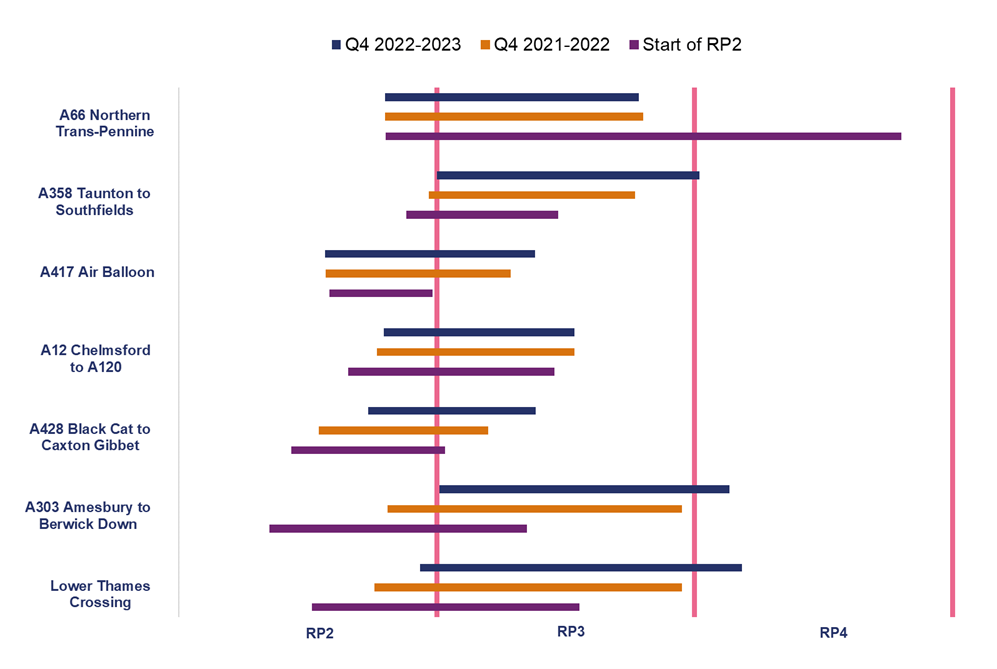

2.58 Figure 2.14 shows how planned construction periods have changed for large and complex schemes due to start construction in RP2. In most cases delays have been caused by difficulties in gaining planning consent.

Figure 2.14 Construction periods for large and complex schemes due to start construction in RP2

2.59 The A66 Northern Trans-Pennine scheme received £145 million of additional funding during RP2 to accelerate its construction period. However, its forecast cost increased by £318 million since the start of RP2. In March 2023 government announced a rephasing of the LTC scheme and the deferral of the A27 Arundel and A5036 Princess Way schemes to RIS3. National Highways has not yet reflected this change in its reporting because revised commitment dates have not yet been set by government.

2.60 The impact of inflation on National Highways’ costs is difficult to separate from other factors such as delay and productivity effects due to the Coronavirus (COVID-19) pandemic. The company's RP2 scheme forecasts include the impact of inflation from April 2020 to March 2023. It has also included a further £500 million within its overall enhancement RP2 cost forecast for expected inflation that is not yet in scheme forecasts. The causes and impacts of inflation on National Highways’ costs are discussed further in paragraph 1.25.

2.61 National Highways’ cost forecasts for RIS2 enhancements (that OFT in RP2 or RP3) are increasing over time. Additionally, the delays to large schemes mean there is also a trend of these costs moving from RP2 into RP3.

2.62 Figure 2.15 shows that RP2 forecast costs for enhancements have been reducing in RP2 and government removed £3,496 million of National Highways RIS2 funding in the previous reporting year. For RP3 and beyond the cost commitments of enhancements announced in RIS2 (the ‘RIS2 tail’) have increased due to slippage and inflation.

Figure 2.15 Enhancement cost forecasts for RP2 and ‘RP3 & beyond’ since April 2020 (£ million)

2.63 In this reporting year, RP2 cost forecasts were affected by the continuing impact of delays to large schemes but this was more than offset by the effects of inflation. The company is forecasting to overspend its baseline and risk funding for enhancements in RP2 by £337 million. The enhancement cost pressure also means that it is forecasting to overspend its RIS2 funding overall in RP2 by £140 million.

2.64 Changes to the enhancements portfolio announced in March 2023 are expected to reduce the cost pressure for RP2 once cost forecasts are revised for these changes. Additionally, any further delays to schemes may also contribute towards reducing the overspend pressure in RP2. However, this will also contribute to cost pressures in future road periods.

Enhancements expenditure in the reporting year

2.65 As National Highways’ costs have moved further from RP2 into RP3, an in-year underspend of £286 million has occurred for enhancements. This is part of a wider in-year capital underspend of £360 million.

2.66 Early in the reporting year, the company identified a forecast underspend of £429 million for enhancements. This was due to the impact of ongoing slippage and the budget being set before the finalisation of SR21 funding changes in March 2022.

2.67 National Highways set a target to reduce its forecast capital underspend to £357 million, which at 10% of funding, is the maximum it can carry forward to a future financial year without government approval. This was achieved in part through the acceleration of some project activity to reduce risks to project delivery.

2.68 National Highways’ in-year financial performance is discussed further in paragraphs A5 to A26.

Use of Central Risk Reserve (CRR) on enhancements

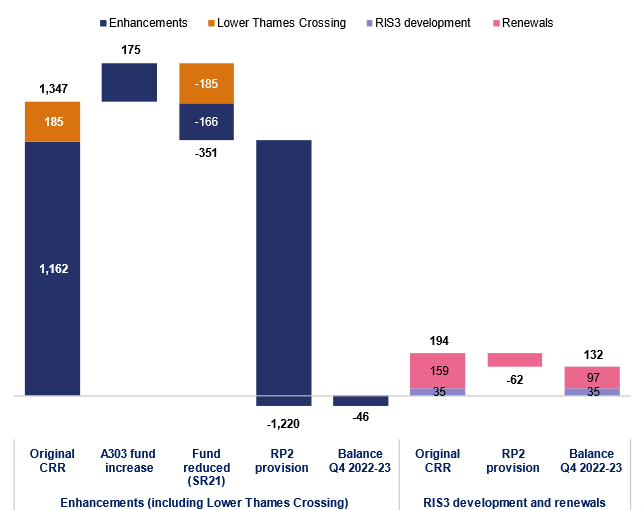

2.69 National Highways has a CRR for funding portfolio level risks for enhancements, LTC, RIS3 development and renewals. This was originally funded at £1,541 million (£1,347 million for enhancements including LTC, £194 million for RIS3 development and renewals) but government has made changes during RP2 in-line with wider funding changes.

2.70 National Highways has made significant allocations from its enhancements CRR in RP2. As shown in Figure 2.16, the enhancements CRR funding is now over-allocated by £46 million. However, £132 million of the CRR for RIS3 development and renewals remains unallocated, meaning that overall, there is a CRR balance remaining of £86 million.

Figure 2.16 Funding changes and use of Central Risk Reserve (CRR) since April 2020 (£ million)

2.71 The changes to the enhancement portfolio announced in this reporting year mean some of the CRR allocated for enhancement schemes is no longer required in RP2. This will improve the enhancements CRR balance. However, the reporting year changes to the programme and those expected in the fourth year of RP2 have created uncertainty and challenges for the management of financial risks to the end of RP2.

2.72 It is vital that National Highways has a good understanding of how it is using its CRR and can forecast its use of the reserve in the remainder of the road period. In 2022, ORR’s review of National Highways’ use of CRR identified that the company needed to improve its management of the reserve. In this reporting year we have seen the company begin to introduce recommended changes to provide greater control over the use of the reserve and improvements in its management reporting. It has plans to improve its forecasting and assessment of future risks to ensure it can prioritise its use of funding, particularly where it may not be sufficient in the fourth year of RP2. We will scrutinise these changes as they develop to ensure they deliver the stated benefits.

Earned Value Metrics

2.73 Earned value metrics cover National Highways’ supply chain performance against the cost and schedule contractual commitments of enhancements construction. Therefore, these metrics are not necessarily a direct reflection of the company’s performance. For example, a supplier may be behind its contract schedule in a metric, but the company could still deliver the relevant commitment on time. However, these metrics are indicative of scheme health.

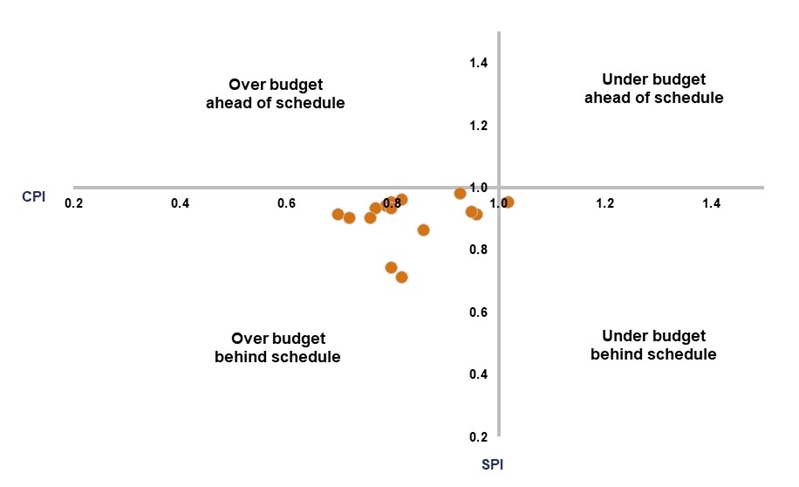

2.74 We assess National Highways’ earned value metrics through two commonly used measures:

● cost performance index (CPI): a ratio that measures the budgeted cost of work performed to date against actual cost to date; and

● schedule performance index (SPI): a ratio that measures the relationship between the progress of work to date and planned (or scheduled) progress.

2.75 If the CPI is greater than 1.0 the task is under budget, if it is less than 1.0 it is over budget. If the SPI is greater than 1.0 the task is ahead of schedule, if it is less than 1.0 it is behind schedule.

2.76 Figure 2.17 shows the CPI and SPI scores reported by the company. All 15 schemes reporting scores had an SPI of less than 1.0. One scheme had a CPI of greater than 1.0. This means that nearly all of the schemes currently in construction are reporting poor scores, that indicate they are over budget or behind schedule compared to the contractual commitments. National Highways should use these scores to manage the performance of its supply chain partners.

Figure 2.17 Reported CPI and SPI scores

2.77 National Highways has a RIS2 commitment to investigate and look to develop new or improved metrics to monitor cost and schedule for enhancement scheme development and construction, engaging with ORR. To date in RP2, the company has focused on improving data quality of the existing metrics whilst investigating alternative supporting metrics. We will continue to hold it to account for development of metrics that enhance its management of cost and delivery of enhancement schemes.